BBM 310 BUSINESS FINANCE SUPPLIMENTARY EXAM

Answer all questions in section A and any other one from section B

SECTION A

QUESTION ONE

a) Define agency relationship from the context of a public limited company and briefly explain how this arises (4marks)

b) Explain measures that would minimize agency problems between the owners and management in a public company (8marks)

c) Differentiate between the following sets of terms:

i) Primary markets and secondary markets (4marks)

ii) Capital markets and money markets (4marks)

QUESTION TWO

a) Consider an investor who expects to receive ksh. 24000 at the end of each year for the next four years. If the market interest rate for the next four years is expected to be 12%, determine the future values of these cash flows. (4marks)

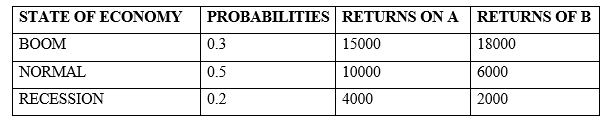

b) Prime developers ltd is considering investing in two projects A and B. The returns and probabilities of the project are as shown below;

Required:

Calculate the

i) Expected monetary value

ii) The standard deviation and

iii) The coefficient of variation of the two projects (15marks)

c) Kericho Farm Supplies Ltd intends to acquire farm machinery whose initial cost is ks 2.4 million with a residual value of ksh. 400,000. The machinery is estimated to have a four year economic life. During its 4 year economic life it is expected to generate the following revenues:

Year 1 2 3 4

Revenues sh.“000” 1500 1640 1800 1420

The annual operating expense of the machinery is estimated to be ksh. 800,000 p.a. The machinery will be depreciated using straight line method. The corporate tax rate is 35% payable in the year in which the income relates.

Required;

By using the cash flow statement determine the cash flow to be generated by the machinery (20marks)

SECTION B

QUESTION ONE

a) Describe what valuation of financial assets is and of what importance it is to the firm

(5marks)

b) Eastern star ltd has issued preference shares that promise to pay ksh. 6 as dividends per share each year. The cost of the preference share is 12%.

Required:

i) Determine the intrinsic value of the preference share. (3marks)

ii) If the current market price of the preference share is sh. 60, is the share overvalued or undervalued by the market forces (2marks)

QUESTION TWO

a) Explain the role of capital markets authority (CMA) in an economy. (4marks)

b) i) Differentiate between systematic and unsystematic risks. (4marks)

ii) What is risk-return tradeoff? (2marks)