TOPIC 1 INTRODUCTION TO ECONOMICS.

Introduction to Economics

Economics is a social science which studies the allocation of scarce resources which have alternative uses among competing and usually limitless wants of the consumers in the society. It is thus concerned with the way people apply their knowledge, skills and effort to the gift of nature in order to satisfy human their material wants

It is also defined as the study of how human beings strive to satisfy their unlimited wants using limited resources.

Basic Economic Concepts

1 HUMAN WANTS.

This are basic needs that human beings need to function normally this include; food, shelter, clothing and air. Things like radio, education, watches, and vehicles are not very basic. They are meant to have an individual have a happy and comfortable and luxurious life.

- Form utility-This is created through changing the form of a raw material to a finished product. It is usually done during various manufacturing processes. The finished goods are in a better form for use than the raw materials.

- Time utility-this is created through warehousing or storage

- Possession utility-This is created through trade or exchange.

- Place utility-this is created through distribution. After goods have been produced, they must be moved to the places where they are required for use.

Characteristics of human wants.

- They are many, numerous and unlimited.

- They continually change with time and other factors.

- Some are repetitive e.g. supper, lunch etc.

- Wants are competitive

- Wants are complementary-Used together e.g. shoe polish and a shoe.

- Wants are habitual that they always occur e.g. toothpaste, perfume etc.

- Wants are universal-Everybody wants them.

Characterisics of basic wants.

- One can’t do without them.

- They are felt needs

- Can’t be postponed

- They are satisfied before secondary wants.

Difficulties in satisfying human wants.

Although human wants are there to satisfy man with lives requirements, it is not always possible to have them this is because;

- They are too many and new ones keep cropping up.

- Resources to satisfy them are never enough (limited).

- They are repetitive hence people will always strive for more resources.

- They continually change with time and other factors like age and gender.

- Some are habitual making life unbearable without them.

- Due to scarcity of resources, a problem of deciding which want to satisfy first with scarce resources arise.

Types of human wants.

They are classified into two groups.

1.Basic human needs-This are things one cannot do without e.g. food. They always come at the top for the scale of preference and failure to satisfy them one can lead a miserable life or even die.

- 2. Secondary human wants-they are things one cannot do without. They help one lead a happy meaningful and comfortable life e.g. TV set, radio, cars, education, sodas etc.

NB.one must satisfy basic needs before attaining secondary wants.

Since the resources to satisfy human wants are scarce, one has to select on what wants are to be satisfied first and which can wait.

2 Economic Resources These are ingredients that are available for providing goods and services in order to certify the human wants. A resource must be scarce and have money value.

Characteristics of economic resources.

- They are scarce in relation to their uses

- They have a monetary value.

- They have alternative uses.

- They are unevenly distributed

- They have utility

- Can be combined to produce goods and services. They are transferrable from one place to another.

Types of economic resources.

There are three main ways of classifying economic resources namely;

- Natural resources-They are also called the gifts of nature and are fixed in such by they are held in trust by the government for the citizens. They include; forest, river, mountain, minerals and lakes.

- Artificial resources-They are created by people through various production activities e.g. machinery,tools,roads,railway,airport,dams,bridges,h.e.p,harbours,soaps,books.

- Human resources-They are mental/physical efforts offered by people to the production society. These efforts cannot be separated from their providers e.g. teaching, health services, mechanics, carpentry, engineers etc.

3Natural Resources refer to anything given by God or nature such as fertile soil, rivers, lakes, mountains etc.

4 Man Made Resources refers to anything created by man to assist in further production such as tools, equipment’s, roads and buildings etc.

5 Scarce and Choice if the resources available are not enough to produce goods and services to satisfy all the wants then they are said to be scarce. As a result, individuals and society cannot have all the things that they want. Since resources are limited, choices have to be made. The choice to satisfy one want implies others are forgone. Individuals have to make choices e.g. consumers with their limited income and unlimited wants have to choose how they spent their income.

Importance of scarcity.

- Makes people to work hard

- Stimulates usage of available resources

6 Opportunity Cost refers to the value of benefit expected from the best second alternative forgone. It is based on the fact that resources being scarce have competing alternative uses. The choice to satisfy one alternative means that another is forgone. The value of the second best forgone alternative is the opportunity cost.

7 Utility-this is the quality of that commodity that satisfies human want.

8.Economics-subject/discipline.

9.Economy-this is the country’s financial position.

- Economies-this are the benefits of large scale.

11.Ceteris paribus-this is a major concept meaning, other factors held constant

- Pareto efficiency-this is a situation in which it is not possible to make someone better off without making someone worse off.

13.Consumer sovereignity-this refers to the freedom of individuals and households to decide for themselves what they want to buy in a given market.

Production Possibility Frontier/Capacity (PPF/PPC)

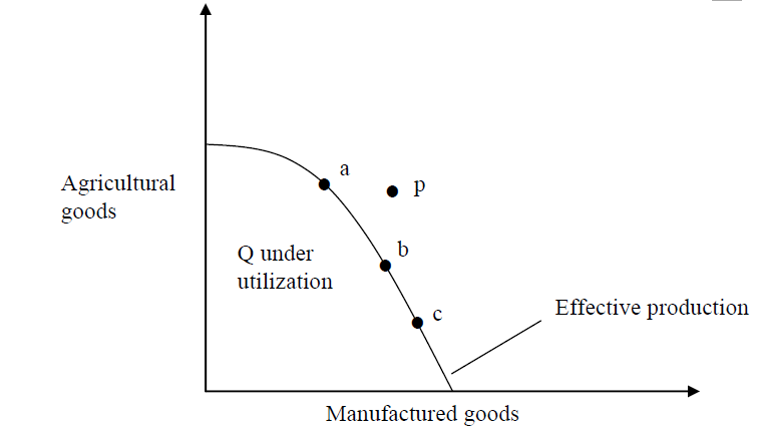

It provides a graphical illustration of the problem of scarcity and choice which is the basic economic problem. The curve shows what a country produces with existing supply of land, capital and entrepreneurship ability. With limited supply of economics resources a country has a wide variety of options and variety of goods and services it can produce. Assume a simple hypothetical economy where a country produces two types of goods i.e. agriculture and manufactured goods. The two extreme possibilities are:

- a) The country commits all its resources to the production of agriculture and non to manufacturing.

- b) All the resources are put to manufacture and none to agriculture.

These two extreme cases are unlikely and the country will most likely choose to produce goods of both commodities. The opportunity cost of producing either of them is increasing which the law of diminishing return.

The main branches of economics are:

- Microeconomics

This is the study of the smallest economic decisions making units of the society. Microeconomics theory is a branch of economics that studies the behavior of individual decision making units such as consumers, resource owners and business firm as well as individual markets in a free market economy. The aim of microeconomics is to explain the determination of prices and quantities of individual goods and services. Microeconomics also considers the impact of government regulation and taxation of individual markets. For example, microeconomics analyses the forces that determine the prices and quantities of television sets sold. Microeconomics can be considered as the ultimate cellular structure of economics. It is the study of individuals, households and firms. The major areas are

demand and supply analysis , market equilibrium ,consumer theory , theory of the firm , market structure and distribution theory

2.Macroeconomics

This is the study of bigger and complex systems. Macroeconomic theory is the study of the behavior of the economy as a whole whereby the relationship is considered between broad economic aggregates such as national income, employment and prices. The economy is disaggregated into broadly homogenous categories and determinants of the behavior of these aggregates are integrated to provide a model to the entire economy.

Macroeconomics focuses on the economic stabilization whereby government policy is used to moderate business cycles and encourages real economic growth. Macroeconomics became a separate topic of discussion in the aftermath of John Maynard Keynes and the great depression. The line between microeconomics and macroeconomics is, however, blurred and there are many areas of overlap between the two. Key areas of macroeconomics are:

national income ,economic growth and development , money and banking , public finance unemployment ,inflation and international trade

Why Study Economics?

It is useful to study economics for the following reasons

- Economics provides the underlying principles of optimal resource allocation and thus enables individuals and firms to make economically rational decisions. Thus for example the preparation of budgets involves knowledge of demand and elasticity analysis. The making of price policy decisions draws heavily on the concept of elasticity in economics. Additionally, the theory of production in economics is concerned with the principles that facilitate the optical combination factors of production.

- A study of economics enables individuals and organizations to appreciate the constraints imposed by the economic environment within which any entity operates. Thus an individual or firm is more fully enabled to appreciate the implications of the annual budget considering how for example the increased liberation of the economy will affect a particular business entity and the economy in general. Additionally, the student of economics is able to appreciate the effects of such economic variables as inflation, exchange rates, interest rates money supply and so on.

- The area of development economics is fundamentally concerned with the reasons why societies develop and means of accelerating development. It is vital for individuals as citizens to appreciate the parameters that determine the development process so that they contribute more fully to facilitate and contribute to solving the economic problems that characterize their society.

- Economics is an analytical subject and its study can help develop logical reasoning which is never superfluous.

- It is an examinable and mandatory for students perusing business courses

- Students appreciate the effect of economic variables e.g. inflation, exchange rate, interest rate, money and supply etc.

The Methodology of Economics

The methodology used in studying and applying economics can be divided into three. This are basically the methods of solving economic problems.

- Positive economics is concerned with what is, or how the economic problem facing societies are actually solved.it deals with facts using positive statements. for example; “Kenya is a member of the East African community” and “Uganda is currently Kenya’s major trading partner” are positive statements. For example a dispute over whether Uganda is currently Kenya’s major trading partner can be settled by looking at the statistics of Kenya’s trade with its partners.

- Normative economics refers to the part of economics that deals with the value of judgments. This implies that normative deals with what ought to be, or how the economic problems facing the society should be solved. Normative statements usually reflect people’s moral attitudes and are expressions of what particular individuals group thinks ought to be done. A statement such as “Uganda to should join the Southern Africa

Development Community” or “upper income classes ought to be taxed heavily”, are normative statements.

- Scientific method

Economics make use of scientific method to develop theories. Inquiry is generally confined to positive questions. One of the major objectives of sciences is to develop theories. A theory is a general or unifying principle that describes and explains the relationship between things observed in the world around us. The purpose of a theory is to predict and explain. The search for a theory begins whenever a regular pattern is observed in the relationship between two or more variables and one asks why this should is so. A theory refers to a hypothesis that has been successfully tested. It is important to note that economics hypothesis is not tested by realism of its assumptions but its ability to predict accurately and explain. The following procedures are adopted in the scientific method:

- i. The concepts are defined in such a way that they can be measured in order to be able to test the theory against the facts.

- ii. A hypothesis formulated..

iii. The hypothesis is then used to make predictions.

- The hypothesis is tested by considering whether its predictions are supported by facts.

Economic Systems

These refer to the way in which different societies solve the three different basic economic problems which are: which goods should be produced and in what quantities?

- How should various goods and services be produced?

- How should various goods and services be distributed?

To answer this question, various political and economic structures have been put in place, whereby we have;

- Free market/capital system/laser faire economy

It refers to a system where decisions about allocation of resources are made by individuals on the basis of prices generated by forces of market prices of demand and supply.

FEATURES /CHARACTERISTICS

- Private property individuals have the right to own or dispose off their property as they may consider it fit.

- Freedom of choice and enterprise Individuals have the right to buy or hire economic resources, organize them for production purpose and sell them in the market of their choice. Such persons are referred to as entrepreneurs.

- Self interest in the pursuant of personal goals. The individuals are free to do as they wish and have the motive of economic activity in self-interest.

- Competition There is a large number of buyers and sellers such that each buyer and seller accounts for but is insignificant to influence the supply and demand and hence prices.

- Reliance on price mechanism .This is an elaborate system of commerce in which numerous choices of consumers and producers are aggregated and balanced against each other. The interaction of demand and supply determine prices.

- No government intervention hence no price controls, taxes and subsidies.

- There are property rights provided and enhanced by the government through copy rights patents, trademarks etc. e.g. on innovating and inventing one is protected from absorption and thus you enjoy the benefits.

- There is excessive advertising.

Advantages of free market economy

- There is the matching of demand and supply. Production takes place in response to demand hence a balance between what is produced and consumed. No wastage.

- There is flexibility of the market in responding to changes in demand and supply conditions thus variety products are offered.

