WEDNESDAY: 6 April 2022. Afternoon paper. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings. Do NOT write anything on this paper.

QUESTION ONE

1. In control theory, a “feedback control” mechanism is the one which supplies information to determine whether corrective action should be taken to re-establish control of a system. In the context of the above statement, distinguish between “feedforward” and “feedback” controls giving an example of each as used in management accounting. (4 marks)

2. Jumbo Ltd. is proposing to introduce to the market a home security appliance system. It has three different possible models; Micro, Basic and Macro which vary in sophistication and complexity, but currently the company has capacity to manufacture only one model. An analysis of the probable acceptance of the models has been carried out and the resulting profit estimated. The results are as follows:

Profits (Sh.”000″)

Model acceptance Acceptance Probability Micro Basic Macro

Excellent 20% 60 100 120

Moderate 50% 40 60 80

Poor 30% 20 0 -40

The Finance Director of Jumbo Ltd. estimates the utilities for various sums of money from Sh.-40,000 to Sh.120,000 as follows:

Monetary value (Sh. “000”) -40 -20 0 20 40 60 80 100 120

Utility 0 0.20 0.37 0.52 0.65 0.78 0.89 0.96 1.00

Required:

Using scenario analysis, determine which model should be introduced to the market under:

Maximisation of expected monetary value. (3 marks)

The criterion of maximisation of expected utility. (3 marks)

3. Compute the maximisation value payable to acquire perfect information under (b) above. (3 marks)

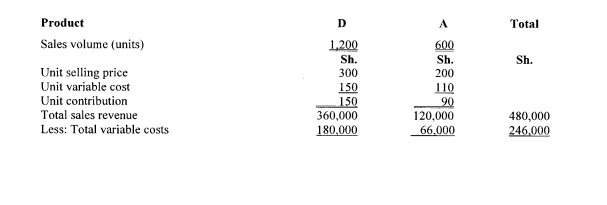

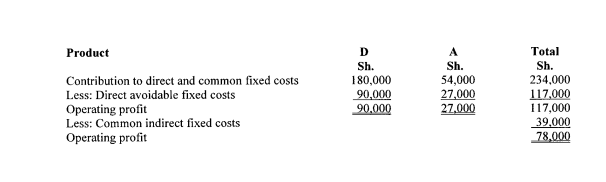

4. BB Ltd. sells two types of products branded “D” and “A”. “I he Financial Controller has prepared the following information based on the sales forecast for the period:

The common fixed costs relate to the costs of common facilities and can only be avoided if neither of the products is sold. The Managing Director is concerned that the sales may be less than forecast and has requested information relating to the break-even point for the period.

Required:

The break-even point of the two products in units and sales value if they are sold in the:

Original sales mix. (4 marks)

Sales mix of 1:1 (3 marks)

(Total: 20 marks)

QUESTION TWO

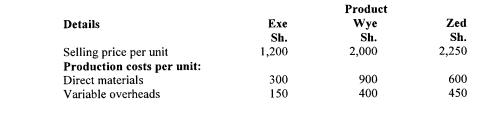

1. Zinc Ltd. is a local manufacturer of three products namely; Exe, Wye and Zed. The management of the company is unhappy with the current production mix and is seeking advice on the most optimal arrangement. The current production is 10,000 units of Exe, 5,000 units of Wye and 6,000 units of Zed. The Management Accountant has provided the following information relating to the three products:

Additional information:

- Each type of product passes through three departments in which a different type of labour is used. The labour requirements in each department are given below:

Department Rate per hour Labour requirements per unit (hours)

Sh. Exe Wye Zed

1 20 3 4 6

2 40 1 2.5 4

3 30 5 7 9

- There is a shortage of labour in department 2 and it is not possible to increase labour input hours beyond the level currently utilised.

- Fixed overheads are budgeted at Sh.5,000,000 per annum and are expected to remain constant.

- A recent market survey disclosed that the maximum sales potential for the company is 12,500 units of Exe, 7,500 units of Wye and 8,000 units of Zed.

