THURSDAY: 16 December 2021. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings. Any assumptions made must be clearly and concisely stated.

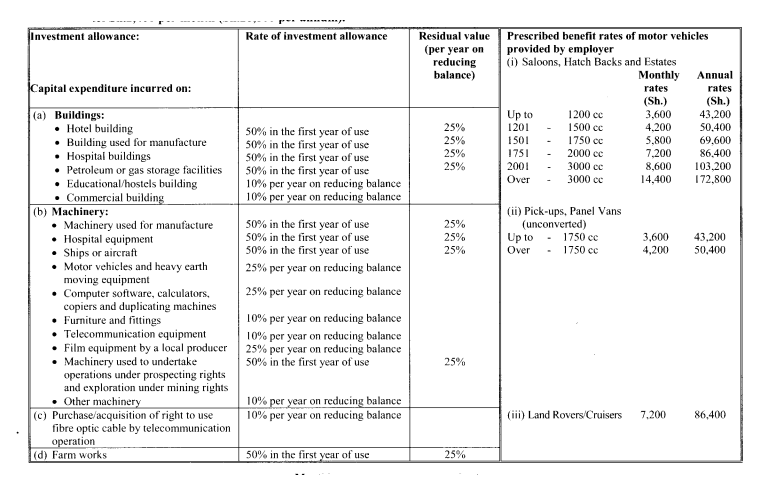

RATES OF TAX (Including wife’s employment, self-employment and professional income rates of tax). Year of income 2020.

Assume that the following rates of tax applied throughout the year of income 2020:

Monthly taxable pay Annual taxable pay Rate of tax

(Sh.) (Sh.) % in each Sh.

1 24,000 1 – 288,000 10%

24,001 40,667 288,001 – 488,000 15%

40,668 57,334 488,001 – 688,000 20%

Excess over – 57,334 Excess over – 688,000 25%

Personal relief Sh.2,400 per month (Sh 28,800 per annum).

QUESTION ONE

1. As economies continue to recover from the impact of the COVID-19 pandemic, tax collection in many countries continues to face challenges. This trend has resulted in some revenue authorities resorting to some drastic measures to boost tax revenue.

One recent measure taken is monitoring of social media accounts and postings to assess taxation compliance.

Required:

Justifying your response with practical reasons, argue the case for or against monitoring of social media accounts to assess taxable capacity and compliance.

(Note: marks will be awarded for only one position taken). (6 marks)

2. A delegation comprising government officials and entrepreneurs from a neighbouring country has visited your country, which is a beneficiary of the African Growth and Opportunity Act (AGOA) to learn more on AGOA and its benefits.

Required:

Prepare a brief to be presented to the delegation covering the following:

Background information on AGOA. (2 marks)

Conditions to be considered as an AGOA beneficiary country. (3 marks)

Trade benefits provided under AGOA. (3 marks)

3. Alternative Dispute Resolution (ADR) is a method of handling tax disputes outside the Judicial process. All applications for ADR should go through a suitability test before the application is submitted for ADR.

Required:

Summarise the disputes that may not be suitable for the ADR mechanism. (3 marks)

Describe the documents that must be submitted to support and facilitate the ADR discussions. (3 marks)

(Total: 20 marks)

QUESTION TWO

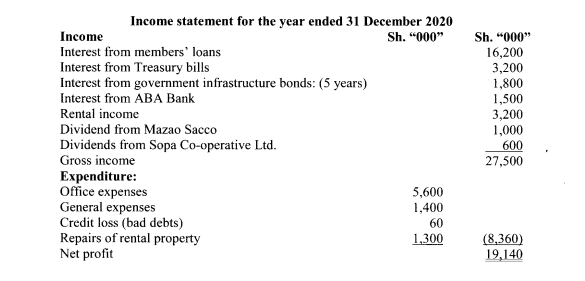

1. The following information relates to Msanii Sacco Ltd. for the year ended 31 December 2020:

Additional information:

- Office expenses include:

Sh. “000”

- Salaries to Sacco employees 1,200

- Salary to the caretaker of rental property 200

- Purchase of office computers 400

- General expenses include depreciation of Sh. 484,000 and non-performing loans to members of Sh. 620,000 which were written off

- Corporate tax rate during the year was 25%.

Required:

Adjusted taxable profit or loss for the year ended 31 December 2020.

