. REVIEW CONSIDERATIONS

Review Procedures

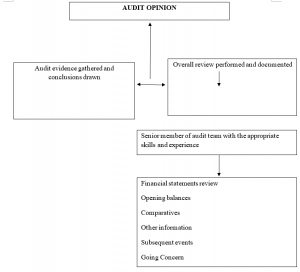

An auditor must perform and document an overall review of the financial statements before making an audit opinion. This review, along with the conclusions drawn from other audit evidence obtained, gives the auditor a reasonable basis for his opinion on the financial statements. It needs to be carried out by a senior member of the audit team, who has the appropriate skills and experience.

What specific tasks should be carried out?

Compliance with accounting regulations

The auditor should consider whether the financial statements are in accordance with statutory requirements and whether the accounting policies are in accordance with accounting standards. In addition, the policies should be appropriate to the entity, properly disclosed and consistently applied.

When assessing the accounting policies used by the entity, the auditor should consider policies adopted in specific industries, standards and guidelines, the need for a true and fair view and the need to reflect substance over form.

Review for consistency and reasonableness

The auditor needs to consider whether the financial statements are consistent with his knowledge of the entity’s business and with the evidence accumulated from other audit procedures, and that the manner of disclosure is fair.

The auditor will consider:

- Information and explanations received during the audit

- New factors which may affect presentation and/or disclosure requirements.

- Results of analytical procedures applied

- Undue influence by directors

- Potential impact of the aggregate of uncorrected misstatements identified.

Analytical procedures

Analytical review procedures are used as part of the overall review procedure. This review should cover accounting ratios, changes in products/customers, price and product mix changes, wages changes, variances, trends in production and sales, changes in material/labour content of production and variations caused by industry or economy factors. Significant fluctuations and unexpected relationships must be investigated.

Summarise errors

During the course of the audit of financial statements, there will be material or immaterial errors uncovered. The client will normally adjust the financial statements to take account of these errors. At the end of the audit however, there may be some outstanding errors and the auditors will summarise these unadjusted errors. The auditor should show both the balance sheet and the profit and loss effect of these errors.

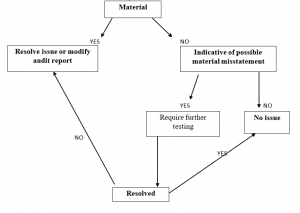

Evaluating the effect of misstatements

As part of the standard on materiality (ISA 320) in evaluating whether the financial statements are prepared in accordance with an applicable financial reporting framework, the auditor should assess whether the aggregate of uncorrected misstatements that have been identified during the audit is material.

The aggregate of uncorrected misstatements is:

- Specific misstatements identified by the auditor, including ones identified during the audit of the previous period if they affect the current period (e.g. opening stock) and

- The auditor’s best estimate of other misstatements which cannot be quantified specifically (e.g. projected errors or system errors).

If the aggregate of misstatements is material, the auditor must consider reducing audit risk by carrying out additional testing. Otherwise, he may request management to adjust the financial statements for the identified misstatements which the latter may wish to do anyway.

If the aggregate of the misstatements approaches the level of materiality, the auditor should consider whether it is likely that undetected misstatements, when taken with the aggregated uncorrected misstatements, could exceed the materiality level. If so, he should consider reducing the risk by performing additional testing or, as before, requesting management to adjust the financial statements for the identified misstatements.

Completion checklists

Auditors frequently use checklists as control documents and evidence, that all final procedures have been carried out and that all material amounts are supported by sufficient appropriate audit evidence. The checklists should be signed off.

REPORTING ON AUDITED FINANCIAL STATEMENTS (ISA 700)

Audit Opinion

The objective of an audit is for an independent auditor to express an opinion on a set of financial statements. The auditor is that independent person who gives his opinion on a set of financial statements. His opinion is contained in a clear written expression called the audit report.

He does not provide absolute assurance. In other words he does not say the “accounts are correct”. Audits have their limitations.

Considerations in reporting

The auditor needs to consider a number of key matters:

- Has he received all the information and explanations necessary

- Has he carried out all the procedures needed to meet applicable auditing standards.

- Have applicable accounting requirements been used in the preparation of the financial statements.

- Do the financial statements give a true and fair view.

