UNIVERSITY EXAMINATIONS: 2021/2022

EXAMINATION FOR BACHELOR OF BUSINESS IN INFORMATION

TECHNOLOGY

BUSS 100: INTRODUCTION TO ACCOUNTING 1

FULL/ PART TIME

DATE: DECEMBER, 2021 TIME: 2 HOURS

INSTRUCTIONS: Answer Question ONE and Any other TWO Questions

QUESTION ONE (20 Marks)

a) Briefly explain 3 Users of Accounting Information (6 Marks)

b) By giving examples, briefly explain the following concepts

i. Going Concern (2Marks)

ii. Materiality (2Marks)

iii. Accrual concept (2Marks)

c) According to the statement of financial position of Zeddy Distributors, the firm has a debit

balance at the bank of Kshs 3900 on 30th September 2018, however the bank statement obtained

the same day shows a different balance

An investigations into the difference shows the following information:

i. On 27th September 2018 a cheque for Sh3480 was received from customer for s settlement

of of an invoice for Shs 3600, an entry of Shs 3600 has not been made in the cash book.

ii. A cheque paid for sales promotion on 20th September 2018 for 1680 has been entered in

the cash book as 1860

iii. A standing order for insurance premium of Ksh 2600 had been made by the bank on 28th

September 201 but no entry has been made in the cash book

iv. Cheque for Ksh 22340 sent to creditors on 30th September 2018 were not paid by the bank

until 3 rd October 2018

v. Cheques received from customers amounting to Ksh 45300 were paid into the bank on 30th

September 2018 but were not credited by the bank until October 2018

Prepare I) Updated cashbook

II) Bank reconciliation statement (8 Marks)

(Total 20 Marks)

QUESTION TWO

The following details are from the books of James Bogonko for the month of March 2018

“1 Balances brought forward: Cash Sh .230; Bank Sh .4,756.

“2 The following paid their accounts by cheque, in each case deducting 5 percent

“3 Discounts: R Burton Sh 140; E Taylor Sh. 220; R Harris Sh 800.

“ 4 Paid rent by cheque Sh.120.

“ 6 J Cotton lent us Sh 1,000 paying by cheque.

“ 8 We paid the following accounts by cheque in each case deducting a 21⁄2 per

cent cash discount: N Black Sh 360; P Towers Sh 480; C Rowse Sh 300.

“ 10 Paid motor expenses in cash Sh 44.

“ 12 H Hankins pays his account of Sh. 77, by cheque Sh 74, deducting Sh 3

cash discount.

“ 15 Paid wages in cash Sh. 160.

“ 18 The following paid their accounts by cheque, in each case deducting 5 per cent

cash discount: C Winston Sh 260; R Wilson & Son Sh 340; H Winter Sh 460.

“ 21 Cash withdrawn from the bank Sh 350 for business use.

“ 24 Cash Drawings Sh 120.

“ 25 Paid T Briers his account of Sh 140, by cash Sh 133, having deducted

Sh 7 cash discount.

“ 29 Bought fixtures paying by cheque Sh 650.

“ 31 Received commission by cheque Sh 88.

REQUIRED

a) Prepare a three column cashbook

b) Balanced off, and the relevant discount accounts in general ledger (15 Marks )

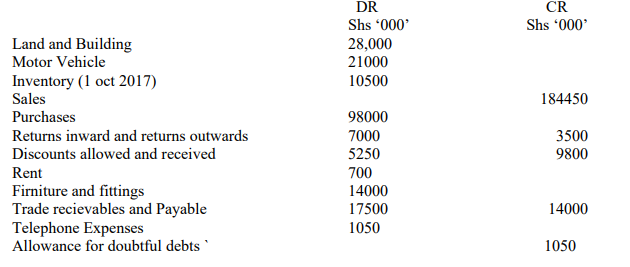

QUESTION THREE

Jamboree Katambi runs Wholesale business selling children clothing her trial balance for the

year ended 30th September 2018 was as follows

Additional information

i. Inventories as at 30th September 2018 was valued at Sh 7000,000

ii. Allowance for doubtful debts is to be increased by 10%

iii. Rent accrued as at 30th September 2018 amounts to Sh 525,000

iv. Electricity and Telephone bills prepaid as at September 2016 amount to Sh 175,000 and

525,000 respectively

v. General Expenses accrued as at 30th September 2018 amounts to Sh 700,000

vi. Depreciation is provided on motor vehicle and furniture anf fittinfs at 15% per annum on

straight line basis.

REQUIRED

a) Income Statement for the year ended 30th September 2018

b) Statement of Financial Position as at 30 September 2018 (15 Marks)

QUESTION FOUR

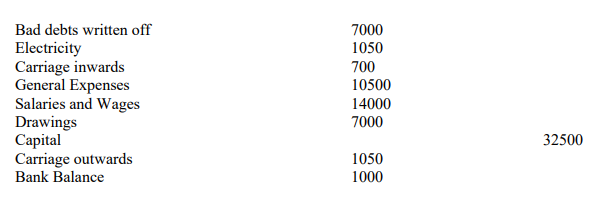

Cain and Abel are partners in the business of selling motor vehicle spare parts and accessories.

The trial balance given below was extracted from the books of the partnership on 30th June

Abel was the general manager of the firm and was earning a salary of Sh 31250 per month. This

salary has not been included in the accounts. He brought in capital of Sh 200000 in cash and was

thereafter entitled to one-fifth of the firm’s profits. The partnership agreement provides for

interest to be charged on drawings made after the commencing of partnership at the rate of 10%

per annum.

The following additional information is provided:

1. The sales including returns of Sh 96000 whereas there were no purchase returns of the period

2. Depreciation is to be provided on written down value of the building at 5% per annum

and on furniture at 20%per annum. Although the cost of the land on 30th June 2020 was

Sh 700,000 no depreciation is to be provided.

3. A debt of Sh 20,000 is to be written off, and the provision for bad and doubtful debts is

to be maintained at 5% of the remaining debtors.

4. The drawings by Aloo after the formation of the partnership are Sh 200,000 made on 1st

April 2020.

5. Insurance paid in advance and rates outstanding at 30th June 2018 are Sh 5,000 and

Sh 10,000 respectively

6. Stock in trade was Sh 1,350,000 at 30th June 2020

Required:

1) Statement of comprehensive income for the year ended 30th June 2020,

2) Statement of financial position as at 30th June 2020 (15 Marks)