MONDAY: 5 December 2022. Afternoon Paper. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings Do NOT write anything on this paper.

QUESTION ONE

1. In the context of IAS 16 (Property, Plant and Equipment):

Explain how the initial cost of property, plant and equipment should be measured and the treatment of subsequent expenditure. (4 marks)

Describe the requirements regarding the revaluation of non-current assets, the treatment of surpluses and deficits on revaluation and the gains or losses on disposal. (6 marks)

2. Voxy Limited leased a factory to Teana Limited with effect from 1 July 2022. The lease is for four (4) years at an

annual lease rental of Sh.4,000,000 payable annually in arrears. The lease contract provides that the lessee shall be

responsible for the insurance and maintenance of the factory during the lease term. The implicit rate of interest in

the lease is 15% per annum.

Required:

Demonstrate, with suitable calculations, the accounting treatment of the above lease transactions in the financial statements of Voxy Limited (lessor) for the years ended 30 June 2023, 2024, 2025 and 2026. (10 marks)

(Total: 20 marks)

QUESTION TWO

1. Explain TWO challenges that a business entity might face while preparing segmental reports. (2 marks)

2. IFRS 2 “Share Based Payments”, identifies three types of share based transactions.

Required:

Explain the THREE types of share based transactions in each case indicating their accounting treatment in line with IFRS 2 “Shared Based Payments”. (6 marks)

3. The objective of International Public Sector Accounting Standard (IPSAS) 21 “Impairment of Non-cash generating Assets”, is to prescribe the procedures which a public sector entity applies to determine whether a non- cash generating asset is impaired.

Required:

With regard to International Public Sector Accounting Standard (IPSAS) 21, “Impairment of Non-cash generating Assets”, briefly explain the accounting treatment of impairment of non-cash generating assets and how the requirements of IPSAS 21 compare with those of the International Accounting Standard (IAS) 36 “Impairment of Assets”, applicable to commercial sector entities. (6 marks)

4. Discuss the nature and contents of Management Commentary in the context of enhancing the usefulness of financial information to the users of financial statements. (6 marks)

(Total: 20 marks)

QUESTION THREE

H Limited, a public limited entity, operates in the information technology sector. It has made several investments in other

companies within the industry, which has earned it market leadership in the sector.

