SUPPORT TOOLS FOR PURCHASING DECISION MAKING

Tendering process

Invitation to Tender

The procuring entity/firm shall prepare an invitation to tender that sets out the following:

- The name and address of the procuring entity;

- The tender number assigned to the procurement proceedings by the procuring entity;

- A brief description of the goods works or services being procured including the time limit for delivery or completion;

- An explanation of how to obtain the tender documents, including the amount of any fee;

- An explanation of where and when tenders must be submitted and where and when the tenders will be opened; and a statement that those submitting tenders or their representatives may attend the opening of tenders.

Tender Documents

The procuring entity/firm shall prepare tender documents in accordance with this section and the regulations. The tender documents shall contain enough information to allow fair competition among those who may wish to submit tenders.

The tender documents shall set out the following:

- The specific requirements prepared under relating to the goods, work or service being procured and the time limit for completion

- If works are being procured, relevant and bills of quantities

- The general and specific conditions to contract will be subject, including any requirement that performance security be provided before the contract is entered into

- The tender number assigned to the procurement proceedings by the procuring entity

- Instructions for the preparation and submission of tenders including;

- The forms for tenders

- The number of copies to be with the original tender

Any requirement that tender security be provided and the form and any such security

- Any requirement that evidence provided of the qualification person submitting the tender

- An explanation of where and when tenders must be submitted, a statement that the tenders will be opened immediately after the deadline for submitting them and an explanation of where the tenders will be opened

- A statement that those submitting to their representatives may attend the o tenders

A statement of the period during which tenders must remain valid

The procedures and criteria to be used to evaluate and compare the tenders; a statement that the procuring entity may, at any time, terminate the procurement proceedings without entering into a contract; and

Modifications to tender

- A procuring entity may amend the tender documents at any time before the deadline for submitting tenders by issuing an addendum.

- An amendment may be made on the procuring entity’s own initiative or in response to an inquiry.

- The procuring entity shall promptly provide a copy of the addendum to each person to whom the procuring entity provided copies of the tender documents.

- The addendum shall be deemed to be part of the ‘tender documents.

Advertisement of Tender

The procuring entity shall take steps reasonable to bring the invitation to tender to the attention of those who may wish to submit tenders. If the estimated value of the goods, works or services being procured is equal to, or more than the prescribed threshold for national advertising, the procuring entity shall advertise, at least twice in a newspaper of general nationwide circulation which has been regularly published for at least two years before the date of issue of the advertisement, and on its website in instances where the procuring entity has a website, the advertisement shall also be posted at any conspicuous place reserved for this purpose in the premises of procuring entity as certified by the head of procurement unit.

Time for Preparing Tenders

The time allowed for the preparation tenders must not be less than the minimum period of prescribed for the purpose of this subsection

If the tender documents are amended when the time remaining before the deadline for submitting tenders is less than one third of the time allowed for the preparation of tenders, the procuring entity shall extend the deadline as necessary to allow amendment of t he tender documents to be taken in account in the preparation or amendment of tenders.

Provision of Tender Documents

The procuring entity shall provide copies of the tender documents expeditiously and in accord with the invitation to tender.

The procuring entity may charge such fees may be prescribed for copies of the tender documents.

Tender security

A procuring entity may require that tender security be provided with tenders.

The procuring entity may determine the form and amount of the tender security, subject to such requirements or limits as may be prescribed.

Tender security shall be forfeited if the person submitting the tender:

- Withdraws the tender after the deadline for submitting tenders but before the expiry of the period during which tenders must remain valid;

- Rejects a correction of an arithmetic error

- Refuses to enter into a written contract or fails to furnish any required performance security.

The procuring entity shall immediately release any tender security if :

- The procurement proceedings are terminated;

- The procuring entity determines that none of the submitted tenders is responsive; or

- A contract for the procurement is entered into.

Opening of Tenders

The accounting officer shall appoint a tender opening committee specifically for the procurement in accordance with the following requirements and such other requirements as may be prescribed –

The committee shall have at least three members; and

At least one of the members shall not be directly involved in the processing or evaluation of the tenders.

Immediately after the deadline for submitting tenders, the tender opening committee shall open all tenders received before that deadline.

Those submitting tenders or their representatives may attend the opening of tenders.

The tender opening committee shall assign an identification number to each tender.

As each tender is opened, the following, shall be read out loud and recorded in a document to be called the tender opening register –

The name of the person submitting the tender;

The total price of the tender including any modifications or discounts received before the deadline for submitting tenders except as may be prescribed; and

If applicable, what has been given as tender security.

