MAASAI MARA UNIVERSITY

REGULAR UNIVERSITY EXAMINATION

2019/2020 ACADEMIC YEAR

FOURTH YEAR FIRST SEMESTER

SCHOOL OF BUSINESS AND ECONOMICS

BACHELOR OF COMMERCE

COURSE CODE: BCM 4113

COURSE TITLE: FINANCIAL MANAGEMENT

DATE: 10/12/2019 TIME: 11.00AM – 1.00 PM

INSTRUCTIONS TO CANDIDATES:

Answers question ONE and any other three questions.

BCM 4113: Financial Management Page 2

QUESTION ONE:

a) In reference to the provisions of agency theory in financial management

discuss clearly and precisely instances in which the interests of the

management of a corporate body may conflict with those of the

shareholders. (8 marks)

b) Suggest mechanisms that can be adopted to resolve the conflicts in 1(a)

above. (7 marks)

c) Write short notes on the following theories relating to capital structure of

firms; (6 marks)

i. Net income approach.

ii. Net operating income approach

iii. The Modigliani-Miller Approach

d) Before the introductionof interest rate caps in 2016 by the Kenyan

legislature, lending rates charged by commercial banks were very erratic.

Explain common factors attributable to such phenomenon. (4 marks)

QUESTION TWO

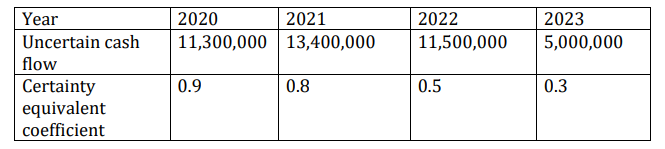

Handshake is contemplating to invest in a project on 1st January 2020 whose

initial cost is Sh. 30,000,000 and additional capital of Sh. 1,500,000 on 1st

January 2022. The project promises the following uncertain cash flows with

corresponding assigned certainty equivalent coefficients.

a) If the risk-free discount rate is 11% compute the NPV of the project and

advice the firm whether the project can be undertaken. (7 marks)

BCM 4113: Financial Management Page 3

b) Show whether your advice would change if certainty equivalent was not

taken into account in the decision-making process. (4 marks)

c) Outline the weaknesses and strengths of certainty equivalent as used in

project appraisals. (4 marks)

QUESTION THREE

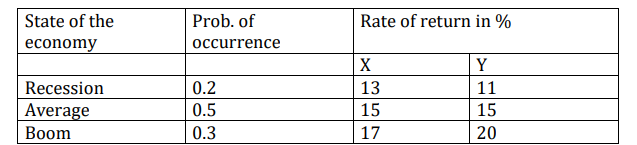

TangaTanga Ltd is considering two possible capital projects for next year. Each

project has a 1-year life, and project returns depend on next year’s state of the

economy. The estimated rates of return are shown in the table below:

Required:

a. Compute each project’s expected rate of return (4 marks)

b. Compute the variance and standard deviation of each project.(6 marks)

c.Compute the co-efficient of variation for each project (2 marks)

d. Which project may be preferred and why? (3 marks)

QUESTION FOUR

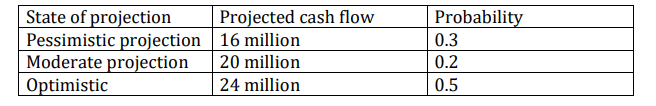

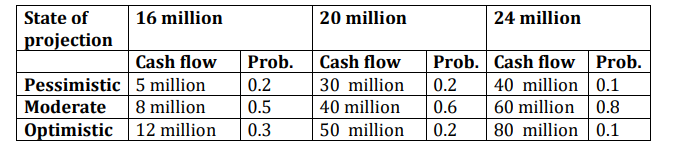

a) Mwananchi is considering to invest in a project that require initial

capital of 40 million. Projected cash inflows over its useful life of two

years are as follows:

Required: Determine:

a. Expected monetary value of the project using decision tree approach.

(6 marks)

b. Assuming the cost of capital is 10% advice the investor whether the

project is viable using decision tree approach. (9 marks)

QUESTION FIVE

a) Explain precisely whether you agree or disagree with assertions of the

relevancy or irrelevancy dividend policy theorists. (4 marks)

b) Discuss any five factors that influence formulation of dividend policies by

corporate bodies. (5 marks)

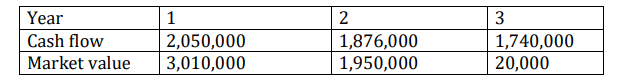

c) Umash ltd is considering to invest in a certain project which promises the

following cash flows over its useful life of 3 years. The market value for the

asset has also been given after the end of each year.

Required:

If the project requires 4,810,000 and the discount rate is 10% advice Umash

limited whether the project should be undertaken for the entire useful life.

(6 marks)