TUESDAY: 5 April 2022. Morning paper. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings. Do NOT write anything on this paper.

QUESTION ONE

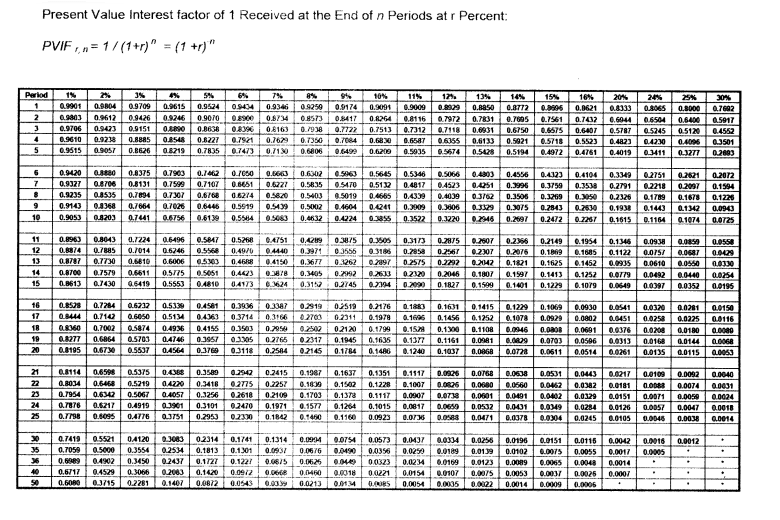

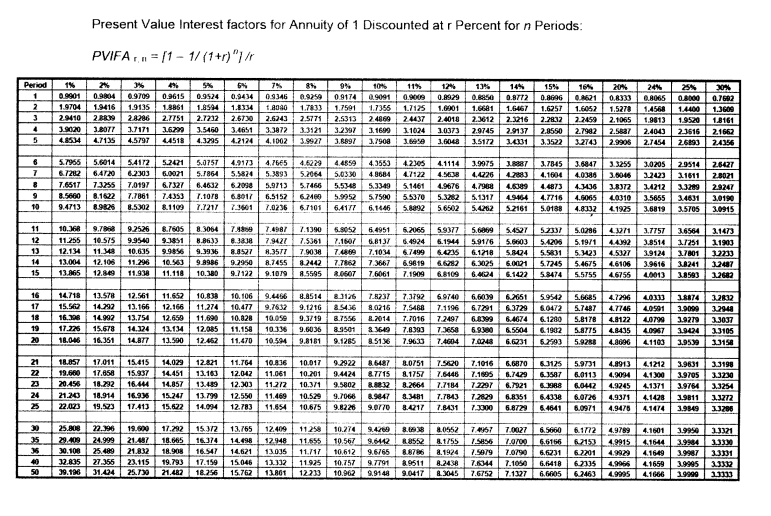

1. Treetop Limited is considering an investment project in the tourism industry worth Sh.48 million which will be a diversification from the mainstream activities. The Sh.48 million project cost will be financed as follows: Sh.10 million using internal funds; Sh.20 million using a rights issue and Sh.18 million with long-term loans.

The investment is expected to generate pretax net cash inflows of approximately Sh.14 million per year for a period of 10 years. The residual value at the end of the 10 year period will be Sh.15 million after taxes. As the investment is in an area where the government wishes to develop, a subsidised loan of Sh.8 million out of the total Sh.18 million is available. This will cost 2% below the company’s normal cost of long-term debt finance which is 8%.

Additional information:

- The company’s equity beta is 0.85 and its financial gearing is 60% equity and 40% debt by value.

- The average equity beta in the tourism industry is 1.2, and average gearing is 50% equity and 50% debt by market value.

- The risk free rate is 5.5% per annum.

- The market return is 12% per annum.

- Issue costs are estimated to be 1% of debt financing (excluding the subsidised loan) and 4% for equity financing. These costs are not tax allowable.

- The corporate tax rate is 30%.

Required:

The adjusted present value (APV) of the proposed investment project. (9 marks)

Propose three circumstances under which the APV may be preferred to the net present value (NPV) approach as a method of evaluating a capital investment project. (3 marks)

Dansof Limited is a juice processing firm which is solely equity financed. The company’s board of directors are considering diversifying their operations by entering into the soda processing industry.

