UNIVERSITY EXAMINATIONS: 2018/2019

EXAMINATION FOR THE DEGREES OF BACHELOR OF SCIENCE

IN INFORMATION TECHNOLOGY

BIT1309 FINANCIAL MANAGEMENT FOR IT

FULLTIME/ PART TIME/ DISTANCE LEARNING

DATE: DECEMBER, 2018 TIME: 2 HOURS

INSTRUCTIONS: Answer Question One & ANY OTHER TWO questions.

QUESTION ONE (30 MARKS)

a) Briefly explain your understanding of;

i) Accrued expenses

ii) Prepaid expenses

iii) Bad debts written off

iv) Allowance for doubtful debts

(4 Marks)

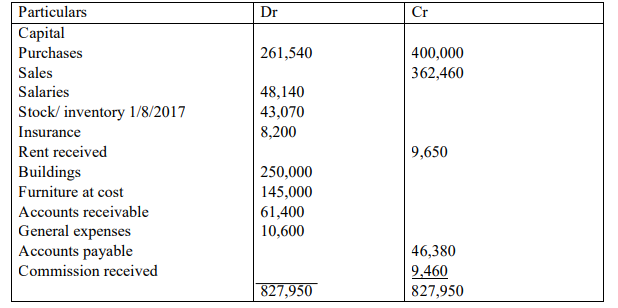

b) The following trial balance was extracted from books of Z Tamaa a sole trader on 31st

July 2018

Additional information

1. Salaries due kshs 3,500

2. Insurance prepaid kshs 4,140

3. Commission receivable due kshs 1200

4. Allowance for doubtful debts is to be maintained at 5% on accounts receivable (debtors)

5. Provision for depreciation on furniture is at 15% on cost

6. Inventory (stock) on 31st July 2018 kshs 50,080

Required

a) Prepare an income statement for the year ended 31st July 2018 (10Marks)

b) A statement of financial position (balance sheet) as at 31st July 2018 (6Marks)

a) Discuss five specific users of accounting information. (10 Marks)

QUESTION TWO (20 MARKS)

a) Explain branches of accounting. (4 Marks)

b) A balanced trial balance does not guarantee the accuracy of financial statement. Discuss

this statement giving examples of errors where the trial balance still balances. (10 Marks)

c) An asset whose value is Kshs. 1,000,000 is to be depreciated at 20% p.a on reducing

balance basis. Calculate the annual depreciation charges for the first three years.

(6 Marks)

QUESTION THREE (20 MARKS)

The Edward Company uses a double column cash book to record its cash and bank related

transactions. It engaged in the following transactions during the month of March 2018:

March 01: Cash balance $1,450 (Dr.), bank balance $1,500 (Dr.).

March 02: Paid Mark & Co. by check $120.

March 04: Received from John & Co. a check amounting to $400.

March 05: Deposited into bank the check received from John & Co. on March 04.

March 08: Purchased stationary for cash, $25.

March 12: Purchased merchandise for cash, $525.

March 13: Sold merchandise for cash, $1,800.

March 15: Cash deposited into bank, $850.

March 17: Withdrew from bank for personal expenses, $40.

March 19: Issued a check for merchandise purchased, $630.

March 20: Drew from bank for office use, $150.

March 22: Received a check from Peter & Co. and deposited the same into bank

immediately, $880.

March 25: Paid a check to Daniel Inc. for $270.

March 26: Bought furniture for cash for office use, $175.

March 28: Paid office rent by check, $120.

March 29: Cash sales, $650. March 30: Withdrew from bank for office use, $145.

March 31: Paid salary to employees by check, $300.

Required:

Record the above transactions in respective ledger accounts and extract a trial balance as at

march 2018. (20 Marks)

QUESTION FOUR (20 MARKS)

a) i Define internal control system. (10 Marks)

ii Evaluate the importance of internal control system in an organisation.

b) Mr Kipper Ling runs a business providing equipment for bakeries. He always makes a note

of sales and purchases on credit and associated returns, but he is not sure how they should be

recorded for the purposes of his accounts.

(10 Mark)

Write up the following transactions arising in the first two weeks of august 2016 into the

following relevant day books:

i. Sales daybook

ii. Purchases daybook

iii. Sales return daybook

iv. Purchases return daybook

1 August Mrs Bakewell buys $500 worth of cake tins.

1 August Mr Kipper Ling purchases $2,000 worth of equipment form wholesalers TinPot

Ltd.

2 August Mr Kipper Ling returns goods costing $150 to another supplier, 1 Cook.

3 August Jack Flap buys $1,200 worth of equipment

3 August Mr Bakewell returns $100 worth of the goods supplied to her.

4 August Mrs Victoria Sand Witch buys a new oven for $4,000

5 August Mr Kipper Ling purchases $600 worth of baking trays from regular supplier TinTin

Ltd

8 August Mr Kipper Ling purchases ovens costing $10,000 from Hot Stuff Ltd

8 August Mr Kipper Ling returns equipment costing $300 to Tinpot Ltd

QUESTION FIVE (20 MARKS)

a) (i) Define the term depreciation

(ii) Explain any four factors that cause depreciation of non current assets (4Marks)

(iii) Distinguish between straight line method of calculating depreciation and the

reducing balance method (4Marks)

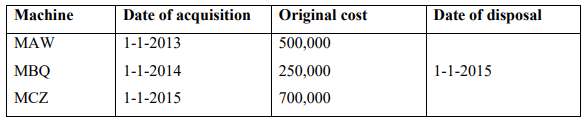

b) J. Mwakisha a contractor started business on 1st January 2013.The acquisitions by cheque

and disposal of machinery over the subsequent 3 years were as follows;

Machine Date of acquisition Original cost Date of disposal

The machines are depreciated on a straight line basis using a rate of 20% p.a

Required for each of the year’s 2013, 2014 and 2015

i) Machinery account

ii) Provision for depreciation on machinery account

iii) Income statement extract