THURSDAY: 16 December 2021. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings.

QUESTION ONE

1. Simon Peter, a financial analyst at ABL Ltd. has prepared financial forecasts regarding the current capital market environment. He recently gave a presentation to the Managing Director of his firm.

Excerpts of his presentation were as follows:

“Noting that year-end holiday sales have been weak over the past several years, I believe that current expectations should be likewise muted. In fact, just last week, I had an occasion to visit Nairobi and noticed that the number of shoppers seemed quite low. The last time I saw a retail establishment with little pedestrian traffic at the beginning of December was in the year 2000 and that coincided with one of the worst holiday sales periods in the past 50 years. Thus, there will be no overall year-over-year retails growth this holiday season”.

Required:

Examine any two psychological traps that may be interfering with the creation of Simon Peter’s forecasts. (4 marks)

Recommend three measures that could be used to mitigate the bias caused by each of the psychological traps identified in (i) above. (3 marks)

2. Explain the term “risk tolerance”. (2 marks)

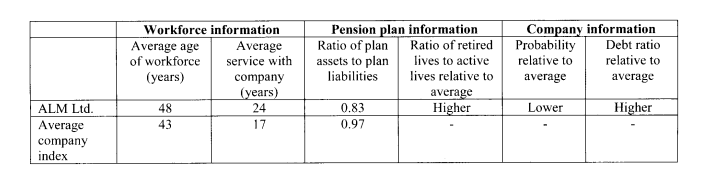

3. As an investment manager of a defined benefit pension plan for ALM Ltd., a large multinational firm, you decide to compare workforce, pension plan and company information for ALM Ltd. with similar information for an average company in the main stock market index as shown below:

Required:

Based on the specific circumstances of ALM Ltd., determine whether ALM Ltd.’s pension plan has below average, average or above average risk tolerance compared with the average main stock market index company pension plan. (1 mark)

Cite five reasons to justify your answer in (i) above. (5 marks)

4. A portfolio manager presents the following annual performance attribution:

Sh.

Beginning value 150,000,000

Net contributions 850,000

Risk free asset (incremental value contribution) 675,000

Funds value (asset category) 165,500,000

Funds value (benchmarks) 165,900,000

Additional information:

- The incremental return contribution for allocation effects is 0%.

- The total fund return is 11.05%.

Required:

Determine how much of the total return was attributed to style bias. (3 marks)

Determine how much value active stock selection is added to the fund. (2 marks)

(Total: 20 marks)

QUESTION TWO

1. With regard to currency portfolio management, explain four active currency trading strategies. (8 marks)

2. Samuel Mwamba is a financial advisor for Delta Wealth Management Firm (DWMF). He is reviewing the investment policy statement (IPS) for one of the clients, Eric, with the aim of developing an asset allocation strategy and coming up with an appropriate portfolio.

Eric is 47 years old and has summed his annual spending needs to an annual withdrawal of 5% of assets which should provide a safe stream of income without reducing the principal. The expectation of inflation is 2.5% for the foreseeable future and the tax rate is 30%.

The Financial Advisor has identified the asset classes as follows:

Asset class Expected return (%) Expected standard deviation (%)

Domestic equities 9.3 15.0

International equities 11.4 20.0

Fixed income 5.4 3.0

Real estate 6.7 12.0

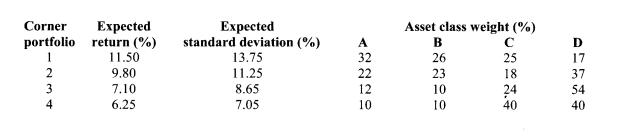

For each of these asset classes, he develops four portfolios which will be used to construct an optimal portfolio for Eric. The risk free rate is 2%.

Required:

Calculate before tax return requirement for Eric. (1 mark)

Identify the optimal portfolio for Eric assuming that borrowing is not allowed. (5 marks)

Calculate the standard deviation for the optimal portfolio selected for Eric. (2 marks)

3. Outline two advantages of using each of the following asset allocation optimisation approaches:

Black-Litterman. (2 marks)

Resampled efficient frontier. (2 marks)

(Total: 20 marks)

QUESTION THREE

1. In relation to structuring equity investment portfolio management, distinguish between “top-down” and “bottom up” approaches to portfolio management. (6 marks)

2. An analyst is estimating various measures of spread for SAF Limited’s shares. The following is a sample of quotes of SAF Limited’s share on the Securities Exchange on 10 December 2021 between 10.49 a.m. and 10.57 a.m.

