INTRODUTION TO ACCOUNTING

- NATURE OF ACCOUNTING

Accounting is defined as the process of identifying, measuring and reporting economic information to the users of this information to permit informed judgment

Many businesses carry out transactions. Some of these transactions have a financial implication i.e. either cash is received or paid out. Examples of these transactions include selling goods, buying goods, paying employees and so many others.

Accounting is involved with identifying these transactions measuring (attaching a value) and reporting on these transactions. If a firm employs a new staff member then this may not be an accounting transaction. However when the firm pays the employee salary, then this is related to accounting as cash involved. This has an economic impact on the organization and will be recorded for accounting purposes. A process is put in place to collect and record this information; it is then classified and summarized so that it can be reported to the interested parties.

- USERS OF ACCOUNTING INFORMATION

Accounting information is produced in form of financial statement. These financial statements provide information about an entity financial position, performance and changes in financial position.

Financial position of a firm is what the resources the business has and how much belongs to the owners and others.

The financial performance reflects how the business has performed, whether it has made profits or losses. Changes in financial positions determine whether the resources have increased or reduced.

The users of accounting information have an interest in the existence of the firm. Therefore the information contained in the financial statements will affect the decision making process.

The following are the users of accounting information:

- Owners:

They have invested in the business and examples of such owners include sole traders, partners (partnerships) and shareholders (company). They would like to have information on the financial performance, financial position and changes in financial position.

This information will enable them to assess how the managers of the business are performing whether the business is profitable or not and whether to make drawings or put in additional capital.

- Customers

Customers rely on the business for goods and services. They would like to know how the business is performing and its financial position.

This information would enable them to assess whether they can rely on the firm for future supplies.

Suppliers

They supply goods or services to the firm. The supplies are either for cash or credit. The suppliers would like to have information on the financial performance and position so as to assess whether the business would be able to pay up for the goods and services provided as and when the payments falls due.

- Managers

The managers are involved in the day-to-day activities of the business. They would like to have information on the financial position, performance and changes in financial position so as to determine whether the business is operating as per the plans.

In case the plan is not achieved then the managers come up with appropriate measures (controls) to ensure that the set plans are met.

- The Lenders

They have provided loans and others sources of capital to the business. Such lenders include banks and other financial institutions. They would like to have information on the financial performance and position of the business to assess whether the business is profitable enough to pay the interest on loans and whether it has enough resources to pay back the principal amount when it is due.

- The Government and its agencies

The Government is interested in the financial performance of the business to be able to assess the tax to be collected in the case there are any profits made by the business.

The other government agencies are interested with the financial position and performance of the business to be able to come with National Statistics. This statistics measure the average performance of the economy.

- The Financial Analyst and Advisors

Financial analyst and advisors interpret the financial information. Examples include stockbrokers who advise investors on shares to buy in the stock market and other professional consultants like accountants. They are interested with the financial position and performance of the firm so that they can advise their clients on how much is the value their investment i.e. whether it is profitable or not and what is the value.

Others advisors would include the press who will then pass the information to other relevant users.

- The Employees

They work for the business/entity. They would like to have information on the financial position and performance so as to make decisions on their terms of employment. This information would be important as they can use it to negotiate for better terms including salaries, training and other benefits.

They can also use it to assess whether the firm is financially sound and therefore their jobs are secure.

- The Public

Institutions and other welfare associations and groups represent the public. They are interested with the financial performance of the firm. This information will be important for them to assess how socially responsible is the firm.

This responsibility is in form the employment opportunities the firm offers, charitable activities and the effect of firm’s activities on the environment.

- THE ACCOUNTING EQUATION

A business owns properties. These properties are called assets. The assets are the business resources that enable it to trade and carry out trading. They are financed or funded by the owners of the business who put in funds.

These funds, including assets that the owner may put is called capital. Other persons who are not owners of the firm may also finance assets. Funds from these sources are called liabilities.

The total assets must be equal to the total funding i.e. both from owners and non-owners. This is expressed inform of accounting equation which is stated as follows:

ASSETS = LIABILITIES + CAPITAL

Each item in this equation is briefly explained below.

Assets:

An asset is a resource controlled by a business entity/firm as a result of past events for which economic benefits are expected to flow to the firm.

An example is if a business sells goods on credit then it has an asset called a debtor. The past event is the sale on credit and the resource is a debtor. This debtor is expected to pay so that economic benefits will flow towards the firm i.e. in form of cash once the customers pays.

Assets are classified into two main types:

- Non- current assets (formerly called fixed assets).

- Current assets.

Non- current assets are acquired by the business to assist in earning revenues and not for resale. They are normally expected to be in business for a period of more than one year.

Major examples include:

- Land and buildings

- Plant and machinery

- Fixtures, furniture, fittings and equipment

- Motor vehicles

Current assets are not expected to last for more than one year. They are in most cases directly related to the trading activities of the firm. Examples include:

- Stock of goods – for purpose of selling.

- Trade debtors/accounts receivables – owe the business amounts as a resort of trading.

- Other debtors – owe the firm amounts other than for trading.

- Cash at bank.

- Cash in hand.

Liabilities:

These are obligations of a business as a result of past events settlement of which is expected to result to an economic outflow of amounts from the firm. An example is when a business buys goods on credit, then the firm has a liability called creditor. The past event is the credit purchase and the liability being the creditor the firm will pay cash to the creditor and therefore there is an out flow of cash from the business.

Liabilities are also classified into two main classes.

- Non-current liabilities (or long term liabilities)

- Current liabilities.

Non-current liabilities are expected to last or be paid after one year. This includes long-term loans from banks or other financial institutions. Current liabilities last for a period of less than one year and therefore will be paid within one year. Major examples:

- Trade creditors/

or accounts payable – owed amounts as a result of

business buying goods on credit.

- Other creditors – owed amounts for services supplied to the firm

other than goods.

- Bank overdraft – amounts advanced by the bank for a short-term

period.

0 THE LEDGER AND THE TRIAL BALANCE.

Specific Objectives

By the end of the subject, the trainee should be able to:-

- Define a ledger and an account

- Explain the importance of a ledger

- Explain the relationship between the ledger and accounts

- Classify ledgers

- Classify accounts

- Explain the double entry systems

- Balance off ledger accounts

- Define a trial balance

- Explain the importance of the trial balance

2.1 THE LEDGER

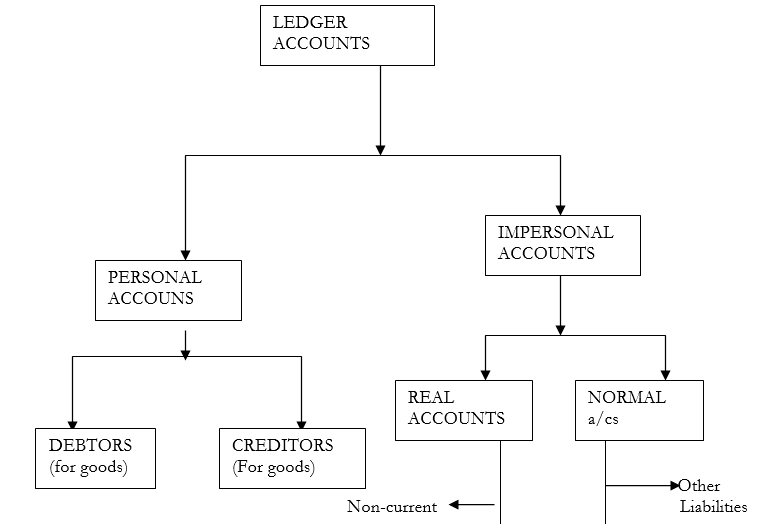

The ledger is simply the accounts. The Ledger is classified into 3 main classes.

- Sales Ledger, which has the accounts of all the debtors.

- Purchases Ledger, which has the accounts of all the creditors.

- The General Ledger. Has all the other accounts i.e. other assets, liability, incomes and expenses and capital.

The ledger accounts can also be classified as follows:

The Accounting equation forms the basis of double entry and therefore it should always be maintained. Any change in assets, liabilities or capital will have a double effect such that assets will always be equal to liabilities plus capital. If the owners put in additional capital then this will increase the cash at bank and the capital amount therefore the equation is still maintained.

Name Debit Credit

| Date | Detail | Folio | Amount | Date | Detail | Folio | Amount | |

|

|

In this account the date will show the opening period of the asset ,liability or capital i.e. the balance brought forward. It will also show the date when a transaction took place (i.e. either an asset was bought or liability incurred).

