MAASAI MARA UNIVERSITY; THE SCHOOL OF BUSINESS AND ECONOMICS.

SUPPLEMENTARY/SPECIAL EXAMINATIONS FOR BACHELOR OF

BUSINESS MANAGEMENT/ EDUCATION ARTS/ARTS ECONOMICS

1ST YEAR, 1ST SEMESTER JAN-ARIL. 2014

UNIT BBM 100/ECO 101: PRINCIPLES OF ACCOUNTING 1/ FINANCIAL ACCOUNTING I

Time 3 hours

Answer question ONE and any other THREE questions.

QUESTION ONE.

a. Define the following accounting financial accounting concepts and for each explain the implications in the preparation of final financial statements. ( 6mks)

i) Accrual concept.

ii) Materiality concept.

iii) Matching concept.

b. i) Discuss four reasons behind the preparation of control accounts. ( 4mks)

ii) The following data were obtained from the books of Ole Matope business;

Debit balance in the sales ledger (1.1.2012) 314,000

Credit balance in the sales ledger (1.1.2012) 4,800

Returns inwards 12,000

Cash receipts from debtors 178,000

Discount allowed 7,000

Carriage charged on debtors 5,000

Bad debts written of 3,000

Dishonored cheques from debtors 9,000

Sales ledger debits transferred to purchases ledger 1,200

Credit balance in sales ledger (31.12.2012) 5,000

Required: prepare a sales ledger control account ( 5mks )

c. Discuss any five errors that do not affect the equality of a trial balance. ( 5mks)

d. The following errors were identified by Santai traders.

1. Purchase of goods worth 10,000 on credit from J Serem double entry was completed erroneously in K Serem account.

2. Purchase of a machine in cash worth 50,000 was debited to purchases account.

3. The sales account was overcast by 20,000 as well as the salaries account.

4. Sales of 42,000 to Almis was entered in the books as 24,000

5. Payment of cash of 32,000 to Mwangi was entered on the debit side of the cash book and credited to Mwangi’s account.

Required: Prepare journal entries in the General journal to correct the above errors. (5mks)

QUESTION TWO.

a. The following trial balance relates to XYZ proprietorship on 31st June 2012.

Dr Dr

Sh.“000” Sh.“000”

Sales—————————————————————————————— 436,000

Purchases———————————————————– 163,000

Rent and Rates—————————————————- 40,000

Insurance————————————————————– 3,000

Carriage inwards—————————————————- 4,000

Returns inwards—————————————————– 3,000

Returns outwards————————————————————————— 1,000

Sales promotion—————————————————–19,000

Electricity————————————————————- 23,000

Stock(1.7.2011)—————————————————- 20,000

Salaries————————————————————- 117,000

Telephone expenses——————————————- 24,000

Discount allowed————————————————– 2,000

Discount received———————————————- —————————– 1,000

Interest paid ——————————————————— 3,000

Drawings———————————————————- 25,000

Machinery at cost————————————————– 60,000

Buildings————————————————————-180,000

Provision for depreciation on buildings———————————————– 20,000

Capital (1.7.2012)—————————————————————————-185,000

5 yr Barclays loan————————————————————————— 60,000

Debtors—————————————————————- 41,000

Creditors—————————————————————————————-22,000

Bank overdraft———————————————————————————2,000

727,000 727,000

Additional information.

1 Machinery is to be depreciated at 25% using straight line method.

2 Prepaid insurance amounted to Sh. 2,000,000

3. salaries owing amounted Sh. 4,000,000

4. Stock on 31.06.2012 was valued at Sh. 22,000,000

Required: Prepare;

i. An income statement for the year ended 31.06.2012. (10mks)

ii. Statement of the financial position for NYS Proprietorship as at 31.06.2012. ( 5mks)

QUESTION THREE.

a. Discuss any eight users of financial accounting reports and their information needs. (8mks)

b. The following transactions relate to Ole Sakuda traders for the month of August 2013.

1st balances were ; Bank sh. 20,000 and cash sh. 50,000

2nd Credit purchases from Olelenku worth sh. 47,000

3rd Credit sales to Kandara sh. 15,000 and Room sh. 22,000

5th Cash purchases Sh. 25,000

10th Buyers returned defective goods as follows; Kandara 1,000 and Room 1,050

15th Olelenku’s account was settled in full less 5% cash discount by cheque.

