BBM 403 ADVANCED ACCOUNTING II – SUPPLIMENTARY

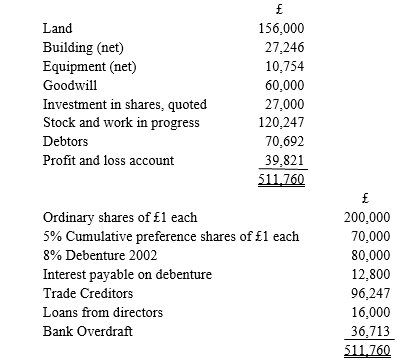

Q1. The Shires Property Construction Company Ltd found itself in financial difficulty. The following is a trial balance at 31st December 2009 extracted from the books of books of the company.

The authorized share capital is 200,000 ordinary shares of £1 each and 100,000 5% cumulative preference shares of £1 each.

During a meeting of shares and directors, it was decided to carry out a scheme of internal reconstruction. The following scheme has been agreed.

Each ordinary share is to be redesignated as a share of 25p.

The existing 70,000 preference shares are to be exchanged for a new issue of 35,000 8% cumulative preference shares of £1 each and 140,000 ordinary shares of 25p each.

The ordinary shareholders are to accept a reduction in the nominal value of their shares from £1 to 25p, and subscribe for a new issue on the basis for 1 for 1 at a price of 30p per share.

The debenture holders are to accept 20,000 ordinary shares of 25p each in lieu of the interest payable. The interest rates is to be increased to 9½ %. A further £9,000 of this 9½% debenture is to be issued and taken up by the existing holders at £90 per £100.

£6,000 of directors loan is to be canceled. The balance is to be settled by issue of 10,000 ordinary shares of 25p each.

Goodwill and the profit and loss account balance are to written off.

The investment in shares is to sold at the current market price of £60,000.

The bank overdraft is to be repaid.

£46,000 is to be paid to trade creditors now and the balance at quarterly intervals.

10% of the debtors are to be written off.

The remaining assets were professionally valued and should be included in the books and accounts as follows:

Land £90,000

Building 80,000

Equipment 10,000

Stock and work in progress 50,000

It is expected, that due to changed conditions and new management, operating profits will be earned at the rate of £50,000 pa after depreciation but before interest and tax. Due to losses brought forward and capital allowances it is unlikely that any tax liability will arise until 2007.

Show the necessary journal entries including cash, to effect the reconstruction scheme. ( 8 Marks)

Prepare the balance the sheet of the company immediately after the reconstruction. ( 7Marks)

Show how the anticipated operating profits will be divided amongst the interested parties before and after the reconstruction, and ( 8 Marks)

Comment on the capital structure of the company subsequent to reconstruction.

( 2 Marks)

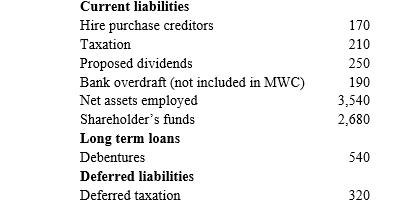

Q2. The current cost balance sheet of a company contained the following figures.

£000

Current assets

Bank & cash (not included in MWC) 450

Required

Calculate the current cost gearing proportion. ( 15 Marks)

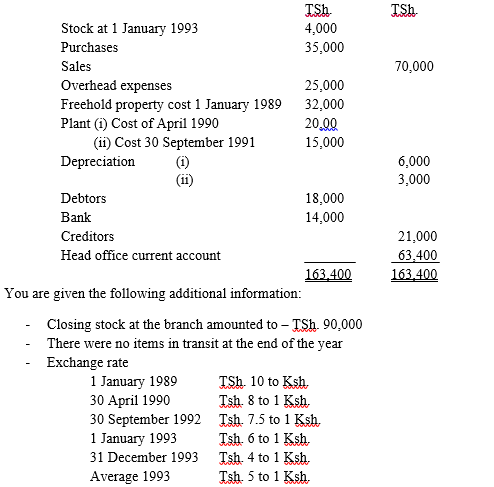

Q3. The following id the Branch Trial Balance of Arusha Limited at 31 December 1993.

– Depreciation is provided for on plant at 10% p.a on cost at the year end.

Required:

i. Prepare the Branch Trading Profit and Loss Account for 1993 using

– Historical rate assuming the branch current on head office books was shown at Ksh. 7,450.

– Closing rate assuming the branch current account in the head office books was shown at Ksh. 10,567.

ii. Comment on the nature of the profit on exchange

( 15 Marks)

Q 4 State the functions of each of the following:

a) KASNEB ( 5 Marks)

b) Registration of Accountants Board (RAB) ( 5 Marks)

c) ICPAK ( 5 Marks)

Q 5 Explain the following:

a) Arguments for Inflation Accounting ( 5 Marks)

b) Objectives of Inflation Accounting ( 5 Marks)

c) Limitations of Inflation Accounting ( 5 Marks)