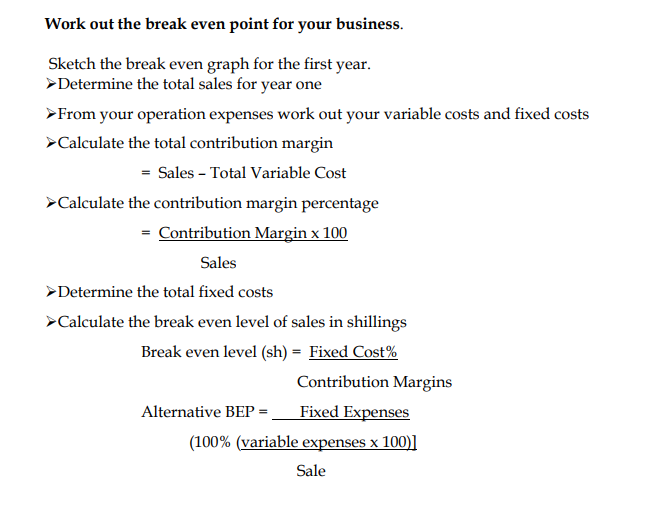

The break-even analysis is used to analyze the effect on profits of different costs, volumes, and prices. This analysis shows the level of sales required to support the overhead of the business. The break-even point is that point at which the business will cover all its costs

but will make me profit.

The figures that we will use in the analysis can all be taken from your profit and losses. The first step is to break down all expenses, including cost f goods sold, into three categories: fixed, variable, and semi-variable. Fixed costs are those which remain the same

regardless of the amount of sales. Some examples that are commonly fixed are: rent, management salaries, depreciation, interest, and professional services. Variable expenses are those expenses that vary directly with sales volume. Variable costs are direct material,

sales commissions, and shipping costs. Semi-variable costs are those costs which vary with sales, but not indirect proportion. For example, if you double your sales, your utility expenses may increase but it probably will not double; on the other hand, it your sales

drop to 0, utility expenses may fall, but it will not fall to.