WEDNESDAY: 6 December 2023. Afternoon Paper. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings. Do NOT write anything on this paper.

QUESTION ONE

1. With reference to strategic management accounting, evaluate THREE underpinnings of each of the following concepts:

Balanced scorecard model. (3 marks)

Responsibility accounting. (3 marks)

2. “Carbon credits” and “carbon credit tax” are increasingly being applied in environmental management

accounting (EMA) as transparent measurable and result oriented activities aimed at protecting and preventing environmental degradation by adopting environmental management strategies, policies and compliance requirements. Carbon credit tax (CCT) is aimed at enhancing compliance. CCT is levied on pollution caused by carbon emission to the environment. One of the aims of the tax is to discharge organisations from operating with excessive carbon emission and instead encourage a transition to more sustainable alternatives by detecting and preventing external costs of environmental management.

Required:

With reference to the above statement, identify THREE benefits that might accrue to an organisation as a result of implementation of carbon credit strategies and policies towards:

Environmental detection costs. (3 marks)

Environmental external failure costs. (3 marks)

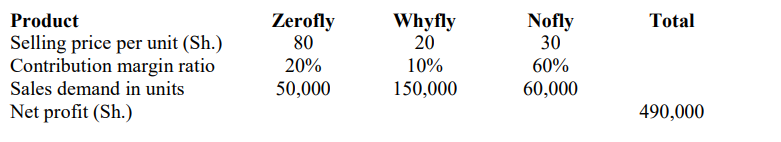

3. TL Ltd. sells three types of mosquito nets branded Zerofly, Whyfly and Nofly. Product Whyfly is currently generating profits below target net profit of Sh.750,000.

The following table shows selected data for the three products for the previous year ended 30 June 2023:

Additional information:

1. The above data is expected to remain unchanged if Tsavo Ltd. continues producing all the three

products.

2. The sales manager believes that profits can be increased by dropping Whyfly due to its low

contribution margin ratio and concentrate on the sales of Zerofly and Nofly.

3. The entire workforce used to produce Whyfly will be utilised in the production of Nofly. The labour

mobility is such that 3 units of Whyfly equal 1 unit of Nofly. To increase demand for Nofly, a 10% price reduction will be allowed next year after dropping Whyfly.

4. Unit fixed cost is Sh.6.5.

5. TL Ltd. prepares statements on marginal costing basis.

Required:

Prepare a comparative statement of profit or loss before and after dropping Whyfly. (6 marks)

Advise the management of TL Ltd. on whether to continue or drop product Whyfly. (2 marks)

(Total: 20 marks)

QUESTION TWO

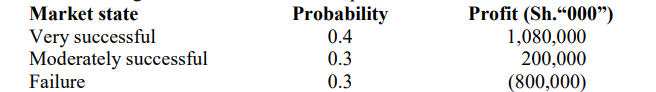

1. Chane Ltd. is considering whether to develop and market a new product. The development cost of the new product will be Sh.360,000,000.

Additional information:

1. There is a 75% chance that the product development exercise will be successful.

2. The following matrix relates to the new product:

3. The development cost of Sh.360,000,000 has been accounted for in the calculation of the above

profits and losses.

Required:

As the Management Accountant of Chane Ltd., advise the management of the company on whether or not to develop the new product. (10 marks)

2. Scotts Ltd. has experienced stock outs occasioned by the company’s poor inventory estimation techniques.

The company has therefore engaged you to estimate its demand for the year 2024.

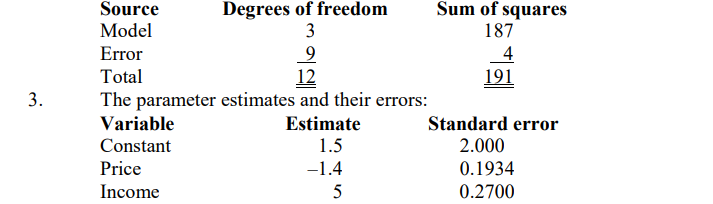

The company’s accountant had started using regression analysis and availed the following information to you:

1. The demand for the company’s’ product is dependent on disposable income and price of the

products.

2. The analysis of variances table:

Required:

Develop a regression equation that will be used for prediction. (2 marks)

Determine the coefficient of determination. Interpret your result. (4 marks)

Test the adequacy of the model for prediction (F tables value 11.56). (4 marks)

(Total: 20 marks)