- There are no resources wasted in planning as no planning is required

- Consumer sovereignty and competition gives rise to a wide variety of goods and services giving consumers a wide range to choice from.

- Higher rates of economic growth due to the incentive available for hard work which is motivated by profits.

- No wastage of resources on unrealistic projects because investment decision are based on profits.

- The costs associated with government bureaucracy are highly reducing encouraging entrepreneurship in the economy.

- Better quality products are produce due to innovation and inventions

- Intensive innovation and invention is prevalent due to competition.

- Affordable prices of products.

Disadvantages of free market economy

- Income inequality the ability of some people and firms to acquire excessive market power leads to greater inequality in income and wealth.

- There is likelihood of developing Monopoly powers whereby one firm controls the production and distribution of commodities.

- The price mechanism on its own cannot allocate resources to production of public goods e.g. schools, security etc.

- Instability in economy and unemployment. This is due to trade cycle i.e. recession, depression, recovery and boom.

- The inability to deal with structural changes caused by wars, natural calamities among others.

- Inadequate provision of merit goods. Merit goods are goods of importance to the community such as health, education, security among others

- Due to excessive advertising consumers are likely to make irrational choices at the expense of moral life/health

- Over-exploitation of resources

- Planned economy/command/government controlled/socialism/communism

It refers to an economic system where the crucial decisions are determined a body appointed by the state. The body takes up the role of mechanism which prevails in a free market economy

Features of a command economy

- Leadership and control of economies. All important means of production (resources) are publicly owned such as land, power generation, housing among others.

- Rationing of certain commodities if supply of such fall below demand.

- Existence of production targets for different sectors of the economy. The government determines how resources are allocated through planning.

- Fixing of prices and wages

- Occasional existence of restricted labor market in which workers take up jobs assigned to them.

6 Government decides what is to be produced, how it will be produced and for whom to produce.

Advantage of planned economy

- Avoids economic instability

- Minimize negative externalities

- Makes adequate provision of public and merit goods ie education, health and safety.

- Facilitate the shift of resources in pursuant of grand schemes such rapid industrialization

- Puts checks on monopoly power which are controlled by state monopolies (Parastatals).

- Ensures there is full employment.

- Low inflation rate is being experienced.

- Minimum waste of resources.

- Minimum inequalities of wealth and income

- Easier government control.

Disadvantages of Planned economy

1There is wastage of resources in production because consumers demand is judged in advance without the use of price mechanism.

2 The cost of gathering information for planning is expensive to the state.

3 There is no individual incentives and initiative for hard work and innovation.

4 The power of consumer sovereignty is curtailed.

5 There is no incentive for hard work and this discourages the suppliers

6 Some resources may end up being underutilized

- Difficulty in estimating demand due to different time frames i.e. Decembers and end month and sometimes during certain occasions such as valentine demand tends to rise.

(c) Mixed economy

Refers to an economic system where resource allocation is determined by the state-i.e. the government and price mechanism. Both the government and private sector have a role to play in resource allocation.it is widely adopted in many countries and results varied depending on nature of the economy. The government normally intervenes when the private sector of market fails to allocate resources effectively as long as the objective of the economic growth and development is achieved.

Advantages of mixed economic systems.

- Optimal utilization of nations resources

- Relatively wider tax base

- Consumers are protected from consumption of harmful products

- A considerable degree of consumer sovereignity.

- High quality products and services due to competition

- More equal istribution /allocation of resources.

- Relatively stable prices.

Role of government.

- Checking quality of products.

- Offering government subsidies

- Offering import and export tariffs.

- Ensuring price controls

- Foreign exchange market

- Taxation by ensuring there is redistribution of income through a system of taxation.

- To create a framework of regulations and rules to ensure fair competition thus promoting competition between firms both small and big ones.

- Government intervention can prevent market failures in price mechanism.

- Stabilization of the economy.

- The government is able to maintain competition by controlling monopoly power.

TAKE AWAY ASSIGNMENT

MIXED ECONOMIC SYSTEMS ARE NOT THE BEST.DISCUSS.(15 MARKS)

Format

- Introduction

- Body

- Conclusion

- References

- Type-times new roman, font-1.5, line spacing 1.5, page numbers-must.

TOPICWO: DEMAND ANALYSIS.

The theory of demand and supply enables us to understand the determination of prices and quantities in different markets. For example, why the prices of agricultural commodities such as tomatoes, apples, mangoes and cabbages increase and decrease at certain times of the year, why have the prices of computers, music systems and television sets been steadily declining over time. An understanding of the working of the price system provides us with the answers to some of these questions. The price system provides the basis for determining the prices of factors of production.

Definition of Demand

Demand refers to the quantity of a commodity that consumers are willing and able to purchase at any given price over a given period of time, holding other factors constant. It is important to realize that demand is not the same thing as want, need or desire. Only when want is supported by the ability and willingness to pay the price does it become an effective demand and have an influence on the market price. Hence demand in economics means effective demand. It is different from desire in that it has to be supported by the ability to purchase the product/service.

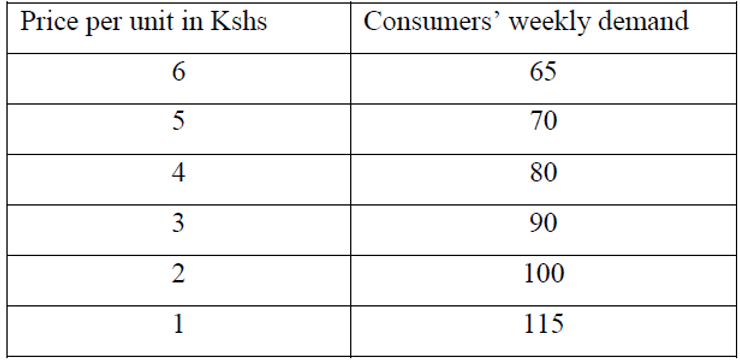

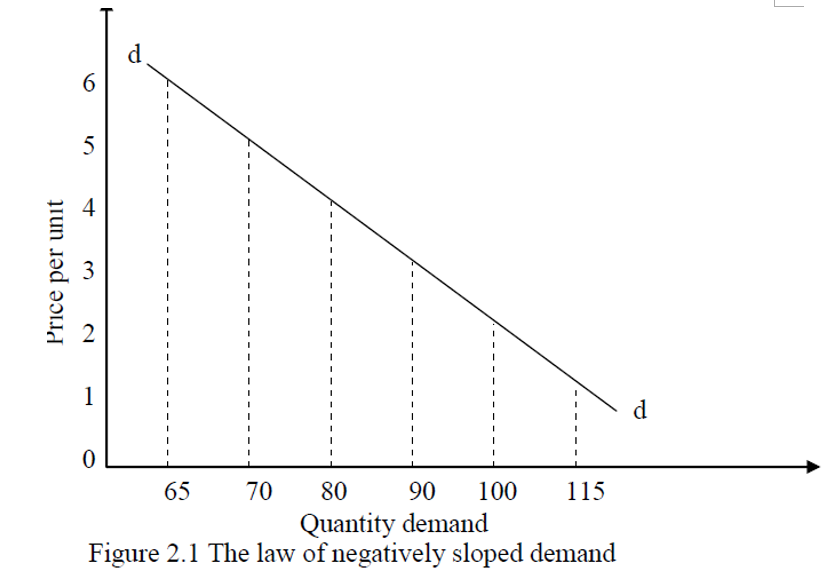

The price of a commodity is most important factor/determinant of demand. All factors affecting demand other than the price are referred to as conditions for demand. While analyzing the relationship between price and quantity of demand economists assume that all factors affecting demand remain constant. An individual demand for a given good can be presented in a form of a demand schedule. A demand schedule is a table showing quantity of a commodity that could be purchased at various prices. The Table 2.1 shows an individual’s demand for commodity X.

From the table, 65 units of commodity X will be demanded per week if the price is Kshs 6 per unit.

A demand schedule can be represented in the form of a graph known as a demand curve. Figure 2.1 shows the demand curve for commodity X. The curve shows graphically the relationship between quantity demanded and the price of the commodity. A demand curve has a negative slope. It slopes downwards from left to right showing that as the price of a commodity falls demand increases. The inverse relationship between the price of a commodity and the quantity demanded is what is referred as the law of demand.

This law states that, “ceteris paribus (other things remaining constant), the lower the price of a commodity the greater the quantity demanded by the individual and vice versa”.

Exceptions to the Law of Demand

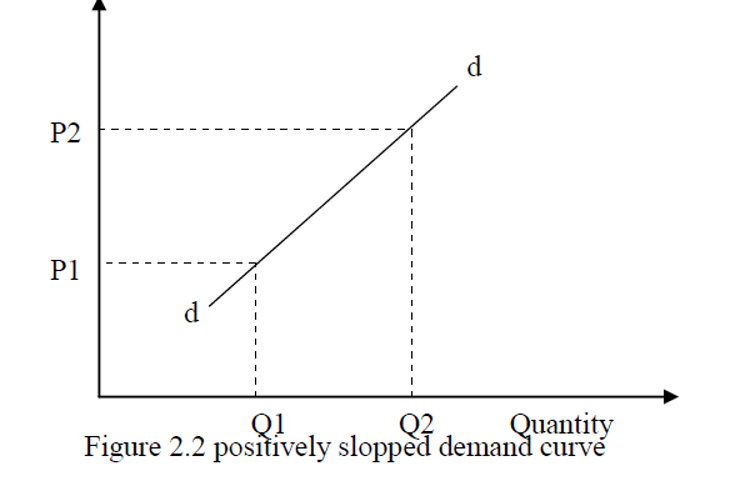

There are some demand curves that slopes upwards from left to right showing that as the prices of a product rise more is demanded and vice versa. This type of demand curve is known as regressive, exceptional or abnormal demand curve and occurs in the following situations:

- When there is fear of a more drastic price changes in the future. This will causes consumers to increase their quantity demanded to avoid paying a higher price in the future. This situation is often found in the stock exchange where there is often an increase in the demand of shares of a company if its shares are expected to increase.

- In the case of giffen goods. This refers to basic foodstuffs that constitute a high proportion of the budget of low income families. When the price of a giffen good rises, the proportion of the total income of individuals who consumes these giffen goods rises and since such consumers are worse off in real terms, they can no longer afford to consume other more expensive commodities like meat and fruits. To make up for the goods they can no longer afford to buy, they are more likely to purchase more of basic foodstuffs; conversely when the price of basic foodstuffs falls. They become better of in real terms and are likely to buy more or relatively more expensive foodstuffs and less basic foodstuffs. Ie ugali and meat.

- Goods of ostentation (Veblen goods). These are commodities whose prices falls in the upper price ranges and that have a snob appeal. The wealthy are usually concerned about status. Believing that only goods at high prices are worth buying and worth the effect of distinguishing them from other consumers. In the case of such commodities, a firm increasing its prices may find that the sales of its product increase and at lower prices less of the commodity may be bought as the commodity is rejected as being substandard. Consumers often in making comparisons between similar products with different prices opt for relatively more expensive product believing it to be better. As prices increase demand increases this is referred to as snob effect. Examples of goods of ostentation are expensive perfume, jewellery, cars clothes, etc. The demand curve will be positively slopping as indicated in Figure 2.2.

4.inferior goods- these are goods assumed to be of low quality compared to others available that can be used to satisfy same want.an increase in price of an inferior good may be taken to mean an improvement in quality. Demand for such commodities will hence tend to increase with increase in prices.

- Expectation of future shortages

- Necessities-they are necessary for life. Demand will not change even if prices go up.

7.Habitual goods and services-a consumer will consume certain goods and services at same quantity at any price because these goods have become habitual and one can’t do without them e.g. addictive’s ie drugs.

The Determinants of Demand

The demand of the product can be considered from the standpoint of either individual demand or market demand. Demand for any commodity can be considered from two points of view:

(a) Individual demand is the amount the individual is willing and able to buy at a given price and over a given period of time. Factors affecting individual demand are;

- The price of the product.

