FRIDAY: 17 December 2021. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings.

QUESTION ONE

1. A company expects to sell 1,000 units per month of a newly launched product but there is uncertainty as to both the unit selling price and the unit variable cost. The company has set a target minimum profit of Sh.85,000 per month. The following estimates of selling price, variable cost and their related probabilities are provided:

Selling price per unit Probability Variable cost per unit Probability

Sh. Sh.

200 0.25 80 0.20

250 0.40 100 0.50

300 0.35 120 0.30

There are specific fixed costs of Sh.50,000 per month expected for the new product.

Required:

Expected monthly profit from the new product. (2 marks)

Probability of the company achieving its profit target. (6 marks)

2. Babycom Ltd. produces and sells four types of dolls for children. The company also produces and sells a set of dress kit for the dolls.

The following estimates for the next financial year have been provided:

Doll type Estimated Standard material Standard Estimated sale

demand cost labour cost price per unit

Units Sh. Sh. Sh.

A 50,000 20 15 60

B 40,000 25 15 80

C 35,000 32 18 100

D 30,000 50 20 120

Dress kit 200,000 15 5 50

Additional information:

- To encourage the sale of dress kits, a discount of 20% in its price is offered if it were to be purchased along with the doll. It is expected that all the customers buying the dolls will also buy the dress kit.

- The company’s factory has effective capacity of 200,000 labour hours per annum on a single shift basis and it provides all the products on that basis.

- The labour hour rate is Sh.15 while overtime of labour has to be paid at double the normal rate.

- Variable costs are at 40% of direct labour cost.

- Fixed costs are estimated at Sh.3,000,000.

Required:

Expected contribution from the four types of dolls and the dress kit. (8 marks)

The net profit for the organisation as a whole. (4 marks)

(Total: 20 marks)

QUESTION TWO

1. Explain the following terms as used in strategic management accounting:

Life-cycle costing. (3 marks)

Target costing. (3 marks)

2. A plastic moulding company recycles plastic waste to produce plastic chairs. The company has received a three- year contract for the supply of a new model of chairs to be sold by Tumani Supermarket Ltd. through a chain of retail shops.

The following data relate to the cost estimates for the new model of chairs.

Sh.

Plastic waste cost per chair 300

Labour cost per hour 200

Fixed overheads per year 1,250,000

Capital investment 1,600,000

Additional information:

- The estimated time to produce the first chair is 10 hours.

- It is estimated that a learning curve effect of 90% on labour to produce the chairs will be experienced.

- The contract requires skilled labour that cannot be increased above the currently available hours. The available hours will produce 5,000 chairs for the first year.

- Assume that an equilibrium of labour hours in the first year will be available in both year 2 and year 3.

- The selling price per chair is set at Sh.900.

- All cash flows occur at the year end while the initial investment is incurred at the start of year 1.

- The capital investment has a nil salvage value at the end of the contract period.

- The company has a cost of capital of 12%.

Required:

Using the Net Present Value (NPV) of the contract, advise the management of the company on whether to accept or reject the contract. (10 marks)

State four other factors that the management of the company should consider before making the decision in (i) above. (4 marks)

(Total: 20 marks)

QUESTION THREE

1. Summarise the components of time series. (4 marks)

2. BZK Ltd. is a manufacturing company based in Africa.

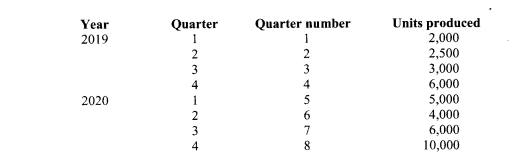

The company has presented the following data relating to its production in the last two years for each quarter:

The trend equation for the number of units produced has been estimated as follows:

X = 3,800 + 1,000Q

Where; X represents units produced per quarter.

Q represents the quarter number

The company’s Management Accountant has established the following relationships between the quarterly costs and output based on the data collected in the last two years.

Cost item Relationship

Office rent TC = 500,000

Office salaries TC = 200,000 + 2x

Fuel cost TC = 45,000 + 6x

Transport wages TC = 62,000 + 8x

Sundry costs TC = 29,965 + x

Where; TC represents the total cost per quarter

x represents the number of units produced per quarter

Required:

Using multiplicative time series model and least squares method for the trend, forecast the number of units to be produced in each of the quarters of the year 2021. (10 marks)

Using your answer in (b) (i) above and the cost relationship equations, determine the expected cost for each item of cost and the total cost to be incurred in the fourth quarter of the year 2021. (3 marks)

Establish the 95% confidence interval for the total cost obtained in (ii) above given that the standard error of estimate is Sh.122,599 and t – value is 2.447. (3 marks)

(Total: 20 marks)

QUESTION FOUR

1. Discuss the following types of inventory models:

Deterministic models. (3 marks)

Stochastic models. (3 marks)

2. A wholesaler is worried about the uncertainty of demand and lead time of the following stock items:

- Stock item X

The weekly demand for the item is 200 units, with a normally distributed demand with a standard deviation of 30 units and a lead time of 16 weeks.

- Stock item Y

It has a daily demand of 50 units with a lead time that is normally distributed with a mean of 20 days and a standard deviation of 2 days. The re-order level of the stock item has been set at 1,100 units.

- Stock item Z

The item is ordered every 6 months. The lead time is 3 months and demand is normally distributed with a mean of 1,000 units per month and a standard deviation of 80 units. The cost of stock-out is Sh.80 and the cost of holding one unit of buffer stock is Sh.20 per annum.

Required:

The re-order level of stock item X that would restrict the probability of a stock out at 5% during a single re-order period. (4 marks)

The probability of a stock out of item Y during a single re-order period. (4 marks)

The total annual cost of holding safety stock and stock out cost if re-order level is set at 3,600 units. (6 marks)

(Total: 20 marks)

QUESTION FIVE

1. Business organisations especially the manufacturing firms are required to factor in environmental concerns in their decision making.

Required:

Analyse four ways of aligning business operations with environmental issues. (8 marks)

2. You are the management accountant of Zeta Ltd.

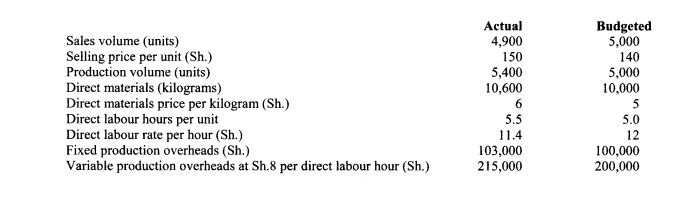

The following computer printout shows details relating to budgeted and actual production for the month of July 2021:

Additional information:

- Zeta Ltd. uses a standard absorption costing system.

- There was no opening or closing work in progress.

Required:

Prepare a statement which reconciles the budgeted profit with actual profit for the month of July 2021. (12 marks)

(Total: 20 marks)