UNIVERSITY EXAMINATIONS: 2011/2012

UNIVERSITY EXAMINATIONS: 2011/2012

FIRST YEAR EXAMINATION FOR THE BACHELOR OF SCIENCE

IN INFORMATION TECHNOLOGY

BIT 1309 BIT 1208 FINANCIAL MANAGEMENT FOR IT

DATE: JULY, 2012 TIME: 2 HOURS

INSTRUCTIONS: Answer Question ONE and any other TWO

QUESTION ONE

a) The International Accounting Standards Board (IASB) issues International

Accounting Standards (IASs) and is also responsible for the Framework for the

Preparation and Presentation of Financial Statements.

Required:

Describe any Six users of financial statements as identified by the IASB in the

Framework for the Preparation and Presentation of Financial Statements. Within

your description, comment on the needs of each user. (12 Marks)

b) An asset can be defined as ‘a resource controlled by an enterprise as a result of

past events and from which future economic benefits are expected to flow’. The

following transactions occurred in the year ended 30 June 2012 in Soco

enterprise:

i. The acquisition by Soco of goods for sale worth Sh.250,000, on credit. These

goods have not been sold as at 30 June 2012.

ii. The acquisition by Soco of a machine from Rugo enterprise at a rental of Sh.

1,000 per month. The rental is terminable at any time by either Soco or Rugo. The

total cost of the machine is estimated at Sh.50,000

iii. Expenditure of 250,000 by Soco on research to improve one of its products. The

research has not resulted in an improvement in the product.

Required:

State whether or not each of the three transactions above results in assets for

Soco enterprise in accordance with the definition given. Explain and give reasons

for your answers. (6 Marks)

c) Computer technology has greatly improved the way financial information is

prepared and saved. This has also improved the internal control systems, all the

same, information technology can potentially weaken the control systems.

Explore the positive and negative impacts of computers on the internal control

systems of an organization (8 Marks)

d) Differentiate between direct and indirect costs in the context of manufacturing

accounts (4 Marks)

QUESTION TWO

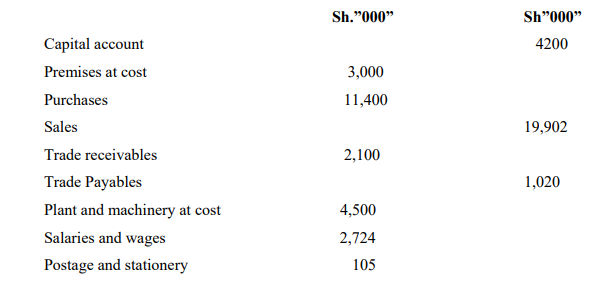

The following trial balance was extracted from the books of Ababu, a sole trader, as at 30

Additional information:

1. Closing inventory as at 30 April 2010 was valued at Sh. 2,160,000.

2. Allowance for doubtful debts is to be adjusted to 3% of trade receivables.

3. Accrued wages as the end of the year amounted to Sh. 276,000 while insurance

was prepaid by Sh.68, 000

4. Depreciation is to be provided as follows:

Premises 2% on straight line method

Plant and machinery 10% on straight line method

Required:

i. Income statement for the year ended 30 April 2010 (10 Marks)

ii. Statement of financial position as at 30 April 2010 (10 Marks)

QUESTION THREE

Mr Willy Sitati started his business on 1st January 2010. Prepare the necessary accounts

balance them off and extract a trial balance from the following information.

January 2010

1st Started his firm with capital in cash of Sh. 250,000

2nd Bought goods on credit from the following persons. D Kamau Sh. 54,000, C

Maina Sh.87,000, G Kuria Sh.25,000 D Bosire Sh.76,000 and L Mwangi

Sh.64,000

4th Sold goods on credit to C Malli Sh.43,000, B Munro Sh.62,000, H Thuku Sh.