Required:

Advise the management of Zinc Ltd. on the most profitable production mix and optimal profit using:

Limiting factor analysis. (8 marks)

Throughput accounting. (6 marks)

2. Describe three assumptions of the learning curve theory. (3 marks)

3. Explain three characteristics of the Just-in-Time (JIT) inventory system. (3 marks)

(Total: 20 marks)

QUESTION THREE

1. Majimbo Ltd. has two Divisions; A and B whose respective performance is under review. Division A is currently earning a profit of Sh.35 million and has net assets of Sh.150 million. Division B currently earns a profit of Sh.70 million with net assets of Sh.325 million. Majimbo Ltd. has a current cost of capital of 15%.

Required:

Using the information above, calculate the return on investment and residual income for each of the two divisions under review and comment on your results. (8 marks)

State which method of performance evaluation (Return on investment or Residual income) would be more useful when comparing divisional performance and why. (2 marks)

2. Dominion Beverages Ltd. makes and sells two beverage products branded “Bingo” and “Boost”.

The budgeted sales and profits for the year 2021 were as follows:

Product Sales quantity (Units) Revenue (Sh.) Costs (Sh.) Profit (Sh.)

Bingo 400 8,000 6,000 2,000

Boost 300 12,000 11,100 900

2.990

Actual sales were as follows:

Bingo 280 units with a profit of Sh.5.30 per unit.

Boost 630 units with a profit of Sh.2.80 per unit.

The company management is able to control the relative sales of each product through the allocation of sales effort, advertising and sales promotion expenses.

Required:

Calculate and interpret the following variances:

Sales margin price variance. (2 marks)

Sales margin volume variance. (2 marks)

Sales margin mix variance. (2 marks)

Sales margin quantity variance. (2 marks)

Sales margin total variance. (2 marks)

(Total: 20 marks)

QUESTION FOUR

1. Evaluate three benefits of life cycle costing. (6 marks)

2. Magunga Ltd. has two divisions, namely; division A and division B. Division A produces Product X which it sells to external market and also to Division B. Divisions in Magunga Ltd. are treated as profit centres and they are given autonomy to set transfer prices and choose their suppliers. The performance of each division is measured on the basis of the target profit given for each period.

Division A can produce 100,000 units of Product X at full capacity. Demand for Product X in the external market is 70,000 units only at a selling price of Sh.250 per unit. To produce Product X, division A incurs Sh.160 as variable cost per unit and total fixed overheads of Sh.4,000,000. Division A has employed Sh.12,000,000 as working capital which is financed by a cash credit facility provided by its lender bank at the rate of 11.5% per annum. Division A has been given a profit target of Sh.2,500,000 for the year. Division B has found two other suppliers; C Ltd. and H Ltd. who agreed to supply Product X. Division B has requested a quotation for 40,000 units of Product X from Division A.

Required:

Determine the transfer price per unit of Product X that Division A should quote in order to meet the target profit for the year. (8 marks)

Calculate the price that Division A should quote to Division B if Magunga Ltd.’s policy was to quote transfer prices based on opportunity cost. (6 marks)

(Total: 20 marks)

QUESTION FIVE

1. Kitchen Masters Ltd. (KML) is a grocery and general merchandise retail group. KML has supermarkets located in most towns and cities in its home country. Over the last few years, profits have fallen and KML has recognised that it has paid insufficient attention to customer care.

KML has now realised the importance of the customer experience at its supermarkets. In an attempt to earn the loyalty of its customers, KML has introduced a loyalty card scheme that rewards customers with discount vouchers based on their spending and buying patterns at supermarkets.

The management of KML is considering the introduction of a balanced scorecard approach to manage the performance of its stores.

Required:

Recommend an objective and suitable performance measure for each of the three non-financial perspectives of a balanced score card that KML could use to support its new strategy of improving customer experience.

Note: In your answer, you should state the three perspectives and then recommend with reasons, an objective and a performance measure for each one of the three perspectives. (9 marks)

2. Rigid Ltd. prepared fixed and flexible budgets for the financial year 2020/2021 as provided below:

Fixed budget for full capacity Flexible budget for 75% level

Sh. Sh.

Sales 1,350,000 1,012,500

Direct materials 425,000 318,750

Direct labour 185,000 138,750

Variable overheads 215,000 161,250

Semi variable overheads 365,000 323,750

Profit 160,000 70,000

Profit

After the closing of the financial year 2020/2021, the total actual sales stood at Sh.1,107,000 and there was a favourable sales price variance of Sh. 27,000.

Required:

Prepare a flexible budget for the actual level of sales. (11 marks)

(Total: 20 marks)