UNIVERSITY EXAMINATIONS 2017/2018

EXAMINATION FOR THE DEGREE OF BACHELOR OF SCIENCE IN

INFORMATION TECHNOLOGY

BIT1309 FINANCIAL MANAGEMENT FOR IT

FULL TIME/PART TIME/DISTANCE LEARNING

DATE APRIL 2018 TIME 2 HOURS

INSTRUCTIONS: Answer Question One and ANY OTHER TWO questions

QUESTION ONE (30 MARKS)

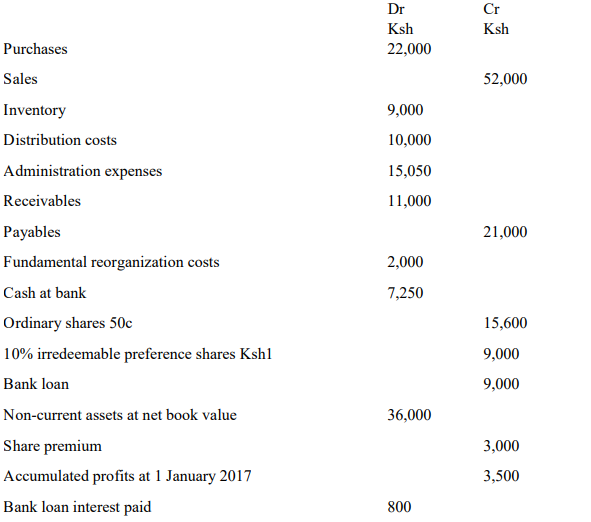

1. The trial balance of Msani company as at 31st December 2017 was as follows:

The following should be taken into account

1. A building whose net book value is currently Ksh4,000 is to be revalued to

Ksh11,000.

2. Tax for the current year is estimated at Ksh3,000.

3. Closing inventory is Ksh10,000.

a) Prepare the following statements for the year ended 31 December 2016:

i. Statement of financial position. (10 Marks)

ii. An income statement. (10 Marks)

b)Discuss five specific users of accounting information (10 Marks)

QUESTION TWO (20 MARKS)

a) Discuss five components of internal control system

(10 Marks)

b) Enter the following transactions in a double column cash book/two column cash book.

(10 Marks)

2017 Ksh

March 1 Cash in hand 80,000

March 1 Bank Balance 120,000

March 3 Received a cheque from Osman 24,000

March 4 Deposited Osman’s cheque with bank —

March 8 Withdrawn from bank for business use 20,000

March 10 Goods sold for cash 30,000

March 15 Goods bought for cash 80,000

March 18 Goods sold for cash 60,000

March 20 Paid Rahim by cheque 26,000

March 30 Deposited into bank 16,000

March 31 Paid salary in cash 10,000

March 31 Paid rent by cheque 6,000

QUESTION THREE (20 MARKS)

a. Identify five types of business documents and sources of data for an accounting system,

together with their contents and purpose (10 Marks)

b. Mr Kipper Ling runs a business providing equipment for bakeries. He always makes a note of sales

and purchases on credit and associated returns, but he is not sure how they should be recorded for

the purposes of his accounts. (10 Mark)

Write up the following transactions arising in the first two weeks of august 20×6 into the following

relevant day books:

i. Sales daybook

ii. Purchases daybook

iii. Sales return daybook

iv. Purchases return daybook

1 August Mrs Bakewell buys Ksh500 worth of cake tins.

1 August Mr Kipper Ling purchases Ksh2,000 worth of equipment form wholesalers TinPot Ltd.

2 August Mr Kipper Ling returns goods costing Ksh150 to another supplier, 1 Cook.

3 August Jack Flap buys Ksh1,200 worth of equipment

3 August Mr Bakewell returns Ksh100 worth of the goods supplied to her.

4 August Mrs Victoria Sand Witch buys a new oven for Ksh4,000

5 August Mr Kipper Ling purchases Ksh600 worth of baking trays from regular supplier TinTin Ltd

8 August Mr Kipper Ling purchases ovens costing Ksh10,000 from Hot Stuff Ltd

8 August Mr Kipper Ling returns equipment costing Ksh300 to Tinpot Ltd

9 August Pavel Ova purchases goods costing Ksh2,200

11 August Mrs Bakewell buys some oven proof dishes costing Ksh600

QUESTION FOUR (20 MARKS)

a. Show the following transactions in ledger accounts (10 Marks)

2018

Jan. 1 Mr. Javed started business with cash Ksh100,000

2 He purchased furniture for Ksh20,000

3 He purchased goods for Ksh60,000

5 He sold goods for cash Ksh80,000

6 He paid salaries Ksh10,000

b. Discuss FIVE limitation of accounting. (10 Marks)

QUESTION FIVE (20 MARKS)

a. In preparing financial statements, the accountant follows fundamental assumption

concept. Discuss: (10 Marks)

a) Business entity concept

b) Dual aspect concept

c) Cost concept

d) Consistence

b. Discuss the causes of depreciation. (5Marks)