The detail column (also called the particulars column) shows the nature of the transaction and reference to the corresponding account. The Folio Column for purposes of detailed recording shows the reference number of the corresponding account. The amount column shows the amount of the asset, liability or capital.

The left side of the account is called the debit side and the right side is called the credit side. All assets are shown or recorded on the debit side while all the liabilities and capital are recorded on the credit side. Each type of asset or liability must have its own account whereby all transactions affecting them are recorded in this account. Therefore there should be an account for Premises, Plant and Machinery, Stock, Debtors, Creditors etc.

Under the accounting equation if all assets are represented by liabilities and capital therefore all debits should be the same as credits.

For the double entry to be reflected in the accounts, every debit entry must have a corresponding credit entry. The transactions affecting these accounts are posted in the account as debit entry and credit entry to complete the double entry.

When we make a debit entry we are either:

- Increasing the value of an asset.

- Reducing the value of a liability.

- Reducing the value of capital.

When we make a credit entry we are either:

- Reducing the value of an asset.

- Increasing the value of a liability.

- Increasing the value of capital.

Accounting for sales, purchases, incomes and expenses.

Sales:

This is the sell of goods that were bought by a firm (the goods must have been bought with the purpose of resale). Sales are divided into cash sales and credit sales. When a cash sale is made, the following entries are to be made.

- Debit cash either at bank or in hand.

- Credit sales account.

For a credit sale:

- Debit debtors/ Accounts receivable account.

- Credit sales account.

A new account for sales is opened and credited with cash or credit sales.

Purchases:

Buying of goods meant for resale. Purchases can also be for cash or on credit. For cash purchases:

- Debit purchases.

- Credit cash at bank/cash in hand

For credit purchases, we:

- Debit purchases.

- Credit creditors for goods.

A new account is also opened for purchases where both cash and credit purchases are posted. NOTE: NO ENTRY IS MADE INTO THE STOCKS ACCOUNT.

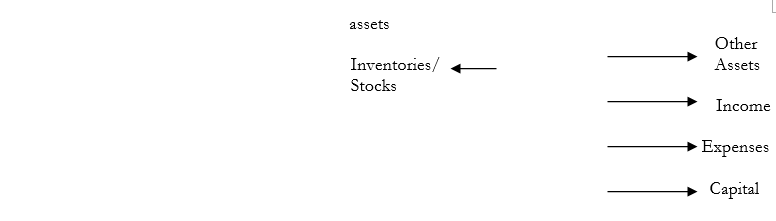

Incomes:

A firm may have other incomes apart from that generated from trading (sales). Such incomes include:

- Rent

- Bank interest

- Discounts received.

When the firm receives cash, from these incomes, the following entries are made:

- Debit cash in hand/at bank.

- Credit income account.

Each type of income should have its own account e.g. rent income, interest income.

Incomes increase the value of capital and that is the reason why they are posted on the credit side of their respective accounts.

Expenses:

These are amounts paid out for services rendered other than those paid for purchases. Examples include:

- Postage and stationery

- Salaries and wages

- Telephone bills

- Motor vehicle running expenses.

- Bank charges.

When a firm pays for an expense, we:

- Debit the expense account.

- Credit cash at bank/in hand.

Each expense should also have its own account where the corresponding entry will be posted. Expenses decrease the value of capital and thus the posting is made on the debit side of their accounts.

The following diagram is a simple summary of the entries made for incomes and expenses.

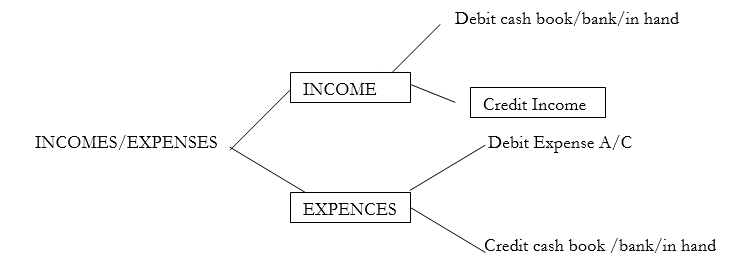

Returns Inwards and Returns Outwards.

Returns Inwards: These are goods that have been returned by customers due to various reasons e.g.

- They may be defective/damaged,

- Being of the wrong type .

- Excess goods being delivered.

Goods returned may relate to cash sales or credit sales. For the goods returned in relation to cash sales and cash is refunded to the customer the following entries are made:

- Debit returns – inwards

- Credit cashbook.

For goods returned that relate to credit sales; no cash has been given to customer, the following entry is to be made.

- Debit returns inwards.

- Credit debtors.

Returns Outwards: These are goods returned to suppliers/creditors. They may be for cash purchases or for credit purchases. For cash purchases a cash refund given to the firm by the supplier,

- Debit the cashbook (cash at bank/hand).

- Credit returns outwards.

For credit purchases and no refund has been made:

- Debit creditors.

- Credit returns outwards.

Accounting for drawings, discounts allowed and discounts received.

Drawings

The owner makes drawings from the firm in various ways:

- i) Cash or bank withdrawals

When the owner withdraws money from the business we debit drawings and credit cashbook (cash in hand or cash at bank).

- ii) Taking goods for own use and

When the owner takes out some of the goods for his own use, we debit drawings and credit purchases.

iii) Personal expenses, paid by the business

Here we debit the drawings and credit expense account

Taking some of the other assets from the business e.g. motor vehicles or using part of the premises.

Sometimes the owner may take over some of the assets of the business e.g. vehicle or converting business premises into living quarters or not paying into the business cash collected personally from the customers. When this happens we debit drawings and credit the relevant asset e.g. motor vehicles, premises or some building or even debtors.

Discounts

Discounts received.

A discount received is an allowance by the creditors to the firm to encourage the firm to pay the amount dues within the agreed time. It is an amount deducted from the invoice price.

THE TRIAL BALANCE

The trial balance is a simple report that shows the list of account balances classified as per the debits and credits. The purpose of the trial balance is to show the accuracy of the double entries made and to facilitate the preparation of final accounts i.e. the trading, profit & loss account and a balance sheet.

The debits of the trial balance should be the same as the credits, if not then there is an error in one or more of the accounts.

The trial balance in example 1.8 would be extracted as follows:

Name

| Trial balance as at 31 May 2002 | ||

| Debit | Credit | |

| £ | £ | |

| Rent – income | 5 | |

| Debtor – U Foot | 7 | |

| Motor vehicle | 300 | |

| Bank | 1555 | |

| Purchases | 289 | |

| Wages | 117 | |

| Capital | 2000 | |

| Creditor – M Rooks | 152 | |

| Furniture & Fittings | 150 | |

| Sales | 352 | |

| Cash in hand | 72 | |

| Creditor – P Scot | 114 | |

| Expenses – Rent | 15 | |

| Expenses – Stationery | 27 | |

| Returns Outwards | 23 | |

| Drawings | 44 | . |

| 2464 | 2464 | |

From the trial balance please note that assets and expenses are on the debit side. Capital, liabilities and incomes are normally listed on the credit side.

The next example is a detailed one that shows extracting of trial balance once all the postings have been made in the relevant accounts.

TYPES OF ERRORS AND THEIR CORRECTION

Specific Objectives:

By the end of the topic, the trainee should be able to:

- State the type of errors that do not affect the agreement of a trial balance

- State types of errors that affect the agreement of a trial balance

- Explain functions of a suspence account

- Correct the errors

3.1 ERRORS ON ACCOUNTS

There are two types of errors in accounts:

- Errors that don’t affect the trial balance

- Errors that affect the trial balance

Errors that don’t affect the trial balance

The trial balance produced from the accounts appears to be okay/correct, i.e the debits are the same as the credits. However, on taking a close check on the balances and transactions posted, errors may have been made and therefore the balances shown on the trial balance may be incorrect i.e. under/over stated.

There are 6 main types of errors that don’t affect the trial balance and these are explained as follows:

- Error of omission

Here, a transaction is completely omitted from the accounts and therefore the double entry is not made e.g. a sales invoice of £400 is not posted in the sales journal therefore no entry is made in the debtor’s account and the sales account i.e. both debit of £400 in debtor’s account and credit of £ 400 in the sales account.

The effect of the error is understates both the debtors and the sales.

To correct this error, the transaction is posted in the books by:

Debiting debtors £400

Crediting sales £400

- Error of Commission

This error occurs when a transaction is posted to a wrong account but the account is of the same class. Example: a credit sale to T Thompson is posted to L Thompson’s account for an amount of £ 200. Instead of a debit to T Thompson’s account it is made to L Thompson’s account and the corresponding credit in the sales account is correct.