Hint: Start with the reported profit. (6 marks)

Tax liability for the year ended 31 December 2020. (2 marks)

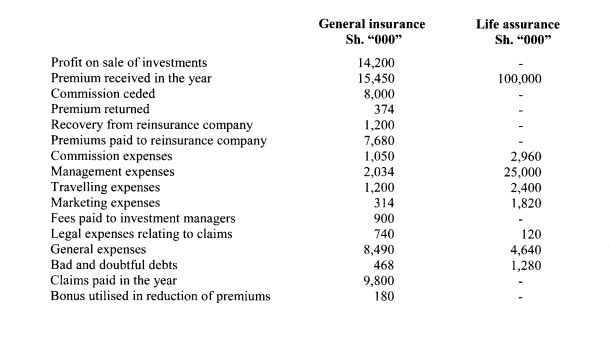

2. Triplecom Insurance Company Ltd. is a resident company carrying on both general and life assurance businesses. The

following information relates to the insurance company’s business for the year ended 31 December 2020:

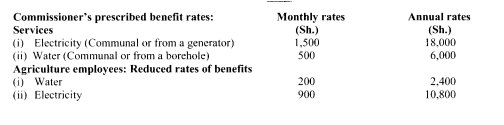

Additional information:

- Claims outstanding for general business were as follows:

- As at 1 January 2020 Sh.6,640,000.

- As at 31 December 2020 Sh.7,000,000.

- General expenses under general insurance include cost of computers Sh. 800,000 and cost of saloon car Sh.3,260,000.

- Reserves for unexpired risks for general insurance were as follows:

- As at 1 January 2020 Sh.3,240,000.

- As at 31 December 2020 Sh.6,200,000.

- The Life assurance fund balance was valued by an actuary at Sh. 310,000,000 as at 31 December 2020. 8% of this fund balance was recommended to be transferred for the benefit of shareholders. At the beginning of the year, the fund had been valued at Sh.250,000,000. 10% of the surplus was recommended to be transferred for the benefit of shareholders.

- Outstanding premiums in respect of life insurance business were as follows:

- As at 1 January 2020 Sh.12,000,000.

- As at 31 December 2020 Sh.9,200,000.

- Other income received by Triplecom Insurance Company Ltd. comprised:

- Interest from fixed deposit account Sh.780,000.

- Dividend received from qualifying company Sh.3,000,000 (net).

- The company owns the building which houses its offices. Part of the office space is rented out to other tenants.

In the year to 31 December 2020, the company received Sh.2,800,000 net rental income from their estate agents. Property management fees amounting to Sh.3,200,000 for the year to 31 December 2020 had not been deducted.

Required:

The taxable income or loss for Triplecom Insurance Company Ltd. for the year ended 31 December 2020. (12 marks)

(Total: 20 marks)

QUESTION THREE

1. You have been appointed as the first tax consultant of ABC International PLC, a newly incorporated company in your country.

Required:

Draft a letter to the Revenue Authority for income tax registration for ABC International PLC. (4 marks)

2. Reward Investment Company Ltd., a company registered for value added tax (VAT) purposes, provided the following details in respect to the month of January 2021:

- Purchased goods on credit for Sh.696,000 and for Sh.464,000 in cash respectively.

- Invoices were issued for sales of Sh.371,200 to non-VAT registered customers. The invoices issued included exempt sales amounting to Sh.174,000 and the balance were at standard rate.

- Purchased goods for Sh.672,800 from VAT registered businesses. However, goods valued at Sh.139,200 were returned to suppliers.

- Received a debit note for erroneous invoicing of goods valued at Sh.73,080.

- Issued credit notes for Sh.26,680 in respect of returns by credit customers.

- Settled electricity bills amounting to Sh.32,480.

- Settled audit fees of Sh.27,840 by cash.

- Received credit notes of Sh.62,640 for invoices received which had been overcast.

- Exported goods to Dubai for Sh.690,000.

- Imported goods from Zambia for Sh.250,000 when import duty was at 20%.

- Total goods sold as exempt supplies during the month amounted to Sh.494,000. These supplies could not be traced from goods purchased at the standard rate.

- Catering services to employees amounted to Sh.58,000 from a local restaurant.

- A debtor for goods valued at Sh.45,240 was declared bankrupt and a bad debt relief granted.

All transactions are stated inclusive of VAT at the rate of 16% where applicable unless otherwise stated.

Required:

Prepare a statement showing the following with regard to the transactions above:

- Input and output VAT.

- Deductible input tax.

- VAT payable by or refundable to Reward Investment Company Ltd.

- Comments on the VAT payable or refundable.