The Process of forming an audit opinion

- Ascertain whether all the evidence reasonably expected to be available has been obtained and has been evaluated.

- Assess whether the effect of not gaining sufficient and relevant evidence is such that the financial statements could be misleading as a whole or in material part.

- Ascertain whether the financial statements are prepared in accordance with International Financial Reporting Standards (IFRS)..

- Assess whether a departure from the accepted accounting principles is required to give a true and fair view and has there been adequate disclosure.

- Assess whether any unnecessary departure from accounting principles is material or pervasive to the financial statements. A material departure will give an “except for” opinion while a pervasive departure will result in an adverse opinion.

- Conclude as a whole whether the financial statements give a true and fair view.

KEY CONCEPTS

If the auditor feels that the financial statements give a true and fair view he should express an unqualified opinion stating that they present fairly in all material respects in accordance with the applicable financial reporting framework.

True and fair view

The key opinion is whether the accounts give a true and fair view. Unfortunately, there is no formal definition as it is not laid out in Company law.

However, it is generally accepted that a set of accounts can only give a true and fair view if they are not factually incorrect and present information in an impartial way that is clearly understood by the reader.

It could also be argued that in order to ensure that a set of accounts gives a true and fair view, an auditor should have regard for Company Law and Accounting Standards pertaining to those financial statements and that he himself has carried out the audit in accordance with the relevant regulatory pronouncements, codes of ethics and Auditing Standards.

Materiality

Materiality needs to be considered by an auditor in evaluating the effect of misstatements on the financial statements and when determining the nature, timing and extent of audit procedures.

Information is material if its omission or misstatement could influence the economic decisions of users taken on the basis of the financial statements.

An item might be material due to its nature, value or impact on users of accounts. Only issues that are material will have an impact on the auditor’s opinion.

Statutory requirements

Aside from the key opinion, there are a number of other issues that the auditor should consider.

Matters of opinion:

- Have proper accounting records been kept

- Is the information in the directors’ report consistent with that given in the financial statements

- Does a financial situation exist which may require an Special Meeting

- Have the accounts been prepared in accordance with the provisions of the companies’ acts.

Matters of fact:

- Has the auditor received all the information and explanations he deems necessary for the purposes of his audit

- Do the financial statements agree with the books of account.

BASIC ELEMENTS OF THE AUDITOR’S REPORT

Title

It should clearly indicate that the report is prepared by an independent auditor. This independence confirms that all the relevant ethical standards have been met.

Addressee

The auditor needs to consider the circumstances of the engagement and the local regulations. Under company law the audit report should be addressed to the shareholders.

Introductory paragraph

This paragraph will:

- Identify the entity been audited

- State that the financial statements have been audited

- Identify each of the financial statements being audited

- Refer to the significant accounting policies and other notes contained within the financial statements

- Specify the date and period covered by the financial statements.

Statement of management responsibility

It must contain a statement that the management is responsible for the presentation of the financial statements. That responsibility includes:

- Designing, implementing and maintaining internal controls Selecting appropriate accounting policies and

- Making reasonable accounting estimates.

Auditor’s responsibility

The audit report should state that the auditor is responsible for expressing an audit opinion. It should inform the reader that the auditor adhered to international standards on auditing and ethical requirements and performed the audit so as to obtain reasonable assurance that the financial statements were free from material misstatements.

It should also be noted that this responsibility includes:

- Examining on a test basis, evidence to support the amounts and disclosures in the financial statements

- Assessing the accounting principles used in the preparation of the financial statements

- Considering whether the accounting policies are appropriate to the entity’s circumstances, consistently applied and adequately disclosed

- Assessing the significant estimates made by management in the preparation of the financial statements

- Evaluating the overall financial statement presentation.

Auditor’s opinion

If the auditor feels that the financial statements give a true and fair view he should express an unqualified opinion stating that they present fairly in all material respects in accordance with the applicable financial reporting framework.

Other reporting requirements if any

Any other matters required by law should be reported here such as the keeping of proper books of account.

Auditor’s signature

Should be either the engagement auditor’s signature or the audit firm’s name.

Date

The report should be dated as of the completion date of the audit. It should not be signed earlier than the date the financial statements are approved by management.

