December 2021. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your

workings.

QUESTION ONE

1. Using historical data, F.A. Cherono calculated the covariance between Kenyan and Rwandan stocks to be 230. She estimates the correlation as 190 using a factor model method based on a proxy for the world market portfolio. She uses a shrinkage estimator to estimate covariances and finds that 0.30 is the best weight on the historical estimate.

Required

Calculate the shrinkage estimate of the covariance between Kenyan and Rwandan equities. (2 marks)

Describe the theoretical advantage of a shrinkage estimate of covariance compared to a raw historical estimate. (1 mark)

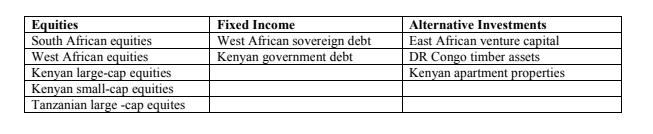

2. Consider the responsibilities for two investment managers, F.A. Theuri and F.A. Gitahi. Theuri works in a Kenyan investment bank portfolio management department and manages separately managed accounts (SMA’s) for high-net-worth clients. The accounts’ requirements limit investments to Kenyan stocks, Kenyan fixed-income securities, and prime Kenyan money market products. The investing objective of these balanced accounts is long-term capital growth and income. Gitahi, on the other hand, is the chief investment officer of a big South African – based, internationally oriented asset management that invests in the following categories

of assets:

NB: Venture capital is equity investment in private companies.

Gitahi also runs SMA’s with generally long-term time horizons and global tactical asset allocation programs.

Required

Using the above information, compare and contrast the information and knowledge requirements of Theuri and Gitahi. (5 marks)

3. Describe how an equity manager’s investment universe can be segmented. (6 marks)

4. The following data is provided for four managers who are benchmarked against the same index:

Required:

Identify and justify the manager most likely to be:

A shrewd stock picker. (2 marks)

A multi-factor investor who is well-diversified. (2 marks)

A rotator for sectors. (2 marks)

(Total: 20 marks)

QUESTION TWO

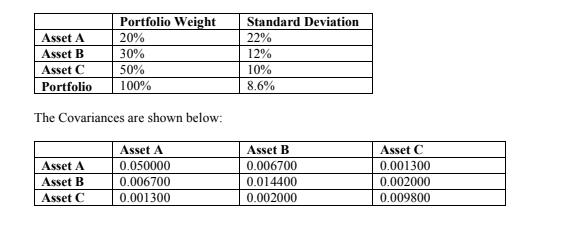

1. Ngwiri is managing a diversified portfolio which has the following characteristics:

Required:

Calculate the absolute contribution to portfolio variance of asset A. (2 marks)

Given that the absolute contribution to portfolio variance of assets B and C are 0.001998 and 0.002880 respectively, calculate the relative contribution to portfolio variance of asset A. (1 mark)

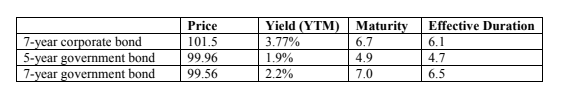

2. The following information on three bonds is provided.

F.A. Mwende plans to buy 1 million par of the corporate bond and she is aware that there is some controversy in the financial services industry regarding whether it is best to compute G-spread by matching maturity or duration. Maturity has been used in the industry for sometime and is regarded as simpler. Some theoretical arguments favour an interpolation based on duration as more accurate. She has determined the difference in the two methods is not generally large and favours the more traditional “use maturity “approach.

Required:

Calculate the initial benchmark (G-spread) of the corporate bond based on interpolated maturity matching. (2 marks)

Calculate the hedge position to abolish interest rate risk for the 1 million par of the corporate bond and calculate the expected return on the hedged position. (2 marks)

After buying the corporate bond, the yield of the 5 and 7 year government bonds increase 10 and 15 bp respectively, while the corporate bonds yield declines 3 bp. Estimate the new price of the corporate bond. (2 marks)

3. Western Kenya Investment Management (WKIM) wishes to capitalize on the prestige associated with presenting GIPS-compliant performance statistics for promotional purposes. WKIM chooses to develop five composites for marketing reasons to save time and money. These portfolios constitute 60% of the firm’s fee- paying discretionary holdings. Recognising that it cannot claim compliance for all of its portfolios, WKIM intends to incorporate the following compliance statement in its performance presentation: “The investment results contained in this report have been compiled and presented in accordance with the requirements of the

Global Investment Performance Standards (GIPS) for the bulk of assets managed by Western Kenya Investment Management, Incorporated.”

Required:

Discuss if WKIM’s claim of GIPS compliance is appropriate. (3 marks)

4. Nyamongo is in charge of investing a fresh Sh.10 billion contribution to Koner Bank’s pension fund. The mandate is to work with active managers to make investments. The equity portion of the pension plan is benchmarked against the wider equity market.

Required:

Discuss the benefits and drawbacks of employing a single manager with either a growth or value style, one manager with each style, or one manager with a market-oriented style. (8 marks)

(Total: 20 marks)

QUESTION THREE

1. KBA, a big charity organisation, intends to invest in one or more hedge funds. Amina, KBA’s CIO, is reviewing data provided by the organisation’s senior analyst, F.A. Saroni. Amina questions Saroni about why a market-neutral long-short hedge fund that KBA is exploring has refused to use an equity index as a benchmark.