Additional information:

- The current unlevered equity beta is 1.4 for Dansoft Limited and 1.5 for the soda processing industry respectively.

- The gearing in the soda processing industry is on average 40%. Hence, the capital structure comprises 40% debt and 60% equity.

- The return on market portfolio is 15%.

- The risk free rate of return is 12%.

- Debt finance is considered to be risk free.

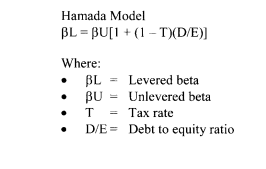

- The Hamada Model should be used to determine the levered equity beta.

- The cost of equity will be determined using the capital asset pricing model (CAPM).

- Corporation tax rate is 30%.

Required:

Recommend the suitable discounting rate for the new investment if the directors were to finance the new project as follows:

20% debt and 80% equity. (4 marks)

50% debt and 50% equity. (4 marks)

(Total: 20 marks)

QUESTION TWO

1. Examine three practical weaknesses of the arbitrage pricing model (APM) as used in portfolio theory. (3 marks)

2. Albert Onchiri, a finance manager at Wema Limited, is considering investing in shares of Safari Airways, a company quoted at the securities exchange. The returns on the securities exchange index and Safari Airways shares are shown below for the five possible states of the economy that might prevail next year:

Economic condition Probability Market return Safari Airways return

(%) (%)

Rapid expansion 0.15 25 13

Moderate expansion 0.35 20 10

No growth 0.25 15 8

Moderate contraction 0.15 10 4

Serious contraction 0.10 4 2

Required:

The expected return of Safari Airways shares. (2 marks)

The correlation between the returns on the securities exchange with the return on Safari Airways shares. (6 marks)

Comment on the result obtained in (b) (ii) above. (2 marks)

Albert Onchiri is thinking of undertaking an alternative investment but similar to that of Safari Airways’s shares. If the risk free rate of return is 10%, determine the minimum required rate of return of this investment. (3 marks)

3. Explain the following terms as used in corporate restructuring and reorganisation:

Leveraged buyout (LBO). (2 marks)

Argenti’s A Score Model. (2 marks)

(Total: 20 marks)

QUESTION THREE

1. Modigliani and Miller (MM) suggested that “real world considerations, primarily institutional constraints on high leverage, would prevent firms from approaching 100% debt levels”.

Required:

Giving reasons, explain whether you agree with the above statement. (4 marks)

2. An unlevered firm operates in a perfect market and has a net operating profit (EBIT) of Sh.4,000,000. The required rate of return on assets of firms in this industry is 16%. Assume that the firm issues Sh.10,000,000 worth of debt with a required rate of return of 14.5% and uses the proceeds to repurchase outstanding shares. There are no corporate or personal taxes.

Required:

The market value and required rate of return of this firm’s shares before the repurchase transaction according to MM proposition I. (2 marks)

The market value and required rate of return of this firm’s remaining shares after the repurchase transaction according to MM proposition II. (4 marks)

Summarise four disadvantages of using futures contracts as financial instruments. (4 marks)

