Facts

Price mechanism is a system in a free enterprise economy in which resources allocation and prices are determined by forces of demand and supply with little or no government interference. This depends on the forces of demand and supply. It can also be called the price system.

Under price mechanism, demand and supply determine resource allocation. There is no government intervention in the production decisions of producers, for instance in form of price legislation. Decisions of producers are influenced by the interests of the consumers. There is private ownership of resources.

Profit maximisation is the main objective of production. Consumers aim at utility maximisation. There are many competing firms in different industries. Under the price system, the market forces operate freely. When demand increases and exceeds supply, prices increase. When supply increases and exceeds demand, prices reduce automatically.

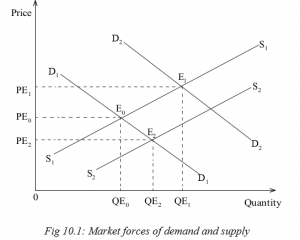

When the forces of demand and supply are left to interact freely in the market, equilibrium is attained in the market where quantity demanded is equals to quantity supplied. In the above diagram, E0 is the equilibrium point. Price OPE0 is the equilibrium price determined by the market forces. Quantity OQE0 is the equilibrium quantity.

Let us assume that demand increases and supply remains constant at S1. This implies that demand is greater than supply. The demand curve will shift from D1 to D . A new equilibrium point is attained at E1. Equilibrium price When supply increases and demand remains constant at D1, the supply curve shifts from S1 to S2. Supply exceeds demand. A new equilibrium is attained in the market at E2. Equilibrium price reduces from OPE0 to OPE2.

10.2.1 Advantages of price mechanism

- Price mechanism promotes efficient allocation and use of resources. Due to competition and desire to maximise profits, resource owners allocate them more efficiently to avoid wastages.

- Under price mechanism, producers aim at maximising profits. The desire to maximise profits encourages research, invention and innovation. This leads to an increase in production and improvement in technology, resulting into economic growth.

-

There is speculation under price mechanism. Speculators ensure steady supply of commodities. Consumers are offered a chance to access commodities all the time throughout.

There is competition between producers. Competition leads to efficiency in production. Producers will cut on origination or costs so as to compete favourably in the market.

- Price mechanism encourages acquisition and distribution of commodities from areas where supply is high to areas where there is little or no supply. This also ensures a ready supply of commodities to the consumers.

- Price mechanism answers the following economic questions:

- What to produce: Producers produce commodities that fetch high profits.

- How to produce: The method of production used should be cost effective.

- For whom to produce: Producers manufacture or produce commodities when they are assured of a ready market for the goods.

- When to produce: Commodities are normally produced when needed.

- It encourages effective distribution and redistribution of resources. Resources are distributed to areas where they are rewarded favourably depending on their demand and prices. Land is used in areas where rent is high, labour goes to where wages are high and capital where interest is maximum.

- Price mechanism works automatically. It therefore does not require the government to put in a lot of resources for implementation. This makes it cheap to operate. It is the responsibility of the government and gives it a chance to concentrate on other areas.

10.2.2 Disadvantages of price mechanism

- Price mechanism promotes income inequality. Resource owners earn more incomes than those without. Those with more earn more and those with less earn less.

- The high cost and inefficient firms are pushed out of business by the most efficient ones. This kind of competition may result into a monopoly in the long run.

- The desire to maximise profits is high under price mechanism. This profitoriented motive can make producers to supply us with sub standard or counterfeit products, or exploit consumers who have little information about the market.

Standardisation culture

RBS has developed sector standards to avoid associated dangers and also prevent wrong practices in the industry.

Ref.: The Standards Journal, Volume 1, Issue No: 08. April 22 2014

- Since there is no government control in price mechanism, there may be introduction of harmful and illegal products to the market.

Standardisation culture

Always purchase products that have been approved by RBS. RBS certified products are good for use by consumers.

- Too much competition may eliminate upcoming and small firms from the market. This may lead to unexploitation of some resources.

- Unprofitable but essential commodities may disappear from the market. Private producers aim at making profits and not providing satisfaction or essential commodities. Private producers of much more benefits

- Price mechanism is slow and may not bring about enhanced structural changes and growth in the economy. The market forces of demand and supply cannot quickly drive the economy to desired levels of growth.

- The price system cannot provide public goods some of which are not profit making. For instance street lights may not be provided by the private sector which aims at profit making.

