Co-operatives are legally registered bodies, in many countries there is a Co-operative Act governed by the National Registrar of Co-operatives, or similar, or they are under the guidance of the government’s business registration body.

Co-operatives are commercial trading organisations; they have limited liability which means that the co-operative, and not the individual members, is liable for any debt.

Co-operatives differ from private business in who the shareholder is, the amount of votes each shareholder has and how profits are distributed.

Shareholders in co-operatives are individuals or other registered co-operatives; they are trading partners, either as an individual or as another registered co-operative. They are called members, who own and control the co-operative.

Each member has one share that carries one vote in any decision making.

Voting is based on one member one vote – regardless of the amount of share value held.

Members invest in the co-operative by purchasing a share, the amount invested and the interest paid will be decided by each co-operative.

Net profits are distributed according to the rules, most co-operatives retain about 25% to 35% that is paid into a reserve fund and the remainder is distributed as dividends to members in proportion to the amount of trade each member has transacted with the co-operative in the year the profit was made and for social and environmental purposes.

There is a definition of a primary co-operative and a secondary co-operative:

The members of a primary co-operative are individual traders and customers

The members of a secondary co-operative are primary co-operatives

One sort of co-operative is the Savings and Loans Co-operative. This co-operative trades in money; it receives savings from members and lends funds to members against the amount saved. Eligibility for membership is based on living or working in a defined geographical area – individuals and other co-operatives can be members of a Savings and Loans Co-operative Society.

When a Co-operative registers itself it does so using a model set of Rules (By-Laws) to which it adds the details of who can be members; the main social and commercial objectives; and the commercial activities it will undertake.

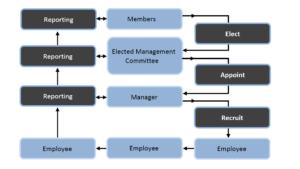

How Co-operatives are managed

Management structures vary depending on the size of the co-operative: below is a generic diagram for a small to medium sized co-operative using an organisational structure that can be found across Europe, Africa, Asia, the South Pacific and the Caribbean; and to a lesser extent the Americas. In many countries enterprise size is defined as:

Micro: 0 to 5 employees

Small: 6 to 10 employees

Medium: 11 to 50 employees

Large: 51+ employees

Members

Members are defined in the Co-operative Rules: they are usually traders and customers who they sell goods to, and buy from, the co-operative.

Sometime members are defined as community citizens, employees and anyone else the co-operative wishes to be members.

Membership is voluntary: no one has to be a member.

Members elect, from the membership, individuals who wish to be Management Committee members.

The Management Committee

Any member can be elected onto the Management Committee.

Election is for a two year period after which they have to stand down; but they can stand for re-election for the next period.

It is suggested that the Management Committee should meet, at least, every two months and is responsible for the overall management of the co-operative, strategic planning, investment decisions, governance and managing the manager.

The Manager

The manager is recruited and supervised by the Management Committee and reports to that body for his/her actions.

The manager manages the day to day operations of the co-operative and is responsible for financial accounting and all work carried out by the employees.

The manager can be a member of the co-operative.

The Employees

Employees are recruited by the manager and are supervised by him/her in their work.

Employees can be members of the co-operative.