When deciding whether or not to buy a particular product, an individual will compare the price of the product and the amount of utility or satisfaction expected to be received from the product. If the price is considered worth the anticipated utility the individual will buy the product and if not will not buy. A decrease in the price of a product will probably increase individual’s demand for it since the amount of utility obtained is likely to be worth the lower price. Conversely a rise in the price of a product will probably result in a fall in demand, as the amount of utility received is less likely to be worth the higher price to be paid. An example of this phenomenon is the hotel industry in Kenya. There is usually an increase in domestic tourism during the low season when many Kenyans consider the lower hotel prices to be worth the level of satisfaction they are receiving. During the high season when the hotel prices are high, many do not consider the satisfaction they are receiving to be worth. If the amount a consumer is willing and able to purchase due to change in the price, a change in the quantity demanded is said to take place. If on the other hand the amount the consumer is willing and able to purchase changes because of a change in the price of a given commodity leads to a change in the quantity demanded will be undertaken later in utility analysis and indifference curve analysis.

- The prices of related goods.

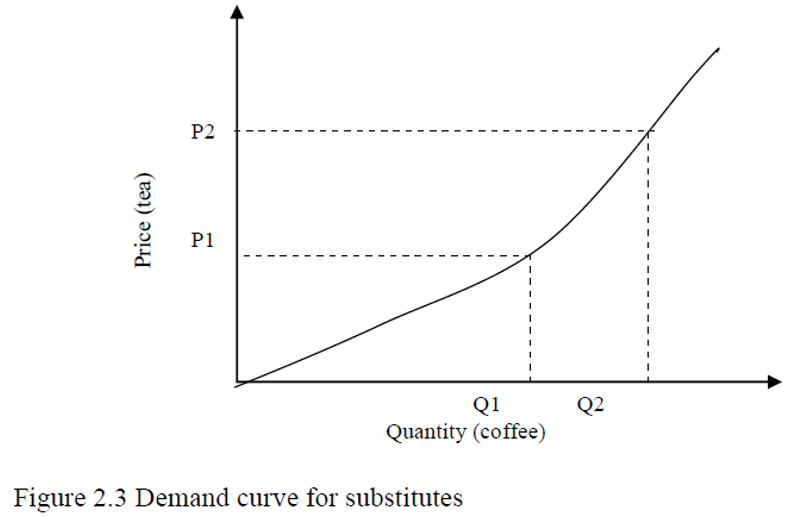

The demand for all goods is interrelated in that they are competing for consumer‟s limited income. Two peculiar interrelationships can be; Substitutes goods such as tea and coffee butter and margarine, beef and mutton, a bus ride and a matatu ride, a mango and an orange, CDs and cassettes. Two goods, X and Y are said to be substitutes if a rise in the price of one commodity, say Y, leads to a rise in the demand of the other commodity X. If the price of tea increases consumers will find coffee relatively cheaper to tea as a result demand for coffee increases. Substitutes are commodities that can be used in place of other goods. This phenomenon is illustrated in Figure 2.3. The graph shows the relationship between the prices of tea over the quantity for coffee. If the price of tea increases from P1 to P2 the quantity

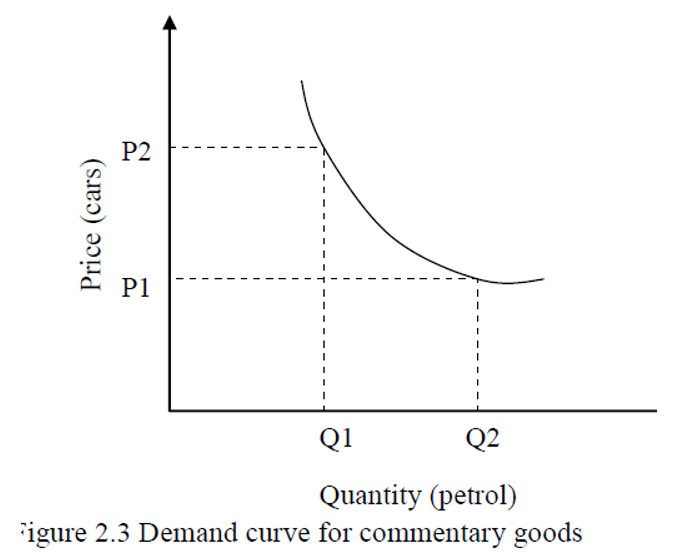

Compliments goods such as shoe and polish, pen and ink cars and petrol, computers and software, bread and margarine, hamburgers and chips, tapes and tape recorders. Demand for some commodities can also be affected by changes in the prices of the complementary if a rise in the price of one of the goods, say A leads to the fall in the demand of another food, say B. Complimentary goods are usually jointly demanded in the sense that the use of one requires or is enhanced by the use of the other. Figure 2.4 illustrates the relationship between complementary goods graphically. For example if the price of cars is lowered demand for petrol increases because more cars will be bought/demanded. The curve shows the relationship between the price and of a car and quantity demanded for petrol. If the price of cars falls from P2 to P1 the quantity demanded for petrol increases from Q1 to Q2.

- Changes in disposal real income.

An individual‟s level of income has an important effect on the level of demand for most products. If income increases demand for the better quality goods and services increases. This relationship however, depends on the type of goods and level of consumers‟ income. The three types of are goods; Normal goods these are goods whose demand increases as income increases. The demand for normal goods increases continuously with increase in income. It tends to become gently as people reach the desired level of satisfaction.

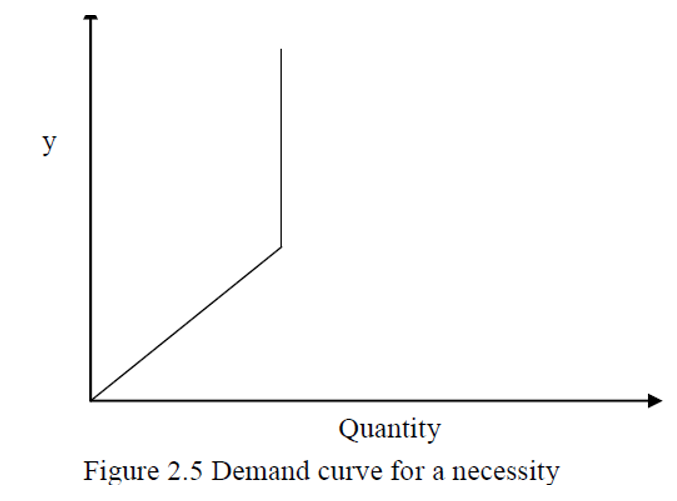

Inferior goods refer to goods for consumers with low income levels such that as income increases its demand falls. At low level of income, these individuals will tend to consume large amount of these goods but as income increases they buy other goods which they consider superior thus demanding less of the inferior goods. At very low level of income an inferior good behave like a normal good only to behave inferior as income increases. Necessities these are goods which consumers cannot do without such as salt, match boxes among others. Their income demand curve tends to remain constant other than at the lowest levels of income as indicated in Figure 2.5

- Changes in consumer tastes, preferences and fashion

Personal tastes play an important role in governing the consumer’s demand for certain goods. For example, preferring to consume imported commodities despite them being extremely expensive. Prevailing fashions are an important determinant of tastes. The demand for clothing for example, particularly is susceptible to changes in fashion.

- Level of advertising is also an important determinant of demand. In highly competitive markets, a successful advertising campaign will increase the demand of a particular product while at the same time decreasing the demand for competing products. Increase in advertising will increase demand in the following ways;

– it helps inform about the product of a firm

– Can introduce new products to the market.

– Induce individuals to frequently use the product/service

Factors affecting advertising policies

– cost of advertising

– mode of advertising

– impact of advertising on the demand of the product

– The target group (old, young)

– number of competitors and quality of their products

– The market share of the firm and the degree of competition

– Future expectations in price changes

– Government policies and taxes

– Appropriate time to make advertisements

– Cultural background

– Language

6.The availability of credit consumers.

This factor especially affects the demand for durable consumer goods which are often purchased on credit. For example a decrease in availability of credit or the introduction of more stringent credit terms is likely to lead to a reduction in the demand of some durable consumer goods.

7.The government policy

The government may influence the demand of a given commodity through legislation. For example making it mandatory for everyone to wear seatbelts. The consumers inevitably get to purchase more seatbelts as a result. Subsidies it’s the opposite of taxation. When the government grants subsidies prices of goods falls leading to increase in demand and vice versa. Price controls and legislations are also government methodologies that will affect demand

8.Climate change demand of various goods varies depending on weather. For instance there is high demand for woolen clothes during rainy reasons

(b) MARKET FACTORS AFFECTING INDIVIDUAL DEMAND

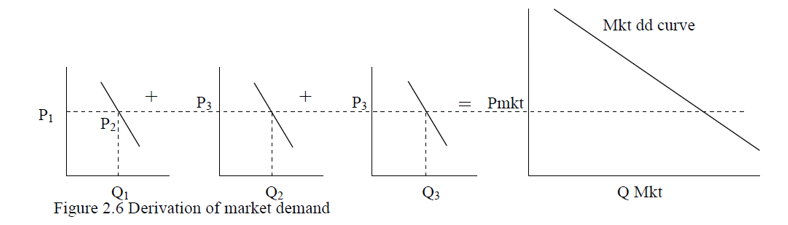

It’s a horizontal demand sum of the demands for individual consumers. It refers to quantity demanded in the market at each price by individual consumers. For this reason all the factors affecting individual demand will affect market demand. The market demand for a commodity can be derived graphically as in Figure 2.6.

Where P1, P2 and P3 are individual prices Q1, Q2 and Q3 are individual quanties demanded. Pmk is the market price qmk is market quantity demanded. Other factors affecting market demand Change in population market demand is influenced by the size of the population, the composition of the population in terms of age sex as well as geographical distributions. Distribution of income more evenly distribution of income may increase demand for normal goods while at the same time it may lower the demand for luxuries.

Movement Along and Shift in Demand Curve

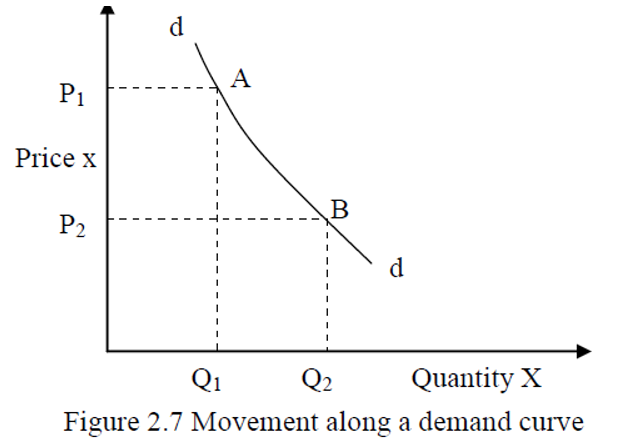

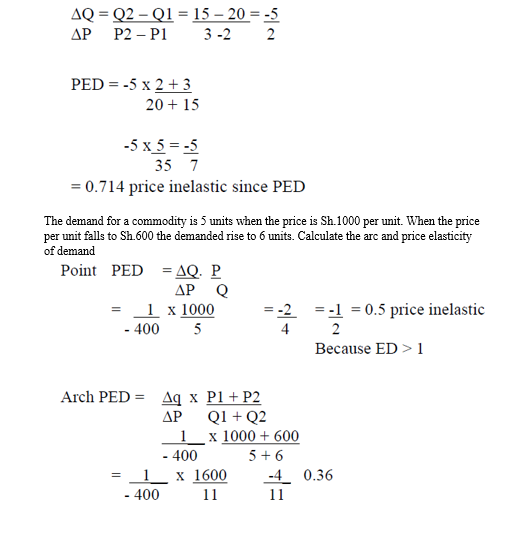

Demand is a multi- variant function in the sense that it is influenced by so many factors such as the price of the commodity, the price of other related commodities, consumer incomes etc. The price of the commodity is the most important determinant of demand and its relationship with the quantity demanded give rise to a demand curve. Movement along demand curve is demonstrated by a change in the price of a good as shown in Figure 2.7 by movement from one point to another on the same demand curve.