- Price mechanism may bring about price fluctuations. Change in demand and supply result into price changes in the market. When demand exceeds supply, price increases. When supply exceeds demand, price lowers.

10.2.3 Methods used to reduce problems caused by price mechanism

The disadvantages of price mechanism can be rectified through the following means:

- Taxation: Differences in incomes created by price mechanism can be corrected through taxation. In this case, the rich may be taxed more than the poor. As a result, the negative outcomes of price mechanism may be reduced.

- Price control: Private producers in most cases cheat consumers by increasing prices. As a result, price control measures are put in place to curb this problem. This is done mainly by the government, through setting the minimum and maximum prices for the commodities. This prohibits producers with monopoly powers from increasing prices unnecessarily so as to maximise profits.

- Economic planning: The government carries out short term and long term economic planning. This planning ensures provision of services and utilities that cannot be provided by private entrepreneurs. This also helps to bring about quick structural changes that price mechanism cannot enforce.

- Formation of consumer associations: This protects consumers against exploitation by the profit motivated private producers. It increases the negotiating capacity of consumers. Consumer associations also provide market information to consumers.

- Government support: The government may subsidise weak firms. This helps the upcoming or weak firms to grow, expand and compete with other firms in the market. Competition improves the quality of products.

- Using anti monopoly/Anti Trust laws: Such laws remove the basis of monopoly created through price system. These prevent firms from merging to become monopolies.

- Nationalisation: The government may take over private firms as a way of controlling the private sector. This reduces private interest that could overrun the public interest in the price system.

10.3 PRICE FLUCTUATIONS

Activity 10.4

Make a visit to Institute of Statistics of Rwanda, or its website, and gather information on the prices of different agricultural commodities in the last years. In groups of five, discuss the following questions.

- Were there frequent changes in the prices of the commodities?

- If yes, identify the reasons and solutions for such changes in prices.

In the agricultural sector usually during the planting seasons, prices for agricultural products are high. After harvest, prices reduce. This rise and fall in prices of commodities in different periods of time is called Price fluctuation. This scenario is common without government intervention. In periods when supply for agricultural products is high, prices are low. When supply reduces, prices increase. Therefore, the differences between supply and demand in the agricultural sector and failure to regulate supply basically explain the constant price fluctuations. Such fluctuations in the agricultural sector can be elaborated by the cobweb theorem.

10.3.1 Cobweb theorem

Activity 10.5

In groups of five, visit the following website www.econ-pol.unist.it and do a research on cobweb theorem. Make notes and make presentations in class.

The cobweb theorem is an economic model used to explain how small economic shocks can become amplified by the behaviour of producers. The amplification is, essentially, the result of information failure, where producers base their current output on the average price they obtain in the market during the previous year.

10.3.1.1 Assumptions of the cobweb theorem This theorem is based on the following assumptions:

- Planned output is not always equal to actual output.

- Production depends on factors that are beyond the control of producers.

- There is a time lag between the time when decisions to produce are taken and the time when products are produced.

- Demand in the current period depends on the prevailing market prices

(Dt = f (Pt).

- Supply in the current period depends on the prices in the previous production season.

(St = f(Pt-1).

The assumptions above suit favourably in agricultural production. There are basically three types of cobweb theorem.

- The convergent/ damped cobweb with a stable equilibrium.

- The divergent/ explosive cobweb with an unstable equilibrium.

- The regular equilibrium.

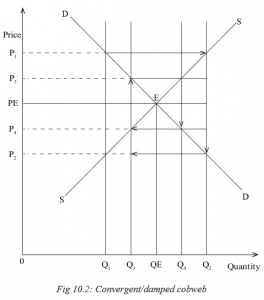

1. Convergent/damped cobweb

Convergent cobweb occurs when price fluctuations tend towards the equilibrium. It happens when demand is more elastic than supply. Demand responds more to price changes than supply. Fluctuations in price tend towards the equilibrium.

Price OPE is the equilibrium price and quantity OQE is the equilibrium quantity. Producers expect to produce output OQE and sell at price OPE. There will be neither excess nor shortage in the market.

However, due to unfavorable natural factors, production is affected. Supply reduces to quantity OQ1. As a result of low supply, prices increase to OP1 in the current period.

When planning for the new season, producers base their plans on the current market price OP1 that is high. They plan to produce more. When they produce in the new season, supply increases to OQ2. Because of this high supply, prices reduce to OP2. As a result, quantity produced in the new season is OQ2 and is sold at a low price OP2.