( 10 marks)

3. Describe the types of risk that require an organisation to develop a tax risk management framework. (6 marks)

(Total: 20 marks)

QUESTION FOUR

1. Describe the features that indicate the possible existence of a tax haven. (6 marks)

2. Lipa and Mali are in partnership trading as Lima Enterprises where they share profits and losses in the ratio of 2:1 respectively.

On 1 April 2020, Sasa was admitted with one-third of the profit without altering the existing profit-sharing ratio of Lipa and Mali.

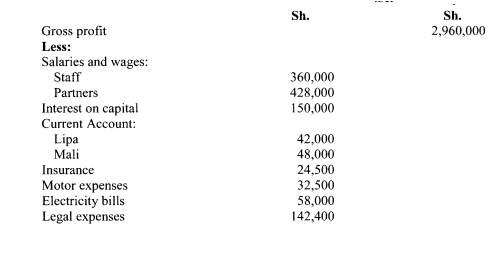

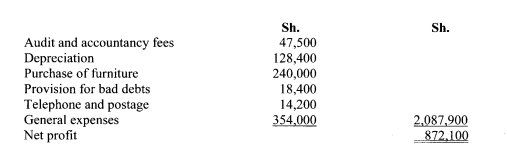

The following income statement for the year ended 31 December 2020 was provided by the partnership:

Additional information:

- Insurance represents Mr. Mali’s life insurance policy for his family.

- Interest on capital was prorated and shared according to the profit and loss sharing ratios.

- Legal expenses included: expenses related to drawing of new partnership deed of Sh.28,000 on admission of Mr. Sasa, conveyance fees of Sh.14,900 and Sh.36,000 for negotiating a loan facility.

- General expenses included cost of computers of Sh.90,000 and computer software of Sh.45,000.

- The firm imported a motor car for use in the partnership business for Sh.800,000. This excluded import duty of 25% and value added tax at 16%.

Note: Assume that income and expenses accrued evenly during the year.

Required:

Prepare a statement of adjusted taxable profit or loss for the year ended 31 December 2020. (10 marks)

Total taxable income for each partner. (4 marks)

(Total: 20 marks)

QUESTION FIVE

1. As a tax manager at the revenue authority in your country, prepare a brief on the following:

Process of being appointed a tax agent. (2 marks)

Requirements for recognition as a tax expert by the revenue authority. (4 marks)

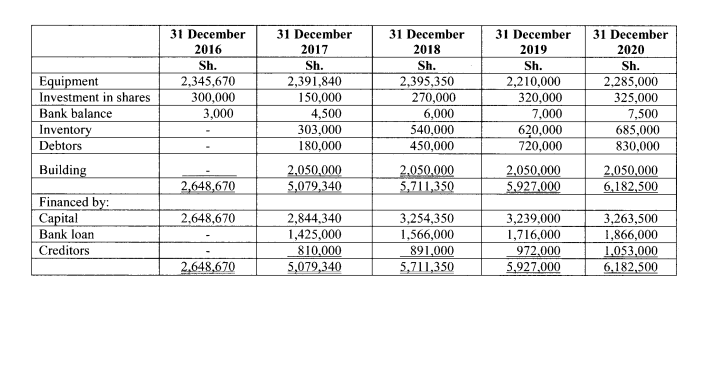

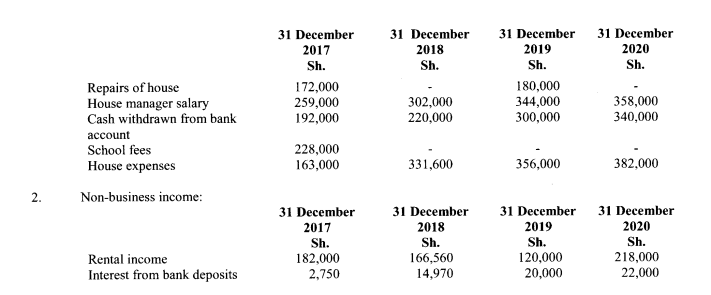

2. Linda Obari has been operating a retail business since year 2016. She has not been maintaining proper books of account over the years and is therefore under investigation by the revenue authority.

The following details were obtained from her business records:

Additional information:

- Personal expenses:

- For the year ended 31 December 2017, salaries paid to Linda Obari’s husband by the business amounted to Sh.312,000 and this was increased every year by 15%.

- She received Sh.360,000 in cash as inheritance in the year 2019 from her late father.

Required:

Compute Linda Obari’s correct taxableincome or loss for the years ended 31 December 2017 to 2020. (10 marks)

Describe the factors that a revenue authority considers in ascertaining the adequacy of living expenses under back duty investigations. (4 marks)

(Total: 20 Marks)