Although the debit entry is made into the wrong account, the two accounts are of the same class i.e. debtors.

To correct this error a transfer is made from L Thompson’s account to T Thompson by:

£

- (i) Debit T Thompson a/c 200

- (ii) Credit L Thompson a/c 200

- Error of principle

In this type of error a transaction is posted not only to the wrong account but also of a different class e.g. Motor vehicle purchased for £ 400 is posted to the motor vehicle expenses a/c. (Instead of debiting motor vehicles, we debited motor vehicle expenses a/c and the credit entry in the cashbook is correct)

The motor vehicles account is a non-current asset, and motor vehicles expenses a/c is an expense account. Therefore a capital expenditure has been posted as revenue expenditure.

To correct this error a transfer is made from the motor expenses account to the motor vehicles a/c by:

£

- (i) Debit Motor vehicles a/c 400

- (ii) Credit Motor expenses a/c 400

- Complete reversal of entries

A transaction is posted to the correct accounts but to the wrong sides of the accounts i.e. a debit is posted as a credit and a credit is posted as a debit. Example: cash drawn from the bank of £150 for business use is posted as a debit in the bank account and credit in cash in hand.

To correct this error, two entries are made in the relevant accounts:

- (i) Correct the error

- (ii) Post the transaction correctly

The entries will therefore be as follows:

- (i) Debit Cash in hand by £150

Credit bank by £150

To correct the error of £ 150 posted in the wrong sides of these account

- (ii) Debit cash by £150

Credit bank by £150

To post the entries correctly

- Error of Original entry

Here a transaction is posted to the correct accounts but the amount posted is not correct i.e. it is either under/over stated. In some cases, this is known as a transposition error e.g. cash received from a debtor of £980 is credited/posted to the customer’s account as £890.

To correct this error, the amount understated or overstated is posted to these accounts to reflect the correct balance. In this case, we will:

£

Debit cash book 90

Credit debtors 90

- Compensating Errors

These are errors that tend to cancel out each other i.e. if the effect of one error is to understate the debits or credits then another error may take place to overstate the debits or credits by the same amount, hence canceling out each other. E.g. if the balance c/d of the purchases a/c is £3,980 but shown in the trial balance as £3,890 and another error carried to the trial balance of fixture amounting to £4,540 instead of £4,450:

£

Purchases 3,980

3,890

(90)

£

Fixtures 4,450

(4,540)

90

This type of error is corrected by use of a suspense account.

Errors That Affect The Trial Balance And The Suspense Account

These types of errors are reflected on the trial balance because the debits will not be same as the credits. The debits may be more than the credits and vice versa.

Examples include:

- Transaction is posted on one side of the accounts i.e. only a debit entry or a credit entry. Example cash received from a debtor is debited to the cashbook and no other entry is made in the account, i.e. no credit entry on the debtor’s a/c.

- A transaction is posted on one side of both the accounts i.e. two debits or two credits. Example a payment to a creditor of £ 300 is credited in the cashbook and also credited in the creditor’s accounts.

- A transaction is posted correctly but different amounts i.e. debit is not the same as the credit. Example – cash received from a debtor of £ 450 is debited in the cashbook as £ 450 and credited as £ 540 in the debtor’s a/c.

- Error on balances of accounts – i.e. understatement or overstatement of an account balance due to mathematical errors.

- Balance on an account is shown on the wrong side of the account when opening the ledger accounts or when taken up to the trial balance. Example Bal c/d in the cash book for cash at bank of £ 2000 is shown as a credit i.e. an overdraft, instead of a debit in the trial balance. The balance may also be brought down as an overdraft instead of a debit balance in the trial balance.

- A balance is omitted from the trial balance on the accounts in total.

To correct the above errors, the appropriate or the adjusting entries are made through an account called a suspense account.

The difference in the accounts is posted to this account and the entries to correct the accounts are posted here. The balance to be shown on the suspense accounts depends on which side the error is shown on the trial balance.

If the debits > credits, then an amount is included on the credit side of the trial balance so that the debits = credits. This is a credit balance and will be taken to the suspense account on the credit side.

SOURCE DOCUMENTS

Specific Objectives

By the end of subject, the trainee should be able to:

- Explain the meaning of source documents

- Identify types of source documents

- Explain the uses of source documents

- Explain the relationship between source documents and books of accounts.

SOURCE DOCUMENTS

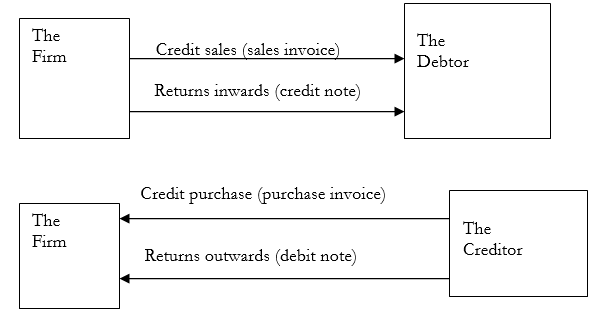

This shows the evidence transactions. They are collected, filed and posted in the books of prime entry. Example, if a firm sells goods on credit, then an invoice is raised. The source documents as shown in the above include:

- Sales invoice

- Purchases invoice

- Credit note

- Debit note

- Receipts, cheques and petty cash vouchers

- Other correspondences.

(i) Sales Invoice

The sales invoice is raised by the firm and sent to the debtor/customer when the firm makes a credit sale.

The sales invoice contains the following:

- Name and address of the firm

- Name and address of the buying firm

- Date of making the sale – invoice date.

- Invoice number

- Amount due (net of trade discount)

- Description of goods sold

- Terms of sale

(ii) Purchases Invoice

A purchase invoice is raised by the creditor and sent to the firm when the firm makes a credit purchase. It shows the following:

- Name and the address of the creditor/seller

- Name and address of the firm

- Date of the purchase (invoice date)

- Invoice number

- Amount due

- Description of goods sold

- Terms of sale

(iii) Credit note

A credit note is raised by the firm and issued to the debtor when the debtor returns some goods back to the firm. It’s contents include:

- Name and address of the firm

- Name and address of the debtor

- Amount of credit

- Credit note number

- Reason for credit e.g. if goods sent but of the wrong type.

The purpose of the credit note is to inform the debtor or customer that the debtor’s account with the firm has been credited i.e. the amount due to the firm has been reduced or cancelled.

The credit note may also be issued when the firm gives an allowance of the amounts due from the debtors. From the context we can assume that all credit notes are issued when goods are returned.

(iv) Debit note

This is raised by the creditor and issued to the firm when the firm returns some goods to the creditor. It includes the following items:

- Name and address of the firm

- Name and address of the creditor

- Amount of debit

- Debit Note number

- Reason for the debit

The purpose of the debit note is to inform the firm that the amount due to the creditor has been reduced or cancelled.

(vi) Receipts

A receipt is raised by the firm and issued to customers or debtors when they make payments in the form of cash or cheques. It shows:

- The name and address of the firm

- The date of the receipt

- Amount received (cash or cheque or other means of payment)

- Receipt number.

Cheques

When a firm opens a current account with the bank, a chequebook containing cheques issued. The cheques allow the firm to make payments against the account with the bank. When a firm issues a cheque to its creditors for payments, it authorizes the bank to honour payments against the firm’s account with the bank. The cheque contains the following information:

- Name and account number of the firm (account holder)

- The date of the cheque

- Name of the payee (creditor)

- Name of the firm’s bank

- Amount payable in words and figures

- The cheque number

- The authorized signature(s)

Petty cash vouchers

A petty cash voucher is raised by a cashier to seek authority for payments (payments of small value in the firm which require cash payments e.g. fuel, bus-fare, office snacks), which is approved by a senior manager and filed for record purpose. It shows:

- Date of payment

- Amount paid

- Reason for payment

- Authorized signature(s):

- Person approving

- Person receiving

The person receiving the money must then return a document supporting how the money was utilized e.g. fuel receipt, bus ticket e.t.c.

(vii) Other correspondence

These include information received within or outside the firm that has a financial implication in the accounts.

Examples are:

- Letters from the firm’s lawyers about a debtors balance.

- Hire-purchase/credit sale or credit purchase agreements that relate to non-current assets.

- Memorandum from a senior manager requiring changes to be made in the accounts.

- Bank statement from the bank, e.g. bank charges.

REVIEW QUESTIONS.