This low price OP2 discourages producers such that they plan to produce less in the coming season. Basing on a low price OP2, they produce low output OQ3. Because of this low output produced, in the following season, prices increase to price OP3. Thus output OQ3 is sold at a high price OP3 in the current period.

This relatively high price encourages producers to produce more in the forthcoming season. Basing on price OP3, producers plan to increase supply. In the next season, they produce a high output OQ4, which then pushes the price downwards to OP4.

This variation of increase and decrease in output and prices according to seasons, produce equilibrium in the long run.

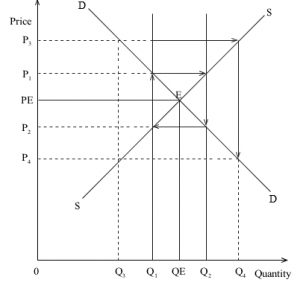

2. Divergent/explosive cobweb

Divergent cobweb occurs when price fluctuations tend to move away from the equilibrium. This happens when supply is more elastic than demand. Supply responds more to price changes than demand. Fluctuations in price tend to move away from the equilibrium.

Fig 10.3: Divergent/explosive cobweb

Price OPE is the equilibrium price. Quantity OQE is the equilibrium quantity. Producers expect to produce output OQE and sell at price OPE. There will be no excess or shortage in the market.

However, due to unfavorable natural factors, production is affected. As a result, supply reduces to quantity OQ1. As a result of low supply, prices shoot to OP1 in the current period.

When planning for the following season, producers base their plans on the current market price OP1 which is high. They plan to produce more. When they produce in the next season, supply increases to OQ2. Because of this high supply, prices reduce to OP2. So quantity produced in this following season is OQ2 and it is sold at a low price OP2.

This low price OP2 discourages producers such that they plan to produce less in the coming season. Basing on a low price OP2, they produce low output OQ3. Due to this low output produced, in this next season prices increase to price OP3. Thus output OQ3 is sold at a high price OP3 in the current period. This relatively high price encourages producers to produce more in the forthcoming season. Basing on price OP3, producers plan to increase supply. In the next season, they produce a high output, OQ4, which then pushes the price downwards to OP4.

This alternating increase and decrease in output and prices according to seasons recurs in the next seasons. Price and quantity keep moving away from the equilibrium.

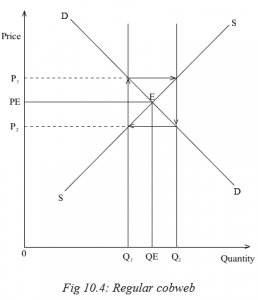

3 Regular cobweb

Regular cobweb occurs when there is unitary elastic demand. The elasticity demand and supply are equal. Fluctuations in prices are constant between two points.

Price OPE is the equilibrium price. Quantity OQE is the equilibrium quantity. Producers expect to produce output OQE and sell at price OPE. There will be no excess or shortage in the market.

However, due to unfavorable natural factors, production is affected. Supply reduces to quantity OQ1. As a result of low supply, prices shoot to OP1 in the current period.

When planning for the next season, producers base their plans on the current market price OP1 which is high. They plan to produce more. When they produce in the next season, supply increases to OQ2. Because of this high supply, prices reduce to OP2. As a result, quantity produced in this new season is OQ2 and it is sold at a low price OP2.

This low price OP2 discourages producers such that they plan to produce less in the coming season. Basing on a low price OP2, they produce low output OQ1 again. Because of this low output produced, in the next season, prices increase to price OP1. Thus output OQ1 is sold at a high price OP1 in the current period.

This relatively high price encourages producers to produce more in the forthcoming season. Basing on price OP1, producers plan to increase supply. In the following season they produce a high output, OQ2 which then pushes the price downwards to OP2.

This cycles continues in that manner season in, season out. Price and quantity keep on fluctuating between the two points.

10.3.2 Causes of price fluctuations of agricultural products

Activity 10.6

Referring to the research you made in Activity 10.4, in groups of 5, share your findings. As a group, make class presentations on the causes of price fluctuations in the agricultural sector.

