TUESDAY: 2 August 2022. Afternoon paper. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings. Any assumptions made must be clearly and concisely stated. Do NOT write anything on this paper.

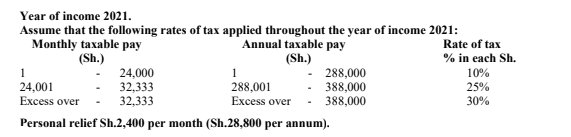

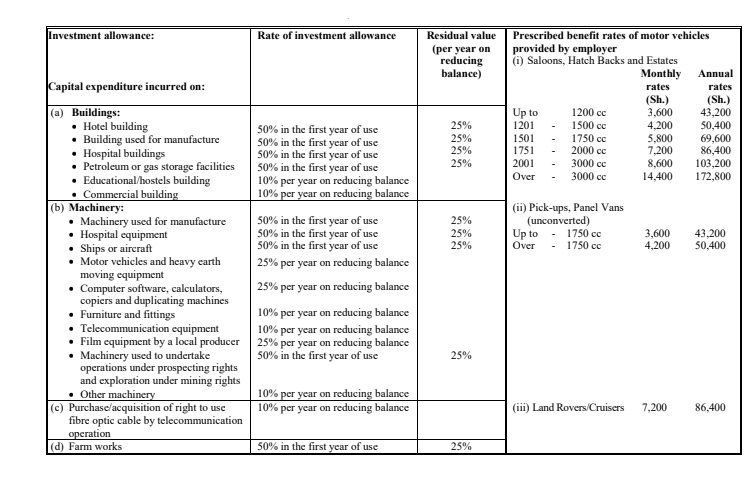

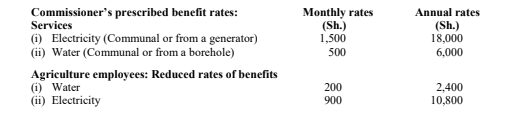

RATES OF TAX (Including wife’s employment, self-employment and professional income rates of tax).

QUESTION ONE

1. With reference to the services provided by tax practitioners, explain the difference between “tax health checks” and “tax audits”, clearly isolating the salient features of each. (6 marks)

2. In one of the recent tax cases decided by the Tax Appeals Tribunal, the Tribunal allowed an application for extension to file an appeal out of time.

A summary of the case facts was as follows:

1. The taxpayer missed on the statutory deadline for filing the Notice of Appeal and Memorandum of Appeal due to factors beyond their control.

2. The revenue authority countered that the objection decision was issued in time via the email provided on the iTax platform and that they were not under any obligation to follow up with the taxpayer on the receipt of the email.

3. In a rejoinder, the taxpayer stated that they were unaware and did not find any email and further that they were unaware of the existence of the Objection Decision until later when applying for a tax compliance certificate.

Required:

Based on the above case and introducing any other relevant facts, discuss four factors that the Tax Appeals Tribunal might have considered in arriving at its decision above. (8 marks)

3. Tax treaties represent an important aspect of the international tax rules of many countries. Experts estimate that over 3,000 bilateral income tax treaties are currently in effect, and the number is growing.

Required:

With reference to the above statement, describe three objectives of international tax treaties. (6 marks)

(Total: 20 marks)

QUESTION TWO

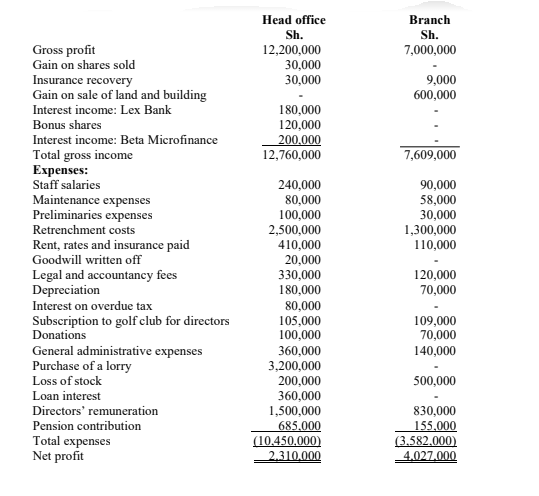

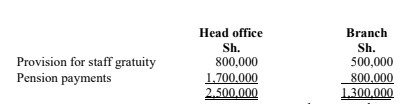

1. Bale Ltd., a small scale retailer operates two sales outlets, one at the head office and the other at the branch. For the year ended 31 December 2021, the following results of the head office and the branch were presented to you:

Additional information:

1. Goods worth Sh.600,000 were transferred from the head office to the branch at 10% below the normal selling price.

2. 70% of insurance recovery was in respect of stocks destroyed by fire, the balance was on compensation on capital items.

