UNIVERSITY EXAMINATIONS: 2016/2017

ORDINARY EXAMINATION FOR THE DEGREES OF BACHELOR OF

SCIENCE IN INFORMATION TECHNOLOGY

BIT 1309 FINANCIAL MANAGEMENT FOR IT

FULLTIME/PART TIME

DATE: AUGUST, 2017 TIME: 2 HOURS

INSTRUCTIONS: Answer Question One & ANY OTHER TWO questions.

QUESTION ONE

a) Identify SIX users of accounting information and describe their information needs.

(8 Marks)

b) Discuss the various classifications of assets (4 Marks)

c) Give a brief overview of the accounting cycle (6 Marks)

d) Differentiate between capital and revenue expenditure (4 Marks)

e) A car was purchased for Shs12,00,000 on 1 April 2012 and has been depreciated at 20% each

year straight line, assuming no residual value. The company policy is to charge a full year’s

depreciation in the year of purchase and no depreciation in the year of sale. The car was

traded in for a replacement vehicle on 1 August in 2015 for an agreed figure of Shs500,000.

The company’s reporting period ends on 31 December.

Required

Determine the profit or loss on the disposal of the vehicle in 2015. (4 Marks)

Prisha has not kept accurate accounting records during the financial year. She had opening

inventory of Shs6,700 and purchased goods costing Shs84,000 during the year. At the year

end she had Shs5,400 left in inventory. All sales are made at a mark-up on cost of 20%.

Required

Determine Prisha’s gross profit for the year (4 Marks)

QUESTION TWO

a) Write up the three column cash book of S. Sui from the following details and balance the

cash book at the end of the month.

Aug. 01 Started business with Shs1800,000 cash in hand and Shs16 000,000 in the bank

Aug. 02 Paid rent by cheque Shs300,000

Aug. 03 Paid utilities by cheque Shs1 240,000

Aug. 05 Cash sale Shs4 300,000

Aug. 07 Received a cheque from debtor C. Lebrity Shs3400,000 after

Shs135,000 discount

Aug. 09 Cash sales paid directly into bank Shs2 980,000

Aug. 11 Paid cash into bank Shs4 000,000

Aug. 15 Paid account at Vendor Ltd the amount owing Shs2 900,000 received 5%

discount

Aug. 18 Mr. Sui withdrew Shs1500,000 from the bank for personal use

Aug. 20 Paid for motor repairs by cash Shs850,000

Aug. 25 Withdrew Shs500,000 from the bank for office use

(13 Marks)

b) The balancing of the trial balance is not an absolute proof of accuracy in the books of

accounts. Give examples of accounting errors that the trial balance may not help to disclose.

(7 Marks)

QUESTION THREE

Salome Kageni reported the following transactions for the month of October 2016

1 October Cash in hand Sh.141,300; cash at bank sh.228,600 and capital

account Shs.369,900

3 October Bought goods for cash at Sh.36,900.

4 October Purchased good on credit from Muna Enterprises for Sh.52,200

7 October Sold goods on credit to Bedi Traders for Sh.80,100 l

9 October Withdrew Sh.4,500 from the bank for private use.

11 October Sold goods on credit to Joseph Amotto for Sh.57,600.

15 October Paid Muna Enterprises Sh.45,000 by cheque.

20 October Joseph Amotto returned goods worth Sh.3,600.

21 October Received Sh.36,000 in cash from Joseph Amotto.

22 October Purchased furniture on credit for Sh.7,200 from Kanji Furniture

House.

23 October Purchased goods on credit from Shimoni Brothers for Sh.78,300.

25 October Deposited cash into the bank amounting to Sh.19,800.

28 October Joseph Amotto was declared bankrupt. He paid only Sh.9,000 by

cheque to Blue Estate Groceries Shop. The balance was declared

a bad debt

29 October Goods worth Sh.5,400 were returned to Shimoni Brothers.

30 October Paid Sh.4,500 by cheque for advertisement.

31 October Paid salaries to staff in cash amounting to Sh.16,200.

31 October Made cash sales amounting to Sh.196,200.

Required:

i. Prepare ledger accounts to record the above transactions (15 Marks)

ii. Prepare Her trial balance as at 31 October 2016 (5 Marks)

QUESTION FOUR

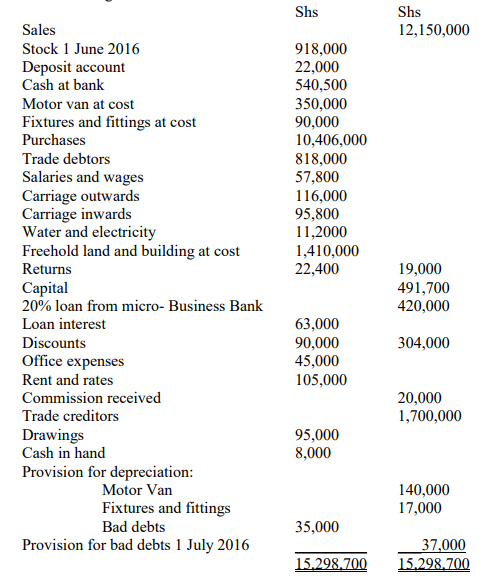

The following is the trial balance of Machax Traders as at 30 June 2017

Additional information

1. Closing stock was valued at Shs 800,000.

2. Prepaid rent for the months of July to September of the year 2015 amounted to Shs 24,000

3. A further amount of Shs 10,000 is to be written off as bad debts.

4. the provision for bad debts at the end of he year is to be adjusted to 5% of the trade debtors

5. Depreciation n fixed assets is to be provided as follows:

Motor vehicles Shs.200,000

Fixtures and fittings – Shs. 42,000

6. loan interest amounting to Shs 21,000 has not been paid

Required:

a) Income statement for the year ended 30 June 2017

b) Statement of financial position as at 30 June 2017 (20 Marks)

QUESTION FIVE

a) A company receives rent from a large number of properties. The total received in the year

ended 30 April 2017 was Shs481,200.

The following were the amounts of rent in advance and in arrears at 30 April 2016 and 2017

30 April 2016 30 April 2017

Shs Shs

Rent received in advance 28,700 31,200

Rent in arrears (all subsequently received) 21,200 18,400

Determine the amount of rental income should appear in the company’s statement of profit or

loss for the year ended 30 April 2017 (8 Marks)

b) Explain the importance of accounting function in any business organization (8 Marks)

c) Discuss the limitations of accounting (6 Marks)