UNIVERSITY EXAMINATIONS 2017/2018

EXAMINATION FOR THE DIPLOMA IN INFORMATION

TECHNOLOGY/ DIPLOMA IN BUSINESS INFORMATION

TECHNOLOGY

DIT 302/ DBIT 106: FINANCIAL MANAGEMENT FOR IT /

FUNDAMENTALS ACCOUNTING

FULL TIME/PART TIME/DISTANCE LEARNING

DATE: NOVEMBER, 2017 TIME: 2 HOURS

INSTRUCTIONS: Answer ANY THREE questions

QUESTION ONE (20 MARKS)

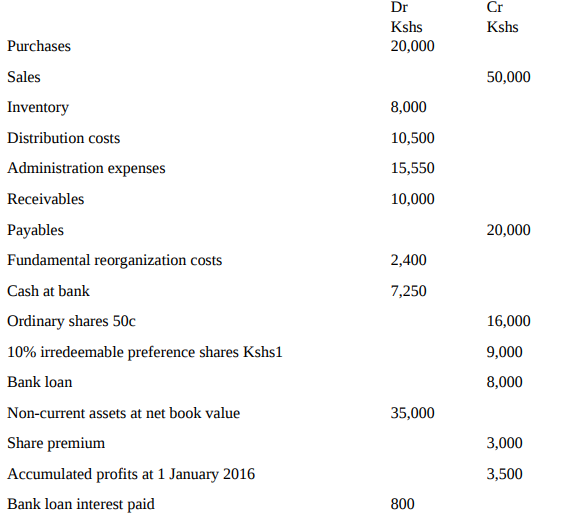

The trial balance of Penguin, a company as at 31st December 2016 was as follows:

The following should be taken into account

1. A building whose net book value is currently Kshs5,000 is to be revalued to

Kshs11,000.

2. Tax for the current year is estimated at Kshs3,000.

3. Closing inventory is Kshs12,000.

a) Prepare the following statements for the year ended 31 December 2016:

i. Statement of financial position. (10 Marks)

b)Identify five types of business documents and sources of data for an accounting system,

together with their contents and purpose. (10 Marks)

QUESTION TWO (20 MARKS)

a) Explain branches of accounting. (5 Marks)

b) Discuss five specific users of accounting information. (10 Marks)

c) Distinguish between direct and indirect cost. (5 Marks)

QUESTION THREE (20 MARKS)

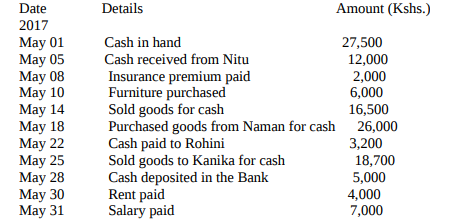

a) Prepare a cash book statement for M/s Rohan traders;

b)The elements of financial statements are the general groupings of line items contained

within the statements. Identify and explain any five of such elements of financial

statements. (10 Marks)

QUESTION FOUR (20 MARKS)

a) Show the following transactions in ledger accounts; (10 Marks)

Date

June 2017

1. Started business with Kshs.50,000 in the Bank.

2. Bought motor van paying by cheque Kshs.12,000.

3. Bought fixtures Kshs. 4,000 on credit from office masters ltd.

4. Bought a van on credit from motor cars ltd Kshs.8,000

5. Took Kshs. 1,000 out of the bank and put it into the cash till

6. Bought fixtures paying by cash Kshs. 600.

b)In preparing financial statements, the accountant follows fundamental assumption concept.

Discuss: (10 Marks)

a) Fair presentation

b) Going concern

c) Accruals/matching

d) Consistence

QUESTION FIVE (20 MARKS)

a) Discuss any FIVE limitation of accounting. (10 Marks)

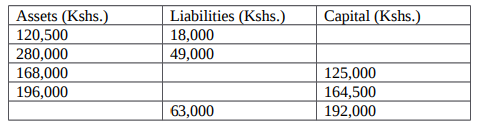

b) Complete the gaps in the following table.

c) Discuss the causes of depreciation. (5Marks