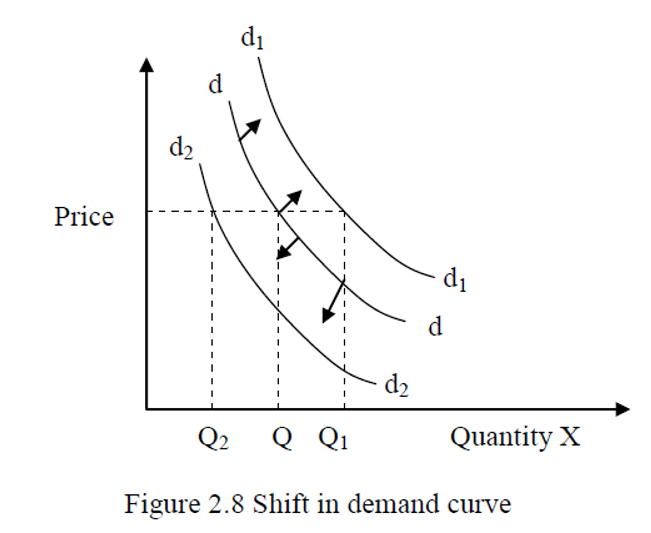

A change in price of a good from P1 to P2 causes a movement from point A to B along the demand curve. This movement along demand curve shows a change in quantity demanded which is an increase or a fall in the quantity demanded. A shift in the demand curve is caused as a result of a change in any factor affecting demand other than price such as changes in consumer income tastes and preferences. For this reason all other factors affecting demand other than price of the product are also referred to as shifting factors as illustrated in Figure 2.8 Any change in the shifting factors will cause changes in demand (an increase or a fall in demand). A shift to the right (dd to d1d1) shows an increase in demand while a shift from (dd to d2d2) shows a decrease in demand.

TERMS USED IN DEMAND

(a) Joint demand it is the demand whereby two commodities are always demanded together. One good cannot be demanded in the absence of the other such as car and petrol.

(b) Competitive/rival goods it is the demand for goods which are substitutes such tea and coffee.

(c) Derived demand where goods are demanded in order to provide goods such as cotton is required to produce cotton wool

(d) Composite demand (several uses) where some goods are used for different purposes such as steel for cars machine etc.

Elasticity of Demand

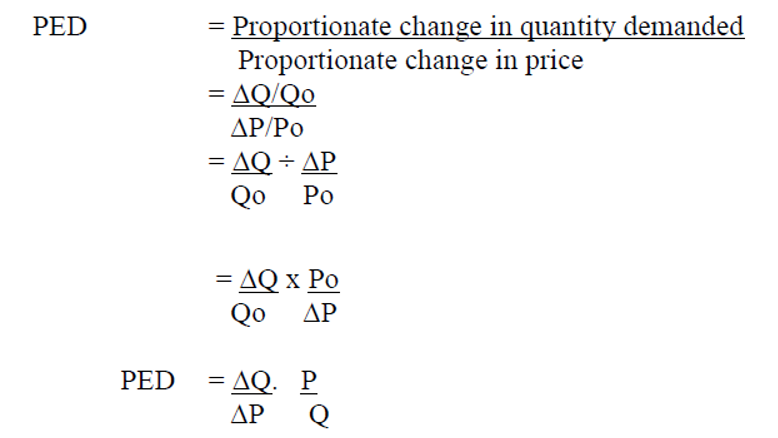

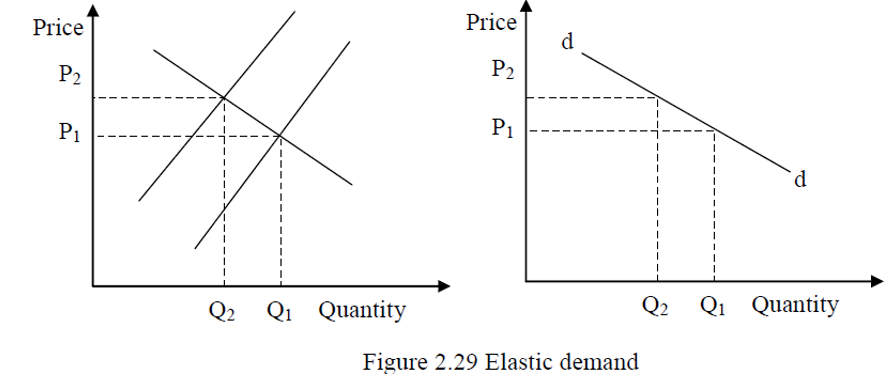

It can be defined as the ratio of the relative change of a dependent variable to changes in another independent variable. Elasticity can be analyzed in terms of demand and supply. It can also be defined as a measure of responsiveness of quantity demanded of a good in to changes in income or prices of other related goods. There are three types of elasticity; price elasticity of demand, cross elasticity of demand and income elasticity of demand. Price elasticity of demand it‟s the measure of responsiveness of the quantity demanded of a commodity to changes in its own price. It is also referred to as own price elasticity. It abbreviated as PED/ED. It is calculated as follows

If changes in prices cause more than proportionate change in quantity demanded it is said to be price elastic, in this case ED >1. If changes in the price causes less than proportionate change in quantity demanded, then demand is said to be price inelastic this is represented by ED < 1. If changes in price causes proportionate change in quantity demanded then, demand is said to be unit elastic or unitary elastic where ED= 1

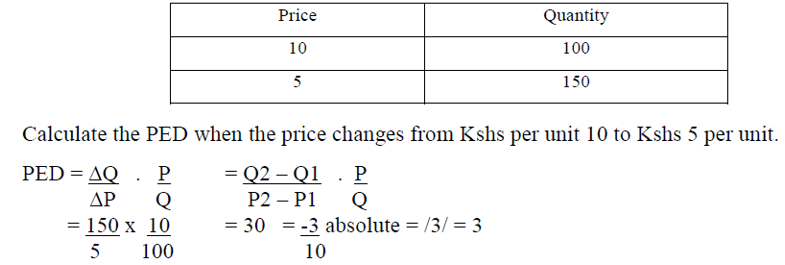

To illustrate price elasticity consider the Table 2.3 which shows demand schedule of commodity X.

This price elastic because 3 >1 The price elasticity of demand is classified into two:

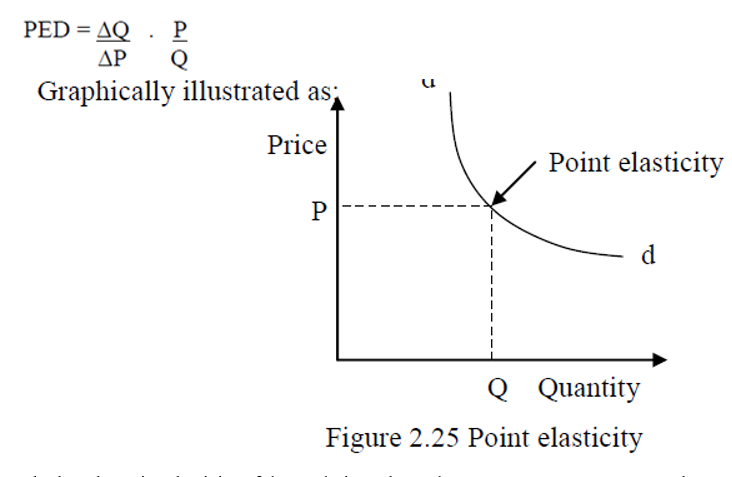

(i) Point elasticity

(ii) Arc elasticity

The point elasticity of demand measures elasticity at a particular point along the demand curve. It is calculated using the formulae

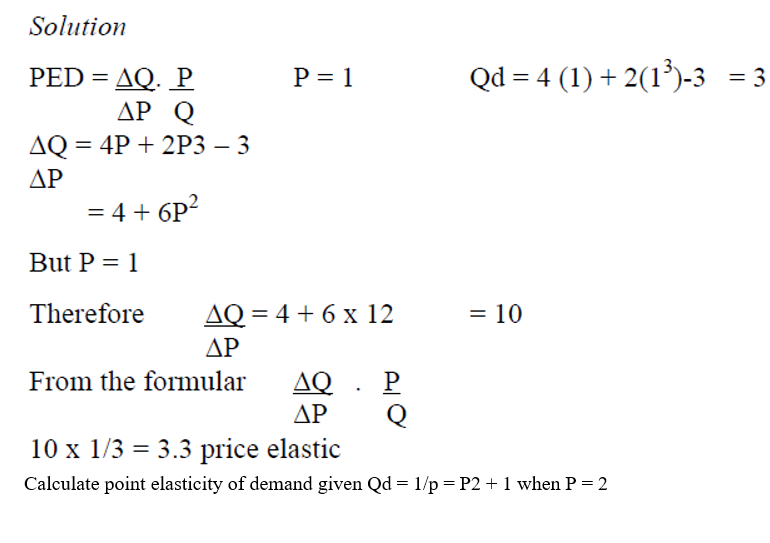

Calculate the point elasticity of demand given that Qd= 4P +2p3 -3 Q = 4+2-3 =3Where P =1

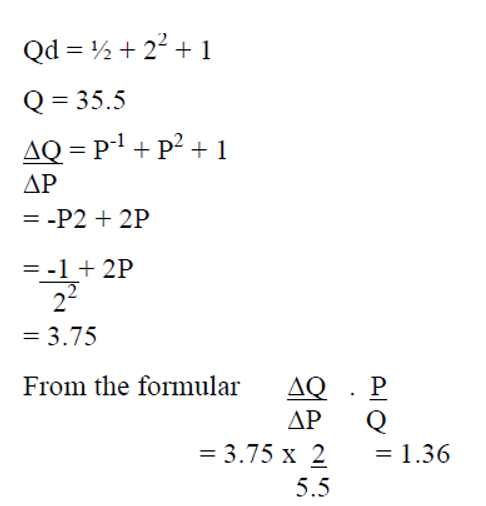

Arc Elasticity of demand

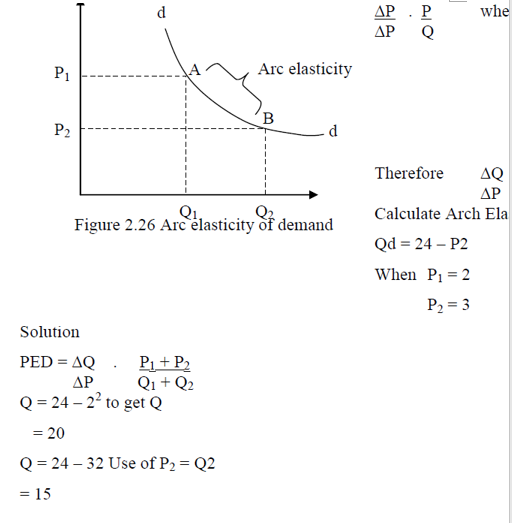

This measures the elasticity of demand between two points on the demand curve. Arc elasticity is the coefficient of the price elasticity between two points on the demand curve. It is therefore an estimate of the elasticity along a range of the demand curve. This estimate improves as the arc becomes small and approaches a point in the limit. Arc elasticity can calculated for both linear and non-linear demand curves using the following formula: It is illustrated as in Figure 2.26

TYPES OF ELASTICITY

There are five types of elasticity of demand.

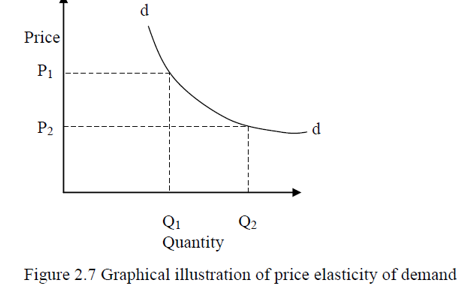

(i) Perfectly elastic demand. Demand is said to be perfectly elastic when the consumers are willing to buy an amount of a commodity at a given price, but non at a slightly higher price. In this case elasticity of demand is equally to infinity. The will be a horizontal straight line as illustrated in Figure 2.28. This is a case of a commodity in a perfectly competitive market. Where an increase in price may lead to a loss of all customers.