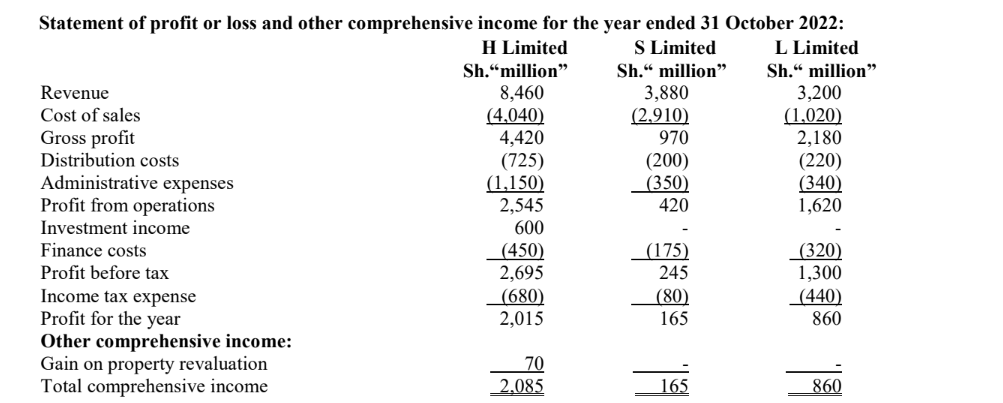

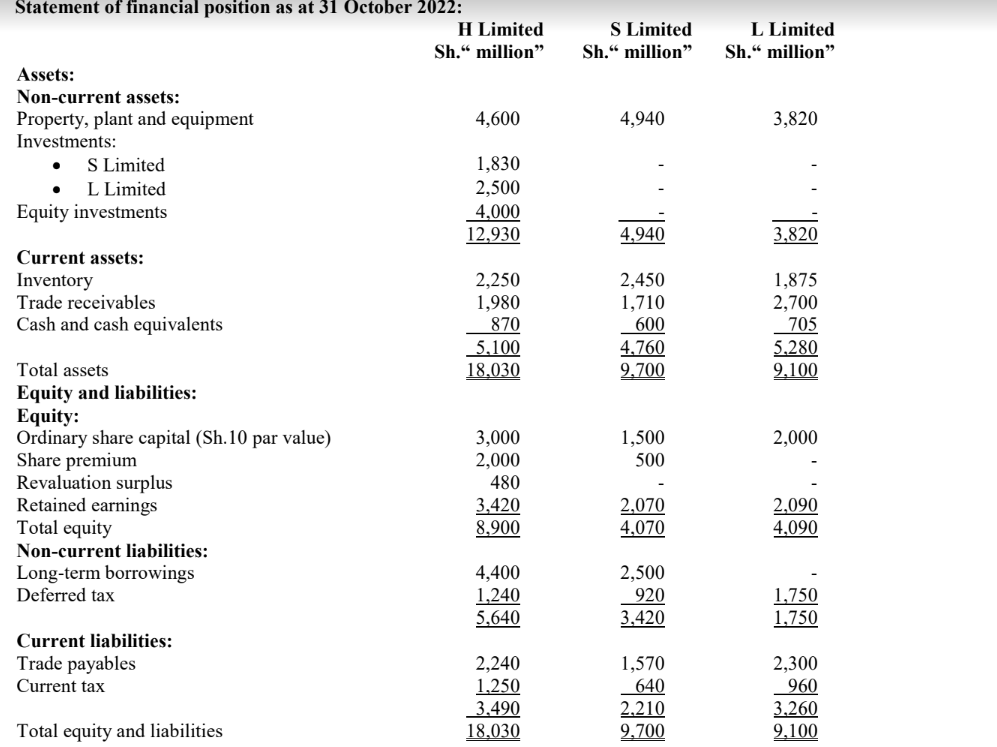

The following draft financial statements for the year ended 31 October 2022 relate to H Limited and its investment companies.

Additional information:

1. H Limited acquired an 80% ordinary shareholding in S Limited on 1 November 2019 when the retained earnings of S Limited stood at Sh.340 million. The acquisition consideration comprised cash of Sh.1,830 million. The fair values of the identifiable net assets of S Limited at acquisition date were Sh.2,440 million. The excess of the fair values over the carrying values was due to an unrecognised brand whose remaining economic useful life at the date of acquisition was five (5) years.

2. M Limited is the main competitor of H Limited and on 1 May 2022, M Limited and H Limited each acquired 50% of the 200 million ordinary shares of Sh.10 each in L Limited.

The consideration paid by H Limited consisted of cash of Sh.15 per share and also a 1 for 2 share exchange when the market price of H Limited’s share was Sh.20 each. M Limited also paid Sh.15 per share for their interest but did not issue any shares to the owners of L Limited. The ordinary shares of L Limited have one voting right each. Upon the acquisition, H Limited had a contractual right to appoint 60% of the board of L Limited, with the remaining 40% appointed by M Limited. M Limited and H Limited each appointed one member to L Limited’s senior management team. It is the senior manager appointed by H Limited who makes the key decisions regarding the development of L Limited’s new technologies, its principal revenue stream, the market it will operate in and how it is financed. The fair values of L Limited’s net assets approximated their carrying values at the date of acquisition.

3. H Limited has a policy of measuring the non-controlling interests at fair value. The non-controlling interest in S Limited had a fair value of Sh.970 million at 1 November 2019.

4. During the year ended 31 October 2022, S Limited sold goods worth Sh.400 million to H Limited. S Limited reports a gross profit margin of 25% on all its sales. 20% of these goods remained in the closing inventory of H Limited as at 31 October 2022.

