UNIVERSITY EXAMINATIONS: 2018/2019

EXAMINATION FOR THE DEGREE OF BACHELOR OF SCIENCE IN

INFORMATION TECHNOLOGY

BIT 1309: FINANCIAL MANAGEMENT FOR IT

FULL TIME/PART TIME/DISTANCE LEARNING

DATE: AUGUST, 2018 TIME: 2 HOURS

INSTRUCTIONS: Answer Question One & ANY OTHER TWO questions.

QUESTION ONE (30 MARKS)

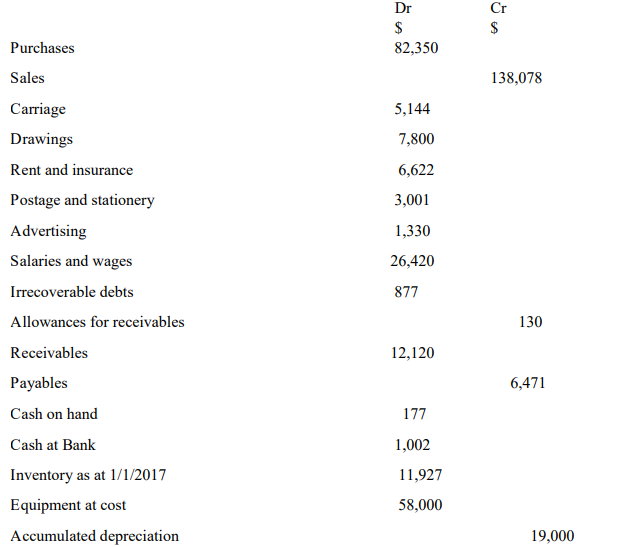

1. The following trial balance has been extracted from the ledger of Mr. Yousef, a sole trader:

The following additional information as at 31/12/2017 is available.

1. Rent is accured by $ 210.

2. Insurance has been pre-paid by $ 880.

3. $ 2,211 of carriage reprent carriage inwards on purchases.

4. Equipment is to be depreciated at 15% per annun using straight line method.

5. The allowance for receivables is to be increased by $ 40.

6. Inventory at the close of business has been valued at $ 13,551.

a) Prepare the following statements for the year ended 31 December 2017:

i. Statement of financial position. (10 Marks)

ii. An income statement. (10 Marks)

b)Discuss five specific users of accounting information (10 Marks)

QUESTION TWO (20 MARKS)

a) To meet the needs of readers, it is suggested that accounting information in financial

management must have qualitative characteristics. Evaluate the following characteristics

i. Relevance (8 Marks)

ii. Reliability

iii. Comparability

iv. Understability

b) Gateway Ltd sets up a company and in the first nine days of trading the following transactions

occurred (12 Marks)

1 January issued $10,000 share capital for cash

2 January purchased goods for $4,000 and pay by cheque

3 January bought delivery van for $2,000 and pay by cheque

4 January purchased $1,000 of goods on credit

5 January sold goods for $1,500 cash

6 January sold all remaining goods for $5,000 on credit

7 January paid $800 to suppliers by cheque

8 January paid rent of $200 by cheque

Required

a) Complete the relevant ledger accounts

b) Extract a trial balance

QUESTION THREE (20 MARKS)

Identify five types of business documents and sources of data for an accounting system,

together with their contents and purpose (10 Marks)

a) The Edward Company uses a double column cash book to record its cash and bank

related transactions. It engaged in the following transactions during the month of

March 2018: Record the below transactions in a double column cash book

(10 Marks)

a. March 01: Cash balance $2,000 (Dr.), bank balance $2,500 (Dr.).

b. March 02: Paid Mark & Co. by check $120.

c. March 04: Received from John & Co. a check amounting to $400.

d. March 05: Deposited into bank the check received from John & Co. on May 04.

e. March 08: Purchased stationary for cash, $25.

f. March 12: Purchased merchandise for cash, $525.

g. March 13: Sold merchandise for cash, $1,800.

h. March 15: Cash deposited into bank, $850.

i. March 17: Withdrew from bank for personal expenses, $40.

j. March 19: Issued a check for merchandise purchased, $630.

k. March 20: Drew from bank for office use, $150.

l. March 22: Received a check from Peter & Co. and deposited the same into bank

immediately, $880.

m. March 25: Paid a check to Daniel Inc. for $270.

n. March 26: Bought furniture for cash for office use, $175.

o. March 28: Paid office rent by check, $120.

p. March 29: Cash sales, $2,200.

q. March 30: Withdrew from bank for office use, $145.

r. March 31: Paid salary to employees by check, $300.

QUESTION FOUR (20 MARKS)

a. Discuss the causes of depreciation (5Marks)

b. An asset whose value is Kshs. 100,000 is to be depreciated at 20% p.a. Calculate the net

book value at end of second year using both straight line method and reducing balance

method (6 Marks)

c. Discuss FIVE limitation of accounting. (9 Marks)

QUESTION FIVE (20 MARKS)

a) Discuss the FIVE components of internal control system (10 Marks)

b) Post the below transactions using journal entries (10 Marks)

i. Closing inventory of maize at a cost of kshs. 10,000 has not been recorded.

ii. A debt of Kshs. 15,000 is to be written off.

iii. Purchases of a computer for Kshs. 50,000 had not been recorded.