Price fluctuation is the continuous alternate rise and fall in prices of commodities. This is mostly common in the agricultural sector. Usually during the planting seasons, prices for agricultural products are high. After harvest, prices reduce. Without government interventions, in periods when supply for agricultural products is high, prices are low. When supply reduces, prices increase. Therefore, the differences between supply and demand in the agricultural sector and failure to regulate supply basically explain the constant price fluctuations. These differences can be as a result of:

- Perishable commodities: Most agricultural products are perishable. They cannot be kept for long. Before harvest, supply is down. At this time, demand is greater than supply. This forces the prices to rise. After harvest, supply is high. It exceeds demand. This forces prices of commodities such as tomatoes, bananas, onions and vegetables to fall, failure to which the goods may rot and fail to be sold.

- Long gestation periods: There is usually a long time lag between planting season and harvesting period. Immediately after planting, supply remains very low. Because of low supply, prices are high. When harvesting season sets in, supply increases. As supply keeps increasing, prices of agricultural products keep on reducing.

- Difference between planned output and actual output. Agricultural production mostly in developing economies largely depends on natural conditions or factors. These include the amount of rainfall received, effects of pests and diseases, and changes in weather conditions. These factors affect agricultural output either positively or negatively. As a result, farmers’ expected output may vary from what is actually harvested, depending on how favorable or unfavorable these natural conditions were.

When the natural factors are favourable, agricultural harvest may be higher than what was planned. This may lead to a decrease in the price, as there is more supply. On the other hand, when natural conditions become hostile, agricultural harvest reduces. Consequently, prices will rise due low supply in the market.

- Agriculture in developing economies is practiced by many, smallscale producers. Most producers use old methods of production. Regulating output to equate it with demand is difficult. This causes fluctuations in prices.

- Agricultural producers in developing countries produce similar products. They compete for the available market. Thus in case of surplus output, it may not be absorbed by the market which in turn forces selling prices to go down.

- Absence of effective commodity programs. Most developing economies lack programs that can be used to regulate supply and then stabilise prices.

- Agricultural products have low market in industrial production. This reduces the market for surplus output in developing countries. Discovery of new technologies in developed countries reduced the demand for agricultural products. Thus excess agricultural output cannot be easily disposed off. This forces prices down.

- Agricultural products have inelastic demand. This is because most of them are food stuffs. For instance, even if the price for food reduces, the amount of food eaten by an individual almost remains constant. When there is excess supply, disposing it off becomes difficult and this price is forces the price down. On the other hand, food is a necessity, irrespective of the price, people have to consume food. Thus a reduction in supply forces the price to go up.

- Regulating supply of agricultural products through arbitrage is difficult. This is because agricultural products are bulky. Transporting them from areas of excess supply to areas of scarcity is costly. In most developing countries, infrastructures connecting production areas to areas of scarcity are poor. Therefore, marketing surplus output becomes expensive.

10.3.3 Effects of price fluctuations

Activity 10.7

In your groups formed in Activity 10.5, and basing on the findings you got from the market, discuss the effects of price fluctuation. Share your points with the rest of the class.

Price fluctuations in the agricultural sector lead to fluctuations in farmer’s incomes. This affects their activities in the long run. The effects include:

- Planning becomes difficult. This is because of fluctuation in farmer’s incomes and government revenue. Implementation of government plans is affected.

- Agricultural production is a source of revenue to the government. This is especially so in developing economies like Rwanda

Money matters!!!

Agriculture is the backbone of our country. As a result, it forms the biggest percentage of economic activity.

- Agricultural production is discouraged. Some producers are discouraged and may abandon agricultural production in favour of other sectors. This will result into fluctuations in employment in agricultural sector.

- Modernisation of agriculture becomes difficult. This is because it becomes difficult to rely on agricultural revenue to improve agriculture.

- Price fluctuation may result into fluctuation in foreign exchange earnings from agricultural exports. This may lead to Balance of Payment (BOP) deficits when prices of exports reduce.

10.3.4 How to control price fluctuations

Activity 10.8

With the help of your teacher, listen to the guest speaker (District Agricultural Officer or any other agricultural officer). In a discussion with him or her, identify the policies the government can use or has put in place to address the problem of price fluctuation in the agricultural sector in the country. Take notes and discuss as a class.

The following can be done to reduce price fluctuations in agricultural sector:

- Price fixation: This can be done by the government through maximum and minimum price legislation.

- Improving storage systems: Stable prices in the agricultural sector can be ensured by improving storage systems. This will help to regulate supply by storing the excess output during periods of bumper harvests. The excess will be used to stabilise prices in periods of scarcity.

