MONDAY: 4 April 2022. Afternoon paper. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings. Do NOT write anything on this paper.

QUESTION ONE

P Limited is a public limited company listed in the securities exchange. It has diversified its activities by acquiring S Limited, a company domiciled in a foreign country. Both companies prepare their financial statements in accordance with International Financial Reporting Standards. The presentation currency of the group is the Kenya Shilling (Ksh.) while S Limited’s functional currency is the Franc (Fr.)

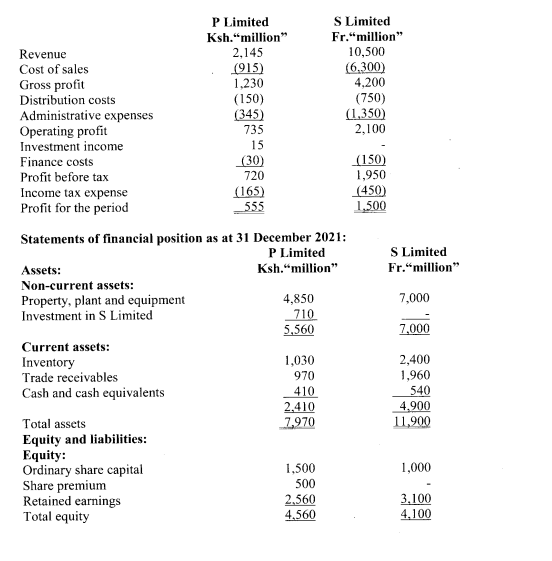

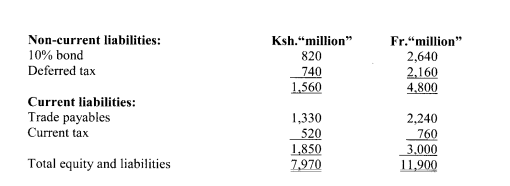

The draft financial statements for the year ended 31 December 2021 are as set out below:

Statements of profit or loss for the year ended 31 December 2021:

Additional information:

- On 1 January 2021, P Limited acquired 80% of S Limited’s 1,000 million Fr 1 ordinary shares for a cash consideration of Fr. 3,550 million.

- As at the acquisition date, the carrying value of S Limited’s net assets was Fr. 2,600 million, but the fair value was Fr.3,200 million. The excess in fair value over the carrying value was due to an unrecognised brand with a remaining useful economic life of five years as at the acquisition date.

- The non-controlling interest in S Limited as at the acquisition date was valued at Fr. 1,450 million using the fair value method.

- As at 31 December 2021, it was determined that goodwill arising on the acquisition of S Limited was impaired by 10%.

- The following foreign exchange rates are relevant:

Fr. to Ksh.1

1 January 2021 5

31 December 2021 4

Average for the year ended 31 December 2021 6

Required:

1. Determine the exchange differences (gains/losses) arising on the retranslation of net assets and goodwill on acquisition of the foreign subsidiary. (6 marks)

2. Consolidated statement of profit or loss and other comprehensive income for the year ended 31 December 2021. (6 marks)

3. Consolidated statement of financial position as at 31 December 2021. (8 marks)

(Total: 20 marks)

