MAASAI MARA UNIVERSITY

REGULAR UNIVERSITY EXAMINATIONS 2013/2014 ACADEMIC YEAR

THIRD YEAR FIRST SEMESTER

SCHOOL OF BUSINESS AND ECONOMICS

BACHELOR OF BUSINESS MANAGEMENT

COURSE CODE: BBM 302

COURSE TITLE: COST ACCOUNTING

DATE: 25TH APRIL 2014 TIME: 2.00PM – 5.00PM

INSTRUCTIONS TO CANDIDATES

Question ONE is compulsory

Answer any other THREE questions

This paper consists of 5 printed pages. Please turn over.

QUESTION ONE.

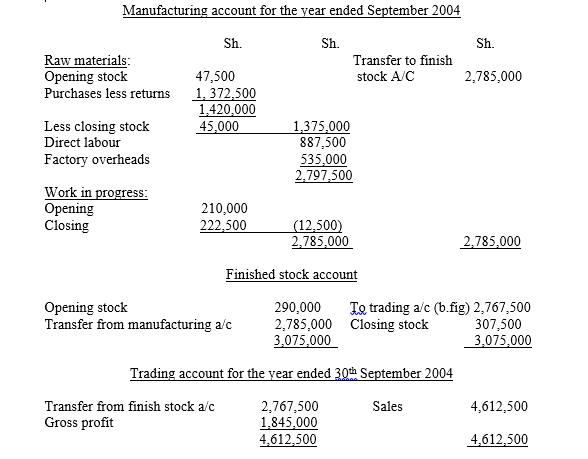

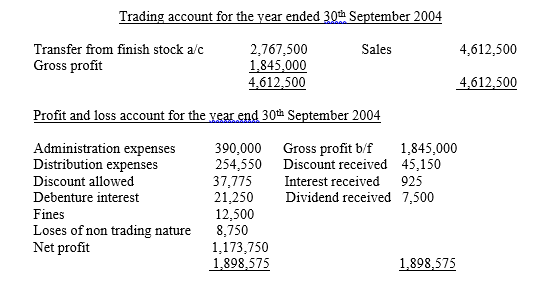

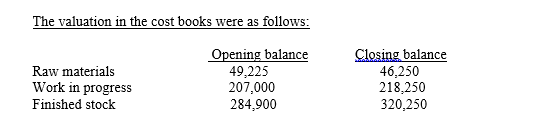

The cost books of Narok ltd reported the profit for the year ended 30th September 2004 as 1,209,750. The financial books of the company disclosed the following position for the year ended on the same date.

:

:

Depreciation amounting to 153,650/- was charged in the cost books, whereas factory overheads in the financial books included 146,825 for the expense heading.

The profit shown in the cost books has been arrived at after charging notional rent 37,500 and interest on capital 75,000/-

Required:

Reconcile the cost and financial books of the company clearly showing your computations and presenting your reconciliation in an orderly manner.

(25mks)

QUESTION TWO.

a) Write short notes on the following methods of computing wages;

1) Piece rate method (2mks)

2) High time rate for overtime (2mks)

3) Differential pierce rate (2mks)

b) Total output of Mr. King for one week was 560 units. He was allowed 6minutes per unit. He completed these units in 50hours. His wage rate per hour is 20/-.

Required;-

Calculate Mr. King’s total wage according to:-

a) Halsey scheme (3mks)

b) Halsey weir scheme (3mks)

c) Rowan scheme (3mks)

QUESTION THREE.

a) Discuss the meanings and applications of the following terms;-

I. Re-order level (1mks)

II. Minimum stock level (1mks)

III. Maximum stock level (1mks)

b) The following information is provided for material Z800;

Maximum consumption = 8,000 units per week.

Minimum consumption = 5,000 units per week.

Lead time = 5-7 weeks

Re-order quantity = 40,000 units

Required;

i. Re- order level (3mks)

ii. Minimum stock level (3mks)

iii. Maximum stock level (3mks)

iv. Average stock level (3mks)

QUESTION FOUR.

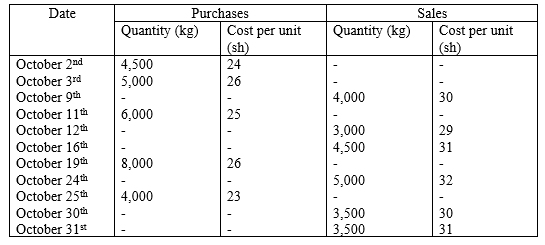

The following transactions relates to material Q200 for the month of October 2005;

The firm values its stock using last in first out method (LIFO)

Required:

a) Prepare store ledger card for October 2005. (10mks)

b) Prepare trading account for the month. (5mks)

QUESTION FIVE.

Mahindi enterprise ltd is located at Nairobi industrial area Kenya. The company manufactures a product “D” which is used in the building industry; the main raw material used in the manufacture of “D” is material BX000.

The following information relates to material BX000:

Annual requirements——————————150,000 units

Ordering costs————————————–15,000/- per order

Annual holdings————————————15% of the purchase price

Purchase price per unit—————————-600/-

Safety stock requirement————————–nil

Required:

a) The economic order quantity (EOQ) (5mks)

b) The number of orders needed per year (5mks)

c) Ordering cycle length (5mks)

QUESTION SIX.

a) Outline five main characteristics and essentials of contract accounting.

(5mks)

b) Vintage construction company Ltd won the contract for the construction of a multi-storey building at the cost of sh. 200million. The data relating to the contract for the year ended 31st December 2007 were as follows:

(Sh.000)

Material issued to site 80,000

Material purchased locally 15,700

Direct wages:

Paid 5,800

Accrued 350

Plant purchased and installed 48,800

Direct expenditure:

Paid 1,780

Accrued 70

Establishment charges 180

Material returned to store 850

Work certified 150,000

Cost of work not certified 3,800

Material on site on 31st December 5,330

Value of plant on 31st December 41,500

The company had received from the client payment amounting sh. 126 million.

Required:

a) Prepare contract account (5mks)

b) Prepare contractee account (5mks