The procuring entity shall, on request, provide a copy of the tender opening register to a person submitting a tender.

Each member of the tender opening committee shall –

- Sign each tender on one or more pages as determined by the tender opening committee; and

- Initial, in each tender, Indicate against the quotation or the price and any modifications or discounts.

The tender opening committee shall prepare tender opening minutes which shall set out –

- A record of the procedure followed in opening tenders; and

- The particulars of those persons submitting tenders, or their representatives, who attend the opening of the tenders.

- Each member of the tender opening committee shall sign the tender opening minutes.

- Extension of Tender Validity Period

Before the expiry of the period during which tenders must remain valid the procuring entity extend that period.

- The procuring entity shall give notice of an extension under subsection (1) to each person who submitted a tender.

- An extension under subsection (1) is subject to such restrictions and requirements as may be prescribed.

- For greater certainty, tender security shall be forfeited if a tender is withdrawn during an extension under subsection (1).

Clarifications

The procuring entity may request a clarification of a tender to assist in the evaluation and comparison of tenders. A clarification may not change the substance of the tender.

Corrections of Arithmetic Errors

The procuring entity may correct an arithmetic error in a tender.

The procuring entity shall give prompt notice of the correction of an error to the person who submitted the tender.

If the person who submitted the tender rejects the correction, the tender shall be rejected and the person’s tender security shall be forfeited.

Responsiveness of Tenders

A tender is responsive if it conforms to all the mandatory requirements in the tender documents.

The following do no t affect whether a tender is responsive –

i) Minor deviations that do not materially depart from the requirements set out in the tender documents; or

ii) Errors or oversights that can be corrected without affecting the substance of the tender.

A deviation described in subsection(2)(a) shall –

i) Be quantified to the extent possible; and

ii) Be taken into account in the evaluation and comparison of tenders.

Notification If No Responsive Tenders

If the procuring entity determines that none of the submitted tenders is responsive, the procuring entity shall notify each person who submitted a tender.

Evaluation of tenders

- The procuring entity shall evaluate, compare the responsive tenders other than tend rejected under section 63(3).

- The evaluation and comparison shall be d using the procedures and criteria set out in the tender documents and no other criteria shall be used.

- The following requirements shall apply respect to the procedures and criteria referred to subsection (2) –

- i) The criteria must, to the extent possible, objective and quantifiable; and

- ii) Each criterion must be expressed so that applied, in accordance with the procedures taking into consideration price, quality service for the purpose of evaluation.

- The successful tender shall be the tender with lowest evaluated price.

- The procuring entity shall prepare an evaluation report containing a summary of the evaluation and comparison of tenders.

- The evaluation shall be carried out within such period as may be prescribed.

Notification of Award of Contract.

- Before the expiry of the period during which tenders must remain valid, the procuring entity shall notify the person submitting the successful tender that his tender has been accepted.

- At the same time as the person submitting the successful tender is notified, the procuring entity shall notify all other persons submitting tenders that their tenders were not successful.

- For greater certainty, a notification under subsection (2) does not reduce the validity period for a tender or tender security.

Creation of Contract

- The person submitting the successful tender and the procuring entity shall enter into a written contract based on the tender documents, the successful tender, any clarifications under section 62 and any corrections under section 63.

- The written contract shall be entered into within the period specified in the notification under section 67(l) but not until at least fourteen days have elapsed following the giving of that notification.

- No contract is formed between the person submitting the successful tender and the procuring entity until the written contract is entered into

Debriefing

It involves explaining to unsuccessful suppliers why they lost their bids.

Benefits of debriefing

- It establishes a reputation of being fair, honest, and ethical.

- The information provided can help the unsuccessful suppliers to improve in future.

- It provides them with some benefits from time and money spent on preparing their tender.

Post – tender negotiations (P.T.N)

It is negotiation after receiving formal tenders but before making contracts with suppliers, so as to obtain improvement in price, delivery etc. However, this should not put other suppliers at a disadvantage. P.T.N is recommended for expensive orders where evidence is not clear and adequate or where doubt exists on quality and performance of supplier. Also applicable in cases of long term contracts.

Forecasting Techniques

Hand outs on forecasting

Quantitative techniques

Qualitative techniques

Investment appraisal techniques

- Traditional methods (Undiscounted methods)

Basic investment appraisal techniques

What is investment appraisal?

