TUESDAY: 5 April 2022. Afternoon paper. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings. Any assumptions made must be clearly and concisely stated. Do NOT write anything on this paper.

RATES OF TAX (including wife’s employment, self-employment and professional income rates of tax).

Year of income 2021.

Assume that the following rates of tax applied throughout the year of income 2021:

Monthly taxable pay Annual taxable pay Rate of tax

(Sh.) (Sh.) % in each Sh.

1 24,000 1 – 288,000 10%

24,001 32,333 288,001 – 388,000 25%

Excess over 32,333 Excess over – 388,000 30%

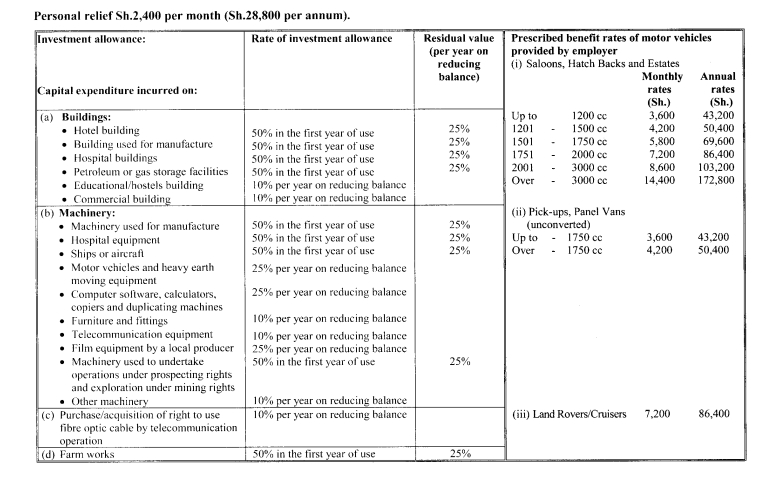

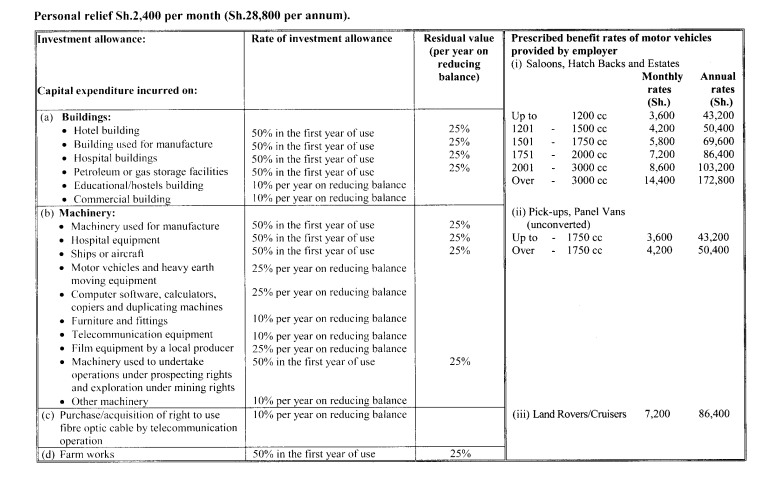

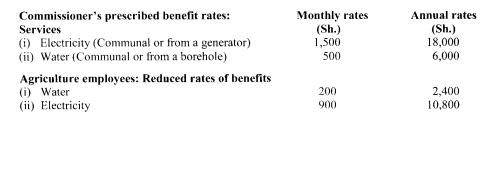

Personal relief Sh.2,400 per month (Sh.28,800 per annum).

QUESTION ONE

1. The following facts relating to a hypothetical tax case in your country have been presented to you. The case related to the applicability of withholding tax on interest accrued in the audited books of a taxpayer.

- Ale Ltd. entered into an agreement with a contractor under which it agreed to pay interest on any contractual fees paid late. A number of payments due to the contractor were delayed and incurred interest. The interest was not actually paid but the obligation to pay was accrued as a liability in the respondent’s books.

- As interest is a business expense, Ale Ltd. expensed it as a tax deductible item thereby reducing its corporation tax liability. The revenue authority undertook an audit and demanded payment on the withholding tax on the accrued interest. Following the demand, Ale Ltd. filed the matter before a tax tribunal.

- The revenue authority claimed that by recognising accrued interest as a liability in its books of account, Ale Ltd. acknowledged that interest was credited to the account of the third party and therefore fell within the definition of the term “paid” under applicable tax laws.

- At the tax tribunal, Ale Ltd. presented the following arguments:

The term “paid” in tax law can only mean delivery of money and discharge of settlement.

Since Ale Ltd. neither settled the outstanding contractual fee nor paid any interest charged, even though the interest was recognised as a liability in its books of account, no withholding tax was due for that transaction.

As per tax laws, tax is withheld upon payment of the expenses thus payment is a necessary pre-requisite for withholding tax to apply.

The settlement of an obligation may be through receipt of cash, cheque or other mode of settlement or discharge and an accrual is therefore not a discharge of a debt. Payment denotes the discharge of a debt or liability and it was premature for the revenue authority to demand payment of the withholding tax before the actual payment of interest. By doing so, the revenue authority clearly exceeded its powers.

