UNIVERSITY EXAMINATIONS: 2012/2013

EXAMINATION FOR THE BACHELOR OF SCIENCE IN

INFORMATION TECHNOLOGY

BIT 1309 FINANCIAL MANAGEMENT FOR ITDATE: AUGUST, 2013 TIME: 2 HOURS

INSTRUCTIONS: Answer Question ONE and Any Other TWO Questions

QUESTION ONE

(a) i) Discuss the main branches of accounting (4 Marks)

ii) Identify the input (data) – processing- output (information) components in the

financial accounting cycle. (6 Marks)

iii) Explain how information technology may be used to strengthen the system of

internal controls. (6 Marks)

iv) Identify and describe four desirable characteristics of accounting information.

(4 marks)

(b) On 1 October 2012, Nduundune had Sh.750,000 in the bank and Sh. 126,000 in

hand.

During the month he had the following receipts and payments:

1 October Cash sale – receipt Sh.80,000

4 October Payment to supplier Mondo Sh.120,000

Payment of rent Sh.300,000

6 October Payment from credit customer Kapondi Sh.450,000

Payment from credit customer Bokelo Sh.250,000

10 October Cash sale – receipt Sh. 100,000

Payment to supplier Waswa Sh.500,000

15 October Payment of hire-purchase installment Sh.150,000

17 October Purchase of new machine Sh.1,200,000

19 October Cash sale – receipt Sh.370,000

21 Cash withdrawn from bank for office use 75,000

22 October Payment from credit customer Moseti Sh.600,000

24 October Payment of fuel bill Sh.175,000

26 October Interest received Sh. 25,000

29 Cash taken from cash till to pay fees for daughter Sh. 25,000

Required:

Prepare a two column cashbook and determine bank and cash balances at the end of the

month (10 Marks)

QUESTION TWO

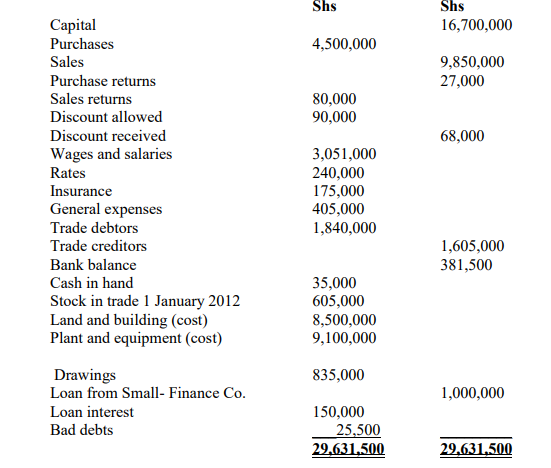

The following trial balance is extracted from the books of Pius Kivu, a sole trader, at the

close of business on 31 December 2012:

The following additional information is provided:

1. Stock at 31 December 2012 amounted to Shs 741,800.

2. Rates paid in advance on 31 December 2012 amounted to Shs 30,000.

3. Wages and salaries owing on 31 December 2012 were as 150,000.

4. Pius Kivu took goods worth Shs 200,000 for personal use.

5. Depreciation is to be provided on straight line basis as follows:

Plant and equipment – 25%

Assume that the above assets were acquired at the beginning of the financial year.

Required:

i) Statement of financial performance for the year ended 31 December 2012.

(10 Marks)

ii) Statement of Financial position as at 31 December 2012. (10 Marks)

QUESTION THREE

Julia Mwaura reported the following transactions for the month of October 2012

1 October Cash in hand Sh.141,300; cash at bank sh.228,600 and

capital account Shs.369,900

3 October Bought goods for cash at Sh.36,900.

4 October Purchased good on credit from Muna Enterprises for

Sh.52,200

7 October Sold goods on credit to Bedi Traders for Sh.80,100 l

9 October Withdrew Sh.4,500 from the bank for private use.

11 October Sold goods on credit to Joseph Amotto for Sh.57,600.

15 October Paid Muna Enterprises Sh.45,000 by cheque.

20 October Joseph Amotto returned goods worth Sh.3,600.

21 October Received Sh.36,000 in cash from Joseph Amotto.

22 October Purchased furniture on credit for Sh.7,200 from Kanji

Furniture House.