Before committing to high levels of capital spend, companies normally undertake investment appraisal.

Investment appraisal has the following features:

- assessment of the level of expected returns earned for the level of expenditure made

- estimates of future costs and benefits over the project’s life.

When a proposed capital project is evaluated, the costs and benefits of the project should be evaluated over its foreseeable life.This is usually the expected useful life of the non-current asset to be purchased, which will be several years. This means that estimates of future costs and benefits call for long-term forecasting.

A ‘typical’ capital project involves an immediate purchase of a non-current asset. The asset is then used for a number of years, during which it is used to increase sales revenue or to achieve savings in operating costs. There will also be running costs for the asset. At the end of the asset’s commercially useful life, it might have a ‘residual value’. For example, it might be sold for scrap or in a second-hand market. (Items such as motor vehicles and printing machines often have a significant residual value.)

A problem with long-term forecasting of revenues, savings and costs is that forecasts can be inaccurate. However, although it is extremely difficult to produce reliable forecasts, every effort should be made to make them as reliable as possible.

- A business should try to avoid spending money on non-current assets on the basis of wildly optimistic and unrealistic forecasts.

- The assumptions on which the forecasts are based should be stated clearly. If the assumptions are clear, the forecasts can be assessed for reasonableness by the individuals who are asked to authorise the spending.

Accounting profits and cash flows

In capital investment appraisal it is more appropriate to evaluate future cash flows than accounting profits, because:

- profits cannot be spent

- profits are subjective

- cash is required to pay dividends.

Return on Capital Employed (ROCE)

ROCE is also known as accounting rate of return (ARR).

Formula

The initial capital cost could comprise any or all of the following:

- cost of new assets bought

- net book value (NBV) of existing assets to be used in the project

- investment in working capital

- capitalised R&D expenditure

Decision rule

The decision rule for ROCE is:

If the expected ROCE for the investment is greater than the target or hurdle rate (as decided by management) then the project should be accepted.

Studying ACCA, CIMA or AAT?

The Kaplan Exam Tips site offers FREE materials to help you prepare for your exams. You’ll find exam tips, video masterclasses, exam reviews and forums for all ACCA and CIMA papers and each AAT level.

Advantages and disadvantages of ROCE

Advantages of ROCE as an investment appraisal technique include:

- simplicity

- links with other accounting measures.

Disadvantages include:

- no account is taken of project life

- no account is taken of timing of cash flows

- it varies depending on accounting policies

- it may ignore working capital

- it does not measure absolute gain

- there is no definitive investment signal.

Payback

The payback period is the time a project will take to pay back the money spent on it. It is based on expected cash flows and provides a measure of liquidity.

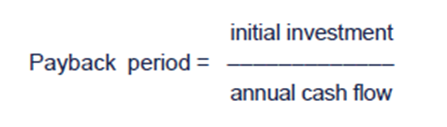

Formula

Constant annual cash flows:

Uneven annual cash flows:

Where cash flows are uneven, payback is calculated by working out the cumulative cash flow over the life of the project.

Decision rule

When using Payback, the company must first set a target payback period.

- Select projects which pay back within the specified time period

- Choose between options on the basis of the fastest payback

Advantages and disadvantage of Payback

Advantages include:

- it is simple

- it is useful in certain situations:

- rapidly changing technology

- improving investment conditions

- it favours quick return:

- helps company growth

- minimises risk

- maximises liquidity

- it uses cash flows, not accounting profit.

Disadvantages include:

- it ignores returns after the payback period

- it ignores the timings of the cash flows. This can be resolved using the discounted payback period.

- it is subjective as it gives no definitive investment signal

- it ignores project profitability

- Modern methods (Discounted methods)

Hand out

Costing techniques (lysons kim)

- MARGINAL COSTING :

Marginal costing may be defined as the technique of presenting cost data wherein variable costs and fixed costs are shown separately for managerial decision-making. It should be clearly understood that marginal costing is not a method of costing like process costing or job costing. Rather it is simply a method or technique of the analysis of cost information for the guidance of management which tries to find out an effect on profit due to changes in the volume of output.

There are different phrases being used for this technique of costing. In UK, marginal costing is a popular phrase whereas in US, it is known as direct costing and is used in place of marginal costing. Variable costing is another name of marginal costing.

Marginal costing technique has given birth to a very useful concept of contribution where contribution is given by: Sales revenue less variable cost (marginal cost)

Contribution may be defined as the profit before the recovery of fixed costs. Thus, contribution goes toward the recovery of fixed cost and profit, and is equal to fixed cost plus profit (C = F + P).