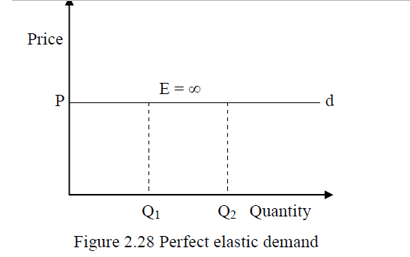

(ii) Elastic demand. Demand is said to be price elastic when a charge in price causes more than proportionate change in quantity demanded. In this case the value of elasticity of demand is greater than 1 and the demand curve will be gently sloped as indicated in Figure 2.29. This implies that if prices increase from P1 to P2 the quantity demanded falls in greater proportion from Q1 to Q2 and vice versa. This is a case of luxury commodity which consumes can do without or a case of a substitute

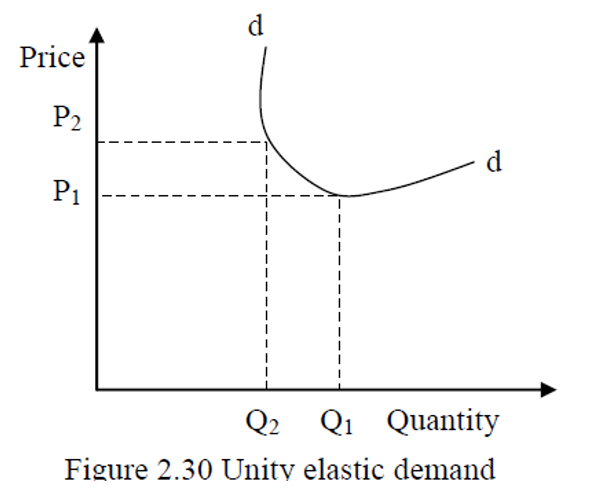

(iii) Unity elastic demand. Demand is said to unit elastic if changes in price cause proportionate change in quantity demanded. If price increase quantity falls in the same proportion and vice versa. ED = 1 and the demand curve will be rectangular hyperbola as illustrated in Figure 2.30. This is a case of a good that lies between a luxury and necessity such as soap opera film or movie

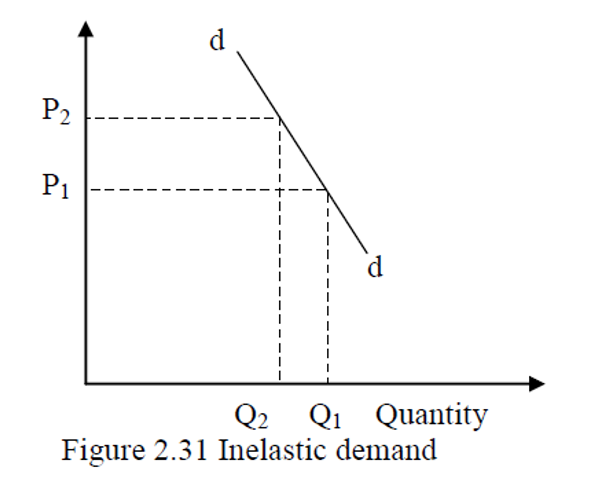

(iv) Inelastic demand. Demand is said to be price inelastic if changes in price causes less than proportionate change in quantity demanded. If prices increases the quantity falls in less proportion and if the prices falls the quantity demanded increases in less proportion ED < 1 as illustrated in Figure 2.31. This is a case of a good which is a necessity. These are goods which consumers cannot do without but need not be consumed in fixed amount like an absolute necessity such a staple food like ugali and milk. It also applies in the case of habit forming goods like beer and cigarettes

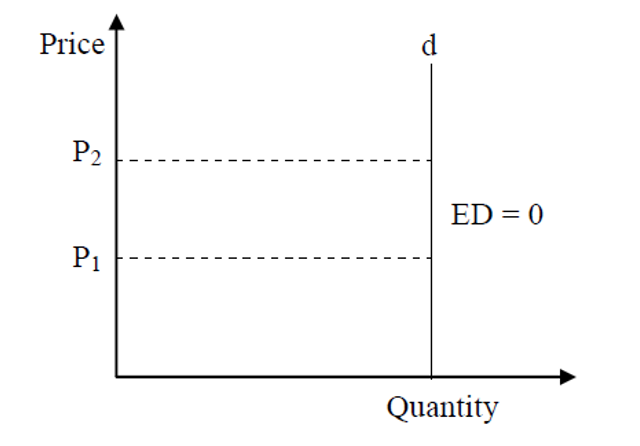

(v) Perfectly inelastic demand. Demand is said to be perfectly price inelastic if changes in price has no effect on the quantity demand (ED= 0). In this case the demand curve will be vertical straight as illustrated in Figure 2.32. This is a case of a good which is an absolute necessity. A good that consumes cannot do without and have to consume in fixed amounts such as salt.

FACTORS AFFECTING PRICE ELASTICITY OF DEMAND

(i) Substitutability. If a substitute is available in the relevant price range, quantity demanded will be elastic. The demand for a particular brand of cigarettes maybe considered being elastic because if there is existence of other brands that are close substitutes. However, the total demand for cigarettes may be inelastic because there are no close substitutes for cigarette. It can hence be said that the greater the number of substitutes for a given commodity, the greater will be its price elasticity of demand.

(ii) The proportion of a consumer’s income spent on the commodity. If this proportion is very small as in the case of match boxes , the quantity demanded will tend to be inelastic. On the other hand if this proportion is relatively large as for example in the case of meat, demand will tend to be elastic. This implies that the greater the proportion of income which the price of the product represents, the greater price elasticity of demand will end to be.

(iii) The extent to which the product is habit forming. Habit forming products like cigarettes or alcohol have a low price elasticity of demand. In the case of in addiction to, say drugs, the price elasticity of demand is likely to be even lower.

(iv) The number of uses of a commodity. The greater the number of uses of the commodity, the greater the price of elasticity. The elasticity of aluminum for example is likely to be much greater than of butter because butter is mainly used as food while aluminum has hundreds of uses such as electrical wiring and appliances.

(v) The length of adjustments. The longer the period allowed for adjustment in the quantity demanded as a commodity the greater its price elasticity is likely to be. This is because it usually takes some time for new prices to be known and for consumers to make the actual switch. Consumers adjust buying habits slowly.

(vi) The level of prices. If the ruling price is at the upper end of the demand curve, quantity demanded is likely to be more elastic than if it was towards the lower end. This is always true for a negatively sloped straight line demand curve.

(vii) Necessities and luxuries Demand for luxury is likely to be price elastic while the demand for necessities is generally price inelastic. However, this depends with availability of close substitutes.

(viii) Width/size of the market the wide definition of the market of a good, the lower is the price elasticity of demand. Thus for wide markets demand will tend to be price inelastic while for a small market demand will tend to be price elastic.

(ix) Time demand for most goods and services tend to be more elastic in the long run as compared to the short run period. This is because consumers will take some time to respond to price changes. For instance, if the price of petrol falls relative to diesel, it will take long for motorists to respond because they are locked in existing investment in diesel engines.

(x) Durability of the commodity durable goods have low elasticity of demand or they are price elastic while perishable goods are price inelastic.

Importance of price elasticity of demand/economic application of the concept of elasticity

(a) The consumer needs knowledge of elasticity when spending income where more income is spent on goods whose elasticity of demand is inelastic and vice versa.

(b) The government imposes taxes with inelastic demand and vice versa. Devaluation when a country devalues or lowers the value of its currency. The currency is made cheaper relative to other currencies. This makes a country’s exports cheaper for foreigners. Its import expensive for the residents. For a country to benefit by increasing exports, the elasticity of demand must be high.

(c) Business/producers They use elasticity of demand on deciding on whether to charge high or lower prices or even deciding on commodities to bring to the market especially those which are price inelastic.

Income Elasticity of demand

It is the measure of responsiveness of demand due to change in income.

YED = ΔQ ∕Q/ ΔP∕Y

Where income elasticity is positive this is a normal good. Where income elasticity is negative this is an inferior good. When the demand of a good does not change with increase in income then income elasticity is zero. In wealthy countries for instance basic clothes will tend to have low income elasticity of demand while foreign will have high elasticity of demand as income increases. In poor countries basic commodities will have high income elasticity compared to manufactured expensive ite

IMPORTANCE OF INCOME ELASTICITY OF DEMAND

(i) Business firms- if demand of a commodity is elastic to price, its possible to revenue by reducing prices. Businesses use specific information to know which price to increase to eliminate shortages or which price to reduce to eliminate surpluses.

(ii) Government uses elasticity to determine the yield of indirect taxes. Inelastic commodities are highly taxed. However, if demand of a commodity is elastic an increase in tax will hinder production

(iii) Price elasticity is relevant for a country considering devaluation as a means of rectifying balance of payment disequilibrium. Devaluation decreases imports and increases exports. However, this will depend on demand of import and export elasticities.

(iv) It helps to explain price instabilities in the agricultural sector

(v) Monopolists apply price discrimination by understanding the demand elasticities. High price is charged to those markets with lower price elasticity

FACTORS AFFECTING INCOME ELASTICITY OF DEMAND

(i) Nature of the need that the commodity covers. For certain goods and services the percentage of income spent declines as income increases such as food.

(ii) The initial level of income of a country (level of development) TV sets, refrigerators, motors vehicles are considered as luxuries in underdeveloped countries while they are considered as necessities in countries with high per capita income.

(iii) Time period. The demand for most goods and services will tend to be income elastic in the long run as compared to short run period. This is because the consumption pattern adjusts with time and also with change in income.

CROSS ELASTICITY OF DEMAND

It is the measure of responsiveness of quantity demanded of a good due to changes in the price of another related good. It is abbreviated as EXY where X and Y are to goods. It is calculated as follows:

EXY = Proportionate change in quantity demanded of a good X/ Proportionate change in quantity demanded of a good Y

ΔQx .Py ΔPy Qx The sign of cross elasticity of demand is positive if the good X and Y are substitutes and negative if X and Y are complimentary. The higher the absolute value of cross elasticity of demand the stronger the degree of substutability or complimentaribility. The main determinant of cross elasticity is the nature of the commodity relative to their uses. If two goods can certify equally the same need the cross elasticity will be high and vice versa.

IMPORTANCE OF CROSS ELASTICITY OF DEMAND

(i) Protection of local industries. If the government imposes a tariff on a good with the intention of protecting a local industry then the local product and the imported product must be close substitutes for the government to achieve its objectives

(ii) If a firm is in a competitive market, there a high positive elasticity of demand between its products and those of competitors. For such a firm, it will not be in its interests to increase the price of its product as this may result to more than proportionate reduction in its sales. However, it might consider lowering the prices of its products in the hope of attracting customers from other firms.

(iii) For product with high degree of complementarity, a fall in price of one of the goods due to increase in supply will benefit the producers of a compliment product due to an increase in sales. E.g. if there is a fall in prices of vehicles, due to an increase in supply the suppliers of fuel experience an increase in sales because more cars will be bought.

TOPIC THREE SUPPLY ANALYSIS

Definition of Supply

Individual supply refers to the quantity of a given commodity that a producer is willing and able to sell at a given price over a specific time period.

Market supply refers to horizontal summation of individuals producers/firms supply in the market. The supply schedule and the supply curve demonstrate the relationship between market prices and quantities that suppliers are willing to offer for sale. Supply differs from “existing stock” or the amount available because it is concerned with amounts actually brought to the market.

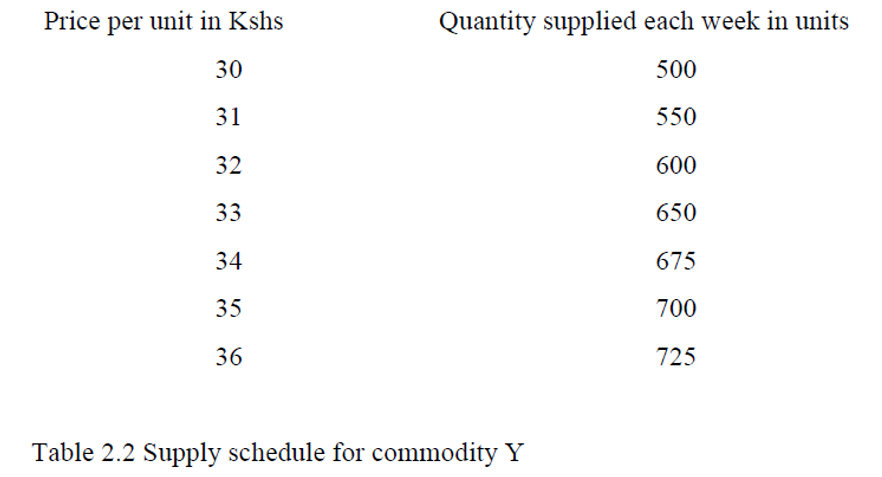

The basic law of supply states that, “a greater quantity will be supplied at a higher price than at a lower price”, holding other factors An individual producer’s supply schedule shows alternative quantities of a given commodity that a producer is willing and able to sell various alternative prices for that commodity ceteris paribus (other things remaining constant).