- Improve transport systems: This facilitates the movement of commodities from areas of plenty to areas of scarcity, quickly and cheaply. This also helps to regulate supply.

- Diversification of the agricultural sector: This creates a variety of commodities supplied to the market. It also reduces competition among sellers especially in foreign markets.

- Improvement in technology: Technology reduces dependence on natural conditions. This increases the quality of output which makes it competitive.

- Processing agricultural products: This adds value to agricultural products and makes them competitive.

- International commodity agreements: These agreements can be used to stabilise prices on the international market. These help to stabilise prices of agricultural products by regulating production in the member countries.

- Stabalisation of process: Prices can be stabilised through establishment of farmers associations to regulate supply. These associations may help to fix quotas and regulate supply. Farmers would produce according to the fixed quotas.

10.3.5 Buffer stock system

Activity 10.9

In groups of four students each, carry out research from your library and internet on meaning and operation of buffer stock and stabilisation fund. Using your findings and illustrations, make class presentations on the same.

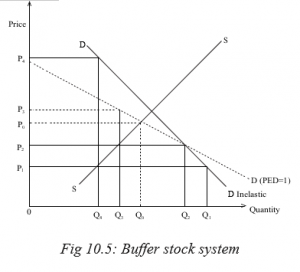

Buffer stock is a system where the government buys excess output from producers, stores it and supplies it to the market in periods of shortage. It is used to stabilise producers’ incomes and prices.

The buffer stock system operates on the assumption that:

- Farmers planed output is not always equal to actual output.

- Agricultural production depends on natural factors that are beyond the control of farmers.

- There is a time lag between the time when decisions to produce are taken and the time when products are produced.

- All prices determined along the demand curve D (PED=1) give the same total revenue.

Farmers expect to produce output OQ0 and sell it at price OP0 that is determined by the market forces. So the expected total revenue (TR) is OP0 × OQ0.

Due to favourable natural conditions, farmers’ actual output increases to OQ1. As a result of excess harvest, prices reduce to price OP1.

However, government wants to stabilise farmers’ incomes and prices. It comes in through marketing boards, buys the excess output. This intervention by the government leads to increase in price to OP2 which is determined along demand curve PED=1.

Farmers sell output OQ1 at price OP2 and their total revenue (TR) is OP2× OQ1 which is equal to the expected revenue OP0 × OQ0. Thus farmers’ incomes are stabilised irrespective of the bumper harvest.

The output that was bought by government is Q2. It is then stored in government designated warehouses to be used during periods of shortage. In the following season, the natural conditions become unfavourable. Farmers’ harvest reduces to output OQ4. Because of low harvest, there is shortage which pushes the prices up to price OP4. Government comes in to stabilise prices and farmers incomes. It draws from its warehouses the excess output bought in the previous season and supplies it to the market. This increases market supply to OQ3. As a result price reduce to OP3 which is determined along the demand curve D (PED=1).

Farmers sell output OQ4 at price OP3 and get total revenue (TR) = OP3×

OQ4 which is equal to expected revenue OP0 × OQ0

It is noted that prices determine along the demand curve D (PED=1) give the same total revenue.

i.e. OP2× OQ1 = OP0 × OQ0.

OP3× OQ4 = OP0 × OQ0.

Therefore, whether there is excess production or shortage, farmers get the same income equivalent OP0 × OQ0 that they expected.

Advantages of Buffer Stock

- The buffer stock system helps to stabilise producer’s incomes. Irrespective of seasonal changes, producer’s incomes remain almost constant.

- The consumer is assured of a steady supply. When producers output is low, the government draws from its stores to supplement what the producers have put to market. This increases market supply and offers a chance to consumers to get what they require.

- Because of a steady income from production, producers are encouraged to keep producing. This is helpful to the economy.

Problems faced by the buffer stock system

- Perishability of agricultural commodities. Most commodities are highly perishable. This makes storage difficult.

- Effects of inflation which affect the stabilisation funds as the money kept in the funds lose value.

- Most developing countries lack efficient storage facilities to keep the surplus output.

- Lack of sufficient funds by marketing boards to run the activities of buying and handling the surplus output. The activities of buffer stock system involve high administrative costs to run.

- Mismanagement and corruption in marketing boards by board members and staff. This affects the proper functioning of buffer stocks.

