MAASAI MARA UNIVERSITY

REGULAR UNIVERSITY EXAMINATIONS 2013/2014 ACADEMIC YEAR

THIRD YEAR FIRST SEMESTER

SCHOOL OF BUSINESS AND ECONOMICS

BACHELOR OF BUSINESS MANAGEMENT

COURSE CODE: BBM 305

COURSE TITLE: PENSION ACCOUNTING

DATE:17TH APRIL 2014 TIME: 2.00PM – 5.00PM

INSTRUCTIONS TO CANDIDATES

Question ONE is compulsory

Answer any other THREE questions

This paper consists of 5 printed pages. Please turn over.

QUESTION ONE

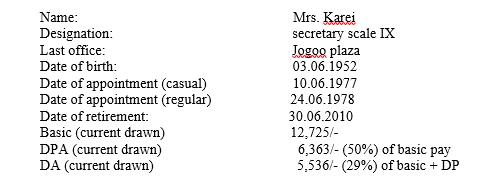

Strategic co Ltd. a registered company based in the city of Nairobi is finalizing the preparation of its employee’s data regarding their annual contributions to the National Social Security Fund. The following information is available for Mrs. Karei for the period of his employment:-

Required:-

a) Compute the amount of pension payable per month.

b) Death cum retirement gratuity(in lumpsum)

c) Commutation (age factor 10.46)

d) Value of reduced pension (25mks)

QUESTION TWO

Explain the following forms of pension plans;

1) Public pension fund (3mks)

2) Occupational pension scheme (3mks)

3) Individual pension plan (3mks)

4) Defined contribution plans (3mks)

5) Defined benefit plans (3mks)

QUESTION THREE

On 31st December 2004, Elianto corn oil ltd discontinued a section of its business dealing with production of cooking oil. The employees of the discontinued section will earn no further benefits. The actuarial assumptions immediately before the curtailment showed a define benefit obligation with a net present value of 1,000,000/- and a plan asset with a fair value of 820,000/-.

The cumulative unrecognized actuarial gains amount to 50,000/-. Elianto ltd had adopted the new standard on employee benefit on 1st January 2004 a time when the increased net liability was recognised as 100,000/- which was to be recognised over five years.

The curtailment reduced the net present value of the obligation by 100,000/-.

Required:

Compute the amount of net liability to be recognised in the balance sheet as at 31st December 2004.

(15mks)

QUESTION FOUR

a) What is a registered pension scheme? Explain using a formatted structure as per the RBA regulations. (5mks)

b) A registered pensionable member is entitled to certain mandatory rights. Explain five of these rights as required by the pension plan.

(5mks)

QUESTION FIVE

ABC Ltd provides lumsum benefit payment on termination of service at the rate of 1% of final salary for each year of service. An employee current salary is100, 000/- and is expected to grow at the rate of 7% per annum (compounded). The approximate discount rate is 10% per annum. The employee is expected to leave employment at the end of five years.

Required:

a) Compute the amount of current service cost (5mks)

b) Amount of interest cost (5mks)

c) Retirement obligation for each of the years (5mks)

QUESTION SIX

a) Pension benefits are paid far out into the future, but how and when they will be paid is uncertain. An actuarial assumption explains extensively the implications of such payments. In that note discuss these two primary types of assumptions:

i. Economic assumptions. (4mks)

ii. Demographic assumptions (4mks)

b) The balances of a define benefit plan are as follows:

Present value of obligations 1,100,000/-

Unrecognized actuarial losses 110,000/-

Unrecognized increase in liability on

introduction of new standard (50,000/-)

Past service costs (unrecognized) (70,000/-)

Fair value of assets 1,190,000/-

Present value of available future refunds

and reductions 100,000/-

Required:

Compute the amount of defined benefit liability (asset)

(7mks)