A supply curve show the relationship between the price of the commodity and the quantity supplied. The relationship is a direct one as the supply curve slopes upwards from left to right. The direct relationship is a graphical representation of the law of supply which states that other things remaining constant a greater quantity will be supplied at higher prices and vice versa. DETERMINANTS OF SUPPLY

The supply of a good is influenced by the following factor

- Price of the good as the price of a given commodity say X rises, with the costs and the prices of all other goods remaining unchanged, the production of commodity X becomes more profitable. The existing firms are therefore likely to expand their profit and new firms are to be attracted into the industry. It should be noted however, that not just the current rise but also expectations concerning the future increases prices may motivate producers. The total supply of goods is expected to increase as the prices rise.

- Prices of other related goods changes in the prices of other commodities may affect the supply of a commodity whose price does not change. Substitutes; two goods X and Y are said to be substitutes in production if the supply of good X is inversely/negatively related to the price of Y. For instance barley and wheat or tea and coffee. If a firm producing both tea and coffee notices that the price of tea is rising may decide to allocate more resources to tea at the expense of coffee. The supply of coffee will therefore fall as the price of tea increases. However, the movement of resource from one use to the other is dependent on the mobility of factors of production. Complimentary goods; two goods X and Y are said to be compliments if an increase in the price of X causes an increase in the supply of Y such as a vehicle and petrol. Jointly supplied goods; two goods X and Y are said to be jointly supplied if an increase in the price of X causes an increase in the price of Y such as petrol and paraffin. If the demand for petrol increases the supply of petrol will rise and at the same time the supply of paraffin will increase. N/B The extent to which firms can move from one industry to another in search of higher profits depends on occupational and geographical mobility of the factors of production.

- Prices of factors of production as the prices of factors of production used intensively by producers of a certain commodity rise, so do the firm costs. This will cause the supply to fall since some firms will eventually leave the industry. Similarly, if the price of one factor of production, say land, increases, some firms may move out of the production of land intensive products into the production of goods that are intensive in other factors of production which are relatively cheaper. Finally other less efficient firms will make losses and eventually leave the market.

- The state of technology

This refers to a a society’s pool of knowledge concerning industrial activities and its improvements. Technological improvements or progress such as improvements in machine performance, management and organization or an improvement in quality of raw materials leads to lower costs through increased productivity and increases the profit margin in every unit sold. This leads to increase in supply.

5.Future expectations of price change Supply of a good is not only influenced by the current prices but future expected price as well. For example, if the price of a good is expected to rise the firm may decide to reduce the amount of supply in the current period. This is to enable them pile stock which they can offer for sale when prices increase in the future. This is known as hoarding. 6.Government policies

- through tax imposition on goods increases the cost of production hence decline in production and supply

- Through subsidies -a grant to citizens of a country which lowers the cost of production hence encourages production and increases in supply.

- Through price control can either by price minimization where prices are fixed above equilibrium encouraging producers to produce more hence increase in supply. It may be undertaken through price maximization where prices are fixed below equilibrium discouraging production hence decline in supply.

- Though quotas where the government puts restriction or limit production of various goods which leads to decline in supply.

7.Weather /climate

The supply of agricultural products is considerably affected by changes in weather conditions. Output in agriculture is subject to variations in weather from year to the next. An excellent growing season associated with favorable weather conditions will result in a bumper harvest leading to an increase in supply. An unfavorable season that results in a poor harvest may be viewed as an increase in the average costs of production because a given expenditure on inputs yields a lower input than it would in a good/ favorable season. A bad harvest is represented by a leftward shift of the supply curve.

8.Objectives of the firm

a business may pursue several objectives such as sales maximization, market leadership, quality leadership, survival, profit maximization, social responsibility. Firms with sales maximization as an objective aim at supplying greater quantities of its product than a firm aiming at profit maximization where the later supplies less quantities but at a higher price in order to maximize the profit.

- Incidence of strikes lead to a reduction in supply of a product. The supply of manufactured goods is particularly likely to be affected by industrial disputes because of generally stronger unions in the industrial sector.

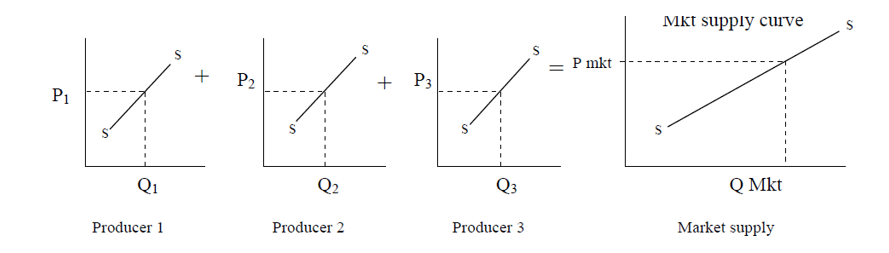

MARKET SUPPLY

The market supply curve represents the alternative amount of a good supplied per period of time at various alternative prices by all the producers of goods in the market. The market supply of goods therefore will be influenced by all the factors that determine individual producer supply and all the number of producers of goods in the market. This concept is illustrated in Figure 2.10 It therefore follows that the market supply curve will have a gently slope than individual supply curves. Figure 2.10 Derivation of market supply curve

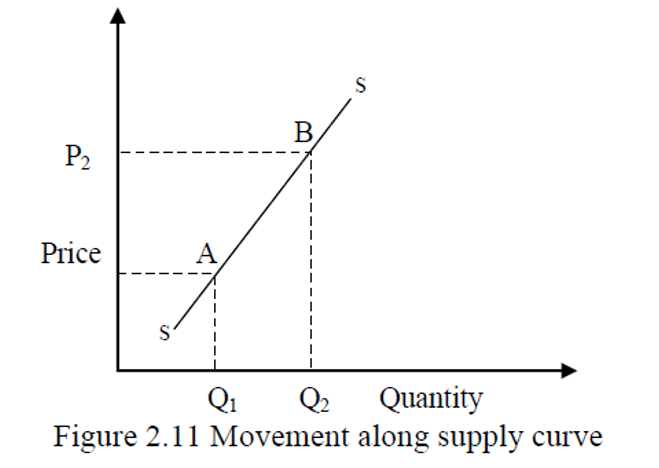

MOVEMENT ALONG AND SHIFT IN SUPPLY CURVE

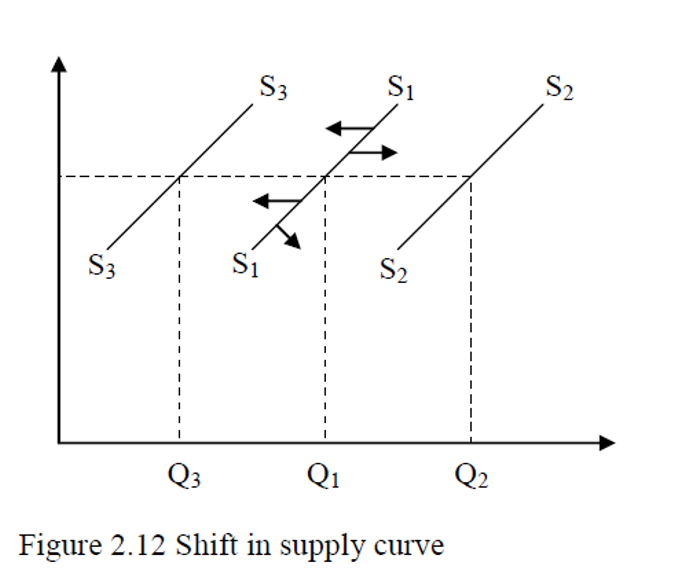

The relationship between price of a commodity and quantity supplied give rise to a supply curve. Any changes in the price of a good causes change in the quantity supplied. This can be traced by the movement along supply curve as shown in Figure 2.11 The movement from point A to B is caused by changes in price from P1 to P2 which bring fourth the movement along the supply curve.

A shift of supply curve is caused by a change in any other factors affecting supply other than the price of the goods. This shift indicates changes in supply as a result of e.g. advances in technology which makes it cheaper to produce goods and services and therefore their supply will increase. Similarly incase of increase in cost of production will lead to a fall in quantity supplies as shown in Figure 2.12. A shift to the right from S1S1 to S3S3 shows a fall in supply.

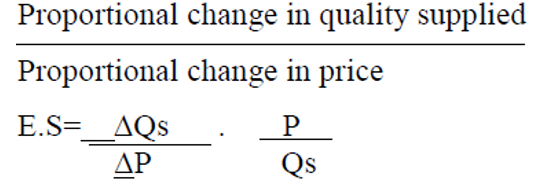

ELASTICITY OF SUPPLY

It is the measure of responsiveness of quantity supplied of a commodity to change in the factors affecting supply. Price elasticity of supply -It is the measure of responsiveness of quantity supplied of a commodity to change in its own price. It is abbreviated as ES and calculated as:

ES will have a positive value because of the direct relationship between the price of the product and quality supplied.

If ES is greater than 1, then the supply is said to be price elastic

If Es <1 then supply is price inelastic

If Es =1 then supply is unit elastic.

TYPE OF PRICE ELASTICITY OF SUPPLY

- Perfectly elastic supply

- Elastic supply

- Unit elastic supply

- Inelastic supply

- Perfectly inelastic supply.

FACTORS AFFECTING PRICE ELASTICITY OF SUPPLY

a) Mobility of factors of production If they are highly mobile then supply will be price elastic since more factors can be employed quickly when the prices increase thus increase in supply

b) The level of employment of resources It refers to the utilization and allocation of resources. If the factors are fully utilized supply will be price inelastic due to the fact that all the facts are occupied and thus can not be mobilized in order to increase supply. However if they are under employed, supply will be price elastic.

c) Production period for product that take short period of time to produce their supply tend to be price elastic. While thus that take a longer period will be price inelastic because it will take a while before the products can reach the market.

d) Nature of the commodity Price elasticity of supply for perishable goods tend to be inelastic due to the fact that the goods do not respond to price fall as they can not be easily stored. On the other hand supply for durable goods tend to be price elastic since they can be store when the price falls thus contracting supply.

e) Risk taking If the entrepreneurs are willing to take risk then supply of the products will be price elastic. Risk taking will in return be determined by the prevailing conditions in the economy. E.g. Political stability, security, government incentives, infrastructure, etc.

f) Level of stock If it‟s high supply will be price elastic because if the price of a good increases more of the good will is supplied from the stock

g) Time period Supply for most goods and services will tend to be more elastic in the long run than in the short run because producer need more time to reorganize factors of production so that they can increase supply of the products.

IMPORTANCE OF PRICE ELASTICITY OF SUPPLY

i) If supply of a good is price elastic thus an increase in demand will benefit both the producer and consumer of products because the producer will be in apposition to supply relatively more of their products and consumer will eventually pay a relatively lower price.

ii) If the supply of commodity I price inelastic business may risk losing revenue when there is a fall in the price of their products. This is because they will be forced to sell their products at a loss or a reduced price margin, e.g. In the case of perishable goods, however in the supply of the goods is price elastic the business people may store their products when price fall thus contracting supply e.g. the case of durable goods.

RELATIONSHIP BETWEEN TOTAL REVENUE AND ELASTICITY

a) Elastic demand Increase in price will reduce the total revenue while a fall in price increase the total revenue

b) Inelasticity demand Increase in price will reduce the total revenue while a fall in price causes reduction in total revenue.

c) Unit demand change in price will leave the price unchanged.