- The buffer stock system increases government responsibilities. The government directly involves itself in actual buying and selling of commodities. This may have an effect on efficiency in other strategic areas like security.

- The system requires alt of market research. Decisions on how much, when to buy and /or sell require much of research. This makes it costly.

10.3.6 Stabilisation fund

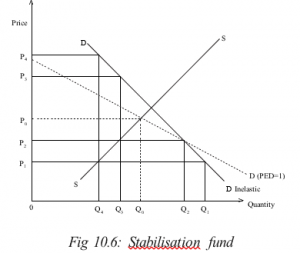

A stabilisation fund is a mechanism set up by a government or central bank to insulate the domestic economy from large influxes of revenue, as from commodities such as oil.

Stabilisation fund system also works on the same assumption as buffer stock system. i.e.

- Farmers planned output is not always equal to actual output.

- Agricultural production depends on natural factors that are beyond the control of farmers.

- There is a time lag between the time when decisions to produce are taken and the time when products are produced.

- All prices determined along the demand curve D (PED=1) give the same total value

Farmers expect to produce output OQ0 and sell it at price OP0 that is determined by the market forces. So the expected total revenue (TR) is OP0 × OQ0.

Due to favourable natural conditions, farmers’ actual output increases to OQ1. As a result of high harvest, prices decreases to price OP1.

However, government wants to stabilise farmers’ incomes and prices. It comes in through marketing boards, fixes a price that is determined along demand curve PED=1 and buys the output at price OP2.

Farmers sell output OQ1 at price OP1 and their total revenue (TR) is OP1× OQ1 which is equal to the expected revenue OP0 × OQ0. Thus farmers’ incomes are stabilised irrespective of the low harvest.

The output that was bought by government is Q1 and it is sold to markets at a market price OP1.

In the next season, the natural conditions become unfavourable. Farmers’ harvest decreases to output OQ4. Because of this low harvest, there is a deficit which pushes the prices up to price OP4.

Government comes in to stabilise prices and farmers incomes. It fixes price OP3 which is determined along the demand curve D (PED=1). It uses the profits made in the previous season to buy output from farmers.

Farmers sell output OQ2 at price OP3 and get total revenue (TR) is OP3× OQ4 which is equal to expected revenue OP0 × OQ0.

It is noted that prices determined along the demand curve D (PED=1) give the same total revenue.

i.e.

OP2× OQ1 = OP0 × OQ0. OP3× OQ4 = OP0 × OQ0.

Therefore, whether there is excess production or shortages, farmers get the same income equivalent OP0 × OQ0 that they expected.

10.4 PRICE CONTROL

Activity 10.10

From the case study on Rwanda Utilities Regulatory Authority (RURA) you carried out at the beginning of this unit, arrange your class into two groups of proposers and opposers and hold a debate on the motion on page 208. “Price regulation by Rwanda Utilities Regulatory Authority (RURA) is better than the Price system.”

Price control refers to the methods that can be used to interfere with the forces of demand and supply in determining prices. Price mechanism is not allowed to influence prices in the market. It can also be called price administration.

- Maximum price legislation (price ceiling).

- Minimum price legislation (price floor).

- Resale price maintenance.

- Rent control.

- Use of international commodity agreements.

Activity 10.11

In your groups, using internet and economics materials in the school library, discuss the different forms of price control and examine the merits and demerits of each.

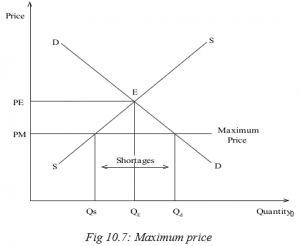

10.4.1 Maximum price legislation (price ceiling)

This is the highest price fixed by the government below the equilibrium point above which it is illegal to buy or sell the commodity. Sellers and buyers are required by law not to buy or sell above the fixed price.

As it is fixed below the equilibrium, consumers are willing and ready to buy more commodities since the prices are affordable. On the other hand however, sellers are discouraged by the low price. Quantity supplied reduces.

OPE is the equilibrium price and OQE is the equilibrium quantity. The equilibrium point is at E. The government fixes the maximum price below the equilibrium point at OPM.

When the maximum price is fixed, quantity supplied reduces from the equilibrium quantity determined by the market forces OQE to OQs. OQs is the quantity supplied at the maximum price.

When the maximum price is fixed, quantity demanded increases from the equilibrium quantity determined by the market forces OQE to OQd. OQd is the quantity demanded at the maximum price.

