THURSDAY: 16 December 2021. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings.

QUESTION ONE

1. Examine three buy side participants involved in alternative investments. (6 marks)

2. Describe four main classifications of hedge fund strategies. (4 marks)

3. A 12 year old industrial property is being valued using the cost approach. The appraiser feels that it has an effective age of 15 years based on its current condition. For example, there are cracks in the foundation that are not feasible to repair (incurable physical depreciation). That is, it would cost more to try to repair these defects than the value that would be created in the property. The appraiser believes that it has a 60 year remaining economic life (75 year total economic life).

The building was constructed using a greater ceiling height than users require in the current market (super- adequacy). It would cost Sh.27 million to reproduce (reproduction cost) the building with the same ceiling height but Sh.25 million to construct a replacement property (replacement cost) with the same utility but a normal ceiling height.

The higher ceiling results in increased heating and air-conditioning cost of Sh.50,000 per year. A capitalisation rate that would be used to value the property would be 10%.

The building was designed to include a cafeteria that is no longer functional (functional obsolescence). This area can be converted to usable space at a conversion cost of Sh.25.000 and it is believed that the value of the property would increase by at least this amount (curable functional obsolescence).

The roof needs to be replaced at a cost of Sh.250,000 and other necessary repairs amount to Sh.50.000. The costs of these repairs will increase the value of the building by at least Sh.300,000 (curable physical depreciation).

The road providing access to the property is a single lane road, whereas newer industrial properties are accessible by two lane road. This has a negative impact on rents (locational obsolescence), which is estimated to reduce net operating income (N01) by Sh.100,000 per year.

Based on comparable sales of vacant land, the land is estimated to be worth Sh.5 million.

Required:

Estimate the value of the property using the cost approach. (10 marks)

(Total: 20 marks)

QUESTION TWO

1. Describe two forms of protection provided to noteholders in a collateralised debt obligations (CDOs). (4 marks)

2. Explain two ways of creating transaction-based indexes in real estate. (4 marks)

3. Examine four mechanisms that offer call protection to commercial mortgage backed securities (CMBS) investors at the loan level. (4 marks)

4. Explain four factors affecting prepayment behavior of a mortgage backed security (MBS). (4 marks)

5. The spot price today for a bushel of maize is Sh.2,250. The continuously compounded interest rate is 5.5% and the storage cost is 2.0% per month.

Required:

The 6-month forward price. (4 marks)

(Total: 20 marks)

QUESTION THREE

1. Explain four categories of leveraged buyouts (LBOs) that create value to investors. (4 marks)

2. Describe three biases in hedge fund indices. (3 marks)

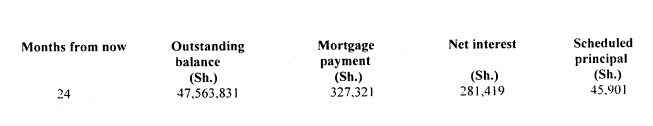

3. An investment firm has assembled Sh.80 million pool of 30 year fixed rate mortgages. The pool characteristics and its estimated cash flows are provided below. The pool has a weighted average coupon (WAC 1 of 6%. a weighted average maturity (WAM) of 356 months, and under current market conditions. prepayments are expected at 310 Public Securities Association (PSA) prepayment assumption.

The pool’s cash flow estimates are as follows:

Required:

Using the 310 PSA prepayment assumption, calculate the current prepayment rate of the pool. (3 marks)

Calculate the expected prepayment amount given a single monthly mortality (SMM) prepayment rate of 2.1482%. (3 marks)

4. The subject property for an analyst is a supermarket containing 22.000 square feet. with a land value of Sh.2 million derived from recent sales. The property is zoned commercial and is currently leased at market rent to a supermarket chain on a 10-year lease at Sh.80 per square foot per year. A vacancy and collection loss allowance of 5% is indicated to reflect the credit rating of the tenant and the term of the lease.

Allowable expenses consist of the following:

- Insurance Sh.380,000.

- Maintenance and repairs Sh.800,000.

- Management of property 5% of effective gross income.

- Legal fees 1% of effective gross income.

Additional information:

1. The land should return a yield of 8%.

- The capitalisation rate for the building include 10% overall yield and 2% for recapture.

Required:

Using straight-line capitalisation method, estimate the value of the supermarket. (7 marks)

(Total: 20 marks)

QUESTION FOUR

1. Describe three theories of commodities future returns. (6 marks)

2. Decribe three futures market participants citing their roles. (6 marks)

3. Joshua Muteti recently took a fully collateralised long futures position on a nearby coffee futures contract at the quoted futures price of Sh.125. Three months later, the entire futures position was rolled when the near term futures price was Sh.127 and the further-term futures price was Sh.128. During the three-month period between the time that the initial long position was taken and the rolling of the contract, the collateral earned an annualised rate of 1%.

Required:

Determine Joshua’s three-month total return on the coffee futures trade. (4 marks)

4. An investment and financial analyst gathered the following data relating to three collateralised mortgage obligation (CMO) tranches:

Securities Nominal spread (%) Spread comparison Option adjusted

zero volatility spread (%)

spread (%)

P 3.17 2.74 0.00

Q 4.35 1.96 -0.63

R 2.05 2.16 0.84

Required:

Determine the most appropriate security to invest in. (4 marks)

(Total: 20 marks)

QUESTION FIVE

1. Explain the term -early amortisation” in the context of credit enhancement. (2 marks)

2. Explain three benefits of crowdfunding to each of the following market participants:

Investors. (3 marks)

Borrowers. (3 marks)

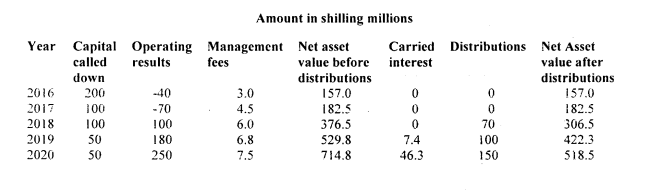

3. A private equity has the following cash flows data:

Required:

Calculate the fund’s multiples for the year 2020:

Distributed to paid in capital (DPI). (2 marks)

Residual value to paid in capital (RVPI). (2 marks)

Total value to paid in capital (TVPI). (2 marks)

4. Fred Okumu is considering investing in an interest only (10) tranche of a collaterised mortgage obligation (CMO) with a coupon of 10% per annum.

The following information relates to the CMO:

Tranche Par amount Coupon rate

Sh. “000” (%)

P 614,000 7.85

Q 540,000 8.05

R 476,000 8.75

S 523,000 9.65

Required:

The notional amount for this notional interest only (10) tranche. (6 marks)

(Total: 20 marks)