MAASAI MARA UNIVERSITY

REGULAR UNIVERSITY EXAMINATIONS

2019/2020 ACADEMIC YEAR

FOURTH YEAR FIRST SEMESTER

SCHOOL OF BUSINESS AND ECONOMICS BACHELOR OF COMMERCE

COURSE CODE: BCM 4103

COURSE TITLE: ADVANCED TAXATION

DATE: 10TH DECEMBER 2019 TIME: 1430 – 1630 HRS

INSTRUCTIONS TO CANDIDATES

1. Answer Question ONE and any other THREE questions

2. Do NOT write on this Question paper

This paper consists of 7 printed pages. Please turn over.

QUESTION ONE

a)Differentiate between the following as applied in tax:

i) Balancing charge and balancing deduction (4 Marks)

ii) Trading receipt and trading deficit (4 Marks)

iii)Zero rated and exempt supplies (4 Marks)

b) Explain the following terms as applied in taxation

i) Pre-shipment inspection (2 Marks)

ii) Tax Havens (2 Marks)

iii)Dumping (2 Marks)

c)The finance act of 2018 increased the VAT on fuel to 8% despite a lot of

opposition by stakeholders. Using your tax knowledge prepare a write up

with your opinion on the implications of such a move. (7 Marks)

QUESTION TWO

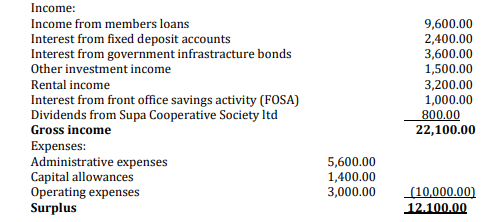

The following information relates to Kwavonza Savings and Credit

Cooperative Society Limited for the year ended 31 December 2019.

Additional information:

i) The society paid dividends and bonuses to members amounting to sh.

6,500,000 for the year ended 31 December 2019

ii) Administrative expenses include:

Salaries to officers directly involved in processing of members loans 1,400,000

Salary to caretaker of rental property 200,000

Purchase of computer software 400,000

iii)Operating expenses include depreciation of sh 84,000 and non-performing

loans to members of sh. 120,000 which were written off

iv)Other investment income includes interest from savings account of sh.

500,000

Required:

i) Kwavonza Adjusted taxable profit or loss for the year ended 31

December 2018 (10 Marks)

ii) Tax liability, if any, for the year ended 31 December 2018 (3 Marks)

iii) Comment on any information not used in (i) above (2 Marks)

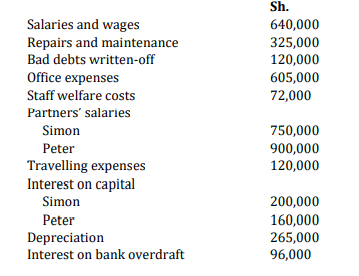

QUESTION THREE

Simon and Peter have been trading as partners under the name Simope

Enterprises, sharing profits and losses equally. They manufacture motor

vehicle accessories for local and overseas markets. They have provided you

with the following information in relation to their trading results for the year

ended 31 December 2018.

i) They reported a net profit of sh.7,000,000 after charging the following

expenses:

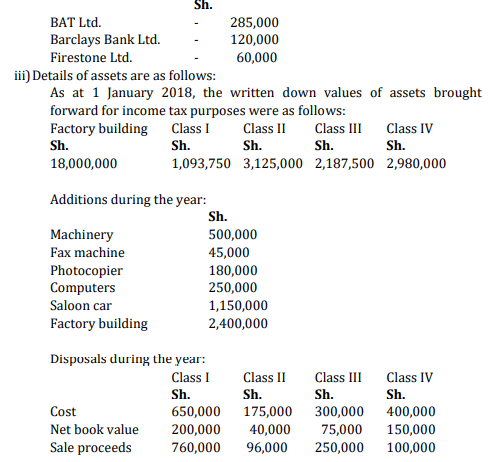

ii) Dividends were received from the following companies:

iv)The old factory building was constructed in 2013 and put into use with

effect from 1 January 2014. The additional building was brought into use

from 1 July 2005.

Required:

a) Capital allowances due to Simope Enterprises for the year 2018 (8 Marks)

b) Taxable profit (or loss) for the partnership and show its division among

the partners. (3Marks)

c) Tax payable by each partner (2Marks)

d) Comment on any information you have not used. (2Mark)

QUESTION FOUR

Malimali Merchants reported the following relating to the month of April

2019. The extract of the company’s cashbook for the month is presented

below:

Additional information:

i) Sales on credit amounted to sh. 600,000 at the standard rate of 16%. One

of the debtors who owed sh. 100,000 was declared bankrupt on 1st may

2019.

ii) Opening stock as at September was valued at sh. 4,800,000

iii) Credit notes amounting to sh. 60,000 were sent to customers. These

related to goods sold at the standard rate

iv) The telephone bill relates to the month of February, March and April 2019.

The expense accrued evenly over the three months period

v) The company returned goods worth sh. 48,000 to suppliers

vi) Insurance was paid in connection to raw materials valued at sh. 288,000

before deducting import duty of sh. 52,000

Required:

a) Prepare the VAT for the month of April 2019. The amounts are stated as

inclusive of VAT where applicable. (8 Marks)

b) In respect to VAT explain the treatment of bad debts (4 Marks)

c) Explain the fines and penalties applicable to the VAT (3 Marks)

6 | P a g e

QUESTION FIVE

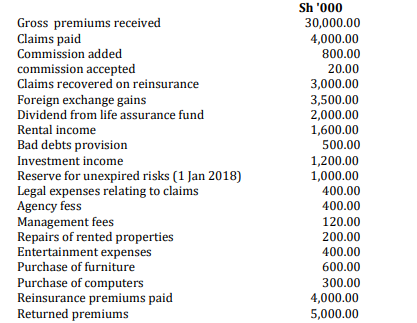

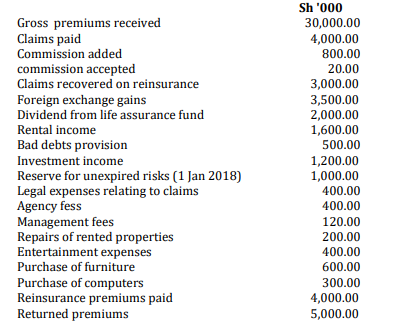

Kiota Insurance Company Limited based in Nairobi has provided the following

information for the year ended 31 December 2018

Additional information:

i) Reserves for unexpired risks on 31 December 2018 amounted to sh.

200,000

ii) The outstanding claims on 1 January 2018 and 31 December 2018 were

sh. 600,000 and sh. 900,000 respectively

iii) Premiums outstanding on 1 January 2018 and 31 December 2018 were sh.

6,000,000 and sh. 12,000,000 respectively

iv) Agency fees included sh. 200,000 relating to the life assurance business

v) Legal fees included sh. 100,000 relating to settlement of a tax dispute

vi) Investment income comprised the following:

Interest from bank (net) 850,000

Interest from treasury bonds (gross) 350,000

Required:

a)Taxable profit or loss of Kiota Insurance Company Limited from the

general insurance business for the year ended 31 December 2018

(10 Marks)

b)Tax liability, if any, from above (2 Marks)

c)Describe the tax treatment of Trusts (3 Marks)