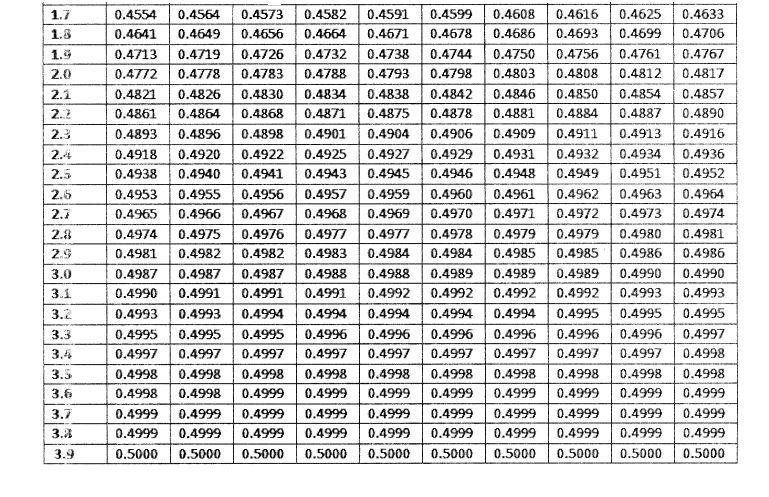

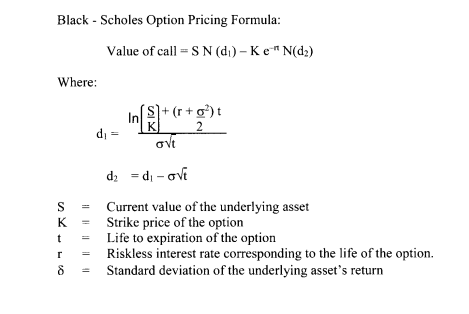

The current market price per ordinary share of Kanga Ltd. is Sh.58. A call option exists on the company’s shares with an exercise price of Sh.52 and with six months to maturity. The option can only be exercised on maturity, that is, it is a European option. The risk free rate of return is 6% and the variance of the rate of return on the shares is 15%.

Required:

Using the Black-Scholes option pricing model, estimate the value of the call option. (6 marks)

(Total: 20 marks)

QUESTION FOUR

1. There are a number of different types of finance which can facilitate the trading of goods and services both globally and domestically. The trade finance industry also supports and accommodates transactions that facilitate international payments, mitigate currency risk and exposure and both debt and equity financing.

Required:

In relation to the above statement, describe five types of trade finance. (5 marks)

2. Propose three reasons why residential real estate investment trusts (REITs) are not popular with investors. (6 marks)

3. Highlight four advantages of big data analytics in the financial sector or project finance. (4 marks)

4. Viwanda Manufacturers Ltd.’s current earnings per share (EPS) is Sh.5.0. The company has an asset beta of 0.90 and adopts a 40% dividend payout ratio as its dividend policy. The risk-free rate of return is 5% and the equity market risk premium is 10%. The management of Viwanda Manufactuers Ltd. intend to undertake a financial reconstruction which will result in a debt to equity ratio change from 0.15 to 0.30. Debt is considered to be risk free. Corporation tax applicable is 30%.

Required:

Show the impact of the financial reconstruction on the weighted average of cost capital (WACC) of the firm. (5 marks)

(Total: 20 marks)

QUESTION FIVE

1. Songo Ltd. has decided to acquire Twiga Ltd.

The financial data for the two companies are given as follows:

Songo Ltd. Twiga Ltd.

Net sales (Sh.”million”) 350 45

Profit after tax (Sh.”mi Ilion”) 28.13 3.75

Number of issued shares (“million”) 7.5 1.5

Earnings per share (EPS) (Sh.) 3.75 2.5

Dividend per share (DPS) (Sh.) 1.3 0.6

Total market capitalisation (Sh.”million”) 420 45

Required:

Pre-acquisition market price per share (MPS) of the combined firm. (2 marks)

Post acquisition earnings per share (EPS) if Twiga Ltd.’s shareholders are offered a share of Sh.30 on a share-for-share exchange. (4 marks)’

If the Price-Earnings ratio of Songo Ltd. drops to 12 times after the acquisition, determine the firm’s post acquisition market price per share. (2 marks)

Formulate a suitable criteria that should guide Songo Ltd. in determining whether to acquire Twiga Ltd. or not. (4 marks)

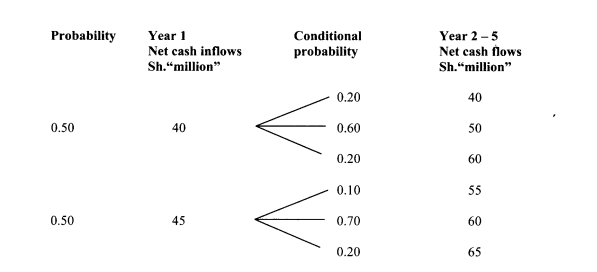

2. Popo Ltd. is considering a project requiring an initial cash outlay of Sh.150 million. The project’s life is five years after which there would be no expected salvage value. The possible incremental after tax cash inflows and associated probabilities of occurrence are as follows:

The company’s required rate of return for this investment is 12%.

Required:

Using decision tree analysis, compute the Expected Net Present Value (ENPV) of the project. (4 marks)

Compute the standard deviation of the Expected Net Present Value in (b) (i) above. (4 marks)

(Total: 20 marks)