WEDNESDAY: 19 May 2021. Time Allowed: 3 hours.

Answer any FIVE questions. ALL questions carry equal marks. Show ALL your workings.

QUESTION ONE

1. Outline five benefits to an economy of capping interest rates. (5 marks)

2. Describe four approaches that could be used by firms in evaluating and selecting a market segment in the financial industry. (8 marks)

3. Enumerate seven characteristics of informal credit markets. (7 marks)

(Total: 20 marks)

QUESTION TWO

1. Summarise four functions of clearing houses in your country. (4 marks)

2. Outline four benefits of complying with the Unclaimed Financial Assets Authority (UFAA) regulations. (4 marks)

3. Explain three reasons why the government intervenes in the financial system in your country. (6 marks)

4. Discuss three measures that could be taken by the Central Bank to regulate commercial banks in your country. (6 marks)

(Total: 20 marks)

QUESTION THREE

1. Distinguish between the following sets of terms as used in derivatives markets:

“Freight derivatives” and “inflation derivatives”. (4 marks)

“Weather derivatives” and “credit derivatives”. (4 marks)

2. Discuss three types of risks of investing in mortgages. (6 marks)

3. Examine three ways in which capital is transferred between savers and borrowers. (6 marks)

(Total: 20 marks)

QUESTION FOUR

1. Explain the term “globalisation of financial markets”. (2 marks)

Assess four reasons that might motivate a firm to raise funds from outside its domestic market. (8 marks)

2. Analyse five types of risks faced by financial institutions in your country. (10 marks)

(Total: 20 marks)

QUESTION FIVE

1. Distinguish between “short hedge” and “long hedge” as used in derivatives markets. (4 marks)

2. Propose four solutions to moral hazard and adverse selection in financial markets. (8 marks)

3. Evaluate four types of regulations that might be implemented by the government in order to protect the public and economy from financial panics. (8 marks)

(Total: 20 marks)

QUESTION SIX

1. Define the term “offshore bank”. (2 marks)

Outline six financial services offered by offshore banks. (6 marks)

2. Discuss three ways in which the government could minimise the challenges faced by informal financial markets in your country. (6 marks)

3. Discuss three reasons why the government of a country might need to regulate the insurance industry. (6 marks)

(Total: 20 marks)

QUESTION SEVEN

1. Explain three factors that could affect market efficiency. (6 marks)

2. Summarise three ways in which share prices could be used to predict the level of economic activity in your country. (6 marks)

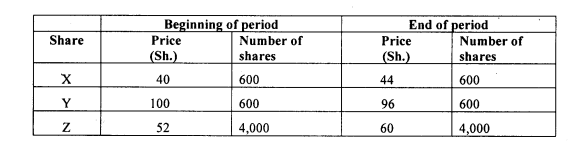

3. Mathew Mule is a financial analyst and has gathered the following data for a value weighted index:

Required:

The average price of each share over the period. (3 marks)

The return on the value weighted index over the period. (5 marks)

(Total: 20 marks)