Time Bid price (Sh.) Ask price (Sh.)

10:49:44 4.69 4.74

10:50:06 4.69 4.75

10:50:11 4.69 4.76

10:50:14 4.70 4.76

10:54:57 4.70 4.75

10:56:32 4.70 4.75

A buyer initiated trade in SAF Limited’s shares and the order was entered at 10:50:06. The order was executed at 10:50:07 at a price of Sh.4.74.

Required:

For the above trade, calculate the following:

Quoted spread. (2 marks)

Effective spread. (4 marks)

3. EMCO Investment Group has decided to pursue a contingent immunisation strategy over a 3-year time horizon. They have purchased at par Sh.400 million worth of 11% semi-annual coupon, 15-year bonds. The current rate of return for immunised strategies is 11% and they are willing to accept a return of 10% (this is the safety net return).

Required:

Determine the cushion spread. (1 mark)

Compute the required terminal value and required assets needed at initial implementation. (2 marks)

Determine whether active management is still viable if interest rates immediately rise to 12%. (5 marks)

(Total: 20 marks)

QUESTION FOUR

1. Evaluate three roles of ethics in securities trading. (6 marks)

2. A portfolio manager has gathered the following data for his top performing Fund “M”:

Variables Fund “M”

Rate of return (%) 18

Beta 1.25

Standard deviation (%) 18.55

Downside deviation (%) 8.75

Additional information:

- Risk free rate is 3.5%.

- Market standard deviation is 15%.

- Market return is 16.50%.

Required:

Calculate the following performance measures for the Fund:

Sharpe Ratio. (2 marks)

M2 measure. (3 marks)

Treynor measure. (2 marks)

Ex post alpha. (3 marks)

3. Explain the following terms as used in alternative investments portfolio management:

Cost of carry. (1 mark)

Roll return (or roll yield). (1 mark)

Backwardation. (1 mark)

Contango. (1 mark)

(Total: 20 marks)

QUESTION FIVE

1. Highlight two advantages and two disadvantages of direct equity investments in real estate. (4 marks)

2. Biko and Olivia live in South Sudan with their 16 year old twins. Biko, 47, works in a highly cyclical industry, while Olivia, 46 is an accountant. The Bikos are saving for their retirement and university education for both children. Biko’s annual salary is Sh.1,900,000, Olivia’s annual salary is Sh.850,000. The family’s living expenses are currently Sh.950,000 per year. Both Biko and Olivia plan to work for 18 more years and they depend on their combined income and savings to fund their goals. Currently, the Bikos have a term life policy insuring Biko with a death benefit of Sh.1,000,000. Their financial adviser, assesses the family’s insurance needs in the event Biko were to die this year. The adviser uses the needs analysis method based on the financial data presented below and the following assumptions:

The discount rate is 6.0% and the tax rate is 30%.

- Salary and living expenses grow at the rate of 3.5% annually.

- Salary and living expenses occur at the beginning of each year.

The following assumptions apply in the event of Biko’s death:

- Olivia will continue to work until retirement.

- Family living expenses will decline by Sh.300,000 per year.

- Olivia’s projected living expenses will be Sh.500,000 per year for 44 years.

- The children’s projected living expenses will be Sh.150,000 per year for 6 years.

Capital Available

Sh.

Cash and investments 9,000,000

Biko’s life insurance 1,000,000

Total capital available 10,000,000

Total cash needs 7,500,000

Required:

Determine, based on the assumptions given, the additional amount of life insurance coverage needed. (7 marks)

3. On 1 January 2020, Kozi Investment Limited’s equity portfolio had shares invested as shown below:

Share Price per share Number of shares

Sh.

A 20 166,500

13 15 222,000

C 35 95,143

On 1 July 2021, the price of share A was down by 20%, the price of share B was up by 40% while the price of share C was unchanged.

Required:

Rebalance the portfolio so that it maintains the original weight which is the target weight. (9 marks)

(Total: 20 marks)