- Name instances when source documents are must in regard to the correctness of accounting records

- What source documents are a must when preparing a sales ledger

- Assume there is an error in the purchases journal, which documents will assist the book-keeper to unearth the cause of the error

BOOKS OF ORIGINAL ENTRY

By the end of the topic, the trainee should be able to:

- Define books of original entry

- Classify books of original entries

- Explain the preparation of books of original entry

- Describe the procedure of posting transactions from the books of original entry to the ledger accounts

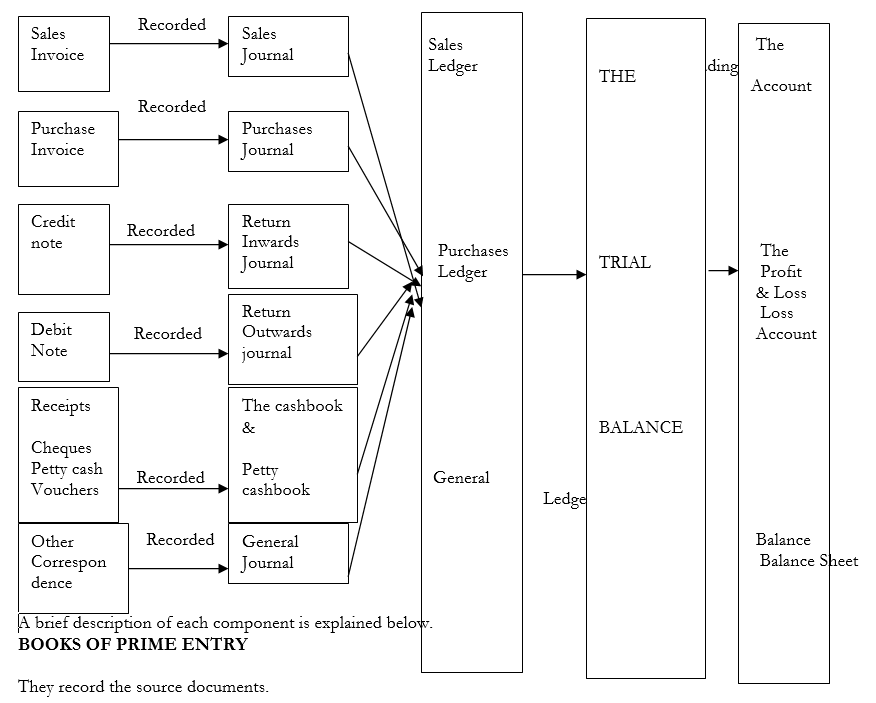

BOOKS OF ORIGINAL ENTRY

The diagram below shows the components of an accounting system for a firm that carries out trading activities from the source documents that record the evidence of transactions, where the documents are recorded and the postings to be made.

Source Books of The List of the

Final

Documents Original entry Ledger Balances Accounts

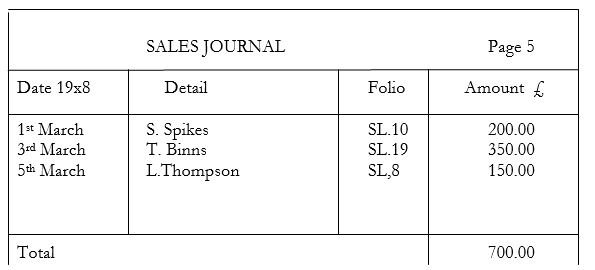

Sales Journal

It is also called a Sales Day Book. It records all the sales invoices issued by the firm during a particular financial period. The format is as follows (with simple records of invoice).

The individual entries in the sales journal are posted to the debit side of the debtor’s accounts in the sales ledger and the total is posted on the credit side of the sales account in the general ledger.

THE CASH BOOK

Specific Objectives.

By the end of the topic, the trainee should be able to:

- Define the cash book

- Explain the types of cash book

- Distinguish between the types of discounts

- Record transactions in a three column cash book

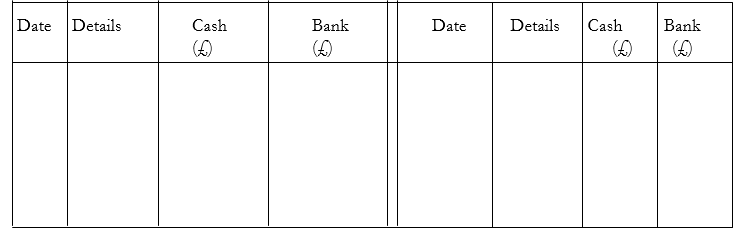

A cashbook records all the receipts (cash and cheques from customers and debtors or other sources of income) and all the payments (to creditors or suppliers and other expenses) for a particular financial period. The cashbook will also show us the cash at bank and cash in hand position of the firm.

There are two types of cashbooks:

- Cash in hand cashbook, which records the cash transactions in the firm or business.

- Cash at bank cashbook, which records the transactions at/with, the bank.

The cashbook is the most important book of prime entry because it forms part of the general ledger and records the source documents (receipts and cheques). The cash at bank cashbook and cash in hand cashbook are combined together to get a two-column cashbook. The format is as follows:

Two-column cashbook.

CASH BOOK

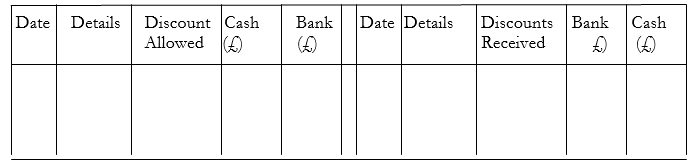

Additional columns for discounts allowed and discounts received can be included with the cash at bank columns to get a 3 – column cashbook. The format is as follows:

The balance carried down (Bal c/d) for cash in hand and cash at bank will form part of the ledger balances and the discounts allowed and discounts received columns will be added and the totals posted to the respective discount accounts. The discount allowed total will be posted to the debit side of the discount allowed account in the general ledger and the total of the discount received will be posted to the credit side of the discount-received account of the general ledger.

Cash at bank can have either a credit or debit balance. A debit balance means the firm has some cash at the bank and a credit balance means that the account at the bank is overdrawn. (the firm owes the bank some money).

THE PETTY CASH BOOK

Specific Objectives.

By the end of the topic, the trainee should be able to:

- Define cash book

- Explain the meaning of the imprest system

- Explain the purpose of maintaining a petty cash book

- Explain the preparation of a petty cash book

Petty Cash Book and the imprest system of Accounting.

Petty Cash Book is a record of all the petty cash vouchers raised and kept by the cashier. The petty cash vouchers will show summary expenses paid by the cashier and this information is listed and classified in the petty cash book under the headings of the relevant expenses such as:

- Postage and stationery

- Traveling

- Cleaning expenses.

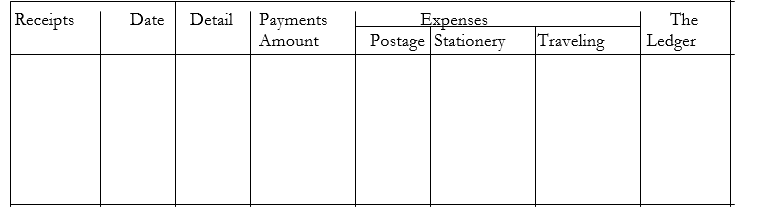

The format is as shown:

Petty Cash Book

The balance c/d of the petty cash book will signify the balance of cash in hand or form part of cash in hand. The totals of the expenses are posted to the debit side of the expense accounts. If a firm operates another cashbook in addition to the petty cash book, then the totals of the expenses will also be posted on the credit side of the cash in hand cashbook.

The Imprest system

This system of accounting operates on a simple principle that the cashier is refunded the exact amount spent on the expenses during a particular financial period. At the beginning of each period, a cash float is agreed upon and the cashier is given this amount to start with. Once the cashier makes payments for the period he will get a total of all the payments made against which he will claim a reimbursement of the same amount that will bring back the amount to the cash float at the beginning of the period.

This is demonstrated as follows:

£

Start with (float) 1,000

Expenses paid (720)

Balance 280

Reimbursement 720

Cash float 1,000

REVIEW QUESTION

A cashier in a firm starts with £2,000 in the month of March (that is the cash float). I n the following week, the following payments are made:

£

1st March – bought stamps for 80

2nd March – paid bus fare for 120

2nd March – cleaning materials 240

3rd March – bought fuel 150

3rd March – cleaning wages 300

4th March – bought stamps 200

4th March – paid L. Thompson (creditor) 400

5th March – fuel costs 150

On the 5th of March the cashier requested for a refund of the cash spent and this amount was reimbursed back.

Required:

Prepare a detailed petty cash book showing the balance to be carried forward to the next period and the relevant expense accounts, as they would appear on the General Ledger.

BANK RECONCILIATION STATEMENTS

Specific Objectives.

