TUESDAY: 22 August 2023. Morning Paper. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings. Do NOT write anything on this paper.

QUESTION ONE

1. Over the years, the World Bank has evolved from a single institution to a group of five unique and collaborative institutions known collectively as the World Bank or the World Bank Group.

Required:

In relation to the above statement, describe FIVE functions of the World Bank. (5 marks)

2. Analyse FIVE differences between portfolio theory and capital asset pricing model (CAPM). (5 marks)

3. Simon Kobia, an investor is evaluating six portfolios with the following characteristics:

The expected return of the market portfolio is 12% with an accompanying standard deviation of 4% while the risk free rate of interest is 5%.

Required:

Using capital market line (CML), advise the investor on which portfolio(s) is inefficient, efficient or

superefficient. (6 marks)

In case of inefficient and superefficient portfolio(s) in (c) (i) above, compute the standard deviation that

the portfolio should have for efficiency to be achieved with the given expected return. (4 marks)

(Total: 20 marks)

QUESTION TWO

1. Explain the following terms as used in mergers and acquisitions:

Poison pill. (2 marks)

Staggered board of directors. (2 marks)

Golden parachutes. (2 marks)

2. Tobin Ltd. is appraising an investment project which has a cost of Sh.20 million payable in full at the start of the first year of operation. The project life is expected to be four years. Forecast sales, volumes, selling prices, variable costs and fixed costs are as follows:

Additional information:

1. Selling price and cost information are in current price terms before applying selling price inflation of 5% per year, variable cost inflation of 3.5% per year and fixed cost inflation of 6% per year.

2. Tobin Ltd. pays annual corporation tax of 30%, with the tax liability being settled in the year in which it arises.

3. The company can claim tax allowable depreciation on the full initial investment of Sh.20 million on a

25% straight line basis.

4. The company’s investment project is expected to have zero residual value at the end of four years.

5. Tobin Ltd. has a nominal after tax cost of capital of 12% and a real after tax cost of capital of 8%.

6. The general rate of inflation is expected to be 3.7% per year for the foreseeable future.

Required:

The nominal net present value (NPV) of Tobin Ltd.’s investment project. (8 marks)

3. James Kamau had Ksh. 3,600,000 to invest and is considering the foreign exchange market (forex market). The following information relates to two forex bureaus:

The two forex bureaus are in the same location.

Required:

Calculate the locational arbitrage gain for James Kamau with Ksh. 3,600,000 to invest, if any. (4 marks)

Explain the scenario that is necessary for locational arbitrage to exist. (2 marks)

(Total: 20 marks)

QUESTION THREE

1. Discuss THREE challenges that organisations face while adopting blockchain technology in their operations. (6 marks)

2. The following information relates to an office complex:

Additional information:

1. Vacancy and collection losses are estimated at 6%.

2. Recently, two buildings have been sold in the same locality:

• The first building had a net operating income of Sh.1,500,000 and was sold for Sh.12 million.

• The second building had a net operating income of Sh.675,000 and was sold for Sh.4.8 million.

Required:

The net operating income (NOI) for the office complex. (4 marks)

The appraised price of the office complex using the income approach. (4 marks)

3. You are provided with the following information on put and call options on a stock:

Required:

Using put-call parity, calculate prices of the following:

Synthetic call option. (2 marks)

Synthetic put option. (2 marks)

Synthetic bond. (2 marks)

(Total: 20 marks)

QUESTION FOUR

1. Kobe Ltd. is about to replace its existing delivery vehicle with a new design of a vehicle that offers greater fuel economy. The company estimates that replacing the existing vehicle will save running costs of Sh.200,000 per year. There are two financing options available:

Option 1: Borrowing funds and purchasing the vehicle

The vehicle could be purchased for Sh.3,400,000 using a bank loan with an after tax cost of borrowing of 4% per year. The vehicle would have a useful life of four years and would have a residual value of Sh.1,400,000 at the end of that period. Straight line tax allowable depreciation is available on the vehicle. The vehicle would be subject to a special tax of Sh.60,000 at the end of each year of operation. The tax expenses are corporation tax deductible.