3. Staff salaries include provision for leave accruals equal to a third of the total salaries for head office and the branch.

4. The interest income recorded in the books of Bale Ltd. was gross although Bale Ltd. received net of withholding tax.

5. Bonus shares were from a company where Bale Ltd. has 30% control.

6. Rent, rates and insurance paid for the branch: At the beginning of the year, rent accrued amounted to Sh.24,000 and as at 31 December 2021 rent prepaid was Sh.42,000. These had not been adjusted for in the accounts.

7. The lorry purchased was imported and duty paid was Sh.130,000. This was omitted from the cost of the lorry.

8. Retrenchment cost analysis.

9. Loss of stock: Fire razed down a warehouse where goods are stored before they are transported to the head office and branch. VAT at 16% was included in the stocks destroyed by fire.

10. 20% of loan interest relates to a loan obtained to finance purchase of shares.

Required:

Compute the combined adjusted taxable profit or loss for the year ended 31 December 2021. (10 marks)

Compute the tax payable (or refundable) for the year ended 31 December 2021 based on your results in 1 (i) above. (2 marks)

2. A tax agent is an important stakeholder in the Alternative Dispute Resolution (ADR) process.

Analyse the roles of a tax agent in relation to the ADR process. (4 marks)

Explain the circumstances under which the Commissioner may cancel the license of a tax agent. (4 marks)

(Total: 20 marks)

QUESTION THREE

1. The following information relates to Pete Masa who works in both Kenya and in the United Kingdom.

• During the year of income 2021, he earned £30,000 from employment, PAYE deducted was £4,200.

• His employment income in Kenya was Sh.1,960,000 (PAYE deducted Sh.384,000) in the year.

• The employer provided accommodation to his family which lives in Kenya. The house is fully furnished at a cost of Sh.340,000.

• He also received consultancy fees of Sh.720,000 and net royalties of Sh.95,000.

Note: Assume the average exchange rate during the year was £1 = Sh.120.

Required:

Calculate tax payable by Pete Masa for the year of income 2021. Assume Kenya and United Kingdom have signed a double taxation agreement. (6 marks)

2. Explain four measures that a tax revenue authority might adopt to reduce tax gaps or revenue leakages in taxation of the digital economy. (4 marks)

3. Explain the tax implications of the following:

Where two or more entities enter into a joint venture agreement or partnership. (4 marks)

Where shareholders are wholly or partly paid in cash for forfeiting their shares in a cessation of business. (2 marks)

4. Explain four possible tax implications of transferring or selling a subsidiary to another subsidiary where both belong to the same parent company. (4 marks)

(Total: 20 marks)

QUESTION FOUR

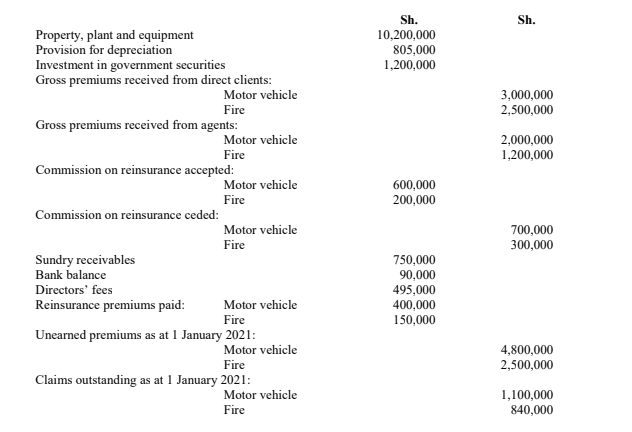

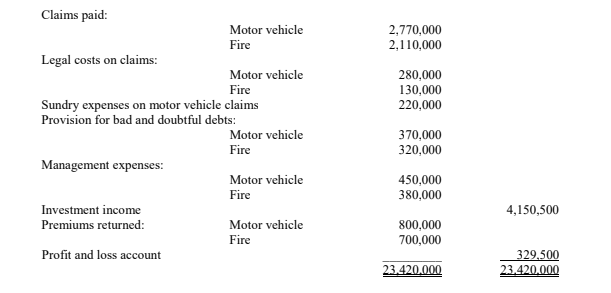

1. Riziki Insurance Company Ltd. was incorporated in the year 2019. The company deals with different classes of insurance. The following trial balance was extracted from the books of account as at 31 December 2021:

Additional information:

1. Claims intimated and outstanding as at 31 December 2021 amounted to Sh.750,000 for motor vehicle insurance and Sh.480,000 for fire insurance.