By the end of the topic, the trainee should be able to:

- To define what is a bank reconciliation statement

- Explain the purpose of preparing a reconciliation statement

- Explain the causes of the difference between bank statements and the cash book balance

- Explain the steps/procedures in preparing bank reconciliation statement

BANK RECONCILIATION STATMENTS

The cashbook for cash at bank records all the transactions taking place at the bank i.e. the movements of the account held with the bank. The bank will send information relating to this account using a bank statement for the firm to compare.

Ideally, the records as per the bank and the cashbook should be the same and therefore the balance carried down in the cashbook should be the same as the balance carried down by the bank in the bank statement.

In practice however, this is not the case and the two (balance as per the bank and firm) are different. A bank reconciliation statement explains the difference between the balance at the bank as per the cashbook and balance at bank as per the bank statement.

Causes of the differences:

Items Appearing In The Cashbook And Not Reflected In The Bank Statement.

Unpresented Cheques: Cheques issued by the firm for payment to the creditors or to other supplies but have not been presented to the firm’s bank for payment.

Uncredited deposits/cheques: These are cheques received from customers and other sources for which the firm has banked but the bank has not yet availed the funds by crediting the firm’s account.

Errors made in the cashbook

These include:

- Payments over/understated

- Deposits over/understated

- Deposits and payments misposted

- Overcastting and undercasting the Bal c/d in the cashbook.

- ii) Items appearing in the bank statement and not reflected in the cashbook:

Bank charges: These charges include service, commission or cheques.

Interest charges on overdrafts.

Direct Debits (standing orders) e.g. to pay Alico insurance.

Dishonored cheques

A cheque would be dishonored because:

- Stale cheques

- Post – dated cheques

- Insufficient funds

- Differences in amounts in words and figures.

Direct credits

Interest Income/Dividend income

Errors of The Bank Statement (Made By The Bank).

Such errors include:

- Overstating/understating.

- Deposits

- Withdrawals

The Purposes of a bank reconciliation statement.

- To update the cashbook with some of the items appearing in the bank statement e.g. bank charges, interest charges and dishonoured cheques and make adjustments for any errors reflected in the cashbook.

- To detect and prevent errors or frauds relating to the cashbook.

- To detect and prevent errors or frauds relating to the bank.

Steps in preparing a bank reconciliation statement.

- To update the cashbook with the items appearing in the bank statement and not appearing in the cashbook except for errors in the bank statement. Adjustments should also be made for errors in the cashbook.

- Compare the debit side of the cashbook with the credit side of the bank statement to determine the uncredited deposits by the bank.

- Compare the credit side of the cashbook with the debit side of the bank statement to determine the unpresented cheques.

- Prepare the bank reconciliation statement which will show:

a) Unpresented cheques

- Uncredited deposits

- Errors on the bank statement

- The updated cashbook balance.

The format is as follows:

(Format 1)

Name:

Bank Reconciliation Statement as at 31/12

£ £

Balance at bank as per cashbook (updated) x

Add: Un presented cheques x

Errors on Bank Statement (see note 1) x x

x

Less: Uncredited deposits x

Errors on Bank Statement (see note 2) x (x)

Balance at bank as per Balance Sheet x

Note 1: These types of errors will have an effect of increasing the balance at bank e.g. an overstated deposit or an understated payment by the bank.

Note 2: These types of errors will have an effect of decreasing the balance at bank e.g. an understated deposit or an overstated payment by the bank, or making an unknown payment.

Format 2

Name:

Bank Reconciliation Statement as at 31/12

£ £

Balance at bank as per bank statement x

Add: Uncredited deposits x

Add errors on bank statement (note 2) x x

x

Less: Unpresented cheques x

Errors on bank statement (note 1) x (x)

Balance at bank as per cashbook (updated) x

===

CONTROL ACCOUNTS.

Specific objectives.

By the end of the topic, the trainee should be able to:-

- Define control accounts

- Explain the uses of control accounts

- Explain the preparation of control accounts

CONTROL ACCOUNTS

Control accounts are so called because they control a section of the ledgers. By control we mean that the total on the control accounts should be the same as the totals on the ledger accounts. There are two main types of control accounts:

- (i) Sales ledger control Account – also called total debtors. The balance on the sales ledger control account should be the same as the total of the balances in the sale ledger.

- (ii) Purchases Ledger Control Account – also called total creditors .The balance carried down (Bal c/d) on the purchases Ledger Control Account should be the same as the total of the balances in the purchases ledger.

Purpose of Control Accounts

- Provide for arithmetical check on the postings made in the individual accounts (either in the sales ledger or purchases ledger.)

- To provide for a quick total of the balances to be shown in the trial balance as debtors and creditors.

- To detect and prevent errors and frauds in the customers and suppliers account.

- To facilitate delegation of duties among the debtors and creditors clerks.

FORMAT OF A SALES LEDGER CONTROL

Sales Ledger Control a/c

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Refunds to Customers

Sometimes a firm can refund some cash on the customers account. This takes place when there is a credit balance on the debtor’s a/c and the customer is not a creditor too.

The entry will be:

Dr. Debtor’s a/c

Cr. Cashbook

Contra against the purchases ledger balances:

Some debtors may also be creditors in the same firm and therefore, if the amount due to them as creditors is less than what they owe as debtors, then the credit balance is transferred from their creditors a/c to their debtors a/c as a contra entry.

Example:

Debtor (A)

| Sales | 2000 | Contra- purchases | 1000 |

| Bal c/d | 1000 | ||

| 2000 | 1100 |

Creditor (A)

| Contra – Debtor | 1000 | Purchases | 1000 |

FORMAT OF A PURCHASES LEDGER CONTROL ACCOUNT

Purchases Ledger Control A/C

|

|

(from cash book) |

|

(from cash book) |

(from cash book) |

(from cash book) |

|

|

|

|

|

(from returns-outwards journal) |

|

(to be derived after posting entries) |

|

NOTES:

The following notes should be taken into consideration:

- Cash received from CASH SALES should NOT be included in sales ledger control a/c.

- Only cash discounts (allowable & receivables) should be included. Trade discounts should NOT be included.

- Provision for doubtful debts is NOT included in the sales ledger control a/c. e. increase or decrease in provisions for doubtful debts will not affect this account.

- Cash purchases are NOT posted to the Purchases Ledger Control A/C. However in some cases it can be included especially where there are incomplete records (Topic to be covered later).

- Interest due that is charged on over due customers’ account may also be shown on the debit side of the sales ledger control. However when trying to determine the turnover under incomplete records then it is wise to omit it.

ACCOUNTING CONCEPTS BASES AND POLICIES

Specific Objectives.

By the end of the topic, the learner should be able to:

- Define accounting concept, convention and bases

- Explain the various types of accounting concept, convention and bases

- concepts/conventions/principles

Accounting Concepts are broad basic assumptions that underlie the periodic financial accounts of business enterprises. Examples of concepts include:

- i) The going concern concept: implies that the business will continue in operational existence for the foreseeable future, and that there is no intention to put the company into liquidation or to make drastic cutbacks to the scale of operations.

Financial statements should be prepared under the going concern basis unless the entity is being (or is going to be) liquidated or if it has ceased (or is about to cease) trading. The directors of a company must also disclose any significant doubts about the company’s future if and when they arise.

The main significance of the going concern concept is that the assets of the business should not be valued at their ‘break-up’ value, which is the amount that they would sell for it they were sold off piecemeal and the business were thus broken up.

- ii) The accruals concept (or matching concept): states that revenue and costs must be recognized as they are earned or incurred, not as money is received or paid. They must be matched with one another so far as their relationship can be established or justifiably assumed, and dealt with in the profit and loss account of the period to which they relate.

Assume that a firm makes a profit of £100 by matching the revenue (£200) earned from the sale of 20 units against the cost (£100) of acquiring them.

If, however, the firm had only sold eighteen units, it would have been incorrect to charge profit and loss account with the cost of twenty units; there is still two units in stock. If the firm intends to sell them later, it is likely to make a profit on the sale. Therefore, only the purchase cost of eighteen units (£90) should be matched with the sales revenue, leaving a profit of £90.

The balance sheet would therefore look like this:

| £ | |

| Assets | |

| Stock (at cost, i.e. 2 x £5) | 10 |

| Debtors (18 x £10) | 180 |

| 190 | |

| Liabilities | |

| Creditors | 100 |

| 90 | |

| Capital (profit for the period) | 90 |

If, however the firm had decided to give up selling units, then the going concern concept would no longer apply and the value of the two units in the balance sheet would be a break-up valuation rather than cost. Similarly, if the two unsold units were now unlikely to be sold at more than their cost of £5 each (say, because of damage or a fall in demand) then they should be recorded on the balance sheet at their net realizable value (i.e. the likely eventual sales price less any expenses incurred to make them saleable, e.g. paint) rather than cost. This shows the application of the prudence concept. (See below).