176,000

6th Paid rent cash Sh. 12,000

9th Malli paid by cheque Sh. 43,000

10th H Thuku paid by cheque Sh.150,000

12th Paid by cheque to G Kuria Sh. 25,000, D Kamau Sh.54,000

15th Paid carriage cash Sh.53,000

18th Bought goods on credit from C.Maina Sh 43,000 and D Bosire Sh. 110,000

21st Sold on credit to B Munro Sh. 67,000

31st Paid rent by cheque Sh.18,000

(20 Marks)

QUESTION FOUR

a) Give the accounting definition of the term depreciation (2 Marks)

b) Using a suitable example in each case explain the factors that cause the assets to

depreciate (6 Marks)

c) The following information appeared in the balance sheet as Zahra transporters Ltd

as at 31 December 2010

Motor vehicles Sh. “000”

Cost 13,500

Accumulated depreciation (5750)

NBV 7750

The following is information is relevant for the year 2011

1. Acquired a pick-up KBM at a cost of 15,000,000

2. Disposed off a bus KBA at 750,000. This bus was acquired in the year 2008 at

cost of 3m.

3. Traded in an old truck for a new one making an additional cash payment of 1.2m.

The old truck was acquired in 2008 at a cost 2.4 m and for trading purposes was

valued at 900,000.

4. As per the company’s policy motor-vehicles are depreciated at 15% straight line

basis

5. full depreciation is given in the years of acquisition non in the year of disposal

Required

Prepare

i. Motor-vehicle account (4 Marks)

ii. Provision for depreciation account (4 Marks)

iii. Motor-vehicle disposal account (4 Marks)

QUESTION FIVE

a) Discuss the significant differences between receipts and payments account and

income and expenditure account (8 Marks)

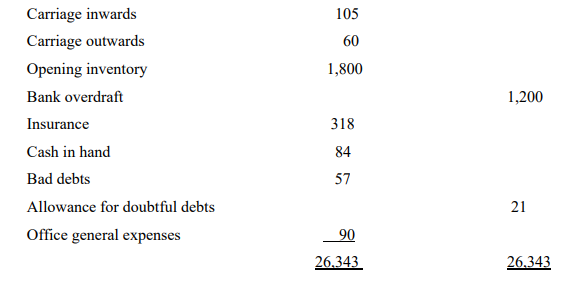

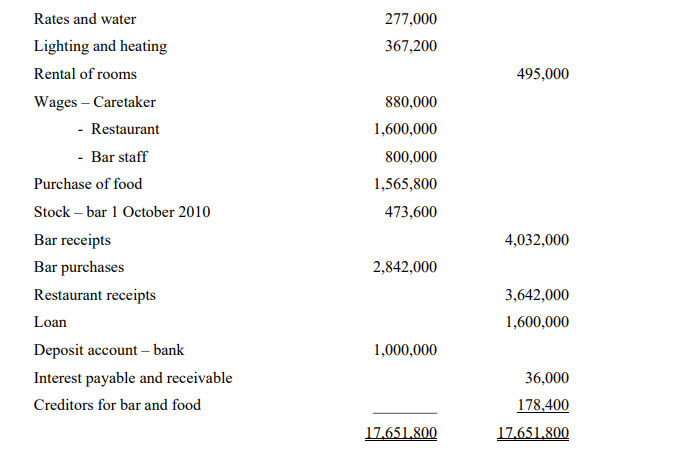

b) The following trial balance was extracted from the books of Books and BookMen society as at 30 September 2011:

Additional information:

1. The bar stock was valued at Sh. 642,800 as at 30 September 2000.

2. It is expected that, of the debtors for subscriptions, Sh. 43,600 will not be collectable.

3. The interest account is net. The loan is at a concessional rate of 4% while 10% has

been earned on the deposit account. No changes have taken place all year in the

principal sums involved.

4. An invoice for Sh. 43,000 of wine had been omitted from the records at the close of

the year although the wine had been included in the bar stock valuation.

5. Depreciation for the year is to be provided as follows:

Furniture and fittings Sh. 194,000

Projectors, cameras, etc. Sh. 19,000.

Required:

i. Bar and restaurant trading account for the year ended 30 September 2011

(6 Marks)

7

ii. An income and expenditure account for the year ended 30 September 2011

(6 Marks)