2. Unearned premium is maintained at 80% and 50% of the net premiums received for motor vehicle and fire insurance respectively.

3. Investment allowances have been agreed with the Commissioner at Sh.1,200,000 for the year ended 31 December 2021.

4. Investment income analysis: Sh.

• Interest received from Government securities 2,040,000 net

• Interest received from local banks 760,500 net

• Dividend received from a Ugandan company 450,000 gross

• Dividend received from a local company 900,000 net

5. Fees paid to investment managers amounted to Sh.750,000 for the year ended 31 December 2021.

Required:

Taxable income or loss for Riziki Insurance Company for the year ended 31 December 2021. (8 marks)

Compute the tax payable, if any. (2 marks)

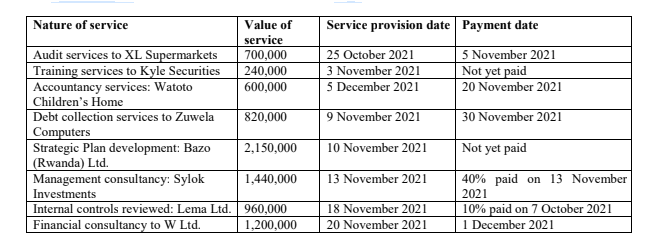

2. Zawadi Associates provides consultancy services to various clients whose terms of contract allow clients to pay for the services either before or after the provision of the service. The following information is provided regarding the firm’s transactions for the months of October, November and December in year 2021.

Additional information:

1. Sylok Investments was declared bankrupt on 30 November 2021.

2. On 5 November 2021, Zawadi Associates renewed its national industrial training license for Sh.30,000 and paid for legal fees Sh.360,000 to follow up on clients who were not paying as per the agreed date.

3. Electricity bill paid on 10 November 2021 was Sh.270,000 out of which Sh.100,000 was payment for outstanding bill for October 2021 and Sh.20,000 was in respect of additional deposits as demanded by the power company.

4. Fuel consumed for partners’ vehicles amounted to Sh.90,000 during the month of November 2021.

5. Computers purchased for business use cost Sh.240,000 in November 2021.

6. Zawadi Associates paid rent for the month of November 2021 amounting to Sh.180,000 on 5 November 2021.

7. Transactions have been stated inclusive of VAT at the rate of 16% where applicable, unless otherwise stated.

Required:

Compute the VAT payable by (or refundable to) Zawadi Associates for the month of November 2021. (7 marks)

Zawadi Associates is planning to engage a firm of financial management consultants from South Africa to facilitate online training on financial management assignments.

Advise Zawadi Associates on the tax point in respect of such services. (3 marks)

(Total: 20 marks)

QUESTION FIVE

1. A recent publication from a leading international advisory group opines that, of all forms of tax incentives, tax holidays are the most popular among developing countries.

Required:

Discuss four limitations of tax holidays in developing countries. (4 marks)

2. In the recent months, the Revenue Authority reports have indicated achievement of tax collection targets.

Required:

Explore the factors that might have led to this achievement. (4 marks)

3. John Malih has been trading as a sole proprietor for the past 4 years. The revenue authority suspects that the business has been involved in tax fraud since it commenced operations.

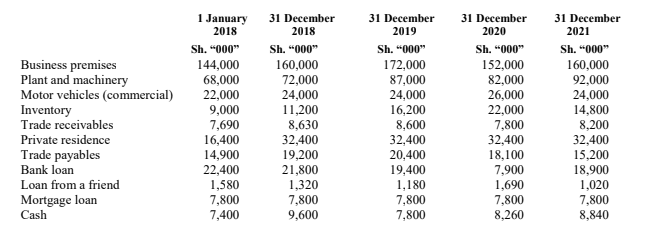

The firm has submitted the following records since its operations from 1 January 2018 to 31 December 2021:

Additional information:

1. During the year ended 31 December 2021, a motor vehicle was disposed of for Sh.2,600,000 (cost was Sh.2,000,000).

2. Interest on mortgage was at a rate of 15% per annum on reducing balance basis. The maximum mortgage interest allowed is Sh.300,000 per annum.

3. His personal expenses for each of the four years were as follows:

4. Ignore capital allowances.

Required:

Determine the taxable income of John Malih for each of the four years ended 31 December 2018, 2019, 2020 and 2021. (12 marks)

(Total: 20 marks)