In this example, the concepts of going concern and matching are linked. Because the business is assumed to be a going concern it is possible to carry forward the cost of the unsold units as a charge against profits of the next period.

Essentially, the accruals concept states that, in computing profit, revenue earned must be matched against the expenditure incurred in earning it.

- The Prudence Concept: The prudence concept states that where alternative procedures, or alternative valuations, are possible, the one selected should be the one that gives the most cautious presentation of the business’s financial position or results.

Therefore, revenue and profits are not anticipated but are recognized by inclusion in the profit and loss account only when realized in the form of either cash or of other assets the ultimate cash realization of which can be assessed with reasonable certainty: provision is made for all liabilities (expenses and losses) whether the amount of these is known with certainty or is best estimate in the light of the information available.

Assets and profits should not be overstated, but a balance must be achieved to prevent the material overstatement of liabilities or losses.

The other aspect of the prudence concept is that where a loss is foreseen, it should be anticipated and taken into account immediately. If a business purchases stock for £1,200 but because of a sudden slump in the market only £900 is likely to be realized when the stock is sold the prudence concept dictates that the stock should be valued at £900. It is not enough to wait until the stock is sold, and then recognize the £300 loss; it must be recognized as soon as it is foreseen.

A profit can be considered to be a realized profit when it is in the form of:

- Cash

- Another asset that has a reasonably certain cash value. This includes amounts owing from debtors, provided that there is a reasonable certainty that the debtors will eventually pay up what they owe.

A company begins trading on 1 January 20X2 and sells goods worth £100,000 during the year to 31 December. At 31 December there are debts outstanding of £15,000. Of these, the company is now doubtful whether £6,000 will ever be paid.

The company should make a provision for doubtful debts of £6,000. Sales for 20×5 will be shown in the profit and loss account at their full value of £100,000, but the provision for doubtful debts would be a charge of £6,000. Because there is some uncertainty that the sales will be realized in the form of cash, the prudence concept dictates that the £6,000 should not be included in the profit for the year.

- The consistency concept: The consistency concept states that in preparing accounts consistency should be observed in two respects.

- Similar items within a single set of accounts should be given similar accounting treatment.

- The same treatment should be applied from one period to another in accounting for similar items. This enables valid comparisons to be made from one period to the next.

- v) The entity concept: The concept is that accountants regard a business as a separate entity, distinct from its owners or managers. The concept applies whether the business is a limited company (and so recognized in law as a separate entity) or a sole proprietorship or partnership (in which case the business is not separately recognized by the law.

- The money measurement concept: The money measurement concept states that accounts will only deal with those items to which a monetary value can be attributed.

For example, in the balance sheet of a business, monetary values can be attributed to such assets as machinery (e.g. the original cost of the machinery; or the amount it would cost to replace the machinery) and stocks of goods (e.g. the original cost of goods, or, theoretically, the price at which the goods are likely to be sold).

The monetary measurement concept introduces limitations to the subject matter of accounts. A business may have intangible assets such as the flair of a good manager or the loyalty of its workforce. These may be important enough to give it a clear superiority over an otherwise identical business, but because they cannot be evaluated in monetary terms they do not appear anywhere in the accounts.

- The separate valuation principle: The separate valuation principle states that, in determining the amount to be attributed to an asset or liability in the balance sheet, each component item of the asset or liability must be determined separately.

These separate valuations must then be aggregated to arrive at the balance sheet figure. For example, if a company’s stock comprises 50 separate items, a valuation must (in theory) be arrived at for each item separately; the 50 figures must then be aggregated and the total is the stock figure which should appear in the balance sheet.

- The materiality concept: An item is considered material if it’s omission or misstatement will affect the decision making process of the users. Materiality depends on the nature and size of the item. Only items material in amount or in their nature will affect the true and fair view given by a set of accounts.

An error that is too trivial to affect anyone’s understanding of the accounts is referred to as immaterial. In preparing accounts it is important to assess what is material and what is not, so that time and money are not wasted in the pursuit of excessive detail.

Determining whether or not an item is material is a very subjective exercise. There is no absolute measure of materiality. It is common to apply a convenient rule of thumb (for example to define material items as those with a value greater than 5% of the net profit disclosed by the accounts). But some items disclosed in accounts are regarded as particularly sensitive and even a very small misstatement of such an item would be regarded as a material error. An example in the accounts of a limited company might be the amount of remuneration paid to directors of the company.

The assessment of an item as material or immaterial may affect its treatment in the accounts. For example, the profit and loss account of a business will show the expenses incurred by he business grouped under suitable captions (heating and lighting expenses, rent and rates expenses etc); but in the case of very small expenses it may be appropriate to lump them together under a caption such as ‘sundry expenses’, because a more detailed breakdown would be inappropriate for such immaterial amounts.

Example:

- If a balance sheet shows fixed assets of £2 million and stocks of £30,000 an error of £20,000 in the depreciation calculations might not be regarded as material, whereas an error of £20,000 in the stock valuation probably would be. In other words, the total of which the erroneous item forms part must be considered.

- If a business has a bank loan of £50,000 balance and a £55,000 balance on bank deposit account, it might well be regarded as a material misstatement if these two amounts were displayed on the balance sheet as ‘cash at bank £5,000’. In other words, incorrect presentation may amount to material misstatement even if there is no monetary error.

- The historical cost convention: A basic principle of accounting (some writers include it in the list of fundamental accounting concepts) is that resources are normally stated in accounts at historical cost, i.e. at the amount that the business paid to acquire them. An important advantage of this procedure is that the objectivity of accounts is maximized: there is usually objective, documentary evidence to prove the amount paid to purchase an asset or pay an expense. Historical cost means transactions are recorded at the cost when they occurred.

In general, accountants prefer to deal with costs, rather than with ‘values’. This is because valuations tend to be subjective and to vary according to what the valuation is for. For example, suppose that a company acquires a machine to manufacture its products. The machine has an expected useful life of four years. At the end of two years the company is preparing a balance sheet and has decided what monetary amount to attribute to the asset.

- x) Objectivity (neutrality):An accountant must show objectivity in his work. This means he should try to strip his answers of any personal opinion or prejudice and should be as precise and as detailed as the situation warrants. The result of this should be that any number of accountants will give the same answer independently of each other. Objectivity means that accountants must be free from bias. They must adopt a neutral stance when analysing accounting data. In practice objectivity is difficult. Two accountants faced with the same accounting data may come to different conclusions as to the correct treatment. It was to combat subjectivity that accounting standards were developed.

- The realization concept: Realization: Revenue and profits are recognized when realized. The concept states that revenue and profits are not anticipated but are recognized by inclusion in the income statement only when realized in the form of either cash or of other assets the ultimate cash realization of which can be assessed with reasonable certainty.

- Duality: Every transaction has two-fold effect in the accounts and is the basis of double entry bookkeeping.

- Substance over form: The principle that transactions and other events are accounted for and presented in accordance with their substance and economic reality and not merely their legal form e.g. a non current asset on Hire purchase although is not legally owned by the enterprise until it is fully paid for, it is reflected in the accounts as an asset and depreciation provided for in the normal accounting way.

Example 3.1

It is generally agreed that sales revenue should only be ‘realized’ and so ‘recognized’ in the trading, profit and loss account when:

- The sale transaction is for a specific quantity of goods at a known price, so that the sales value of the transaction is known for certain.

- The sale transaction has been completed, or else it is certain that it will be completed (e.g. in the case of long-term contract work, when the job is well under way but not yet completed by the end of an accounting period).

- The critical event in the sale transaction has occurred. The critical event is the event after which:

- i) It becomes virtually certain that cash will eventually be received from the customer.

- ii) Cash is actually received.

Usually, revenue is ‘recognized’

- When a cash sale is made.

- The customer promises to pay on or before a specified future date, and the debt is legally enforceable.

The prudence concept is applied here in the sense that revenue should not be anticipated, and included in the trading, profit and loss account, before it is reasonably certain to ‘happen’.

Required

Given that prudence is the main consideration, discuss under what circumstances, if any, revenue might be recognized at the following stages of a sale.

(a) Goods have been acquired by the business, which it confidently expects to resell very quickly.

(b) A customer places a firm order for goods.

(c) Goods are delivered to the customer.

(d) The customer is invoiced for goods.

(e) The customer pays for the goods.