23 October Purchased goods on credit from Shimoni Brothers for

Sh.78,300.

25 October Deposited cash into the bank amounting to Sh.19,800.

28 October Joseph Amotto was declared bankrupt. He paid only

Sh.9,000 by cheque. The balance was declared a bad debt

29 October Goods worth Sh.5,400 were returned to Shimoni Brothers.

30 October Paid Sh.4,500 by cheque for advertisement.

31 October Paid salaries to staff in cash amounting to Sh.16,200.

31 October Made cash sales amounting to Sh.196,200.

Required:

i. Prepare ledger accounts to record the above transactions (15 Marks)

ii. Prepare Her trial balance as at 31 October 2012 (5 Marks)

QUESTION FOUR

i) Give the accounting definition of the term depreciation (2 Marks)

ii) Discuss the factors that cause assets to depreciate (6 Marks)

iii) Why is land not depreciated unlike other noncurrent assets? (2 marks)

Keith established a Jua kali business and started trading on 1.1.2010. Her purchases and

disposal of fixed assets over a period of three years were as follows.

Asset date of purchase cost date of disposal disposal proceeds

M1 1.1.2010 2,800,000

M2 1.1.2010 1,400,000 1.1.2012 504,000

M3 1.1.2012 3,920,000

Required

1. Prepare the following accounts as they would appear in Keith’s books for the year

ended 31st December 2010, 2011, 2012. The firm charges depreciation at 20% per

annum calculated on the straight line method.

i) Assets accounts (3 Marks)

ii) Provision for depreciation account (4 Marks)

iii) Disposal accounts (3 Marks)

QUESTION FIVE

a) Discuss the main differences between income and expenditure account and receipts

and payments accounts (8 Marks)

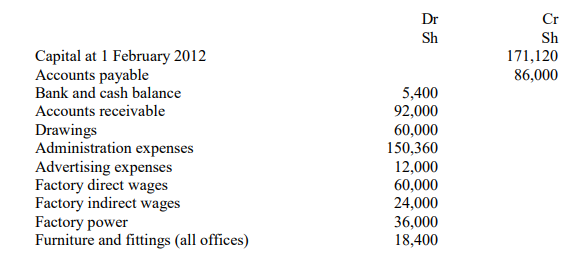

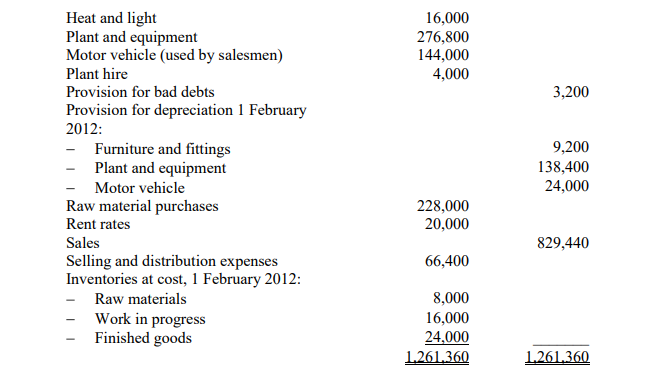

b) Malkia wa Vipondozi owns and manages a small lotion manufacturing business in

Mtwapa. The following balances have been extracted from her books of account at

31 January 2013:

There was also prepayment of Sh. 800 for salesmen’s motor vehicle insurance.

(ii) Inventories at 31 January 2013, were valued at cost as follows:

Raw materials – Sh. 15,200

Work in progress – Sh. 30,400

Finished goods -Sh. 45,600

(iii) Depreciation is to be charged on plant and equipment, motor vehicle, furniture and

fittings at the rates of 20%, 25% and 10% per annum respectively on cost.

(iv) Expenditure on heat and light, and rent and rates is to be apportioned between the

factory and office in the ratio of 9 to 1 and 3 to 2 respectively.

(v) The provision for bad debts is to be made equal to 5% of accounts receivable at 31

January 2013.

Required:

Prepare manufacturing account for the year ended 31 January 2013. (12 marks)