Required:

As a Certified Public Accountant and tax expert, you have been engaged by the revenue authority to counter the arguments by Ale Ltd. for consideration by the Tax Tribunal.

Prepare your professional opinion making reference to the facts above, applicable tax laws and decided tax cases to support your position. (12 marks)

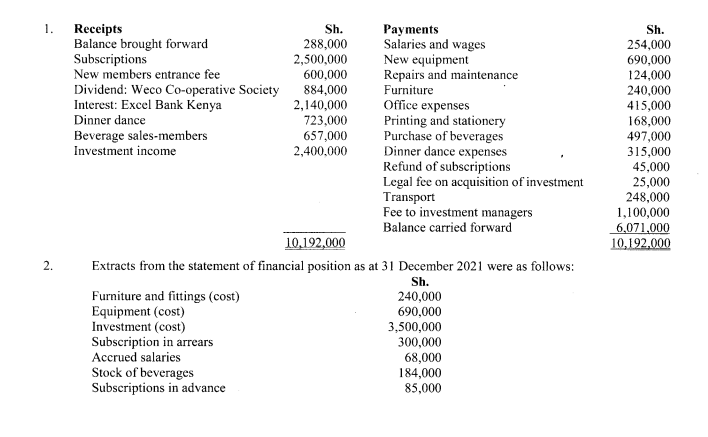

2. The following information was extracted from the accounting records of Sambamba Sports Club, a small-size members club as at 31 December 2021:

- The dividend and interest income were stated at the gross amount.

- Stock of beverages at the beginning of the year were Sh.162,000.

- Subscription in arrears written off in the year amounted to Sh.288,000.

Required:

The taxable income (or loss) and tax payable if any, by Sambamba Sports Club for the year ended 31 December 2021. (8 marks)

(Total: 20 marks)

QUESTION TWO

1. Describe six factors to be considered when developing mitigation strategies for taxation risks. (6 marks)

2. Amua and Beba have carried on business for the last several years under the trade name AB partnership. They share profits and losses equally with capital contributed earning interest at the rate of 10% per annum.

The following details relate to AB partnership’s transactions for the year ended 31 December 2021.

- Amua and Beba capital accounts reflect credit balances of Sh.1,200,000 for each.

- On 1 April 2021, they introduced a new partner Chanda who was to contribute Sh.1,200,000 as his share of capital. They agreed on this day to share profits and losses in the ratio of capital contributed proportional to the period of the year it was invested and that this sharing ratio be backdated to the start of the year 2021.

- The costs incurred during the year were as follows: Sh.

Salaries and wages for staff 1,083,000

Electricity and telephone 389,400

Repairs and maintenance 294,400

Deprecation and impairments 420,000

General insurance 471,000

Debenture interest (paid by ABC Ltd.) 150,360

Directors fees (including Sh.507,720 partners’ salaries) 1,015,440

Legal expenses 510,240

Medical contributions for partners and directors 651,840

Drawings: Amua 99,000

Beba 101,400

Chanda 65,400

Rent and rates 315,960

Motor vehicle running expenses 500,760

Printing and stationery 32,520

- The following assets were purchased during the year: Furniture and fittings Sh.192,000 and a pick-up for Sh.2,160,000.

- During the months of the partnership, the total salaries to partners were Sh.507,720. The salaries were to be apportioned according to the period each partner served in the partnership bUsiness.

- The cost of sales during the year was Sh.21,600,000. Sales were uniform at a margin of 25%.

- The partnership was converted into a limited liability company, ABC Ltd. on 1 July 2021 with the partners becoming the new directors of the company. The new firm was listed on the Securities Exchange but not for purpose of raising additional capital. The costs incurred in listing were Sh.100,000.

- The sales and expenses accrued evenly throughout the year unless otherwise indicated.

Required:

A schedule showing separately the profit or loss for the partnership and the company for the year ended 31 December 2021 (10 marks)

Tax payable (or refundable) by ABC Ltd. from the profit or loss computed in (b) (i) above. (2 marks)

A schedule showing the distribution of profits among the partners. (2 marks)

(Total: 20 marks)

QUESTION THREE

1. Evaluate four factors to be considered in determining the appropriate methods for transfer pricing for multinational corporations in your country. (8 marks)

2. Mika Ltd. sold a machine to Bora Ltd., an associate enterprise and in turn Bora Ltd. sold the same machine to Ceda Ltd., an independent party at a sales margin of 30% for Sh.4,000,000. Bora Ltd. had incurred Sh.40,000 as expenses in shipping the machine to Ceda Ltd.

Required:

Calculate the arms length price charged to Ceda Ltd. (2 marks)

3. Petro Ltd. is a company in the business of exploration and production of oil and gas in your country. The company reported a petroleum profit of Sh.143,600,000 in the year ended 31 December 2021. This figure excludes crude oil produced but not sold valued at Sh.4,200,000. The following expenses comprising capital and revenue expenditures were deducted in arriving at the reported profit.

Sh.