In case a firm neither makes profit nor suffers loss, contribution will be just equal to fixed cost (C = F). this is known as break even point.

The concept of contribution is very useful in marginal costing. It has a fixed relation with sales. The proportion of contribution to sales is known as P/V ratio which remains the same under given conditions of production and sales.

The principles of marginal costing

The principles of marginal costing are as follows.

- For any given period of time, fixed costs will be the same,

- for any volume of sales and production (provided that the level of activity is within the ‘relevant range’). Therefore, by selling an extra item of product or service the following will happen.

- Revenue will increase by the sales value of the item sold.

- Costs will increase by the variable cost per unit.

- Profit will increase by the amount of contribution earned from the extra item.

- Similarly, if the volume of sales falls by one item, the profit will fall by the amount of contribution earned from the item.

- Profit measurement should therefore be based on an analysis of total contribution. Since fixed costs relate to a period of time, and do not change with increases or decreases in sales volume, it is misleading to charge units of sale with a share of fixed costs.

- When a unit of product is made, the extra costs incurred in its manufacture are the variable production costs. Fixed costs are unaffected, and no extra fixed costs are incurred when output is increased.

Features of Marginal Costing

The main features of marginal costing are as follows:

- Cost Classification

The marginal costing technique makes a sharp distinction between variable costs and fixed costs. It is the variable cost on the basis of which production and sales policies are designed by a firm following the marginal costing technique. - Stock/Inventory Valuation

Under marginal costing, inventory/stock for profit measurement is valued at marginal cost. It is in sharp contrast to the total unit cost under absorption costing method. - Marginal Contribution

Marginal costing technique makes use of marginal contribution for marking various decisions. Marginal contribution is the difference between sales and marginal cost. It forms the basis for judging the profitability of different products or departments.

Advantages and Disadvantages of Marginal Costing Technique Advantages

- Marginal costing is simple to understand.

- By not charging fixed overhead to cost of production, the effect of varying charges per unit is avoided.

- It prevents the illogical carry forward in stock valuation of some proportion of current year’s fixed overhead.

- The effects of alternative sales or production policies can be more readily available and assessed, and decisions taken would yield the maximum return to business.

- It eliminates large balances left in overhead control accounts which indicate the difficulty of ascertaining an accurate overhead recovery rate.

- Practical cost control is greatly facilitated. By avoiding arbitrary allocation of fixed overhead, efforts can be concentrated on maintaining a uniform and consistent marginal cost. It is useful to various levels of management.

- It helps in short-term profit planning by breakeven and profitability analysis, both in terms of quantity and graphs. Comparative profitability and performance between two or more products and divisions can easily be assessed and brought to the notice of management for decision making.

Disadvantages

- The separation of costs into fixed and variable is difficult and sometimes gives misleading results.

- Normal costing systems also apply overhead under normal operating volume and this shows that no advantage is gained by marginal costing.

- Under marginal costing, stocks and work in progress are understated. The exclusion of fixed costs from inventories affect profit, and true and fair view of financial affairs of an organization may not be clearly transparent.

- Volume variance in standard costing also discloses the effect of fluctuating output on fixed overhead. Marginal cost data becomes unrealistic in case of highly fluctuating levels of production, e.g., in case of seasonal factories.

- Application of fixed overhead depends on estimates and not on the actuals and as such there may be under or over absorption of the same.

- Control affected by means of budgetary control is also accepted by many. In order to know the net profit, we should not be satisfied with contribution and hence, fixed overhead is also a valuable item. A system which ignores fixed costs is less effective since a major portion of fixed cost is not taken care of under marginal costing.

- In practice, sales price, fixed cost and variable cost per unit may vary. Thus, the assumptions underlying the theory of marginal costing sometimes becomes unrealistic. For long term profit planning, absorption costing is the only answer.

- STANDARD COSTING

Standard costing is a key element of performance management with a particular emphasis on budgeting and variance analysis.

The uses of standard costs

The main purposes of standard costs are:

- control: the standard cost can be compared to the actual costs and any differences investigated.

- performance measurement: any differences between the standard and the actual cost can be used as a basis for assessing the performance of cost centre managers.

- variances: as well as being the basis for preparing budgets, standard costs are also essential for calculating and analysing variances. Variances provide ‘feedback’ to management indicating how well, or otherwise, the company is doing.

- to value inventories: an alternative to methods such as LIFO and FIFO.

