Because these organizations are not trading, the types of accounts to prepare are different from the ones of trading organizations. Note that

1. Instead of a cashbook, the clubs will maintain a receipts and payments which has similar entries to those of a cashbook.

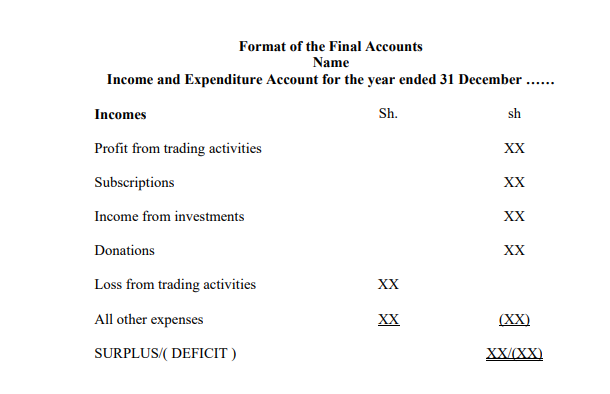

2. Instead of profit and loss account, we have an income and expenditure account.

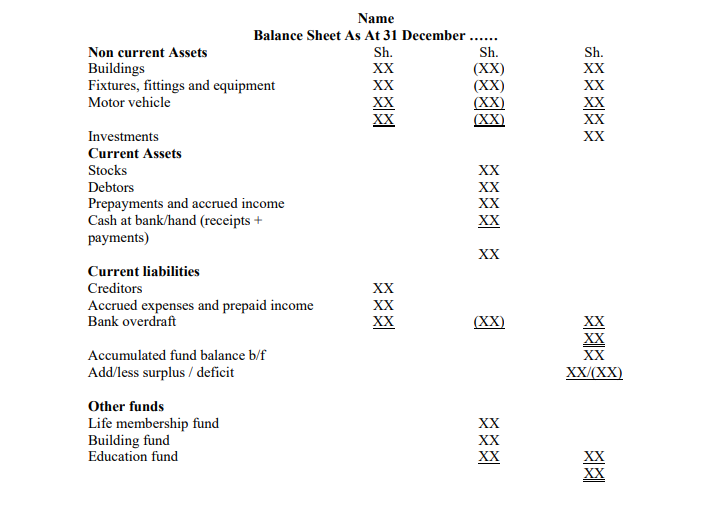

3. Because the club is not formed by any one owner (has no owner), it is funded by members’ contributions, donations, income from investments to get an accumulated fund instead of capital.

From the income and expenditure account, if the incomes are more than the expenditures for the period, then the club has a surplus and not a net profit. If the expenditure is more than incomes, then the club has a deficit and not a loss. The club may carry out some trading activities on a small scale to finance some of the clubs activities and incase a firm has a trading activity, then in addition to the income and expenditure account and the balance sheet, prepare a Bar Trading Account.

Notes to the Above Format:

1.Subscriptions

These are the amounts received by the club from the members to renew their membership. It is often paid on an annual basis.

- It is income for the club and therefore reported in the income and expenditure account.

- Depending on the policy of a club, any subscriptions due but not received are shown as accrued income (debtors for subscriptions) in the balance sheet.

- Any amounts prepaid are shown as prepaid (creditors for subscriptions).

- Some clubs will not report subscriptions as income until it is received in form of cash.

2.Income from investments

Some clubs invest excess cash in the bank (fixed deposit account), shares of limited companies, treasury bills and any other investment that may be available.

- If the club is investing with no specific intention (i.e a general investment) then income from this investment should be reported in the income and expenditure account.

- If the investment is for a specific purpose and relates to a specific fund (e.g building fund) it will not be reported in the income and expenditure account but credited directly to the fund

3.Other funds

- These are funds set up for a specific purpose and not general. They will be shown together with the accumulated fund.

- Any incomes relating to these funds, will be credited directly to the funds and any expenses will be taken off from these funds e.g. building fund, education fund

4.Life membership fund

Some members may pay some amount to become life members of the club and if this happens, there may be a need to spread out this income over the expected life of the members in the club. Depending on the policy of a club, the following accounting treatment may be allowed:

- The full amount is reported in the Income and Expenditure account in the year it is received and therefore no balance is retained in the life membership account.

- The amount is shown separately in the life membership fund with no transfer in the Income and Expenditure account and hence no balance in the life membership account.

- To transfer some amounts from the life membership funds to the income and expenditure account over the expected life of membership to the club.