Advanced Financial Management Revision Kit – Click to download sample

To get complete Advanced Financial Management Revision Kit in Hard Copy, Call/WhatsApp/SMS 0728 776 317

TOPIC 1

ADVANCED CAPITAL BUDGETING DECISION

QUESTION 1

August 2025 Question One A and B

- Highlight FOUR reasons for soft capital rationing in a firm. (4 marks)

- Ushindi Ltd. is considering the following projects:

Additional information:

- Variable costs are 40% of annual revenue.

- Each project is divisible.

- Projects D and E are mutually exclusive.

- Cash flows are confined within the lifetime of each project.

- Cost of capital is 10%.

- Ignore taxation and depreciation.

- The company has a capital limitation of Sh.400 million for investment.

- All cash flows occur at anniversary dates.

Required:

- Optional allocation of the available capital to the projects. (8 marks)

- Maximum resultant Net Present Value (NPV) from the optimal allocation. (4 marks)

QUESTION 2

April 2025 Question One B

As the finance manager of Popo Ltd., the Board has approached you to evaluate the proposed acquisition of new machinery. The purchase price of the machinery is Sh.100 million. It will cost another Sh.20 million to modify it for special use. The machine will be sold after 5 years for Sh.40 million and it will require an increase in net operating working capital (NOWC) of Sh.8 million.

Additional information:

- The purchase of the new machine will not have any effect on revenues but it is expected to save the company Sh.45 million per year before tax operating costs mainly labour.

- The corporate tax rate is 30%.

- The company uses the straight line method of depreciation.

- The project cost of capital is 12%.

Required:

- Using the net present value (NPV) method, evaluate whether the machinery should be purchased. (5 marks)

- Assume the Board suggests that you conduct a scenario analysis for this project because of the uncertainties of cost savings, salvage value and net operating working capital. After an extensive analysis, you come up with the following probabilities and the values for the scenario analysis:

Required:

The project’s expected net present values (ENPV). (6 marks)

- Analyse THREE common pitfalls that could arise in estimating cash flows in capital budgeting. (3 marks)

QUESTION 3

December 2024 Question One C

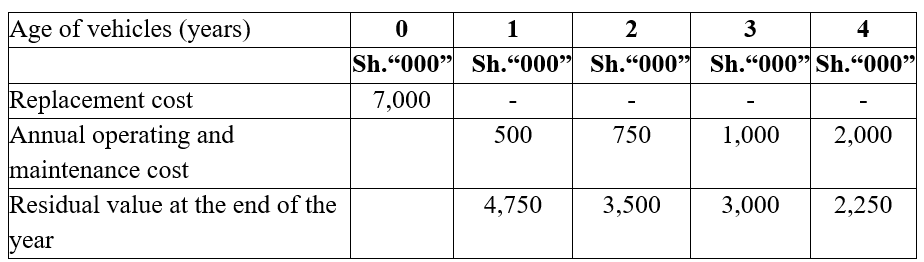

The directors of Jasiri Ltd. wishes to identify the optimum replacement cycle that will minimise the cost of operating its fleet of vehicles.

The relevant data is as follows:

Additional information:

- The company’s cost of capital is 10%.

- Ignore taxation.

Required:

Using the annual equivalent cost (AEC) technique, advise Jasiri Ltd. on the best time to replace the vehicles. (11 marks)

QUESTION 4

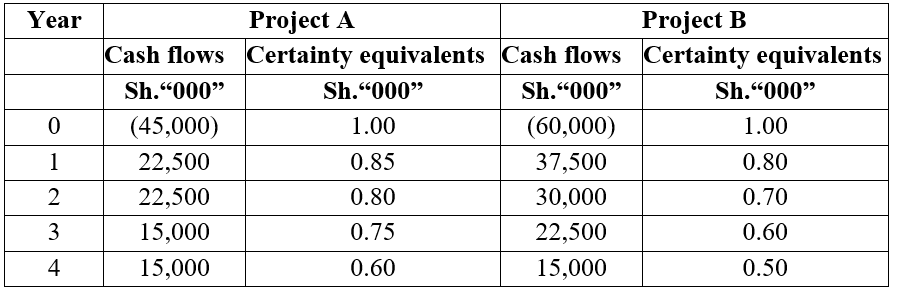

August 2024 Question One B

A company is considering two mutually exclusive projects namely; project A and project B. The company uses the certainty equivalent approach to evaluate capital projects. The estimated cash flows and certainty equivalents for each project are as follows:

The risk free rate is 5%.

Required:

Advise the company on which project to undertake using the certainty equivalent method. (6 marks)

QUESTION 5

April 2024 Question One A and C

Summarise FOUR causes of hard capital rationing as used in capital budgeting.

(4 marks)

(c) Kangaro Youth Sports Ltd. wishes to design a new sports bicycle. The company will have to invest Sh.100 million at the beginning of the first year for the design and model testing of the new bicycle.

The firm’s managers believe that there is an 80% probability that this phase will be successful and the project will continue.

If Phase 1 is not successful, the project will be abandoned with zero salvage value.

The next phase, if undertaken, would consist of making the molds and producing twenty prototype bicycles. This would cost Sh.400 million at the end of the first year. If this phase is successful, the firm would go into full scale production. If the phase is not successful, the molds and prototypes could be sold for Sh.150 million. The managers estimate that the probability that the bicycles will pass the test is 90% and that Phase 3 will be undertaken.

Phase 3 consists of changing over current production line to produce the new design. This would cost Sh.1,100 million in year 2.

If the economy is strong at this point, the net value of cash flows would be Sh.3,500 million, while if the economy is weak the net value of cash inflows would be Sh.2,600 million. Both net values of cash inflows will be realised at the end of year 3 and both states of the economy are equally likely.

The company’s cost of capital is 13%.

Required:

Using a decision tree, determine the project’s expected net present value (ENPV). (5 marks)

Calculate the project’s standard deviation of expected net present value and comment on the result. (4 marks)

Using the normal probability distribution, compute the probability that the project’s net present value will be at least Sh.80 million. (3 marks)

QUESTION 6

December 2023 Question One A

The management of Kapricon Ltd. are in the process of estimating utile and establishing the categories of investors. The management has approached CPA Samuel Okeyo, a financial management consultant and provided him with the following cases:

Case 1: There is 0.50 chance of receiving Sh.30 million and 0.50 chance of receiving Sh.100 million. The investor is willing to pay a maximum of Sh.60 million.

Case 2: There is 0.40 chance of receiving Sh.55 million and 0.60 chance of receiving Sh.100 million. The investor is willing to pay a maximum of Sh.82 million.

Case 3: There is 0.30 chance of receiving Sh.30 million and 0.70 chance of receiving Sh.60 million. The investor is willing to pay a maximum of Sh.45 million.

Assume that utile values of 0 and 1 are assigned to a pair of wealth representing the two extremes Sh.0 and Sh.100 million respectively.

Required:

Using the expected monetary value (EMV) technique, determine the category of investor in case 1, case 2 and case 3 above. (6 marks)

Compute the utile value for case 1, case 2 and case 3 respectively. (3 marks)

QUESTION 7

August 2023 Question Two B

Tobin Ltd. is appraising an investment project which has a cost of Sh.20 million payable in full at the start of the first year of operation. The project life is expected to be four years. Forecast sales, volumes, selling prices, variable costs and fixed costs are as follows:

To get complete Advanced Financial Management Revision Kit in Hard Copy, Call/WhatsApp/SMS 0728 776 317