QUESTION TWO

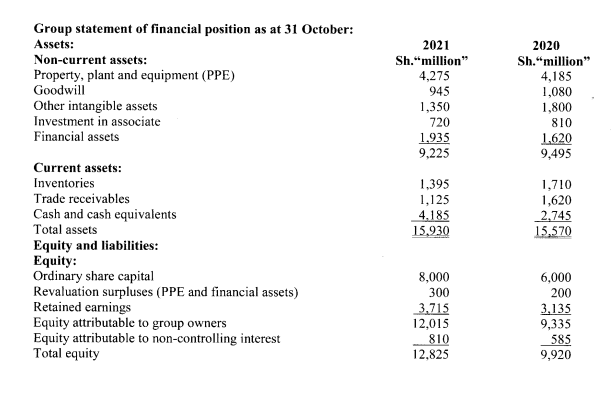

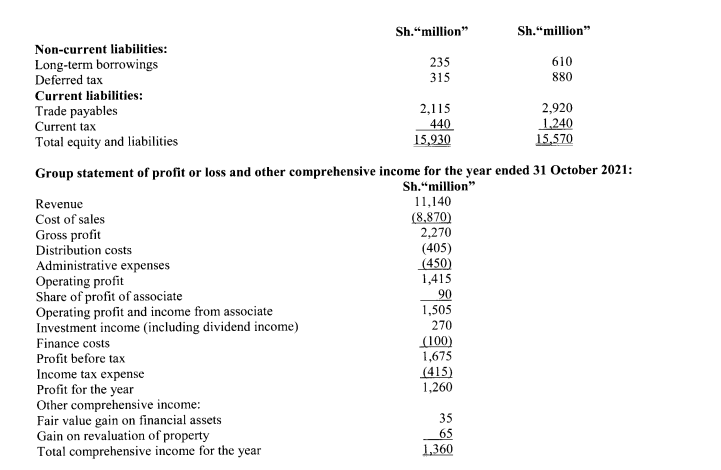

The following draft group financial statements relate to H Limited, a public limited company, and its investment companies:

Additional information:

- During the year ended 31 October 2021, H Limited disposed of its entire 80% equity holding in S Limited for Sh.310 million in cash.

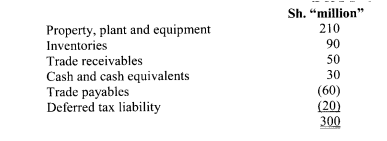

The carrying amounts of the identifiable net assets of S Limited at the disposal date comprised:

The gain/loss on disposal of the subsidiary is included in administrative expenses. The disposal of S Limited is not classified as a separate major line of business or geographical operation. The investment in S Limited had been acquired several years ago at a consideration of Sh.230 million when the fair values of the identifiable net assets stood at Sh.250 million.

- The group policy is to measure the non-controlling interest in all subsidiaries at their proportionate share of net assets at the acquisition date.

- An impairment test carried out at 31 October 2021 showed that goodwill other than that arising on the acquisition of S Limited was impaired. Other intangible assets were also impaired.

- H Limited disposed of plant with a carrying amount of Sh.440 million for cash proceeds of Sh.560 million. The gain on disposal is included in administrative expenses. Depreciation charged to profit or loss during the year ended 31 October 2021 was Sh.260 million.

- The following schedule relates to the financial assets at fair value through other comprehensive income held by H Limited:

Sh.”million”

Balance as at 1 November 2020 1,620

Less carrying amount of financial assets disposed of (235)

Add purchases of financial assets 515

Add fair value gain on financial assets 35

Balance as at 31 October 2021 1,935

The sale proceeds of financial assets were Sh.360 million. Profit on the sale of the financial assets is included in investment income in the financial statements.

- The profit for the year attributable to the non-controlling interests amounted to Sh.390 million.

Required:

A consolidated statement of cash flows for H Group for the year ended 31 October 2021 using the indirect method in

accordance with International Accounting Standard (IAS) 7 “Statement of Cash Flows”. (Total: 20 marks)

QUESTION THREE

1. With regard to International Financial Reporting Standard (IFRS) 15: “Revenue from Contracts with Customers”, explain the key factors that must be considered when determining the transaction price within a contract. (4 marks)

2. The following accounting information was extracted from the financial records of Kibo Limited regarding the defined retirement benefit scheme for its employees:

Sh.”million”

Net defined benefit obligation as at 1 January 2021 1,850

Net defined benefit obligation as at 31 December 2021 2,000

Current service cost 200

Contributions to scheme 225

Benefits paid by trustees 150

The market yield on high quality corporate bonds is at the rate of 5%. Assume there are no tax implications regarding the retirement benefit obligation.

Required:

With suitable calculations, explain the accounting treatment of the various elements of the defined benefit scheme on the financial statements of Kibo Limited for the year ended 31 December 2021, in accordance with International Accounting Standard (IAS) 19 “Employee Benefits”. (6 marks)

3. R Limited, a publicly traded company, had 9 million ordinary shares of Sh.1 par value and 1 million, 7% redeemable preference shares of Sh.10 par value each on 1 October 2020. As at that date, R Limited also had in issue 2.5 million stock options. These options are exercisable at Sh.1.5 per share. The average fair value per ordinary share during the year ended 30 September 2021 was Sh.2. R Limited’s profit for the year to 30 September 2021 from continuing operations was Sh.14,575,000 (30 September 2020: Sh.15,100,000).

The following transactions took place during the year ended 30 September 2021:

- On 1 January 2021, the company issued 1.8 million ordinary shares in a 1 for 5 rights issue at a price of Sh.2 when the market price per share on cum-rights basis was Sh.5.