- to simplify accounting: there is only one cost, the standard.

Types of standard

There are four main types of standard:

- Attainable standards

- They are based upon efficient (but not perfect) operating conditions.

- The standard will include allowances for normal material losses, realistic allowances for fatigue, machine breakdowns, etc.

- These are the most frequently encountered type of standard.

- These standards may motivate employees to work harder since they provide a realistic but challenging target.

- Basic standards

- These are long-term standards which remain unchanged over a period of years.

- Their sole use is to show trends over time for such items as material prices, labour rates and efficiency and the effect of changing methods.

- They cannot be used to highlight current efficiency.

- These standards may demotivate employees if, over time, they become too easy to achieve and, as a result, employees may feel bored and unchallenged.

- Current standards

- These are standards based on current working conditions.

- They are useful when current conditions are abnormal and any other standard would provide meaningless information.

- The disadvantage is that they do not attempt to motivate employees to improve upon current working conditions and, as a result, employees may feel unchallenged.

- Ideal standards

- These are based upon perfect operating conditions.

- This means that there is no wastage or scrap, no breakdowns, no stoppages or idle time; in short, no inefficiencies.

- In their search for perfect quality, Japanese companies use ideal standards for pinpointing areas where close examination may result in large cost savings.

- Ideal standards may have an adverse motivational impact since employees may feel that the standard is impossible to achieve

- ABSORPTION

What is absorption costing?

Absorption costing means that all of the manufacturing costs are absorbed by the units produced. In other words, the cost of a finished unit in inventory will include direct materials, direct labor, and both variable and fixed manufacturing overhead. As a result, absorption costing is also referred to as full costing or the full absorption method.

Absorption costing is often contrasted with variable costing or direct costing. Under variable or direct costing, the fixed manufacturing overhead costs are not allocated or assigned to (not absorbed by) the products manufactured. Variable costing is often useful for management’s decision-making. However, absorption costing is required for external financial reporting and for income tax reporting. Each job while moving through the production department should get its share of overhead. This process of distribution of overheads is called absorption. There can be a number of methods of absorption of overheads, consideration should be given to the type of industry, manufacturing process, nature of industry etc.

The various methods of absorption are

- Direct material cost percentage rate

- Direct labour cost percentage rate

- Prime cost percentage rate

- Labour hour rate

- Machine hour rate

- LIFECYCLE COSTING

Rather than simply looking at a product’s costs for one period, lifecycle costing seeks to understand costs over the whole lifecycle.

Product lifecycles

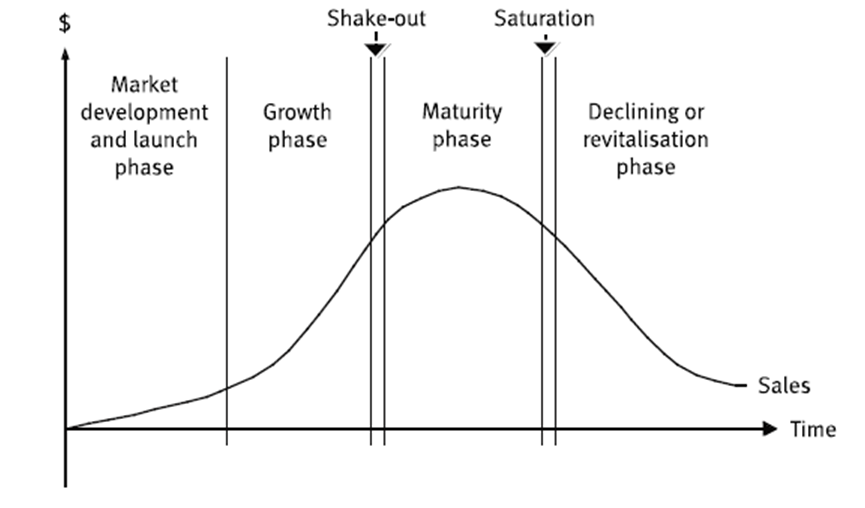

Most products have a distinct product life-cycle:

Specific costs may be associated with each stage.

(1) Pre-production/Product development stage

- A high level of setup costs will be incurred in this stage (preproduction costs), including research and development (R&D), product design and building of production facilities.

(2) Launch/Market development stage

- Success depends upon awareness and trial of the product by consumers, so this stage is likely to be accompanied by extensive marketing and promotion costs.

(3) Growth stage

- Marketing and promotion will continue through this stage.

