Perfect market is a market with many buyers and sellers where nobody can determine the price of goods or services.

Characteristics

- Large number of buyer and sells where each individual firm supplies part of total quality supplied. Buyers are many such that no monopolistic powers can affect the working of the markets. Under this condition no individual firm or buyer can affect the market

- Free entry and free exist there are no barriers to entry or exit to the industries. Entry and exit from the industries may take time but firms have the freedom of movement in and out of the industry.

- Product homogeneity The industry is defined as group of firms producing homogenous product i.e. the technical characteristic as well as the service associated with product sold are identical. There is no why is which buyer can differentiate among the products of different firms.

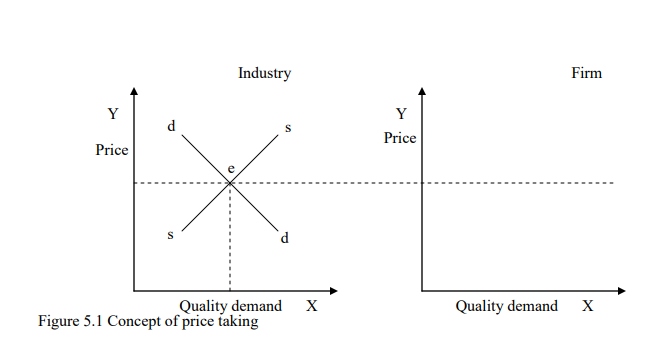

N/B: Under perfect competition firms are price takers. Meaning the demand curve of an individual firm will be perfectly elastic showing that the firm can sell any quantity of output at a given or prevailing market price. The concept of price taking is illustrated in

Figure 5.1

4.Profit maximization The goal of the firm is profit maximization both is the short run and in the long run. No other goal is pursued.

5.No government regulation. There is no government intervention in the operation of this market.

6.Perfect mobility of factors of production. Factors are free to move from one firm to another throughout the economy. It is assumed that there is perfect competition on the factor market.

7.Perfect knowledge All sellers and buyers are assumed to have complete knowledge about the conditions in the market. This knowledge refers not only to prevailing condition in current but also for future periods.

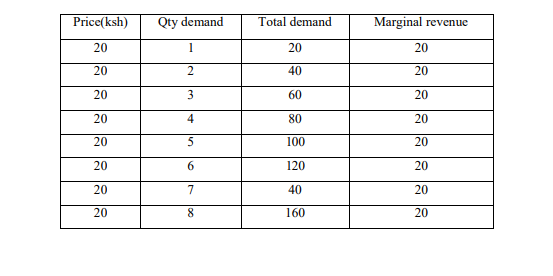

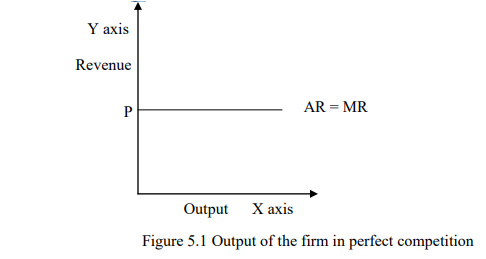

The revenue position of a perfectly competitive firm In perfect competition since each unit of out is sold at the same price both the average and marginal revenue are constant. This is illustrated in Table 5.1

Table5.1 illustrates that as the quality demand increases the price remains unchanged. This implies that each additional unit sold increases the total revenue by in amount equal to its price. This relationship is illustrated graphically as shown in Figure 5.2

The short run Recall that the short run is the context the theory of the firm is the period in which the quality of at least one factor of production is fixed. The level of output during this period of time can alter the utilization of variable factors. In the short run is the

perfect competition can make normal profit, abnormal profits or losses

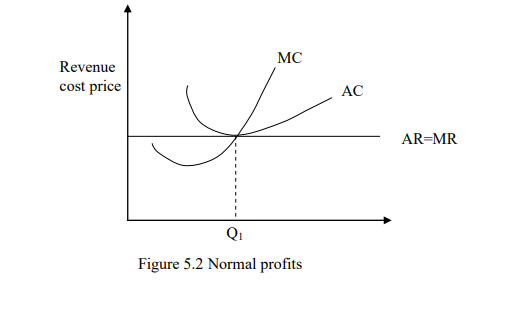

Normal profit This refers to the minimum level of profit which a firm must make in order to induce it to remain in operation. The level of normal profit varies from one industry to the other. This because of different level of risk and nature of the production process

involved in different industries. Normal profits may be considered be just past cost of production line since production will not continue unless at least this level of profit is attained

In the Figure 5.2 the firm is earning normal profit because price is equal to the average cost. The profit maximizing level of output is Q1 where the necessary sufficient conditions are satisfied. Since normal profit are made where the price is equal to average cost it implies that when price exceeds average cost the firm is said to be earning normal

Super-normal profits.

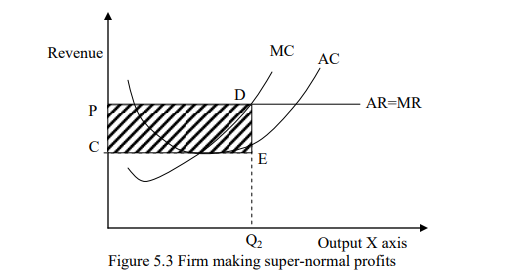

Supernormal profit (P>AC) Categories all those firms which are earning a return which exceeds the minimum necessary to induce them to remain the industry they currently occupy. Figure 5.3 shows a firm making super-normal profits.

From Figure 5.3 when the level of output is Q2 the cost for unit is EQ2 and the price DQ2 supernormal profit is equal to CPDE which is represented by the scheduled area.