TUESDAY: 5 April 2022. Afternoon paper. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Do NOT write anything on this paper.

QUESTION ONE

1. Your firm has been engaged in auditing small entities for the last five years. In a recent development, your firm has been appointed to conduct an audit on a large entity; which is the first assignment of such magnitude. You are required to undertake an interim audit and a final audit of the large entity.

Required:

Explain the objective of an external audit. (2 marks)

Highlight five audit procedures you could undertake during the interim audit of the large entity. (5 marks)

Describe five audit procedures you would undertake during the final audit of the large entity. (5 marks)

Present two drawbacks of conducting an interim audit. (2 marks)

2. Highlight three shortcomings of using standardised audit programs. (3 marks)

3. Evaluate three benefits of an audit committee in a not-for-profit organisation (NGO). (3 marks)

(Total: 20 marks)

QUESTION TWO

1. Analyse three categories of financial statements assertions that may be used by the auditor to test the financial statements of a company. (9 marks)

2. International Standards on Auditing 500, “Audit Evidence”, permits an auditor to place reliance on information produced by a management’s expert in the course of audit work.

Required:

Propose six factors that the auditor might consider before relying on the work of a management’s expert. (6 marks)

3. Your organisation is in the process of computerising the internal audit function. The management has proposed installation of a Generalised Audit Software (GAS) to replace the manual procedures.

Required:

Evaluate five functionalities that are supported by a Generalised Audit Software. (5 marks)

(Total: 20 marks)

QUESTION THREE

1. You have been appointed to lead your engagement team in auditing a new client. During the planning of the audit, the team emphasised on the need to understand the internal control system maintained by the client.

Required:

Describe four components of the internal control system that would be of interest to your team. (8 marks)

Identify two limitations of internal control systems. (2 marks)

2. Antony and Associates (CPA) have been the auditors of Bidii Logistics Company for the last two years. This company deals with shipping and movement of cargo within the East Africa region. The lead auditor in his review of the financial statements suspected fraudulent financial reporting overriding controls and immediately convened a meeting with his engagement team.

Required:

Explain the meaning of “fraudulent financial reporting”. (2 marks)

Discuss six techniques that the management of Bidii Logistics Company might have deployed to achieve fraudulent financial reporting. (6 marks)

Evaluate the importance of the meeting convened by the lead auditor with the engagement team. (2 marks)

(Total: 20 marks)

QUESTION FOUR

1. Jenga Ltd. operates from fifteen separate depots providing plant and machinery hire service throughout the country.

The company offers hire services of a wide variety of tools and equipment to:

- Builders and corporate customers on credit.

- Members of the public on advance payment terms, including payment by cash.

In addition to the revenue generated from the hire of plant and machinery, the company also generates income from the sale of damaged or aged machinery and the hire of accessories and safety equipment.

Required:

Explain the term “inherent risk”. (2 marks)

Evaluate three factors that could suggest that there might be a high inherent risk applying to plant and machinery income as reported in the financial statement of Jenga Ltd. (9 marks)

2. With reference to ISA 700 (Forming an Opinion and Reporting on Financial Statements); distinguish between an “adverse opinion” and a “disclaimer of opinion”. (4 marks)

3. Highlight five threats to an external auditor’s independence. (5 marks)

(Total: 20 marks)

QUESTION FIVE

1. Your audit firm was recently appointed the auditor of Jisifu Ltd. The company has a subsidiary based in western part of the country and its auditors had retired the previous year.

Required:

Assess four factors that would influence you in determining whether or not to send a separate engagement letter to the subsidiary. (4 marks)

2. You are the managing partner in Odhiambo and Associates (Certified Public Accountants). Wasali Ltd. has recently engaged your firm to provide tax consultation services to the company.

Required:

Using four elements of an assurance engagement, explain whether the above engagement qualifies to be an assurance engagement. (4 marks)

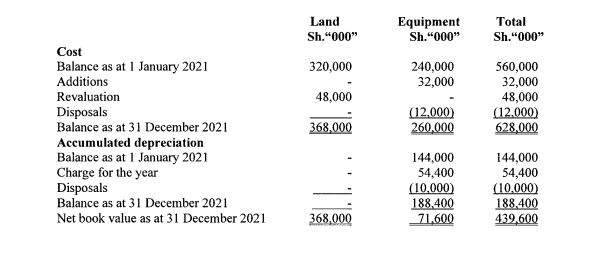

3. The financial accountant of Afiah Ltd. has provided you with the following breakdown of movements on the company’s non-current assets for the year ended 31 December 2021:

Additional information:

- The company does not depreciate its land and you, the company’s auditor, agree that this is appropriate.

- Depreciation on equipment is charged at the rate of 20% per annum with full year’s depreciation charged in the year of acquisition and none in the year of disposal.

- This is the company’s first time revaluing the land. The revaluation was carried out by a reputable firm of auctioneers and valuers, known to you.

- The company maintains a non-current asset register.

Required:

Describe four internal controls that could be present regarding the non-current asset register before you could place reliance on it as a source of audit evidence. (4 marks)

Assess four audit work procedures that could be carried out on the depreciation charge and on the accumulated depreciation balance. (4 marks)

Explain four tests that could be carried out to audit both the additions and the disposals of the equipment. (4 marks)

(Total: 20 marks)