- In this stage sales volume increases dramatically, and unit costs fall as fixed costs are recovered over greater volumes.

(4) Maturity stage

- Initially profits will continue to increase, as initial setup and fixed costs are recovered.

- Marketing and distribution economies are achieved.

- However, price competition and product differentiation will start to erode profitability as firms compete for the limited new customers remaining

(5) Decline stage

- Marketing costs are usually cut as the product is phased out

- Production economies may be lost as volumes fall

- Meanwhile, a replacement product will need to have been developed, incurring new levels of R&D and other product setup costs.

- Alternatively additional development costs may be incurred to refine the model to extend the life-cycle (this is typical with cars where ‘product evolution’ is the norm rather than ‘product revolution’).

Managing Lifecycle Costs

A product’s costs are not evenly spread through its life.

According to Berliner and Brimson (1988), companies operating in an advanced manufacturing environment are finding that about 90% of a product’s lifecycle costs are determined by decisions made early in the cycle. In many industries, a large fraction of the life-cycle costs consists of costs incurred on product design, prototyping, programming, process design and equipment acquisition.

This had created a need to ensure that the tightest controls are at the design stage, i.e. before a launch, because most costs are committed, or ‘locked-in’, at this point in time.

Management Accounting systems should therefore be developed that aid the planning and control of product lifecycle costs and monitor spending and commitments at the early stages of a product’s life cycle.

- Target Costing

Target costing is a way of deriving a target cost to set production managers and is best viewed as the opposite of cost-plus pricing.

Problems with cost-plus pricing

In a traditional cost-plus pricing system,

- The cost of the item is established first.

- A profit per unit is added.

- This results in the selling price.

However, cost-plus pricing ignores the following:

- The price that customers are willing to pay

- The price charged by competitors for similar products

- Cost control

Target costing

A firm could address the problems discussed above through the implementation of target costing:

(1) The first step is to establish a competitive market price. The company would consider how much customers are willing to pay and how much competitors are charging for similar products.

(2) Determine the required profit

(3) A target cost is arrived at by deducting the required profit from the selling price

(4) Steps must then be taken to close the target cost gap from the current cost per unit if higher.

Model and simulation approaches

- Modeling

- Simulation

Define simulation

Simulation is the process of experimenting or using a model and noting the results which occur. In business context the process of experimenting with model usually consist of inserting different input values and observing the resulting output values. For example, in a simulation of queuing situation the input values might be the number of arrivals and/or service points and the output values might be the number and/or times in the queue.

- Advantages of simulation

- Can be applied in areas where analytical techniques are not available or would be too complex

- Constructing the model inevitably must involve management and this may enable deeper insight into a problem.

- A well constructed model does enable the results of various policies and decisions be examined without any irreversible commitment being made.

- Simulation is cheaper and less risky than altering the real system.

- Study the behavior of a system without building it.

- Results are accurate in general, compared to analytical model.

- Help to find un-expected phenomenon, behavior of the system.

- Easy to perform “What-If” analysis

Disadvantages of simulation

- Although all models are simplifications of reality, they may still be complex and require a substantial amount of managerial and technical time.

- Practical simulation inevitably requires the use of computers thus considerable amount of additional expertise is required to obtain worthwhile results from simulation exercise. This expertise is not always available

- Simulation do not produce optimal results

- Expensive to build a simulation model.

- Expensive to conduct simulation.

- Sometimes it is difficult to interpret the simulation results.

- Explain Monte- Carlo method of simulation pointing out its uses in operations research.

This involve a broad class of computational algorithms that rely on repeated random sampling to obtain numerical results i.e. by running simulations many times over in order to calculate those same probabilities heuristically just like actually playing and recording your results in a real casino situation: hence the name. They are often used in physical and mathematical problems and are most suited to be applied when it is impossible to obtain a closed-form expression or infeasible to apply a deterministic algorithm.

Monte Carlo methods are mainly used in three distinct problems: optimization, numerical integration and generation of samples from a probability distribution. Monte Carlo methods are especially useful for simulating systems with many coupled degrees of freedom, disordered materials, strongly coupled solids, and cellular structures. They are used to model phenomena with significant uncertainty in inputs, such as the calculation of risk in business. They are widely used in mathematics, for example to evaluate multidimensional definite integrals with complicated boundary conditions. When Monte Carlo simulations have been applied in space exploration and oil exploration, their predictions of failures, cost overruns and schedule overruns are routinely better than human intuition or alternative “soft” methods.