Sales: This is the sell of goods that were bought by a firm (the goods must have been bought with the purpose of resale). Sales are divided into cash sales and credit sales.

When a cash sale is made, the following entries are to be made.

- Debit cash either at bank or in hand.

- Credit sales account.

For a credit sale:

- Debit debtors/ Accounts receivable account.

- Credit sales account.

A new account for sales is opened and credited with cash or credit sales.

Buying (Purchases:) of goods meant for resale. Purchases can also be for cash or on credit. For cash purchases:

- Debit purchases.

- Credit cash at bank/cash in hand

For credit purchases, we:

- Debit purchases.

- Credit creditors for goods.

A new account is also opened for purchases where both cash and credit purchases are posted. Note: no entry is made into the stocks account.

Incomes:

A firm may have other incomes apart from that generated from trading (sales). Such incomes include:

- Rent

- Bank interest

- Discounts received.

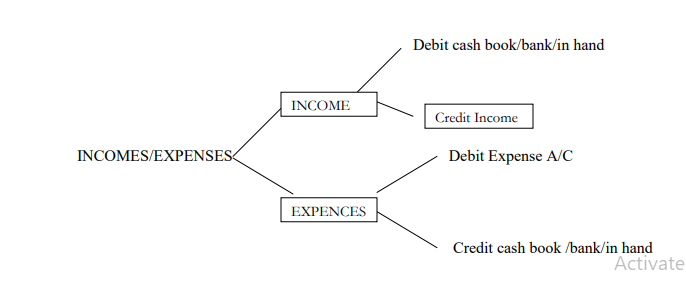

When the firm receives cash, from these incomes, the following entries are made:

- Debit cash in hand/at bank.

- Credit income account.

Each type of income should have its own account e.g. rent income, interest income. Incomes increase the value of capital and that is the reason why they are posted on the credit side of their respective accounts.

Expenses: These are amounts paid out for services rendered other than those paid for purchases. Examples include:

- Postage and stationery

- Salaries and wages

- Telephone bills

- Motor vehicle running expenses.

- Bank charges.

When a firm pays for an expense, we:

- Debit the expense account.

- Credit cash at bank/in hand.

Each expense should also have its own account where the corresponding entry will be posted. Expenses decrease the value of capital and thus the posting is made on the debit side of their accounts.

The following diagram is a simple summary of the entries made for incomes and expenses.