5. As at 31 October 2022, no impairment had arisen in respect of the goodwill arising on the acquisition of S Limited and L Limited.

6. None of the group companies paid dividends during the year ended 31 October 2022.

7. S Limited had not issued any ordinary shares since its shares were acquired by H Limited.

Required:

Consolidated statement of profit or loss and other comprehensive income for H Group for the year ended 31 October 2022. (8 marks)

Consolidated statement of financial position for H Group as at 31 October 2022. (12 marks)

(Total: 20 marks)

QUESTION FOUR

1. In the context of IAS 33 (Earnings Per Share), explain the meaning of the following terms:

Contingently issuable ordinary shares. (2 marks)

Potential ordinary shares. (2 marks)

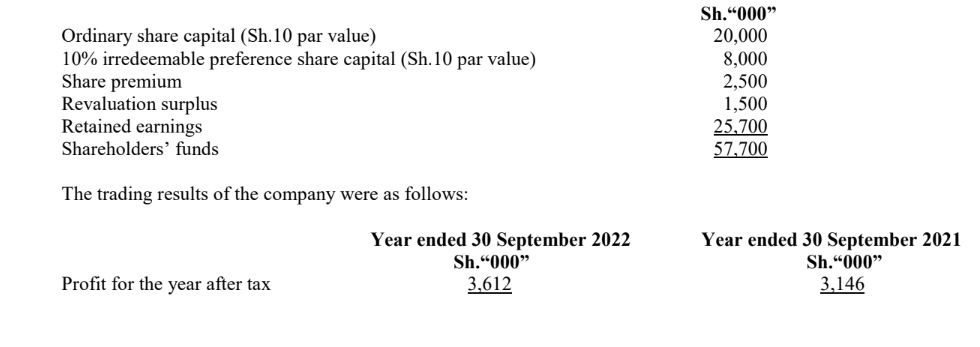

2. D Limited’s equity balances as at 1 October 2020 comprised the following:

Additional information:

1. On 1 January 2021, the company issued 400,000 ordinary shares at full market value.

2. On 1 April 2021, the company made a 1 for 5 bonus issue of ordinary shares to the existing shareholders, utilising its retained earnings.

3. On 1 December 2021, D Limited invited its ordinary shareholders for a rights issue in the proportion of 1 for 4 at Sh.12 per share. The shares were quoted immediately before the rights issue at Sh.15 per share. All the rights were fully subscribed.

4. The company has had in issue a convertible loan stock of Sh.6 million which carries an effective interest rate of 8% per annum. Each Sh.1,000 nominal value of the loan stock will be convertible at the holder’s option into 600 ordinary shares.

On 1 June 2022, holders of Sh.1.5 million loan stock exercised their conversion option.

5. The income tax rate applicable to D Limited is 30%.

6. The company declared and paid dividends on both classes of the equity shares.

Required:

Basic earnings per share (EPS) for the years ended 30 September 2021 and 30 September 2022.(8 marks)

Diluted earnings per share (EPS) for the year ended 30 September 2022. (8 marks)

(Total: 20 marks)