(f) The customer’s cheque in payment for the goods has been cleared by the bank.

Answer

- A sale must never be recognized before a customer has even ordered the goods. There is no certainty about the value of the sale, nor when it will take place, even if it is virtually certain that goods will be sold.

- A sale must never be recognized when the customer places an order. Even though the order will be for a specific quantity of goods at a specific price, it is not yet certain that the sale transaction will go through. The customer may cancel an order, the supplier might be unable to deliver the goods as ordered or it may be decided that the customer is not a good credit risk.

- A sale will be recognized when delivery of the goods is made only when:

- i) The sale is for cash, and so the cash is received at the same time.

- ii) The sale is on credit and the customer accepts delivery (e.g. by signing a delivery note).

- The critical event for a credit sale is usually the dispatch of an invoice to the customer. There is then a legally enforceable debt payable on specified terms, for a completed sale transaction.

- The critical event for a cash sale is when delivery takes place and when cash is received, both take place at the same time. It would be too cautious or ‘prudent’ to await cash payment for a credit sale transaction before recognizing the sale, unless the customer is a high credit risk and there is a serious doubt about his ability or intention to pay.

- It would again be over-cautious to wait for clearance of the customer’s cheques before recognizing sales revenue. Such a precaution would only be justified in cases where there is a very high risk of the bank refusing to honour the cheque.

- Bases

Bases are the methods that have been developed for expressing or applying fundamental accounting concepts to financial transactions and items. Examples include:

- Depreciation of Non current Assets (e.g. by straight line or reducing balance method)

- Treatment and amortization of intangible assets (patents and trade marks)

- Stocks and work in progress (FIFO, LIFO and AVCO)

- Policies

Accounting policies are the specific accounting bases judged by business enterprises to be the most appropriate to their circumstances and adopted by them for the purpose of preparing their financial accounts.

Qualities of Useful Financial Information

The four principal qualities of useful financial information are understandability, relevance, reliability and comparability.

Understandability: an essential quality of the information provided in the financial statements is that it is readily understandable by users. For these reason users are assumed to have a reasonable knowledge of business and economic activities and accounting.

Relevance: information has the quality of being relevant when it influences the economic decisions of users by helping them evaluate past, present or future events or confirming or correcting their past evaluations. The relevance of information is affected by its nature and materiality.

Reliability: information is useful when it is free from material error and bias and can be depended upon by users to represent faithfully that which it purports to represent or could reasonably be expected to represent. To be reliable then the information should:

- Be represented faithfully,

- Be accounted for and presented in accordance with their substance and economic reality and not merely their legal form,

- Be neutral i.e. free from bias,

- Include some degree of caution especially where uncertainties surround some events and transactions (prudence),

- Be complete i.e. must be within the bounds of materiality and cost. An omission can cause information to be false.

Comparability: users must be able to compare the financial statements of an enterprise through time in order to identify trends in its financial position and performance. Users must also be able to compare the financial statements of different accounting policies, changes in the various policies and the effect of these changes in the accounts. Compliance with accounting standards also helps achieve this comparability.

The Accounting Profession in Kenya

The Accountants Act Cap 531 (1977) establishes the Institute of Certified Public Accountants of Kenya (ICPAK) and two boards, to be known as the Registration of Kenya Accountants Board (RAB) and Kenya Accountants and Secretaries National Examinations Board (IASNEB)

The following are the functions of ICPAK as outlined by the Act;

- To promote standards of professional competence and practice amongst members of the institute.

- To promote research into the subjects of accountancy and finance, and related matters, and the publication of books, periodicals, journals and articles in connexion therewith;

- To promote the international recognition of the institute;

- To advise the Examinations board on matters relating to examination standards and policies;

- To carry out any other functions prescribed for it under any of the provisions of the Act or under any other written law; and

- To do anything incidental or conducive to the performance of any of the preceding functions.

A council known as the Council of the institute governs the Institute, which consists of the Chairman, nine members from the institute and one member appointed by the Minister of finance.

The Registration of Accountants Board (RAB) functions include issuing out practicing certificates and registration of qualified persons as members of the institute.

The Act also outlines the following as the functions of IASNEB:

- To prepare syllabuses for accountants’ and secretaries’ examinations, to make rules with respect to examinations, to arrange and conduct examinations and issue certificates to candidates who have satisfied examination requirements;

- To promote recognition of its examinations in foreign countries; and

- To do anything incidental or conducive to the performance of any preceding functions.

REVIEW QUESTIONS

- Why are these accounting policies necessary in the interpretation of the accounting information

- Explain the meaning of the term ‘subject over form’ in relation to the policy of treating assets in financial records

- Outline the reason why the accounting bases and policies must be disclosed to the users of final accounts

- Briefly explain the meaning and the significance of the following:

- a) Accounting concepts.

- b) Accounting bases.

- c) Accounting policies.

- d) Accounting standards.

CAPITAL AND REVENUE EXPENDITURE

Specific Ojectives

By the end of the topic, the trainee should be able to:-

- Explain the terms capital and revenue expenditure

- Explain the recording of capital and expenditure in the books of accounts

- Classify expenditure into capital and revenue Expenditure

Capital Expenditure: This is the amount spent on the acquisition of a non-current asset or adding value to a non-current asset.

Examples of expenses incurred in acquisition:

- Purchase price/cost of the asset.

- Delivery/carriage inwards costs (e.g. shipping charges or import taxes).

- Costs incurred to get the asset in use (e.g. assembly, testing)

- Installation

- Demolition costs in order to construct a new building.

- Architect fees for construction and supervision

- Legal fees incurred in acquisition of a new asset (e.g. lease agreement)

Examples of expenses incurred in adding value to an asset:

- Modify plant to increase its useful life.

- Upgrading plant to improve quality of output.

- Adopting or upgrading the production process to improve or reduce costs.

Revenue Expenditure: There’s an amount spent by the firm in the normal trading process or to assist in earning revenues or income. Examples:

- Postage and stationery.

- Carriage outwards (sales).

- Repairs and maintenance.

Example 4.10

For the business of K Spinns,a wholesaler, classify the following between ‘capital’ and ‘revenue’ expenditure:

- Purchase of an extra motor van.

- Cost of rebuilding warehouse wall, which had fallen down.

- Building extension to the warehouse.

- Painting extension to warehouse when it is first built.

- Repainting extension to warehouse three years later than that done in (d).

- Carriage costs on bricks for new warehouse extension.

- Carriage costs on purchases.

- Carriage costs on sales.

- Legal costs of collecting debts.

- Legal charges on acquiring new premises for office.

- Fire insurance premium.

- Costs of erecting new machine.

Solution.

- Capital expenditure

- Revenue expenditure

- Capital expenditure

- Capital expenditure

- Revenue expenditure

- Capital expenditure

- Revenue expenditure

- Revenue expenditure

- Revenue expenditure

- Capital expenditure

- Revenue expenditure

- Capital expenditure.

ADJUSTMENTS TO FINAL ACCOUNTS

Specific objectives.

By the end of the topic, the trainee should be able to:-

- Explain the meaning of final year accounts

- Explain the purpose of making end of year adjustments

- Explain the procedure of making adjustments in the final accounts

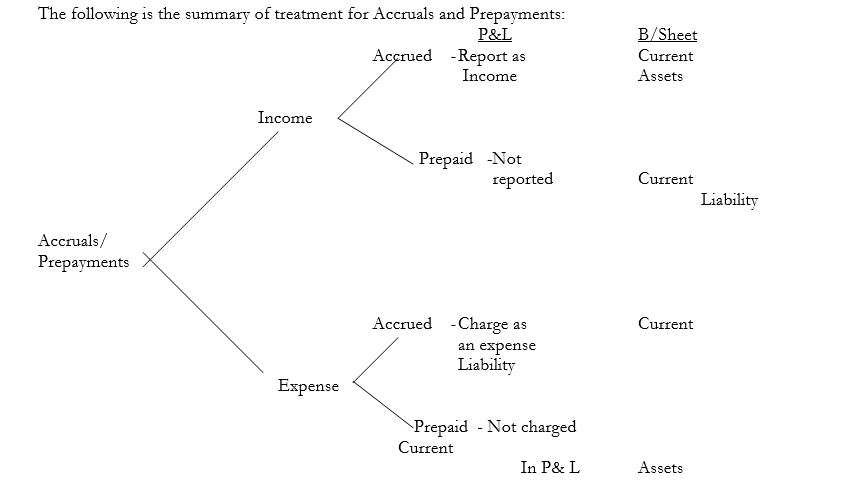

- a) ACCRUALS AND PREPAYMENTS

Revenue and costs must be recognized as they are earned or incurred, not as money is received or paid. They must be matched with one another so far as their relationship can be established or justifiably assumed, and dealt with in the profit and loss account of the period to which they relate. Therefore all incomes and expenses that relate to a particular financial period will be matched together to determine the profit for the year.