The difference between quantities demanded OQd and quantity supplied OQs shows the shortage of commodities that is created by the maximum price.

The government fixes the maximum price to:

- To protect consumers from being cheated by the profit oriented sellers who exorbitantly increase the prices.

- To maintain stability of prices and avoid fluctuations.

- To control monopoly tendencies of increasing prices.

- To encourage consumption of particular commodities.

- To improve on the welfare of the population by keeping prices low.

- To control inflation.

Did you know !!!

There is only one boss in the business. The customer. And he can fire everybody in the company from the chairperson on down, simply by spending his money somewhere else.

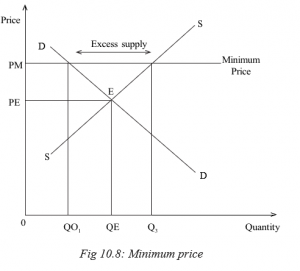

10.4.2 Minimum price legislation (Price floor)

This is the lowest price fixed by the government above the equilibrium point below which it is illegal to buy or sell commodities. For instance a minimum wage for workers or minimum price set by the government for agricultural products to protect farmers from being cheated by the profit oriented traders/ middlemen.

OPE is the equilibrium price and OQE is the equilibrium quantity. The equilibrium point is at E. The government fixes the minimum price above the equilibrium at OPM.

When the minimum price is fixed, quantity supplied increases from the equilibrium quantity determined by the market forces OQE to OQs. OQs is

When the minimum price is fixed, quantity demanded reduces from the equilibrium quantity determined by the market forces OQE to OQd. OQd is the quantity demanded at the minimum price.

The difference between quantity demanded OQd and quantity supplied OQs shows the excess supply that is created by the minimum price.

The government fixes the minimum price to:

- To protect producers and workers in case of a minimum wage from being cheated by the profit motivated buyers and employers respectively.

- To increase producers earnings as a way of encouraging production.

- To stabilise prices by limiting price fluctuations.

10.4.3 Resale price maintenance

This is where the producer fixes the price of his products up to the retail level i.e. retailers sale at a constant price fixed by the producer. For instance:

- Prices of Newspapers.

- Prices of Airtime cards.

- Prices of Text books etc.

10.4.4 Rent control

This is where the government intervenes to fix prices of housing facilities especially in urban areas where their demand is always high as a way of protecting consumers (tenants).

10.4.5 Rationing

This is where the government takes control of the supply channel of a scarce commodity and distributes it to consumers equally at a constant price. It is aimed at ensuring supply of the scarce commodity to all consumers.

10.4.6 Positive effects of price controls

Activity 10.12

With reference to the debate you made in Activity 10.10, while you are in still the same groups, discuss the benefits and demerits of price control.

- Resale price maintenance stabilises producer’s incomese. whether demand is greater or less than supply, producer prices and incomes remain the same.

- Maximum price controls monopoly power. Monopolists usually cheat buyers by charging high prices. Thus maximum price legislation will control price increases by monopolists.

- Price controls maintain price stability. Prices are kept constant and this favours consumers. It keeps the real value of their incomes stable.

- Price control protects consumers from being exploited by profit motivated producers. In periods of scarcity, consumers are protected from high prices.

- Minimum wage increases purchasing power of worker This improves their general standard of living, aggregate demand and production in general.

- The minimum wage protects workers from exploitation by employers by paying them low wages. Producers usually aim at increasing their profits by reducing total costs.

- Price control protects producers from being under paid by profit motivated Traders buy from producers like rural farmers at very low prices.

- Minimum wage maintains industrial peace. It avoids the occurrence of strikes by trade unions when demanding wage increments.

10.4.7 Negative effects of price controls

- Maximum prices lead to black markets. Commodities are sold to willing buyers at higher prices behind counters. This is because of shortages in the markets.

- Minimum wage legislation may increases the supply of labour by reducing voluntary unemployment and so creates unemployment.

- Maximum prices increase demand creating shortages. When the price is fixed below the equilibrium, supply is discouraged but quantity demanded widens.

- Minimum prices like minimum wages increase the cost of production. This reduces the volume of production. Production becomes expensive through a high wage bill.

- Rent control reduces the supply of housing It discourages landlords from expanding housing facilities.

- A minimum price creates storage problems of the surplus output produced. Supply increases with a minimum price but quantity demanded reduces.