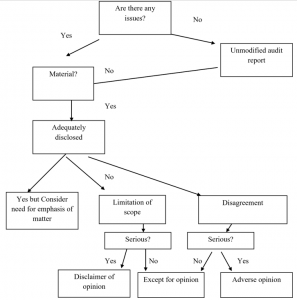

MODIFIED REPORTS

- Matters that do not affect auditor’s opinion

- Matters that do affect auditor’s opinion

| Description | Audit opinion |

| Accounts show a true and fair view | Unqualified audit opinion

“Accounts show a true and fair view” |

| Accounts show a true and fair view but you need to draw attention to a significant matter | Modified audit report with ‘emphasis of matter’ paragraph

“Without qualifying my opinion, I wish to draw your attention…” |

| Material items do not show a true and fair view | Modified audit report

“Accounts show a true and fair view except for……….” |

| A true and fair view is not shown because disagreements are pervasive to the accounts; Accounts are meaningless.

Perhaps there are significant numbers of material disagreements that do not show a true and fair view. |

Adverse audit opinion

“Accounts do not show a true and fair view” |

| The auditor cannot tell whether a true and fair view is given in respect of material items due to limitation in scope of the audit. | Modified audit report

“Accounts show a true and fair view except for……….” |

| Auditor cannot tell whether a true and fair view is given at all due to a limitation in scope of the audit. | Disclaimer of opinion

“I am unable to form an opinion” |

AUDIT REPORT DECISION MAKING

CIRCUMSTANCES GIVING RISE TO MODIFIED REPORTS

Matters that do not affect auditor’s opinion – ‘Emphasis of matter’ paragraph

In certain circumstances, an auditor’s report may be modified by adding an emphasis of matter paragraph to highlight a matter affecting the financial statements which is included in a note in the financial statements that more extensively discusses the matter. The paragraph should be included after the opinion and should refer to the fact that the opinion is not qualified in that respect.

Examples could include questions over the recoverability of a debtor balance or a potential liability such as a fine.

The auditor may feel that there is sufficient disclosure in the accounts and as such there is no need to issue a qualified audit report. He may however, wish to draw the reader’s attention to this matter and hence the emphasis of matter paragraph.

Matters that do affect auditor’s opinion-Limitations on scope of the audit

Has the auditor received all the information and explanations he deems necessary for the purposes of his audit. If not, then he needs to consider has there been a limitation imposed on the scope of his audit. This consideration will affect his opinion.

Matters that do affect auditor’s opinion-Disagreement with management

The auditor may disagree with management about matters such as the acceptability of accounting policies selected, the method of their application or their adequacy of disclosures in the financial statements.

It may even be a disagreement over an actual amount in the accounts or inadequate disclosure of an event or circumstance.

AUDITOR’S RESPONSIBILITIES BEFORE AND AFTER DATE OF AUDIT

REPORT

Events occurring up to the date of the auditor’s report

The auditor should perform audit procedures designed to obtain sufficient appropriate audit evidence such that all events up to the date of the auditor’s report that may require adjustment, or disclosure, in the financial statements have been identified. When the auditor becomes aware of events that materially affect the financial statements, it is his responsibility to consider whether such events are properly accounted for and adequately disclosed.

These procedures are in addition to procedures that may be applied to specific transactions occurring after period end (normal year-end work) to obtain audit evidence as to account balances as at period end, for example, the testing of stock cut-off, receipts from debtors and payments to creditors.

Facts discovered after date of the auditor’s report

The auditor does not have any responsibility to perform audit procedures or make any inquiry regarding the financial statements after the date of the auditor’s report. During the period from the date of the auditor’s report to the date the financial statements are issued, the responsibility to inform the auditor of facts that may affect the financial statements rests with management.

Where the auditor becomes aware of a fact that may materially affect the financial statements, he should consider whether the financial statements need amendment. He should discuss the matter with management and should take the action appropriate in the circumstances.

AUDITOR’S RESPONSIBILITIES FOR OTHER DOCUMENTS

Other information

Other information is financial and non-financial other than that included in the audited financial statements. An entity issues on an annual basis its audited financial statements together with the auditor’s report thereon. This document is frequently referred to as the ”annual report.” In issuing such a document, an entity may also include other financial and non-financial information.

Examples of other information include a report by management on operations, financial summaries or highlights, employment data, planned capital expenditures, financial ratios, names of officers and directors and selected quarterly data.