Geophysical staff salaries 789,000

Legal costs for title deeds 562,400

Dry hole contributions 448,000

Drilling and test development costs 942,600

Capital losses from previous year 192,800

Memorandum of understanding credit 2,840,000

Royalties on domestic sales 3,600,000

Royalties on export sales 5,760,000

Non-productive rent 2,374,800

Customs duty on plant and equipment 672,300

Purchase of assets for offshore operations 7,840,000

Provision for restoration of wells 1,575,000

Petroleum investment allowance 9,262,000

Additional information:

- Petroleum investment allowance included depreciation of equipment of Sh.378,200.

- Off-shore operations included a tractor purchased at Sh.920,000 for use on site in your country.

- Computers and computer software was for Sh.780,000 and Sh.360,000 respectively, for use in the country offices.

- The offices were partitioned at a cost of Sh.1,480,000

Required:

A statement of computation of petroleum profit or loss for the accounting period ended 31 December 2021. (7 marks)

Tax payable, if any, by the company. (3 marks)

(Total: 20 marks)

QUESTION FOUR

1. You have been engaged by the revenue authority in your country to develop a stakeholder engagement action plan.

This is part of the measures to enhance tax awareness, increase compliance and enhance efficiency in tax administration.

Required:

Discuss the stakeholder engagement processes or initiatives that you would include in your action plan, including the objective of each process or initiative. (10 marks)

2. The following information relates to two businesses which are registered for value added tax (VAT) purposes:

- Bebabeba Supermarket Ltd.

They operate a soft drinks dispensing machine which uses special tokens which resemble coins. During the month of July 2021, the machine dispensed drinks worth Sh.300,000 inclusive of VAT. This dispensing machine is slotted with tokens after every one and a half months, that is, on restocking drinks in any month, the tokens are emptied midway the following month. The machine was restocked during the month of July 2021

- Supa Bread Ltd.

The firm bakes ordinary bread. During the month of August 2021 they made sales amounting to Sh.20,000,000, excluding VAT. They have arranged with a distribution company, who ensure bread is delivered to customers. The distribution company raised an invoice of Sh.2,000,000 for services rendered for August 2021.

The electricity company also sent Supa Bread Ltd. a bill of Sh.3,000,000 for the month. The firm also hired advisory services from an overseas company and were billed Sh.1,000,000. The above figures are quoted inclusive of VAT unless stated otherwise.

Required:

For each of the two companies, or as otherwise stated, compute:

The output VAT, if any, for the specified period. (2 marks)

The input VAT (if any), (for Supa Bread Ltd.). (1 mark)

The VAT payable (or refundable) for the specified period based on the information provided only. (2 marks)

3. Define the term “reverse charge” and indicate when it would apply (if at all) to Supa Bread Ltd. (2 marks)

4. Explain the difference between a tax agent and a tax representative. (3 marks)

(Total: 20 marks)

QUESTION FIVE

1. Describe four constraints faced by the revenue authority in your country in the assessment and collection of taxes from the micro, small and medium enterprises (MSMEs). (4 marks)

2. Discuss how the revenue authority of your country might deal with taxpayers’ apathy in filing tax returns.(4 marks)

3. Haraka Ltd. started operations on 1 January 2021 in the business of leasing vehicles and computers.

The following information relates to the company’s transactions for the year ended 31 December 2021.

- The company leased the following assets in the course of the year.

- Six delivery vans to Zito Ltd. for six months at Sh.30,000 each per month.

- Four pickup vehicles to Chama Ltd. in Uganda for Sh.400,000 per month for six months.

- Twenty computers to Upper University at a monthly lease of Sh.4,000 each for the whole year.

- A BMW vehicle to B Ltd. for use by one of its directors at a monthly lease charge of sh.60,000.

- Two Landcruiser Prado vehicles to Z Contractors at an annual lease charge of Sh.1,440,000 in total. The lease contract for one vehicle was cancelled on 30 June 2021 after Z Contractors failed to pay lease charges for 4 months in the year.

- The delivery vans to Zito Ltd. were returned upon lease expiry and Haraka Ltd. leased them to Sokoni Supermarket for four months at Sh.24,000 each per month.

- Haraka Ltd. incurred the following expenses in the course of the year:

Sh.

General administration expenses 1,600,000

Legal expenses 480,000

Repairs and servicing 320,000

- Legal expenses included Sh.120,000 for defence against claims of breach of the lease contract.

- Investment allowances have been agreed with the revenue authority to be Sh.620,000 for the year.

- Haraka Ltd. had other incomes as follows:

- Rental income from residential property Sh.2,400,000 per annum.

- Dividend from Sifa Mutual Fund Sh.36,000 gross.

- Interest from money market fund Sh.120,000 gross.

- Royalties of Sh.360,000 net of advertising expenses of Sh.60,000, renewal of patents Sh.40,000 and research costs of Sh.80,000.

Required:

Compute:

The taxable income or loss for Haraka Ltd. for the year ended 31 December 2021. (10 marks)

The tax payable (if any) by Haraka Ltd. for the year ended 31 December 2021. (2 marks)

(Total: 20 Marks)