- On 1 April 2021, R Limited issued 1 million ordinary shares at their full market value.

- On 1 July 2021, the company issued a Sh.5 million convertible bond with an effective interest rate of 12%. The bond is convertible into ordinary shares at the holders’ option on the basis of 60 shares per Sh.100 bond. None of the bond was converted during the year ended 30 September 2021.

- The income tax rate applicable to R Limited is 30%.

Required:

Basic earnings per share for the year ended 30 September 2021. (4 marks)

Restated earnings per share for the year ended 30 September 2020. (2 marks)

Diluted earnings per share for the year ended 30 September 2021. (4 marks)

(Total: 20 marks)

QUESTION FOUR

The following information was extracted from the financial records of Belta Bank Limited as at 31 March 2022:

Sh.”million”

Cash and balances with the Central Bank 4,046

Money on demand and short term deposits 2,150

Deposits with other commercial banks 4,600

Deposits from other commercial banks 3,324

Investments in government securities 4,485

Investments in equity instruments 765

Property, plant and equipment 7,416

Intangible assets 4,986

Loans and advances to customers 8,144

Customer deposits 7,065

Long-term borrowings 5,660

Other receivables 2,493

Other payables 2,717

Instalment tax paid 360

Deferred tax as at 1 April 2021 370

Interest on loans and advances to customers 2,575

Interest on government securities 2,264

Interest on deposits with other banks 646

Interest on deposits from other banks 662

Interest on customer deposits 1,833

Interest on long term borrowings 1,385

Administrative expenses 2,160

Other operating expenses 1,163

Fees, commission and foreign exchange income 6,090

Ordinary share capital 4,400

Share premium 2,500

Deposit protection reserve as at 1 April 2021 5,000

Retained earnings as at 1 April 2021 3,623

Suspense account (Cr.) 414

Additional information:

- On 1 April 2021, Belta Bank Limited issued a Sh.450 million, five-year 8% coupon bond at par. The bond will be redeemable at a substantial premium which gives it an effective interest rate of 12% per annum. There were no issue costs. The only accounting entries made were to record the cash proceeds from the issue and the annual interest payment on 31 March 2022.

- At 31 March 2022, the directors of Belta Bank Limited accepted a valuation report by a professional valuer which revealed the fair value of the property, plant and equipment to be Sh.2,500 million. The carrying amount of the property, plant and equipment amounted to Sh.1,850 million. The directors do not wish to make interreserve transfer upon revaluation. However, they do account for deferred tax on revaluation of property, plant and equipment. Revaluation is yet to be accounted for in the books of the bank.

- During the year ended 31 March 2022, the current tax on profits was estimated at Sh.890 million. At 31 March 2022, the carrying amounts of the net assets exceeded their tax bases by Sh.1,800 million. These carrying amounts do not include the effect of the revaluation in note 2 above. The income tax rate applicable to Belta Bank Limited is 30%.

Required:

Statement of profit or loss and other comprehensive income for the year ended 31 March 2022. (10 marks)

Statement of financial position as at 31 March 2022. (10 marks)

(Total: 20 marks)

QUESTION FIVE

1. The objective of International Public Sector Accounting Standard (IPSAS) 20 “Related Party Disclosures” is to prescribe the disclosure requirements for related party relationships in public sector entities.

Required:

With reference to IPSAS 20 “Related Party Disclosures”, briefly describe the related party disclosures required and indicate how they differ from the requirements of International Accounting Standard (IAS) 24 “Related Party Disclosures” for commercial sector entities. (4 marks)

2. In the context of International Financial Reporting Standard (IFRS) 16 “Leases”, outline the criteria for identifying a lease contract for the purpose of accounting in the financial statements of lessees. (4 marks)

3. The International Accounting Standards Board (IASB) has issued a practice statement called “Making Materiality Judgements”. This provides non-mandatory guidance that may help preparers of financial statements when applying IFRS standards.

Required:

In the light of the above statement, explain four contents of the practice statement “Making Materiality Judgements”. (8 marks)

4. Integrated Reporting (IR) is founded on integrated thinking that results in a periodic integrated report by an organisation about value creation over time and related communications regarding aspects of value creation.

Required:

In view of the above statement, evaluate the fundamental elements of Integrated Reporting (IR). (4 marks)

(Total: 20 marks)