BBM 103 SUPPLIMENTARY EXAMS

Answer question ONE and any other THREE

QUESTION ONE

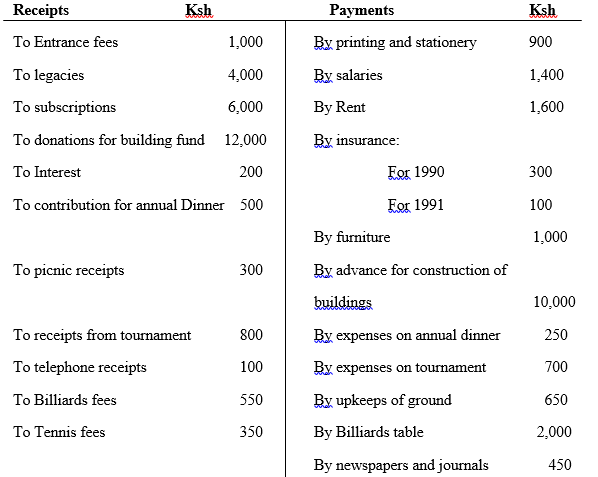

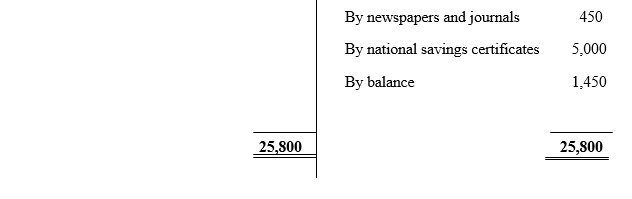

Given below is the Receipts and Payments Account of the popular club for the year ended 31st December, 1990:

Additional information

- Subscriptions include subscriptions for 1991, sh. 500

- Subscriptions outstanding for current year Rs. 800 of which sh. 200 are considered doubtful.

- 60% of the entrance fees are to be capitalized.

- 12% National savings certificates were purchased on 1-7-90

- Sundry persons owed sh. 200 for advertisement in club’s year-book

- Provide sh. 50 as depreciation on furniture

Prepare i) Income and Expenditure Account for the year ended 31st Dec, 1990; and

- ii) Balance sheet as on that date

(25marks)

QUESTION TWO

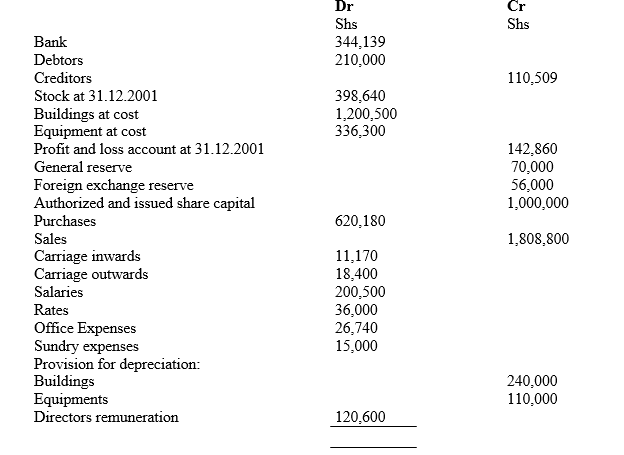

You are to draw up an income statement for the year ended 31 December 2002, and a balance sheet as at the date from the following trial balance and details of Busia Traders Ltd.

Additional Information

- Stock at 31 December 2002 shs. 460,370

- Rates owing shs. 15,000, office expenses owing shs. 1,700

- Dividend of 10 per cent was proposed

- Transfer to reserves; general shs. 10,000, foreign exchange shs. 6,000

- Depreciation on cost: buildings 5 per cent, equipment 20 per cent

(15marks)

QUESTION THREE

The following information relates to the rent income account in the books of a trader on the dates shown:

1.1.2004 31.12.2004

Shs. Shs.

Rent received in advance 8,000 19,200

Rent owing from tenants 28,800 22,400

Rent receiving during the year 518,400

Show the rent income account and the amount posted to the profit and loss account.

(15marks)

QUESTION FOUR

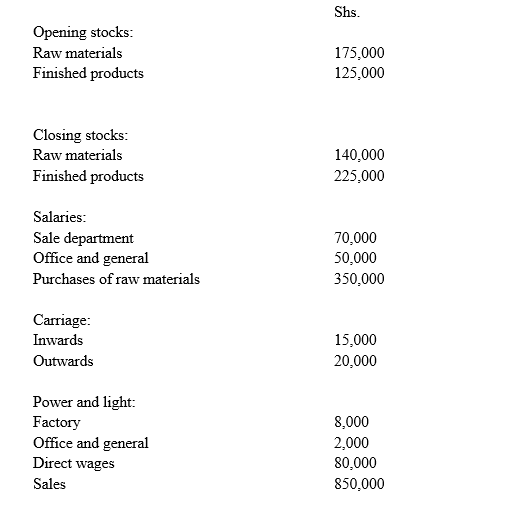

The following information is extracted from the books of A.B.C Company for the year ending 31st December 1989

QUESTION FIVE

The following balances were taken from the books of Tonui, Koech and Langat, partners in a wholesale business, on 30th November 2004

Shs.

Capital Accounts:

Tonui 120,000

Koech 80,000

Langat 40,000

Current Account:

Tonui Cr 24,000

Koech Cr 12,000

Langat Dr 18,000

Drawings:

Koech 17,400

Langat 10,000

Net trading profit for the year was shs. 449,700; salary paid to Langat during the year was shs. 82,000

Their partnership agreement provided the following:

- To maintain Fixed capital account

- Profit and losses to be shared in the ratio of their fixed capital

- 6% interest per annum to be allowed on capital and 10% interest to be charged on drawings

- Langat to be paid a monthly salary of shs. 11,000

- To transfer shs. 30,000 to generate reserve

Required:

- Profit & loss and appropriation account

- Partners’ currents account

(15marks)