APPLICATION OF ELASTICITY IN ECONOMIC POLICY DECISIONS

- Products/services pricing decisions

- Customer spending programs

iii. Production decisions

- Government policy orientation -Taxation policy

-Evaluation policies -Price control/minimum

- Price discrimination

- Shift of the tax burden

TOPIC FOUR PRICE DETERMINATION

The price of an item is the point where supply at a given price intersect demand at a specific price

The Concept of Equilibrium in Economics

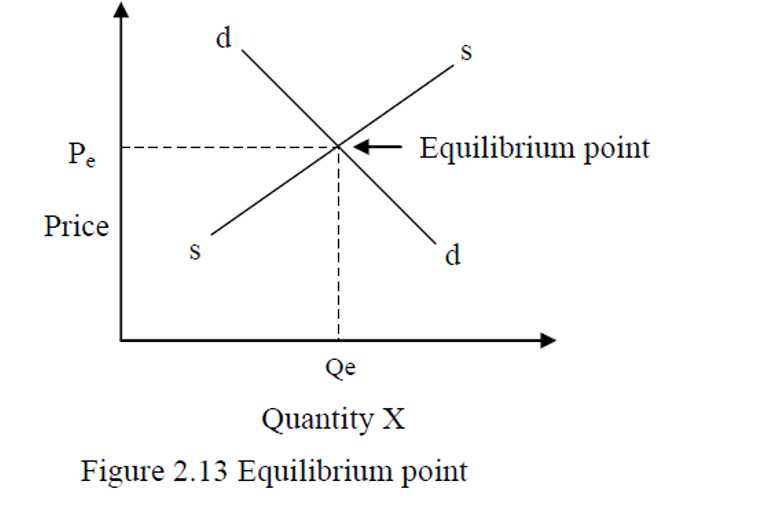

Equilibrium in economics refers to a situation in which the forces determine the behavior of variables are in balance and therefore exert no pressure on these variables to change. In equilibrium the actions of all economic agents are mutually consistent. Market equilibrium occurs when the quantity of a commodity demanded in the market per unit equals the quantity of the commodity supplied to the market over the same period of time. Geometrically, equilibrium occurs at the intersection point of the commodity’s market demand and market supply curve. The price and quantity at the equilibrium are known as the equilibrium price and equilibrium quantity respectively. The price Pe is also referred to as market clearing point. At this equilibrium point the amount that producers are willing and able to supply in the market is just equal to the amount that consumers are willing and able to demand. Both consumers and producers are satisfied and there is no pressure on prices to change and thus the market for goods is said to be at equilibrium.

This is illustrated in Figure 2.13 Equilibrium point Figure 2.13

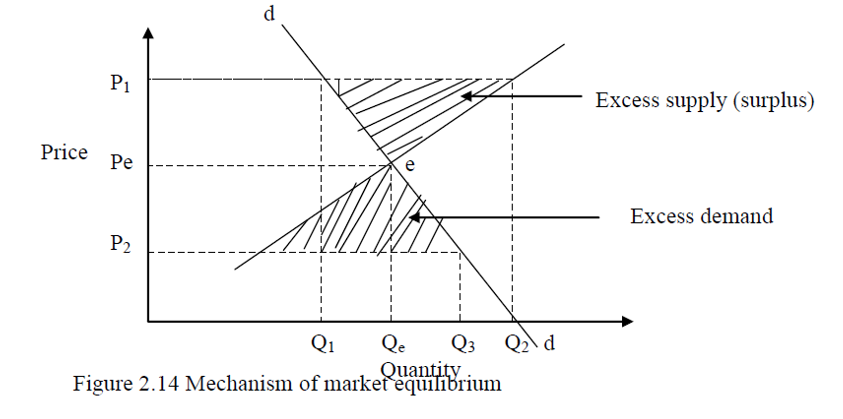

Equilibrium can be defined as a state of rest or balance in which no economic forces are being generated to change the situation. These economic forces are excess demand and supply and are illustrated in Figure 2.14. At P1, the quantity demanded by consumers is Q1 units but producers are willing to supply at price a quantity of Q2 units. Therefore there is an excess supply equal to (Q2 –Q1). Excess supply refers to a situation where quantity demanded is less than quantity supplied at prevailing market price. Producers may therefore react to the excess supply by lowering prices of their products so as to sale the unsold stocks. Excess supply is referred to as a buyer’s market since suppliers may be obliged to lower their prices in order to dispose of excess output a situation which is favorable to buyers. Excess supply represents an economic force that exerts downward pressure on prices. At P2 the quantity demanded is Q2 but producers are willing to supply Q1 units of goods. Therefore, there will be excess demand equal to (Q2-Q1). This situation of excess demand is referred to as sellers’ market because competition among buyers will force up the price due to the existing shortage Excess supply is a situation where quantity demanded is greater than quantity supplied at prevailing market prices.

In this case, the price of goods will rise because of competition among buyers. Excess demand represents an economic force on prices which exerts upward pressure. Prices P1 and P2 are disequilibrium prices and market is said to be at disequilibrium. Therefore, the general rule for eq

The following economic function has been derived by the finance manager of Kenya Breweries ltd. Qa = 3p2 – 4p

6p – 4 – supply

Q6 – 24 – p2

Where P represents prices and Q represents quantity

Which of the two function could represent in demand curve and supply curve and why. At what value of price and quantity is the market in equilibrium?

EQUILIBRIUM

In studying equilibrium, our objective is to determine the market price and quantity and try to identify the forces that influence such a price and quantity.

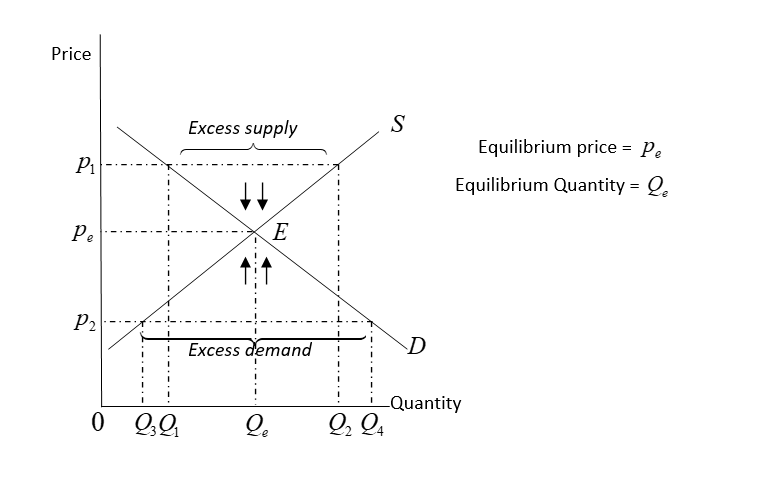

- Equilibrium can be defined as a state of rest. It is a situation whereby quantity demanded is equal to quantity supplied e.

- In this case, we say that the market is clearing and there are no economic forces generated to change this point hence it is stable.

- We determine this graphically by the interpretation point of the demand and supply curves as below.

- In the above diagram it can be seen that the forces of demand and supply determine the price in the market, i.e. a price at which both consumers and sellers are happy and where quantity supplied equals quantity demanded. That price is known as the equilibrium price.

- In the diagram, should the price be above the equilibrium price, forces of demand and supply will work together and lower the price towards the equilibrium price until the equilibrium price is reached. For example at consumers will only be willing to buy from the market while sellers will by willing to supply. In this case an excess supply equals to will be created. Because of this excess supply, sellers will have to reduce the price in an attempt to encourage consumers to buy more. Prices will be reduced until is reached where quantity demanded equals quantity supplied.

- Should the price be below the equilibrium price (e.g. at ) again the forces of demand and supply will work together to ensure is restored. At suppliers are willing to supply only because they consider to be very low. On the other hand, consumers will be willing to buy since very many of them can afford to pay . In this case an excess demand (shortage) equal to will be created. Because of shortages, consumers will compete among themselves for the little that is available and because of this competition, prices will be pushed upwards towards until eventually is reached.

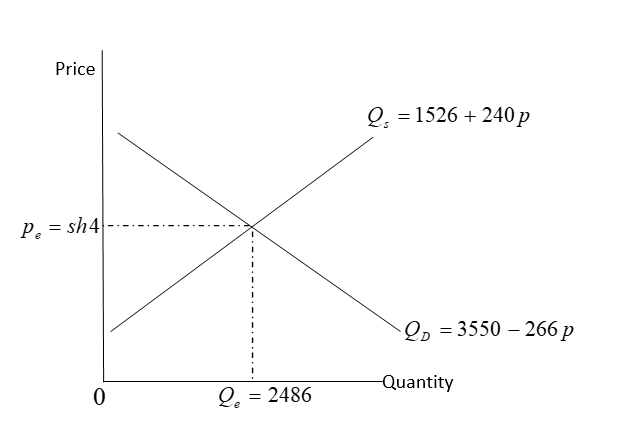

MATHEMATICAL DERIVATION OB EQUILIBRIUM

Example 2

Demand function:

Supply function:

Question: determine the equilibrium market price and quantity.

Solution

At equilibrium

Thus.

TYPES OF EQUILIBRIUM

- Stable equilibrium

- Unstable equilibrium

- Neutral equilibrium

Stable equilibrium: if there is a force that disrupts the market equilibrium, then there would be adjustments that bring back to the initial equilibrium. This type of equilibrium is well explained in the previous section.

Unstable equilibrium: this occurs when the deviation from the equilibrium position tend to push the market further away from the equilibrium conditions of unstable equilibrium occurs when the demand curve is positively sloped as in the case of a giffen good or when the supply curve is negatively sloped as in the case of labor supply.

Neutral equilibrium:-this occurs when the initial equilibrium is disturbed and the forces of disturbances lead to a new equilibrium point. It may occur due to shift of either demand of supply curve, and through effects of taxes etc.

The effect of a shift of demand and supply on market equilibrium.

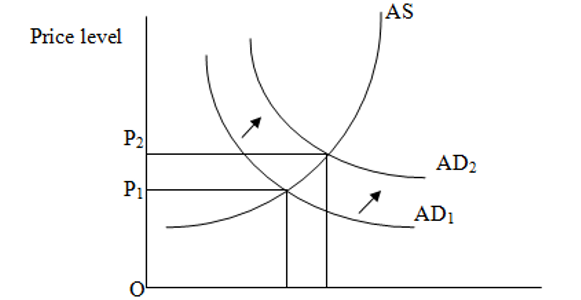

(A) 1 .Shift in demand Increase in demand.

Consider Figure 2.16 which illustrates the effect of an increase on demand on market equilibrium. An increase in demand is represented by a shift of the demand curve from d1d1 to d2d2. The immediate effect will be shortage and this will force prices to rise leading to increase in quantity supplied until equilibrium is re-established at Pe. Fall in demand Consider Figure 2.17 which illustrates the effect of a fall in demand on the market equilibrium. A fall in demand is represented by a shift of demand curve to the left from d1d1 to d2d2. The immediate effect will be a surplus and this will force the producers to lower the price in an attempt to get rid of excess stock. This fall in price will led to decline in quantity supplied until a new equilibrium is established at Pe1; Qe1

- Shift in demand decrease in demand.

(B) Shift in supply

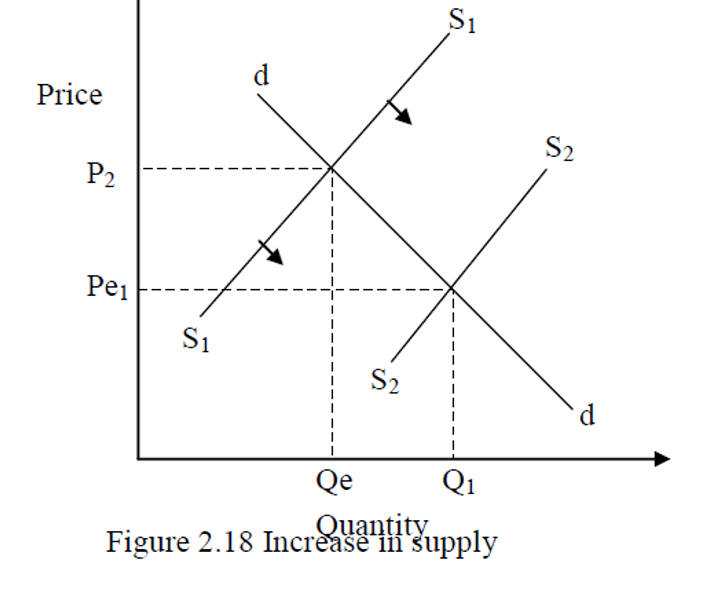

Increase in supply Consider Figure 2.18 which illustrates the effect of an increase of supply on the market equilibrium. An increase in supply is represented by a shift of supply curve to the right from S1S1 to S2S2. The immediate effect will be surplus and this will force the producer to lower their prices in order to get rid of excess stock. This fall will lead to an increase in quantity demanded until a new equilibrium is established at Pe.

