UNIVERSITY EXAMINATIONS 2017/2018

EXAMINATION FOR THE DEGREE OF BACHELOR OF SCIENCE IN

INFORMATION TECHNOLOGY

BIT 1309: FINANCIAL MANAGEMENT FOR IT

FULL TIME/PART TIME/DISTANCE LEARNING

DATE APRIL 2017 TIME 2 HOURS

INSTRUCTIONS: Answer Question One and ANY OTHER TWO questions

QUESTION ONE (30 MARKS)

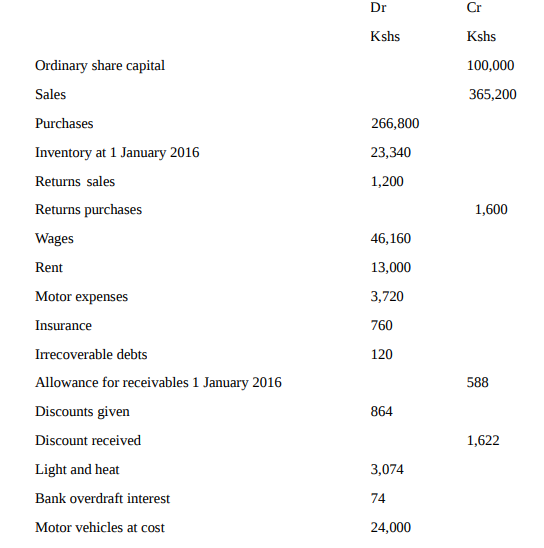

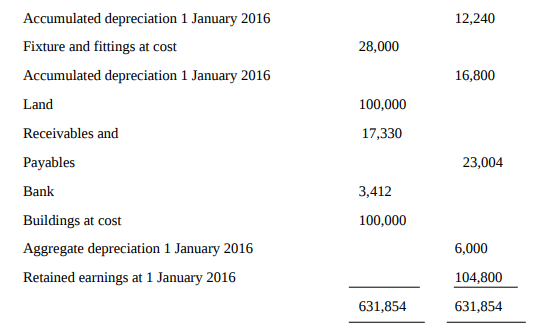

The trial balance of Kevin Suri Co as at 31 December 2016 is as follows:

Additional information

1. Inventory at 31 December 2016 was Kshs25,680

2. Rent was prepaid by Kshs1,000 and light and heat owed was Kshs460 at 31 December 2016.

3. Land is to be revalued to Kshs250,000 at 31 December 2016

4. Following a final review of the receivables at 31 December 2016, Kevin decides to write off

another debt of Kshs130. He also wishes to maintain the allowance for receivables at 3% of

the year-end balance.

5. Depreciation is to be provided as follows:

Building 2% annually, straight line

Fixtures and fittings – straight line method assuming a useful economic life of five years with

no residual value

Motor vehicles 30% annually on reducing balance basis.

A full year’s depreciation is charged in the year of acquisition and none in the year of

disposal.

a) Prepare the following statements for the year ended 31 December 2016:

i. Statement of financial position. (10 Marks)

ii. A statement of comprehensive income. (10 Marks)

b)Discuss five specific users of accounting information. (10 Marks)

QUESTION TWO (20 MARKS)

a) Discuss five components of internal control system. (10 Marks)

b) Prepare cash Book for the month of August 2017 from the following particulars;

(10 Marks)

Date Details Amount (Kshs.)

2017

August 1 Cash in hand 17,600

August 3 Purchased Goods for cash from Rena 7,500

August 6 sold goods to Rohan 6,000

August 10 Wages paid in cash 500

August 15 Cash paid to Neena 3,500

August 17 Cash sales 10,000

August 19 Commission paid 700

August 21 Cash received from Teena 1,500

August 25 Furniture purchased for cash 1,700

August 28 Rent paid 3,000

August 30 Paid electricity bill in cash 1,300

QUESTION THREE (20 MARKS)

a) Identify five types of business documents and sources of data for an accounting system,

together with their contents and purpose (10 Marks)

b) Mr Kipper Ling runs a business providing equipment for bakeries. He always makes a note of sales

and purchases on credit and associated returns, but he is not sure how they should be recorded for

the purposes of his accounts. (10 Mark)

Write up the following transactions arising in the first two weeks of august 20×6 into the following

relevant day books:

i. Sales daybook

ii. Purchases daybook

iii. Sales return daybook

iv. Purchases return daybook

1 August Mrs Bakewell buys Kshs500 worth of cake tins.

1 August Mr Kipper Ling purchases Kshs2,000 worth of equipment form wholesalers TinPot Ltd.

2 August Mr Kipper Ling returns goods costing Kshs150 to another supplier, 1 Cook.

3 August Jack Flap buys Kshs1,200 worth of equipment

3 August Mr Bakewell returns Kshs100 worth of the goods supplied to her.

4 August Mrs Victoria Sand Witch buys a new oven for Kshs4,000

5 August Mr Kipper Ling purchases Kshs600 worth of baking trays from regular supplier TinTin Ltd

8 August Mr Kipper Ling purchases ovens costing Kshs10,000 from Hot Stuff Ltd

8 August Mr Kipper Ling returns equipment costing Kshs300 to Tinpot Ltd

9 August Pavel Ova purchases goods costing Kshs2,200

11 August Mrs Bakewell buys some oven proof dishes costing Kshs600

QUESTION FOUR (20 MARKS)

a) Show the following transactions in ledger accounts. (10 Marks)

1. Karman pays Kshs80 for rent by cheque.

2. Karman sells goods for Kshs230 cash which he banks.

3. He then purchases Kshs70 of goods for resale using cash

4. Karman sells more goods for cash, receiving Kshs3,400.

b)Define: (10 Marks)

i. Financial accounting

ii. Management accounting

iii. Financial management

QUESTION FIVE (20 MARKS)

a) (10 Marks)

i. Define depreciation in accounting.

ii. Examine the reasons for charging depreciation.

iii. Discuss the causes of depreciation.

b) The elements of financial statements are the general groupings of line items contained

within the statements. Identify and explain any five of such elements of financial

statements. (10 Marks)