18th Purchases worth sh.70,000 from Matata paying sh. 20,000 by cash and the rest to be paid later.

28th Received cheques of sh. 10,000 and sh. 15,000 from Kandara and Room respectively.

Required; enter the transaction s in personal accounts only and balance them. ( 7mks)

QUESTION FOUR.

(a) The bank statement and cashbook balances should agree, but sometimes these balances may not agree:

Required: Discuss this statement and explain why it is important to prepare a bank reconciliation statement (5marks)

(b) On 31 October 2012, the cashbook of Mwea Enterprises Ltd. Showed a debit balance of Sh.1,710,000. This did not agree with the balance shown in the bank statement.

Upon investigation, the accountant discovered the following errors:

1. A cheque paid to Kindaruma for Sh.306,000 had been entered in the cashbook as Sh.387,000

2. Cash paid into the bank by a customer for Sh.90,000 had been entered in the cashbook as Sh.81,000

3. A transfer of Sh.1,110,000 to Central Savings Bank had not been posted to the cash book.

4. A receipt of Sh.9,000 shown in the bank statement had not been posted in the cashbook.

5. Cheques drawn amounting to Sh.36,000 had not been paid into the bank.

6. The cash book balance had been incorrectly brought down at 1 November 2011 as a debit balance of Sh.1,080,000 instead of a debit balance of Sh.990,000

7. Bank charges of Sh.18,000 do not appear in the cash book.

8. A receipt of Sh.810,000 paid into the bank on 31 October 2012 appeared in the bank statement on 1 November 2012.

9. A standing order of Sh.27,000 had not been recorded in the cash book.

10. A cheque for Sh.45,000 previously received and paid into the bank had been returned by the customer’s bank marked “account closed”.

11. The bank received a direct debit of Sh.90,000 from an anonymous customer.

12. Cheques banked had been totaled at Sh.135,000 instead of Sh.153,000.

13. A cheque drawn in favour of Nyaga for Sh.120,000 had been entered on the debit side of the cashbook.

Required;

(i) Adjusted cash book as at 31 October 2012. (6 marks)

(ii) A bank reconciliation statement as at 31 October 2012. (4 marks)

QUESTION FIVE.

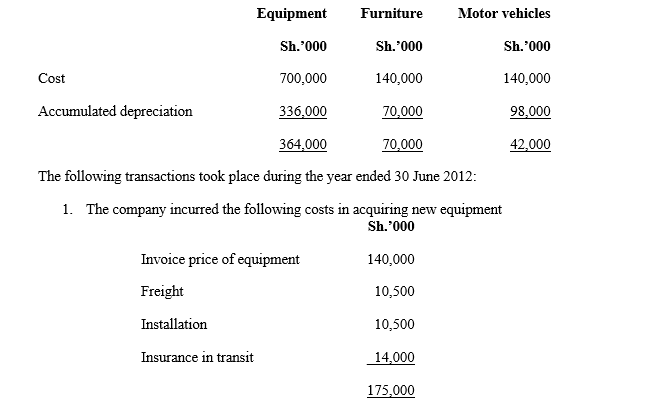

An extract from the balance sheet of Westgate Ltd as at 30 June 2012 showed the following summary of equipment, furniture and motor vehicles.

2. Property, plant and equipment disposed of during the year were as follows:

In addition, a new truck was acquired by trading in an old truck at an agreed value of Sh.10.5 million and making an additional cash payment of Sh.15 million. The old truck had cost Sh.15 million in July 2009.

3. The directors recommended a reclassification of some items of equipment to furniture. These items had cost Sh.15 million and had accumulated depreciation of Sh.3 million.

4. The company’s policy is to charge depreciation on a straight line basis at the following rates:

Equipment 20% per annum

Furniture 12 ½ % per annum

Motor vehicles 30 % per annum

5. A full year’s depreciation was charged in the year of acquisition but none in the year of disposal.

Required:

(a) Explain two methods of charging depreciation that Westgate Ltd could have used, outlining strengths and weaknesses for each. (5 marks)

(b) Fixed assets disposal account for the year ended 30 June 2012. (6 marks)

(c) Provision for depreciation account for the three fixed assets ( 4 mks)