Required:

Prepare an answer to Amina’s inquiry to Saroni. (2 marks)

Suggest an alternative to utilising a stock index benchmark as a baseline for a market-neutral long- short fund. (2 marks)

Discuss how the following variables affect index development in the context of hedge funds:

- Survival bias. (2 marks)

- Value-weighted indices. (2 marks)

- Price staleness. (2 marks)

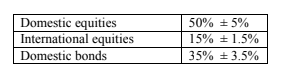

2. The following strategic asset allocation is being reviewed by an investing committee:

The committee believes that the corridors outlined above are suitable if each asset type has the same risk and transaction-cost characteristics. It now seeks to account for asset class disparities when determining corridors.

Required:

Evaluate the consequences of the following sets of facts on the specified tolerance range, given an all-else- equal assumption in each case:

Domestic bond volatility is much lower than that of domestic or international equities, which are equal. Tolerance band for domestic bonds. (1 mark)

Transaction costs in international equities are 10% higher than those for domestic equities. Tolerance band for international equities. (1 mark)

Transaction costs in international equities are 10% higher than those for domestic equities, and international equities have a much lower correlation with domestic bonds than do domestic equities. Tolerance band for international equities. (1 mark)

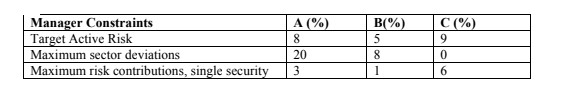

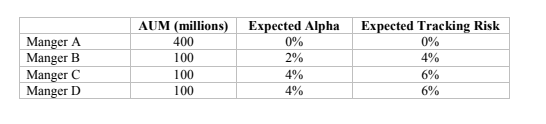

3. F.A. Kamau manages the equity portion of the pension portfolio of Klinker Minerals, a large Kenyan mining company. Kamau is responsible for a portfolio of Sh.700 million of Kenyan equities. Kamau’s annual reward is related to the performance of this portfolio versus the MSCI Kenyan Index, the benchmark for the pension portfolio’s equity portion. He has hired the following managers with expected alphas and active risk shown below:

All four managers’ alphas are uncorrelated and are measured against the MSCI Kenyan benchmark. The pension fund’s trustees have stated objectives of achieving an information ratio of 0.6 or greater, with tracking risk of no more than 2% a year. An optimisation model results in weights on Managers A, B, C and D of 4/7, 1/7, 1/7, and 1/7, respectively.

Required:

Identify the investment approach of Manager A. (2 marks)

Characterise the structure of the optimal portfolio of managers. (2 marks)

Evaluate whether the optimal portfolio of managers is expected to meet the trustees’ investment objectives. (3 marks)

(Total: 20 marks)

QUESTION FOUR

1. A Kenyan fixed-income fund has substantial holdings in euro-denominated German bonds. The portfolio manager of the fund is considering whether to leave the fund’s exposure to the euro unhedged or fully hedge it using a dollar-euro forward contract. Assume that the short-term interest rates are 4% in Kenya and 3.2% in Germany. The fund manager expects the euro to appreciate against the shilling by 0.6%. Assume that IRP holds.

Required:

Explain which alternative has the higher expected return based on the short-term interest rates and the manager’s expectations about exchange rates. (3 marks)

2. The manager of an investment-grade fixed-income fund is concerned about the possibility of a rating downgrade of Alpha Ltd. The fund’s holding in this company consists of 5,000 bonds with a par value of Ksh 1,000 each. The fund manager doesn’t want to liquidate the holdings in this bond, and instead decides to purchase a binary credit put option on the bond of Alpha Ltd. This option expires in six months and pays the option buyer if the rating of Alphas’ bond on expiration date is below investment grade (Standard &

Poor’s/Moody’s BB/Ba or lower.) The payoff, if any, is the difference between the strike price and the value of the bond at expiration. The fund paid a premium of Sh. 130,000 to purchase the option on 5,000 bonds.

Required:

What would be the payoff and the profit if the rating of Alpha Motors’ bond on expiration date is below investment grade and the value of the bond is Sh.870. (4 marks)

What would be the payoff and the profit if the rating of Alpha Motors’ bond on expiration date is investment grade and the value of the bond is Sh.980. (3 marks)

3. Explain event risk, market liquidity risk, market risk, and “J – factor risk” in relation to investing in distressed securities. (8 marks)

4. Define algorithmic trading and its motivation. (2 marks)

(Total: 20 marks)

QUESTION FIVE

1. As an analyst, you are provided with the following information:

Neutral rate 4%

Inflation target 3%

Expected inflation 7%

GOP long-term trend 2%

Expected GOP growth 0%

Required:

Calculate the short-term interest rate target and comment on your answer. (5 marks)

2. Compare the major approaches to economic forecasting. (6 marks)

3. Explain the requirements for compliance with the GIPS Advertising Guidelines (9 marks)

(Total: 20 marks)