MAASAI MARA UNIVERSITY

REGULAR UNIVERSITY EXAMINATION

2014/2015 ACADEMIC YEAR

SECOND YEAR SECOND SEMESTER

SCHOOL OF BUSINESS AND ECONOMICS

BACHELOR OF HOTEL AND HOSPITALITY MANAGEMENT

COURSE CODE: BHM 106

COURSE TITLE: FINANCIAL MANAGEMENT

DATE:25TH AUGUST,2015 ____________ TIME:2.00P.M-4.00P.M

INSTRUCTION TO CANDIDATES

Answer question and any other two

QUESTION ONE

a) You are to enter the following transactions, completing the double entry in the books for the month of May 2002.

2002

May 1 Started business with ksh.2,00,000 in the bank.

“ 2 Purchased goods kshs.17500 on credit from M Rooks.

“ 3 Bought furniture and fittings kshs.15000 paying by cheque.

“ 5 Sold goods for cash ksh.27500.

“ 6 Bought goods on credit kshs.114 from P Scot.

“ 10 Paid rent by cash kshs.1500.

“ 12 Bought stationery kshs.2700, paying in cash.

“ 18 Goods returned to M Rooks kshs.2300.

“ 21 Let off part of the premises receiving rent by cheque kshs.500.

“ 23 Sold goods on credit to U Foot for kshs.7700.

“ 24 Bought a motor van paying by cheque kshs.3000.

“ 30 Paid the month’s wages by cash kshs.11700.

“ 31 The proprietor took cash for himself kshs.4400.

b) The following details for the year ended 31 March 2003 are available. Draw up the trading account of R Sings for that year.

Stocks: 1 April 2002 16,523

Returns inwards 1,372

Returns outwards 2,896

Purchases 53,397

Carriage inwards 1,122

Sales 94,600

Stocks: 31 March 2003 14323

Question 2.

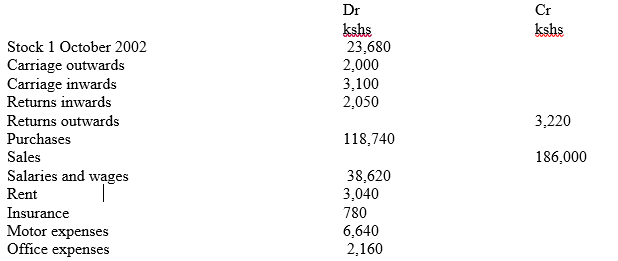

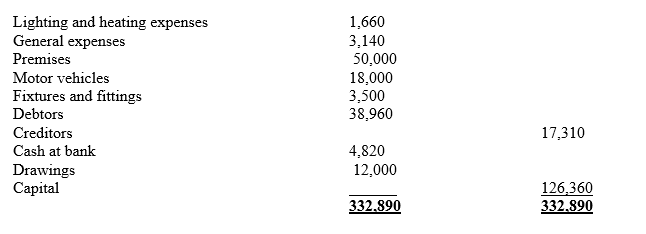

From the following trial balance of P Boones draw up a trading and profit and loss account for the year ended 30 September 2002, and a Statement of Financial Position as at that date.

Question 3

A three-column cashbook is to be written up from the following details, balanced off, and the relevant discount accounts in the general ledger shown.

Mar 1 Balances brought forward: Cash kshs.230; Bank kshs.4,756.

“ 2 The following paid their accounts by cheque, in each case deducting 5 percent discounts: R Burton kshs.140; E Taylor ksh.220; R Harris kshs.800.

“ 4 Paid rent by cheque kshs.120.

“ 6 J Cotton lent us kshs.1,000 paying by cheque.

“ 8 We paid the following accounts by cheque in each case deducting a 2 ½ per cent cash discount: N Black kshs.360; P Towers ksh.480; C Rowse kshs300.

“ 10 Paid motor expenses in cash kshs.44.

“ 12 H Hankins pays his account of kshs.77, by cheque kshs.74, deducting ksh.3 cash discount.

“ 15 Paid wages in cash ksh.160.

“ 18 The following paid their accounts by cheque, in each case deducting 5 per cent cash discount: C Winston kshs260; R Wilson & Son kshs340; H Winter kshs460.

“ 21 Cash withdrawn from the bank kshs350 for business use.

“ 24 Cash Drawings kshs120.

“ 25 Paid T Briers his account of kshs140, by cash kshs133, having deducted kshs7 cash discount.

“ 29 Bought fixtures paying by cheque kshs650.

“ 31 Received commission by cheque kshs88.

Question four

a) Briefly describe four accounting principles (8marks)

b) State the four common types of journals (2marks)

c) Explain the term bank reconciliation and state the reasons for its preparations (5marks)

Question Five

a) The balance in cashbook of Mr. Chuma as at 31/12/03 was sh. 30,000. On the same date

the balance as per the bank statement was sh. 50,000 (credit)

On examining the bank statement and the cash book the following differences were observed

i) Cheque totaling sh. 8,000 had been paid into the bank on 31/12/03 but were not credited by the bank until 1/1/04.

ii) Bank charges amounted to sh. 600

iii) A standing order to KPLC of sh. 800 had been paid by the bank but not entered in the cash book

iv) Interest income amounting to sh. 13,000 collected by the bank did not appear in the cash book

v) Amount paid to supplies but not presented for payment to the bank amounted to sh. 16,400

Required

i. Adjusted cash book balance (5 marks)

ii. Bank reconciliation statement (10marks)

b) Discuss the importance of preparing a bank reconciliation statement (5 marks)