UNIVERSITY EXAMINATIONS: 2014/2015

UNIVERSITY EXAMINATIONS: 2014/2015

ORDINARY EXAMINATION FOR THE BACHELOR OF SCIENCE

IN INFORMATION TECHNOLOGY

BIT 1309 FINANCIAL MANAGEMENT FOR IT

DATE: APRIL, 2015 TIME: 2 HOURS

INSTRUCTIONS: Answer Question ONE and any other TWO

QUESTION ONE

State which accounting concepts are applicable or should be followed in the following

situations, giving your reasons for the concept chosen:

a) A company which depends entirely on imported raw materials has been operating on a

large overdraft. The non-availability of foreign exchange has made importations difficult

and the bankers have also refused to consider further overdraft facilities. The directors

are therefore concerned about the future success of the company and have asked the

accountant to estimate how much the company’s assets are worth. (3 marks)

b) A company’s stock valuation basis has been the lower of cost and net realizable value

since its inception some ten years ago. Due to high rate of inflation some of the

shareholders suggest that last-in, first-out basis of stock valuation be used. (3 marks)

c) The Managing director of a company earns a commission based on turnover. The

amount of commission payable in respect of the year ended 31st December 1992 was

paid in February 1993. No entry relating to the above commission had been made in the

books as at 31st December 1992 which is the year ended for the company. (3 marks)

d) A contractor has estimated that a loss of Kshs.2 million will be incurred by the end of a

contract whose completion is expected by 31st December 1993. The contractor’s

accounts are prepared to 30th June of every year. (3 marks)

Fill the gaps in the following question. (8 marks)

Account to

be debited

Account to

be credited

Bought office machinery on credit from D Isaacs Ltd

The proprietor paid a creditor, C Jones, from his

private monies outside the firm.

A debtor, N Fox, paid us in cash

Repaid part of loan from P Exeter by cheque

Returned some of office machinery to D Isaacs Ltd.

A debtor, N Lyn, pays us by cheque.

Bought van by cash

c) Explain five benefits that accrue to an IT practitioner frrm the knowledge of financial

accounting. (10 Marks)

QUESTION TWO

The following categories of people are recognized as users of the information contained in

financial statements:

Owners

Financial analysts

Lenders

For each of the above users of financial statements, identify the kind of information they

may required, why they require it and the decisions they made from that information.

(9 marks)

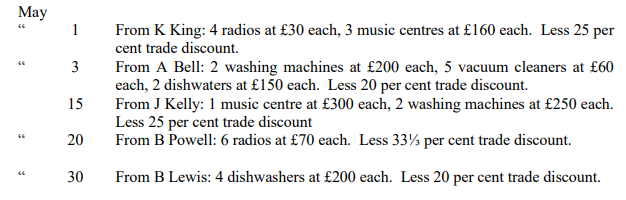

B Mann has the following purchases for the month of May 19X8: All purchases were

made on cash.

Required

a) Prepare the purchases account

b) Cash account

(11 marks)

QUESTION THREE

A business started trading on 1st January 2012. During the two years ended 31st December

2013the following debts were written off to bad debts account on the dates stated:

31st August 2012 N. Jane Kshs. 8,500

30th September 2012 M. Ann Kshs.14,000

28th February 2013 N. Mary Kshs.18,000

31st August 2013 J. Susan Kshs. 6,000

30th November 2012 A. Alice Kshs.25,000

On 31st December 2012 there had been a total of debtors remaining of Kshs.4,050,000. It

was decided to make a provision for doubtful debts of Kshs.55,000.

On 31st December 2013 there had been a total of debtors remaining of Kshs.4,730,000. It

was decided to make a provision for doubtful debts of Shs.60,000

You are required to show:

a) The bad debts account and the provision for bad debts account for each of the two

years. (6 marks)

b) The charges to the profit and loss account for each of the two years. (4 marks)

c) The relevant extracts from the balance sheet as at 31st December 2012 and 2013

(10 marks)

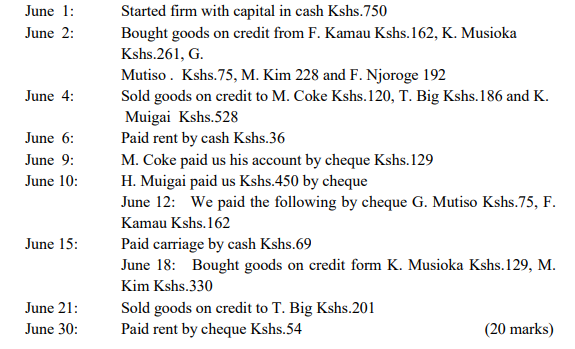

QUESTION FOUR

You are to enter up the necessary accounts for the month of June from the following

details, and then balance off the accounts and extract a trial balance as at 30th June 2014

June 1: Started firm with capital in cash Kshs.750

June 2: Bought goods on credit from F. Kamau Kshs.162, K. Musioka

Kshs.261, G.

Mutiso . Kshs.75, M. Kim 228 and F. Njoroge 192

June 4: Sold goods on credit to M. Coke Kshs.120, T. Big Kshs.186 and K.

Muigai Kshs.528

June 6: Paid rent by cash Kshs.36

June 9: M. Coke paid us his account by cheque Kshs.129

June 10: H. Muigai paid us Kshs.450 by cheque

June 12: We paid the following by cheque G. Mutiso Kshs.75, F.

Kamau Kshs.162

June 15: Paid carriage by cash Kshs.69

June 18: Bought goods on credit form K. Musioka Kshs.129, M.

Kim Kshs.330

June 21: Sold goods on credit to T. Big Kshs.201

June 30: Paid rent by cheque Kshs.54 (20 marks)

QUESTION FIVE

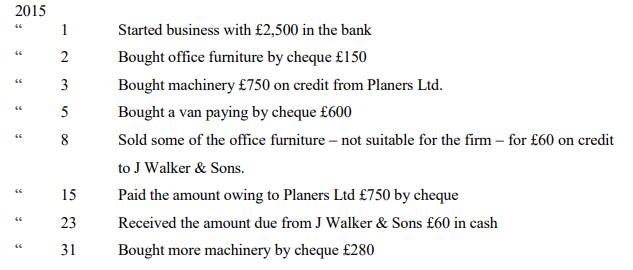

Write up the asset and liability and capital accounts to record the following transactions in

the records of G Powell. (20 marks)

2015