QUESTION FIVE

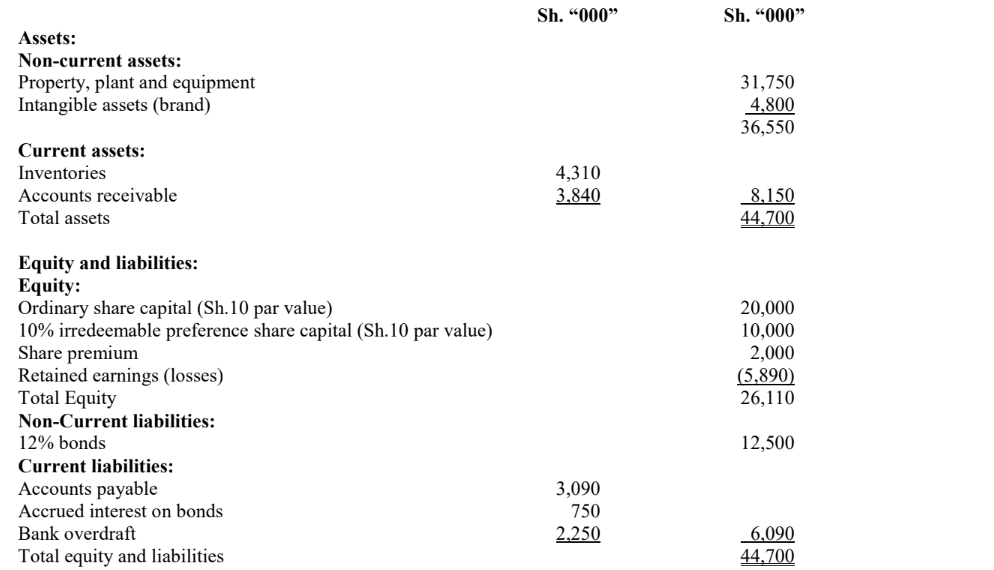

Tahidi Limited, a private limited company, has been in financial difficulties and has reported trading losses for a number of years. The directors of the company invited the shareholders and creditors for a special general meeting where it was

resolved that the operations of Tahidi Limited be transferred to a newly formed company, Sitawi Limited, with effect from 1 August 2022.

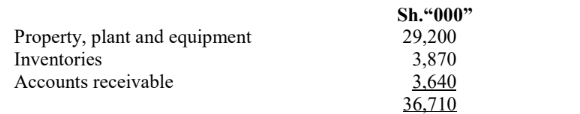

The latest statement of financial position of Tahidi Limited as at 31 July 2022 was as follows:

Additional information:

1. The newly formed company’s authorised share capital comprised five (5) million ordinary shares of Sh.10 par value each.

2. Sitawi Limited issued four (4) new ordinary shares of Sh.10 each credited at Sh.5 each for every two (2) preference shares held in Tahidi Limited. The preference shareholders agreed to immediately pay the balance on the shares allotted.

3. Preference dividends in Tahidi Limited were two years in arrears. Half of the preference dividend arrears were settled by issue of fully paid ordinary shares Sh.10 each in Sitawi Limited.

4. The new company also issued three (3) new ordinary shares of Sh.10 each credited at Sh. 5 each for every five (5) ordinary shares held in Tahidi Limited. The ordinary shareholders agreed to immediately pay the balance on the shares allotted.

5. The bond holders in Tahidi Limited agreed to be transferred to the new company on condition that the bonds would be convertible into ordinary shares after three years. The coupon interest rate for the convertible bonds was to be 8% per annum. Similar bonds with no conversion rights attracted interest at the rate of 10% per annum. Accrued interest on the bonds was to be paid immediately upon taking over.

6. The current liabilities of Tahidi Limited were transferred to Sitawi Limited at their book values.

7. The brand was considered valueless and therefore written off.

8. The tangible assets were taken over by Sitawi Limited at their fair values as follows:

9. Liquidation expenses of Tahidi Limited amounted to Sh.6 million and were settled by Sitawi Limited.

10. Immediately upon take over, Sitawi Limited invited its ordinary shareholders for a 1 for 5 rights issue of ordinary shares at an exercise price of Sh.15.

The average market price of the ordinary shares on cum-rights basis immediately before the rights issue was Sh.20.

The issue was fully subscribed.

Required:

1. The following ledger accounts to close off the books of Tahidi Limited:

Realisation account. (4 marks)

Preference shareholders sundry members account. (2 marks)

Ordinary shareholders sundry members account. (2 marks)

2. Journal entries in the books of Sitawi Limited to record the initial recognition of the 8% convertible bonds and the rights issue on 1 August 2022. (6 marks)

3. Opening statement of financial position of Sitawi Limited as at 1 August 2022. (6 marks)

(Total: 20 marks)