MONDAY: 1 August 2022. Afternoon paper. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Do NOT write anything on this paper.

QUESTION ONE

HARMONISE AUTO INDUSTRIES LIMITED

Harmonise Auto Industries Limited is one of the most prominent companies in the world. They are pioneers in manufacturing load springs in East Africa. Their product is branded as “Ngumu Springs”. Harmonise Limited was started in 1985 by the visionary, Okumu Kamau, who is the chairman and managing director. The Company’s Head office is in Mosa. Under the able guidance of Okumu Kamau, the company grew to become the fourth largest spring manufacturer in Africa.

The group has two plants, one in Joba, and the other in Kota. Both plants are effectively managed by a team of qualified professionals. The Joba plant started operations in 1992, it has the distinction of being East Africa’s first spring plant. The other plant at Joba is ISO 9002 certified.

Harmonise Limited has an audit committee which is responsible for the effective supervision of the financial and accounting controls, as well as compliance with the financial policies of the company. The committee interacts with the auditors to ascertain the quality and precision of the company’s transactions, to review the manner in which they are performing their responsibilities, and to discuss the reports of the auditors.

The sources of funding for Harmonise Ltd are both internal and external. Internal sources of funds include factoring as a way to fund cash flow. While external sources of funds include loans from banks or financial institutions, the external sources are of two types:

1. Term loan.

2. Working capital loan.

A working capital loan is obtained for running and is of two types:

• Fund based.

• Non-fund based.

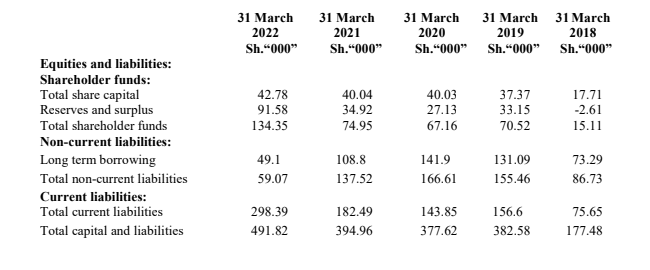

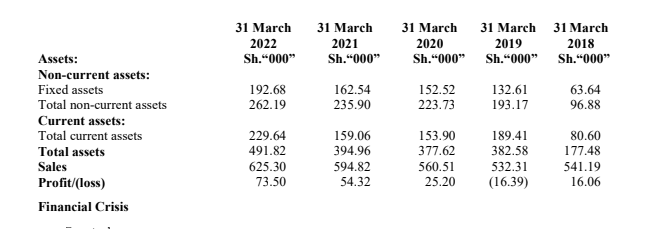

The following information was extracted from the books of Harmonise Limited for the period ended:

Financial Crisis

The Country’s economy, stock market and practically all business forecasts painted a very bright business environment. The first quarter performance was an all-time high and had raised high expectations of a record turnover and profit. The company had geared itself up to achieve a record target turnover and was expecting a good jump in its profits. However, these expectations were met with a rude awakening when COVID-19 struck resulting in massive losses suffered by major businesses all over the world. Harmonise Limited did not remain immune from the global financial crisis and there were strong signs of a slowdown. These events were so sudden that no one was prepared for such a rapid decline in economic cycles the world over.

Required:

1. One of the reasons that Harmonise Limited was able to maintain a stable cash flow was through the use of factoring.

With reference to the above statement, explain six benefits that Harmonise Limited enjoyed as a result of using factoring as a source of finance. (6 marks)

2. Distinguish between the following types of working capital loans:

“Fund based working capital” and “non-fund based working capital”. (4 marks)

3. Explain the following types of fund based working capital:

Working capital term loan. (2 marks)

Bill discounting. (2 marks)

Overdraft. (2 marks)

Cash credit. (2 marks)

4. Discuss four techniques that Harmonise Limited could have used to optimise debtors during the COVID-19 pandemic. (8 marks)

5. Analyse four roles of Harmonise Limited audit committee in credit risk management. (8 marks)

6. Calculate and interpret the following ratios for the year ended 31 March 2022:

Current ratio. (3 marks)

Net profit margin. (3 marks)

(Total: 40 marks)

QUESTION TWO

1. Explain the term “securitisation”. (2 marks)

Outline five steps of securitisation process. (5 marks)

2. Discuss four limitations of using the Net Present Value (NPV) technique of credit risk pricing. (8 marks)

(Total: 15 marks)

QUESTION THREE

1. Explain Market liquidity risk. (2 marks)

Enumerate seven features of process risk. (7 marks)

2. Discuss three requirements for the computation of Probability of Default (PD) by banks according to the new Basel Capital Accord. (6 marks)

(Total: 15 marks)

QUESTION FOUR

1. Identify four objectives of a credit rating system. (4 marks)

2. Describe five conditions that must be met by a risk management architecture. (5 marks)

3. Examine three ways of enhancing collateral management practices. (6 marks)

(Total: 15 marks)

QUESTION FIVE

1.Differentiate between “Credit Option (CO)” and “Credit Spread Option (CSO)”. (4 marks)

2. Assess four risk occurrences covered by a political credit risk insurance cover. (4 marks)

3. Describe seven methods of identifying individual project risks. (7 marks)

(Total: 15 marks)