A fall in supply Consider the Figure 2.19 which illustrates the effect of a fall in supply on the market equilibrium. A fall in supply is represented by a shift of supply curve to the left from S1S1 to S2S2. The immediate effect will be shortage and thus will force the prices to go up leading to a fall in quantity demanded until a new equilibrium is established at Pe1, Qe2.

Price Control

This refers to a deliberate action by the government to artificially impose through legislation the prices of certain goods and services. Such imposed prices are referred to as flat prices. These flat prices may be a maximum or a minimum price. A maximum price refers to that price above which a good or a service cannot be sold. A minimum price refers to that price below which a good/service cannot be sold. The government may find it necessary to control the prices of certain good/service because:

(i) Cheapness It may be objective of the government to keep price of certain goods and services at a level at which they can be afforded by most people hence protecting the consumer being exploited by producers

(ii) Maintenance of income. The government may want to keep the income of certain producers at a higher level than that which would be supplied by market forces demand and supply. Thus the government is able to maintain the low income producers in the market.

(iii) Price stability if there is a wide variation in the price of product year to year the government may wish to iron out these variations for the interests of both producers and consumers. This price control will act as one of the methods to curb inflation.

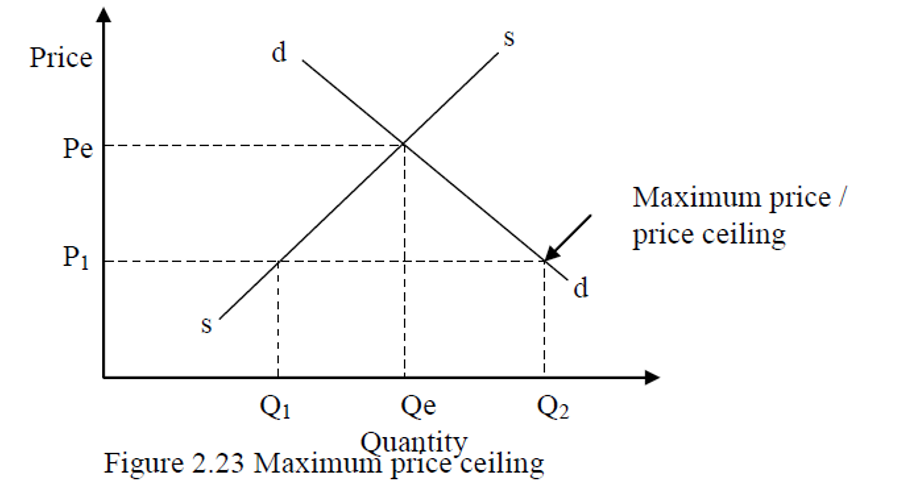

Maximum price control/price ceiling

Consider Figure 2.23, if the government imposes a price ceiling, given by P1 there will an excess demand or shortage equivalent to Q2- Q. Under normal circumstances this economic force of excess demand will exert an upward pressure prices. However, in this case the price cannot go above P1, since P1 is the maximum price. This price is unable to fulfill the rationing function leading to a demand for a centrally administered system of rationing of the good in question.

Other effects of Price controls

(i) Rise of black market where goods are sold above legal price even above the equilibrium price.

(ii) Shortages are likely to become chronic as producers move away from production of price controlled goods.

(iii) Research and development will be encouraged as the producers move from the price controlled industry.

(iv) There will be increased costs efficiency in production by firms as profits can only be increased by reducing costs.

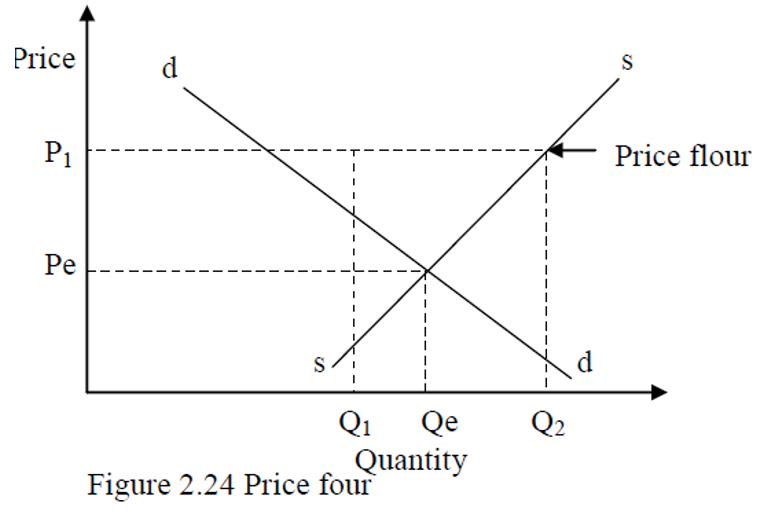

Minimum price/price floor

This refers to the action taken by the government to set a price below which a good/service cannot be sold. They are normally imposed above the equilibrium price since the government feels that the price determined by forces of demand and supply is too low as illustrated in Figure 2.24 If the government imposes a minimum price by P1, the immediate effect will be surplus given by Q1 Q2. Under normal circumstances excess supply exerts a down ward pressure on prices, but in this case prices cannot go below P1 for it is a minimum price. The government then has to intervene by buying excess stock or limiting it to prevent prices from going down.

Other effects of price floors

(i) In the case of a minimum produce price floor, (low income producers) will have a stabilizing effect on their income.

(ii) In the case of minimum wages employed workers will be guaranteed an income compatible with the cost of living.

(iii) Some producers may be willing to dispose off their product below the minimum legal prices especially in the case of labor.

(iv) In the case of minimum wage rate, it will lead to reduction in employment.

Advantages of price control

(a) Protects consumers, especially the low income consumers from price increases by producers.

(b) Ensures that producers have a reasonable income which is subject to inflation

(c) Contributes to industrial peace especially if they constitute part of the comprehensive income policy and a maximum price is fixed on some basic goods.

(d) It may be associated with a decrease in price and an increase in output such as the case of a monopolist overcharging for its products and is forced to lower prices. In this case the monopolist may accompany the fall in price with an increase in output in order to compensate for loss in revenue. (e) It may be used as on

THE PRODUCTION THEORY

Production refers to the creation of wealth for the sole purpose of utility in order to improve the welfare of people. It is creation of goods and provision of services to satisfy human wants.

Types of production/Forms of production.

It can be undertaken either directly or indirectly

- Direct production

This refers to the process where goods and services are produced for one’s own use. It’s another name is subsistence production. This production was very common in past though still practiced in some developing countries. Examples of such production include growing of crops, fishing, keeping poultry and hunting.

Characteristics/features of direct production/reasons for direct production.

- The goods or services produced are mainly for one’s own use.

- It is usually carried out in small scale.

- The methods used for production are usually simple

- It involves little or no specialization.

- The quantities produce are relatively low

- There is usually no surplus for the market.

- Indirect production

It refers to where goods and services are produce for sale.it can also be described as production for the market or commercial production.

Characteristics/features of indirect production.

- Goods and services produced are mainly for sale-income got

- Modern technology is extensively used in the production process-capital intensive

- Production is usually on large scale-thus one enjoys economies of scale

- Surplus goods are produced-no deficit

- Producers tend to specialize in different areas.-efficiency

- The goods and services produced are usually of higher quality.

Today, most production is of the indirect type because most people and countries goods and services are for sale.

LEVELS OF PRODUCTION.

Production is a broad process which includes five main activities and they include extraction, manufacturing, trade and distribution, warehousing and the provision of services. Productive activities are closely linked to what is generally referred to as levels of production. Production may be divided into three levels e.g.

- Primary production/extraction.

The main activity is extraction of natural resources.it may also involve looking after natural resources. The products may be consumed in their natural state, cooked before eating, or used as raw materials for producing other goods. The occupations involved here ranges from quarrying, mining, forestry, fishing, farming and lumbering.

- Secondary production

This involves changing of raw materials into finished products. In this level, raw materials extracted at the primary level are processed into finished goods. This creates more utility in the in the goods mainly through a process called manufacturing.it also includes construction activities e.g. some of the raw materials of quarrying are used in construction of buildings, roads and bridges. The main occupations include processing, manufacturing, oil refining and construction of roads, buildings and bridges. Machines and modern technology is usually used.

- Tertiary production.

This involves activities carried out in provision of services. The two main types include direct and commercial services.

- Direct services-they are provided directly to the consumers who are involved in occupations like. Health care, legal services, domestic services, security, lighting, education, preaching, nursing and entertainment. They are produced both in private practice and in the government through local authorities. Public facilities include garbage collection, sewerage services trucks, hospitals and schools. Current economic systems allow the private individuals to use their private facilities to do so.

- Commercial services-they are services that support various production processes. They include transport, communication, warehousing, advertising, banking and insurance. These services are important in creating place and time utility in goods. They are referred to as aids to trade.

TYPES OF GOODS PRODUCED

- Consumer goods.These are goods which satisfy human wants directly. They are categorized into durable and non-durable goods.

- Producer goods.This refers to categories of goods which give indirect utility to the consumer.

- These are intangible economic goods. E.g. teaching, insurance

FACTORS OF PRODUCTION AND THEIR REWARDS.

To produce adequate goods for the satisfaction of human wants a combination of natural and artificial and human resources must be present. These economic resources are referred to as factors of production. The natural resources are represented by land-primary and the artificial resources by the capital-secondary, and the human resource by labor-primary and the entrepreneur-secondary.

- land

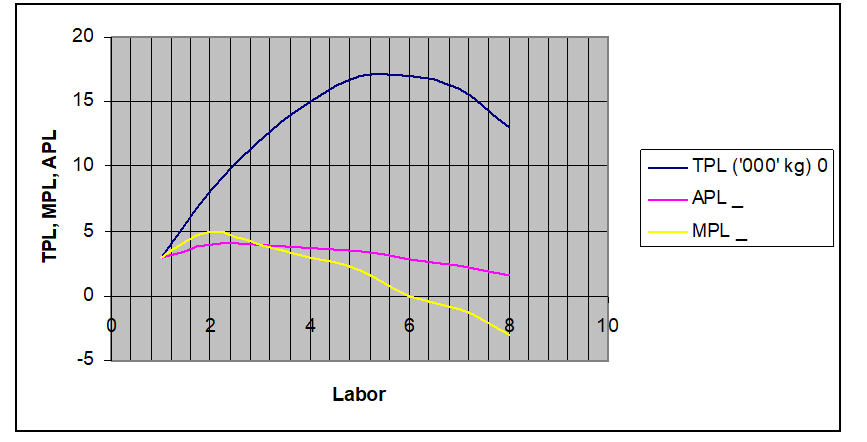

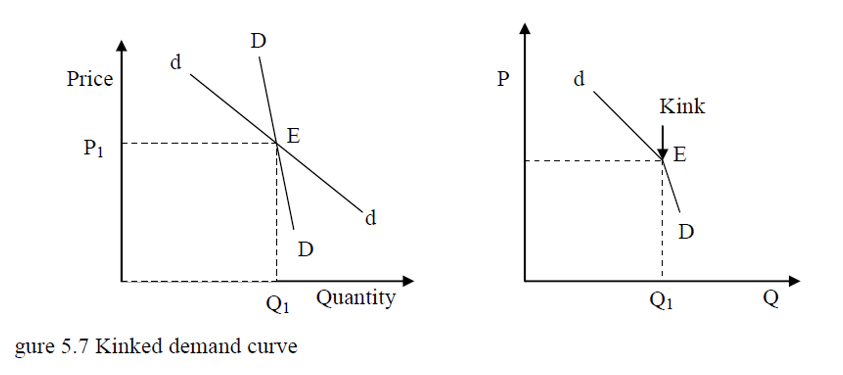

characteristics