QUESTION THREE

1. Evaluate THREE advantages of using simulation analysis in inventory control. (6 marks)

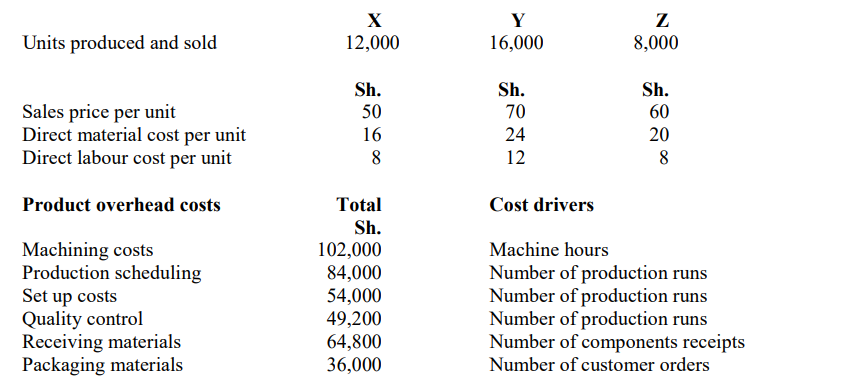

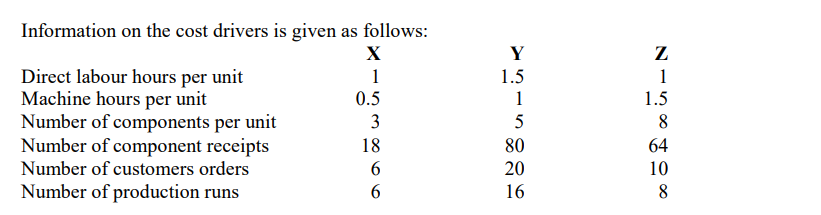

2. Kaza Joy is a small manufacturing enterprise that makes only three products X, Y and Z. Data for the month ended 30 November 2023 is as follows:

Required:

Using activity based budgeting (ABB), compute the cost and gross profit per unit for each products during the month. (14 marks)

(Total: 20 marks)

QUESTION FOUR

1. Highlight FOUR roles of a management accountant in accounting for environmental costs. (4 marks)

2. Discuss the meaning of the following concepts as used in cost estimation:

Economic plausibility tests. (2 marks)

Learning curve phenomenon. (2 marks)

3. Alumax Ltd. produces a single product branded “Salfa”. The machine used to make Salfa is obsolete and Alumax Ltd. is contemplating replacing it.

Additional information:

1. The replacement cost of a new machine is Sh.1 million with expected useful life of five years.

2. The machine will have no salvage value after decommissioning it.

3. It is expected that 20,000 units of Salfa will be produced and sold at a transfer price of Sh.300 per

unit over the five year period as follows:

![]()

4. Variable costs are expected to be Sh.165 per unit produced and sold.

5. The incremental fixed costs, mainly the wages of a maintenance engineer are expected to be

Sh.200,000 per year.

6. Alumax Ltd. uses an imputed interest cost of capital of 13% for the investment appraisal purposes.

7. Depreciation on this machine is calculated on initial cost of the investment at the start of the year.

Required:

The residual income (RI) for each of the five years. (6 marks)

The return on investment (ROI) for each of the five years. (6 marks)

(Total: 20 marks)

QUESTION FIVE

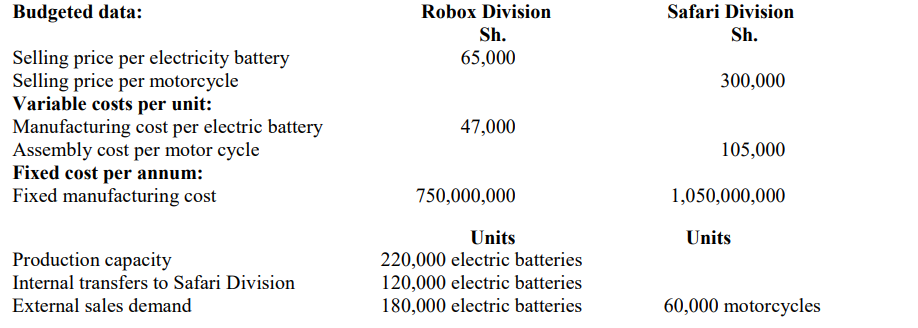

Simplex Group Ltd., manufacturers new patented electric motorcycles.

The group has two divisions, Robox Division and Safari Division. Robox Division manufactures a “dual electric battery” which is the key component for Safari Division. Safari Division is an assembly and distribution division for electric motorcycles. Robox Division sells the dual electric batteries to Safari Division and to external customers.

The following budgeted data is provided for both Robox Division and Safari Division:

Additional information:

1. Safari Division uses two electric batteries manufactured by Robox Division to assemble one motorcycle and sells motorcycles directly to external customers.

2. Internal transfer price is set at opportunity costs.

3. Robox Division must satisfy the demand of Safari Division before selling the dual electric batteries externally.

4. Safari Division is allowed to purchase dual electric batteries from Robox Division or from external supplies.

5. Safari Division is considering two purchasing options:

Option 1: Buy all the electric batteries it requires from Robox Division

Option 2: Outsource from a cheaper external supplier who has offered to supply all 120,000 electric

batteries at a price of Sh.45,000 electric batteries each to Safari Division.

Required:

1. In columnar format, prepare operating statement showing the:

Net profit for each division if Option 1 is adopted. (6 marks)

Net profit for each division and Simplex Group Ltd. as a whole if Option 2 is adopted. (6 marks)

2. Robox Division has received a special order from a new customer for the production of 40,000 electric

batteries. The manager of Robox Division requires an annual target profit for the division amounting to

Sh.6,410,000,000. This order will have no effect on the divisional fixed costs and no impact on the 180,000 electric batteries Robox Division sells to its existing customers.

Calculate the minimum transfer price per electric battery to sell the 40,000 electric batteries to the new

customer that would enable the manager of Robox Division to achieve the target profit. (4 marks)

3. Evaluate FOUR non-financial environmental impact overriding factors to consider before accepting

Option 2. (4 marks)

(Total: 20 marks)