ACCRUALS

Income:

Accrued Income

This is income that relates to the current year but cash has not yet been received. An accrued income should be reported in the profit & loss account and the same income will be shown in the balance sheet as a current asset.

PREPAYMENTS

Prepaid Income

This is income that is not yet due but cash has been received for it. This happens where an income is payable in advance e.g. Rent payable 3 months in advance.

A prepaid income should not be reported in the current financial period but should be carried forward and reported in the period it relates to.

The accounting treatment will be to show it as a current liability.

Accrued Incomes and Expenses and Prepaid Incomes and Expenses are shown in the Balance Sheet as follows:

Balance Sheet Extracts

£ £

Current Assets

Stock x

Debtors x

Accrued Incomes/Prepaid Expenses x

Cash at bank x

Cash in hand x

x

Current Liabilities

Bank overdraft x

Creditors x

Prepaid Incomes/Accrued Expenses x

X

The accruals and expenses items may also be adjusted in the relevant income and expense accounts so that the correct amount of expense or income is reported in the profit and loss account for the year.

Procedures/Steps in making adjustments in the Final Accounts

- Prepare a statement of affairs at the beginning of the period (a list of all assets and liabilities) to determine the beginning capital.

- Open and post the balances and transactions to these 3 relevant accounts (i.e. the cashbook (for both cash in hand and bank), sales ledger control account and purchases ledger control account.

Any other account can be opened where necessary.

- Make adjustments for any accruals or prepayments.

- Extract a list of the balances. (Trial balance).

- Prepare the final accounts.

- b) BAD AND DOUBTFUL DEBTS

Some debtors may not pay up their accounts for various reasons e.g. a debtor may go out of business. When a debtor is not able to pay up his/her account this becomes a bad debt. Therefore the business/firm should write it off from the accounts and thus it becomes an expense that should be charged in the profit & loss account.

In practice a firm may also be unable to collect all the amounts due from debtors. This is because a section of the debtors will not honor their obligations. The problem posed by this situation is that it is difficult to identify the debtors who are unlikely to pay their accounts. Furthermore the amount that will not be collected may also be difficult to ascertain. These debts that the firm may not collect are called doubtful debts. A firm should therefore provide for such debts by charging the provision in the profit and loss account. Provision for doubtful debts maybe specific or general. Specific relate to a debtor whom we can identify and we are doubtful that he may pay the debt (if one of our debtor goes out of business).

Accounting For Bad & Doubtful Debts.

Bad debts

When a debt becomes bad the following entries will be made:

- Debit bad debts account

Credit debtors account with the amount owing.

- Debit Profit and Loss Account.

Credit bad – debts account to transfer the balance on the bad – debts account to the Profit and Loss Account.

Doubtful Debts

A provision for doubtful debts can either be for a specific or a general provision. A specific provision is where a debtor is known and chances of recovering the debt are low.

The general provision is where a provision is made on the balance of the total debtors i.e. Debtors less Bad debts and specific provision.

The accounting treatment of provision for doubtful debts depends on the year of trading and the entries will be as follows. If it is the 1st year of trading (1st year of making provision):

- Debit P&L a/c.

- Credit provision for doubtful debts (with total amount of the provision).

In the subsequent periods, it will depend on whether if it is an increase or decrease required on the provision.

If it is an increase:

- Debit P&L a/c.

- Credit provision for doubtful debts (with increase only).

If it is a decrease:

- Debit provision for doubtful debts.

- Credit P&L a/c (with the decrease in provision only).

Example

Debtors x

Bad debts (x)

x

Specific Provision (x)

x

General Provision (x)

x

Provision for discounts allowable.

In some cases a firm may create a provision for discounts allowable in addition to provision for doubtful debts. This happens where a firm anticipates that some of the debtors may take up cash discounts offered by the firm. The accounting treatment is similar to accounting for provision for doubtful debts. The provision should be made after creating a provision for doubtful debts (debtors figure less either general/specific provision for doubtful debts).

Debtors x

Bad debts (x)

x

Specific provision (x)

x

(x)

x

Provision for discount allowed (on balance) (x)

x

Profit & Loss Account (Extract)

£ £

Incomes

Decrease in provision for D/Debts x

Decrease in provision for discounts allowed x

Expenses

Bad debts x

Increase in provision for D/Debts x

Increase in provision for discounts allowed x

Balance Sheet (Extract)

Current Assets £ £

Debtors x

Less: provision for Doubtful Debts (x)

Less: provision for discounts allowed (x) x

Bad Debts Recovered

A firm may be able to recover a debt that was previously written off. The following entries will be made if this happens:

- Debit – Debtors

Credit – credit bad debts recovered account – to restore the bad debt recoverable.

N/B: This should be the amount to be recovered.

- Debit – Cashbook

Credit – Debtors with the cash received.

- Debit – bad debts recovered account.

Credit – P & L account with the same balance as bad debts account.

REVIEW QUESTION

- A firm recovers debts amounting to £10,000 that had been written off in the previous periods. In the same financial period the firm writes off bad debts amounting £30,000.

REQUIRED:

- Bad debts account to record the above transaction

- Bad debts recovered account

- Profit and loss extracts

Bad debts A/C

| £ | £ |

Bad debts recovered A/C

| £ | £ |

ACCOUNTING FOR FIXED ASSETS

Specific Objectives

By the end of the topic, the trainee should be able to:-

- Define depreciation

- Explain the causes of depreciation

- Explain the reasons for providing for depreciation

- Explain the methods used to provide for depreciation

- Explain the double entry for depreciation

- Maintain accounts for the disposal of fixed assets

- Explain the contents of a fixed assets movement schedule

It is the loss of value of a non-current asset throughout its period of use by the firm. IAS 16 on property, plant and equipment defines depreciation as the allocation of a depreciable amount of a non-current asset over its estimated useful life.

Under the matching concept, all incomes or revenues and expenses for a particular period should be reported in the financial statements and because depreciation is an expense of the business therefore, it will be charged in the P&L A/C.

Causes of Depreciation

- Physical Factors

- a) Wear and tear: Some non-current assets depreciate or lose value due to use overtime

e.g. machinery and motor vehicles.

- b) Rot/decay/rust:: This happens on assets that are not well maintained by the firm e.g.

Some machines.

- Economic Factors

- a) Inadequacy: Some assets lose value due to them becoming inadequate e.g. when a

business grows or expands then some buildings may become inadequate due to space. Also some machines that are unable to manufacture a large number of goods.

- b) Obsolescence: Some assets become obsolete due to change in technology or different

methods of production e.g. computers.

- Time Factors

Some assets have a legal fixed time e.g. properties on lease.

- Depletion

This occurs when some assets have a wasting character due to extraction of raw materials, minerals or oil. Such assets include mines, oil wells, and quarries.

Methods of Calculating Depreciation

These are the methods developed to assist in estimating the amount of depreciation to be charged in the P&L a/c as an expense.

The methods chosen by a firm should be in accordance with the agreed accounting practice, accounting standards and suit the firm’s non-current assets. There are 2 main methods of estimating depreciation and 5 others that will apply in a firm’s situation.

The main methods are: Straight-line method and Reducing Balance method. The other 5 methods include:

- Sum of the digits methods – uses a formular.

- Revaluation method – applies to a non-current asset of low value.

- Machine-Hour method – depreciation is based on number of hours a machine is expected to operate (manufacturing process).

- Unit of output method – depreciation is based on the number of units a machine is expected to produce.

- Depletion of units – depreciation is based on number of units extracted from the asset.

Straight-Line Method

This method ensures that a uniform amount of depreciation is charged in the P&L a/c for a particular asset and is based on the following formular:

Depreciation for year = Cost of asset – Residual Value = £100,000 – £20,000

Estimated useful life 8

= £10,000 per year.

Cost of Asset – Residual Value

Estimated useful life of asset.

Residual Value

The amount the firm expects to sell the asset after the period of use in the firm, also called Sales Value / Scrap Value.

Estimated Useful Life

The period the asset is expected to be used in the firm.

Reducing balance method (diminishing balance method) assumes that benefits accruing from the use of an asset are higher in the first periods of use and lower in the latter periods e.g.

- Fixtures, furniture and fitting.

- Plant and machinery.

- Motor vehicles.

ACCOUNTING TREATMENT ON DEPRECIATION