Option 2: Leasing the vehicle

The vehicle could be leased for a period of four years for a payment of Sh.600,000 per year, payable at the start of each year. The lessor will pay the special tax. Lease payments are a corporation tax deductible expense.

The firm after tax weighted average cost of capital is 8%. The company pays corporation tax at a rate of 30% one year in arrears.

Required:

Advise Kobe Ltd. on whether it should lease or borrow to finance the new vehicle. (8 marks)

Examine THREE reasons other than possible after tax cost advantages why Kobe Ltd. may choose to

lease rather than buy the new delivery vehicle. (3 marks)

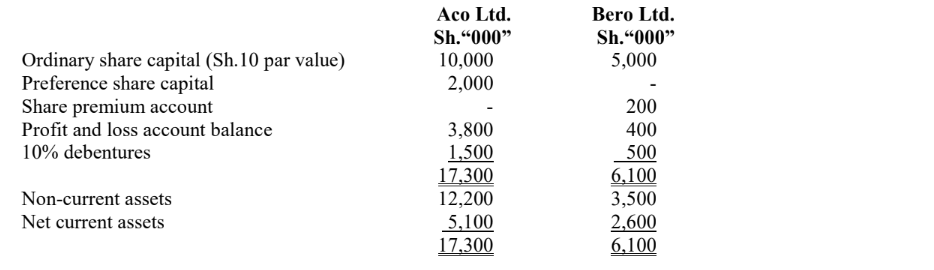

2. The statement of financial position of two companies, Aco Ltd. and Bero Ltd. as at 31 December 2022 are shown below:

Additional information:

1. Aco Ltd. is proposing to acquire Bero Ltd. by means of an issue of its own ordinary shares in exchange

for the ordinary shares of Bero Ltd.

2. The management of the two companies have availed the following information to assist in the takeover:

Required:

Using the following valuation basis and assuming no synergy effects accrue from the takeover, determine the total number of shares the directors of Aco Ltd. will have to offer to the shareholders of Bero Ltd:

Net asset value basis. (2 marks)

Earnings per share basis. (2 marks)

Market value basis. (2 marks)

Present value of future earnings basis. (3 marks)

(Total: 20 marks)

QUESTION FIVE

1. Assess THREE indicators of an organisation restructuring. (6 marks)

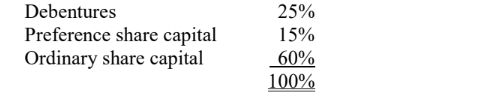

2. Mapato Ltd. has the following capital structure which it considers optimal:

Additional information:

1. Mapato Ltd.’s expected profit after tax for the year ended 30 June 2023 was Sh.34,285,714. Mapato Ltd. has an established dividend pay-out ratio of 30%. The tax rate for the company is 30% and investors

expect earnings and dividends to grow at a constant rate of 9% per annum in the future.

2. The company paid a dividend of Sh.3.6 per share in the year ended 30 June 2023. The company’s shares currently sells at Sh.60 per share.

3. The company can obtain new capital as follows:

Ordinary shares: New ordinary share capital can be issued at a floatation cost of 10%.

Preference share capital: New preference share capital can be issued to the public at Sh.100 per share.

The floatation cost is Sh.5 per share and a dividend of Sh.11 per share.

Debentures: Debentures can be issued at an interest rate of 12% per annum.

4. Assume that the cost of capital is constant beyond the retained earnings breakpoint.

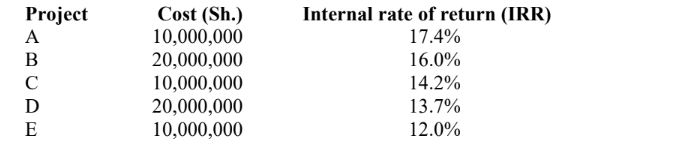

5. Mapato Ltd. has the following investment opportunities:

Required:

Calculate the break point in the marginal cost of capital (MCC) schedule. (2 marks)

Determine the cost of each capital structure component. (4 marks)

Calculate the weighted average cost of capital (WACC) in the intervals between the break points in the

marginal cost of capital (MCC) schedule. (4 marks)

Using the marginal cost of capital schedule, identify the projects that the company should accept and

why. (4 marks)

(Total: 20 marks)