MAASAI MARA UNIVERSITY

REGULAR UNIVERSITY EXAMINATIONS

2019/2020 ACADEMIC YEAR

FOURTH YEAR FIRST SEMESTER

SCHOOL OF BUSINESS AND ECONOMICS

BACHELOR OF COMMERCE

COURSE CODE: BCM 4104

COURSE TITLE: MANAGERIAL ACCOUNTING

DATE: 11TH DECEMBER 2019 TIME: 1100 – 1300 HRS

INSTRUCTIONS TO CANDIDATES

1. Answer Question ONE and any other THREE questions

2. Do NOT write on this Question paper

This paper consists of 5 printed pages. Please turn over.

QUESTION ONE

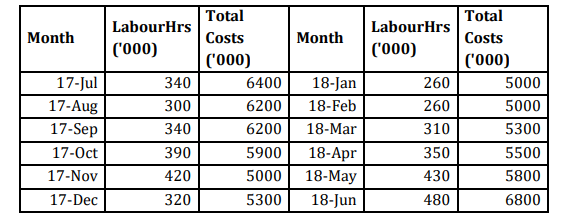

Chuma Moto prepares its budget for the year every 30th June. In relation to

total costs, the company estimates that the labour hours influence the level of

total costs (y=a+bx; y-total costs, a – fixed costs, b – is the variable cost per

unit and x – level of activity). The following data relates to the year ending 30th

Required:

a) Estimate the cost function of the company using:

i) High-low method (4 marks)

ii)Linear regression (4 marks)

b) Calculate the total costs in the following situations if 550 labour hours are

used (2 marks)

c) If the company incurs total costs of sh. 10,000,000 estimate the labour

hours applied (2 marks)

d) Aberdeen Company Ltd. is a manufacturing company which produces and

sells a single product known as Tumbo1 at a price of Sh.10 per unit. The

company incurs a variable cost of Sh.6 per unit and fixed costs of

Sh.400,000. Sales are normally distributed with a mean of 110,000 units

and a standard deviation of 10,000 units. The company is considering

producing a second product, Tumbo2 to sell at Sh.8 per unit and incur a

variable cost of Sh.5 per unit with additional fixed costs of Sh.50,000. The

demand for Tumbo2 is also normally distributed with a mean of 50,000

units and standard deviation of 5,000 units. If Tumbo2 is added to the

production schedule, sales of Tumbo1 will shift downwards to a mean of

85,000 units and standard deviation of 8,000 units. The correlation

coefficient between sales of Tumbo1 and Tumbo2 is –0.9.

Required:

i) The company’s break-even point for the current and proposed production

schedules (5 marks)

ii) The coefficient of variation for the two proposals. (6 marks)

iii) Based on your computation’s in (i) and (ii) above advise the company on

whether to add T2 to its production schedule. (2 marks)

QUESTION TWO

a)Standards are important in the management of costs. In respect to

standards, explain three standards that managerial accountants deal with.

(3 Marks)

b) KaramboLtd manufactures an oil product whose standard variable cost is

given below:

Direct materials (2 kg @ Sh 3) 6

Direct labour (0.75 hours @ Sh 4) 3

Variable overheads 1

The company treats fixed costs as period costs and therefore they are not

charged to products.The following information relates to the month of March

2019.

1/3/2019 31/3/2019

Sh Sh

Stocks (all at standard cost)

Raw materials 12,000 6,000

Finished goods 36,000 42,500

The following information is available for the month of March 2019:

Sh

Sales @ Sh 20 per unit 200,000

Material purchases @ Sh 3.50 per kg 42,000

Direct labour cost (8000 hours) 30,000

Variable overheads 12,000

Material price variance (adverse) 21,000

The management is wondering whether they could have performed better.

Required:Calculate the following variances in each case stating two possible

causes of the following variances:

a) Material usage variance (3 Marks)

b) Labour rate variance (3 Marks)

c) Labour efficiency variance (2 Marks)

d) Variable overhead expenditure variance (2 Marks)

e) Variable overhead efficiency variance (2 Marks)

QUESTION THREE

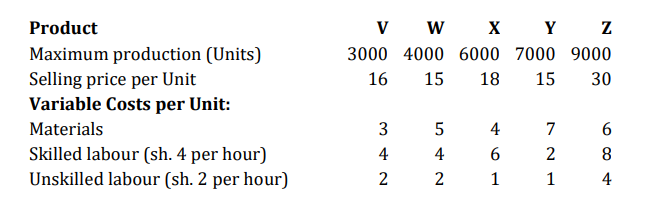

Due to comprehensive bargaining agreement, the wage rates for skilled

workers are to increase by 50% over the budget figures. There is a shortage of

such skilled workers and it takes over a year to train new recruits adequately.

The managing director has asked you for advice as to which order of priority

on the product range would give best use of the skilled resources available.

The cost of unskilled labour of which there is no shortage will go up by 20%

over the budget. The original budget figures for the next period before

allowing for the increase in labour cost detailed above were as follows;

Variable overheads are recovered at the rate of sh. 1 per labour hour. The

skilled labour available amounts to 30000 hours in the period and there are

fixed costs of sh. 22,800.

Required:

a)Calculate the product mix that maximizes profits (10 Marks)

b)Discuss the uses of CVP analysis to management accountants (3 Marks)

c)Differentiate between managerial accounting & cost accounting(2 Marks)

QUESTION FOUR

a) A company produces to order and carries no inventory as a result. Its

demand function is estimated to be P= 100 – 2Q (P- selling price/unit, Qquantity demanded in thousands of units)

Its cost function is estimated to be C=Q2 + 10Q + 500 (C-total cost in

thousands and Q is quantity demanded in thousands of units)

Required:

i) Calculate the output in units that will maximize total profit, calculate the

corresponding unit selling price, total profit and total sales (4 Marks)

ii) Calculate the output in units that will maximize total revenues and to

calculate the corresponding unit selling price, total loss and total sales

revenue (4 Marks)

b) The following data relates to the operations of a manufacturing

organization. The direct labour needed to make the first machine is 1000

hours and the learning curve is 80%. The direct labour cost is sh. 5 per

hour and direct materials cost sh. 1800 per machine while the fixed cost for

either size order is sh. 8000.

Required: Calculate the average unit cost of making:

i) 4 machines (2 Marks)

ii) 8 machines (2 Marks)

iii) What accounting and project management areas can learning curves

be applied? (3 Marks)

QUESTION FIVE

Clearly explain the following as used in managerial accounting. Give examples

where appropriate and be clear in your explanations.

a) Target costing (3 Marks)

b) Value chain analysis (3 Marks)

c) Learning curve (3 Marks)

d) Standard costing (3 Marks)

e) R2 (3 Marks)