ISA 720 states that an auditor should read the other information to identify material inconsistencies with the audited financial statements.

A ”material inconsistency” exists when other information contradicts information contained in the audited financial statements. A material inconsistency may raise doubts about the audit conclusions drawn from audit evidence previously obtained and, possibly, about the basis for the auditor’s opinion on the financial statements.

If, as a result of reading the other information, the auditor becomes aware of any apparent misstatements therein, or identifies any material inconsistencies with the audited financial statements, the auditor should seek to resolve them.

In certain circumstances, the auditor has a statutory or contractual obligation to report specifically on other information e.g. the director’s report. In other circumstances, the auditor has no such obligation.

However, the auditor needs to give consideration to such other information when issuing a report on the financial statements, as the credibility of the audited financial statements may be undermined by inconsistencies which may exist between the audited financial statements and other information. The credibility of the audited financial statements may also be undermined by misstatements within the other information.

When there is an obligation to report specifically on other information, the auditor’s responsibilities are determined by the nature of the engagement and by local legislation and professional standards.

Access to other information

In order that an auditor can consider other information included in the annual report, timely access to such information will be required. The auditor therefore needs to make appropriate arrangements with the entity to obtain such information prior to the date of the auditor’s report. In certain circumstances, all the other information may not be available prior to such date. In these circumstances, the auditor would need to consider his options. Is there a limitation in the scope of the audit! Material inconsistencies

If, on reading the other information, the auditor identifies a material inconsistency, he should determine whether the audited financial statements or the other information needs to be amended.

If the auditor identifies a material inconsistency he should seek to resolve the matter through discussion with management.

If the auditor concludes that the other information contains inconsistencies with the financial statements, and the auditor is unable to resolve them through discussion with management, he should consider requesting management to consult with a qualified third party, such as the entity’s legal counsel and consider the advice received.

If an amendment is necessary:

- In the audited financial statements and the entity refuses to make the amendment, the auditor should express a qualified or adverse

- In the other information and the entity refuses to make the amendment, the auditor should consider including in the auditor’s report an emphasis of matter paragraph describing the material inconsistency or taking other actions.

The actions taken, such as not issuing the auditor’s report or withdrawing from the engagement, will depend upon the particular circumstances and the nature and significance of the inconsistency. The auditor would also consider obtaining legal advice as to further action. Material misstatements of fact

While reading the other information for the purpose of identifying material inconsistencies, the auditor may become aware of a material misstatement of fact.

A ”material misstatement of fact” in other information exists when such information, not related to matters appearing in the audited financial statements, is incorrectly stated e.g. production figures.

If the auditor becomes aware that the other information appears to include a material misstatement of fact, the auditor should discuss the matter with the entity’s management.

When discussing the matter with the entity’s management, the auditor may not be able to evaluate the validity of the other information and management’s responses to the auditor’s inquiries, and would need to consider whether valid differences of judgment or opinion exist.

The auditor should consider whether the other information requires to be amended. When the auditor still considers that there is an apparent misstatement of fact, the auditor should request management to consult with a qualified third party, such as the entity’s legal counsel and should consider the advice received.

If the auditor concludes that there is a material misstatement of fact in the other information which management refuses to correct, the auditor should consider taking further appropriate action. The actions taken could include such steps as notifying management in writing of the auditor’s concern regarding the other information and obtaining legal advice. There is always the danger that these misstatements could undermine the credibility of the financial statements.

Availability of other information after the date of the auditor’s report

Where all the other information is not available to the auditor prior to the date of the auditor’s report, the auditor should read the other information at the earliest possible opportunity thereafter to identify material inconsistencies.

If, on reading the other information, the auditor identifies a material inconsistency or becomes aware of an apparent material misstatement of fact, the auditor should determine whether the audited financial statements or the other information need revision.

When revision of the other information is necessary and the entity agrees to make the revision, the auditors carry out the audit procedures necessary under the circumstances. The audit procedures may include reviewing the steps taken by management to ensure that individuals in receipt of the previously issued financial statements, the auditor’s report thereon and the other information are informed of the revision.

When revision of the other information is necessary but management refuses to make the revision, the auditor should consider taking further appropriate action. The actions taken could include such steps as notifying management in writing of the auditor’s concern regarding the other information and obtaining legal advice.