- Maximum prices reduce the incentives of private producers. This is because their power to determine prices of their products depending on their costs is reduced.

10.5 INTERNATIONAL COMMODITY AGREEMENTS

Activity 10.13

As an individual, visit the school library or use internet. Make findings on the meaning and role of international commodity agreements. Take notes and share with the rest of the class.

These are associations of producer and/or consumer countries of certain commodities formed for purposes of regulating supply and stabilising their prices. They are arrangements by member countries to stabilise trade, supplies, and prices of a commodity for the benefit of all member countries. These agreements usually involve a consensus on the amount of a commodity to be traded, price, and management of stock.

Examples include the International Coffee Agreement (ICA) that established the International Coffee Organisation (ICO), the International Tropical Timber Agreement (ITTA) from which the International Tropical Timber Organisation (ITTO) was established.

Remember: The basic objective of International Commodity Agreements is to stimulate a dynamic and steady growth & ensure reasonable predictability in the real export earnings of the developing countries.

10.5.1 Role played by international commodity agreements

- Commodity agreements are essential in stabilising the international economy and strengthening the Balance of Payment (BOP) status in producer countries.

- International prices for especially primary products are usually low. They usually fluctuate frequently. Commodity agreements thus help to reduce price fluctuations of commodities on the international market.

- They increase the bargaining capacity of their members. Producer countries work as a group in marketing their products and negotiating for prices of their products.

- They increase the prices of their products. By working as one group, member countries may negotiate for better prices than if each country was to go it alone.

- They raise and stabilise export earnings of member countries. This comes after negotiating for better prices on international markets.

- International commodity agreements avoid competition among member countries producing a homogeneous commodity. Countries producing a homogeneous product usually compete for the market which puts them on a disadvantage.

- They employ the quota system to regulate supply as a way of stabilising prices. This avoids excesses and shortages in production.

- Commodity agreements help to stabilise prices of importing countries. Importing countries also benefit as they are assure of stable prices.

10.5.2 Factors that limit the success of international commodity agreements

- Different countries have different economic interests and difficulties. Conflicting interests of members especially producers against consumers limit the successful functioning of commodity agreements.

- Sometimes member countries agree on a fixed quota that each member should produce. Some countries however produce beyond the fixed quotas.

- Countries do not produce proportionately equal amounts. Members that produce large amounts dominate others. The agreements tend to favour

- Different countries are endowed differently with resources. This brings about differences in costs of production which may bring about disagreements on prices.

- If members contribute a small share of the world output, they cannot influence the price on the world market. This comes when some producers of a particular commodity are not members.

- The functioning of these agreements requires independent organs to effectively operationalise them. There is lack of effective supervision to implement the established quotas. Some countries may violet the established quotas.

Activity 10.14

As an individual, visit the website of Retroreflective Equipment Manufacturers Association (REMA) and study its objectives and activities. Discuss how the activities of REMA are related to what you studied in this unit.

Unit Summary

Price mechanism: Is a system where resource allocation and utilisation is determined by prices depending on the forces of demand and supply. Price controls: Refers to the methods that can be used to interfere with the forces of demand and supply in determining prices.

Maximum price legislation: This is the price fixed by the government below the equilibrium above which it is illegal to buy or sell the commodity. Minimum price legislation: This is the lowest price fixed by the government above the equilibrium below which it is illegal to buy or sell commodities.

Rent control: This is where the government intervenes to fix prices of housing facilities especially in urban areas.

Resale price maintenance: This is where the producer fixes the price of his products up to the retail level.

Rationing: This is where the government takes control of the supply channel of a scarce commodity and sells it equally to the citizens. Price fluctuation: This is the continuous alternate rise and fall in prices of commodities.

Buffer stock: This is a system where the government buys excess output from producers, stores it and supplies it to the market in periods of shortages.

Stabilisation fund: This is a mechanism set up by a government or central bank to insulate the domestic economy from large influxes of revenue. International commodity agreements: These are associations of producer and/or consumer countries of certain commodities formed for purposes of regulating supply and stabilising their prices.

Unit Assessment 10

- What do you understand by the term price mechanism?

- Explain the dangers associated with price mechanism.

- Explain the merits of the price mechanism.

- Explain the factors that limit the success of international commodity agreements.

Explain the factors that limit the success of buffer stock systems in Lesser-Developed Countries (LDCs).