UNIVERSITY EXAMINATIONS: 2017/2018

ORDINARY EXAMINATION FOR THE DIPLOMA IN

INFORMATION TECHNOLOGY/ DIPLOMA IN

BUSINESS INFORMATION TECHNOLOGY

DIT302& DBIT 106 – FINANCIAL MANAGEMENT& FUNDAMENTALS

ACCOUNTING

FULLTIME/PARTTIME

DATE: AUGUST, 2018 TIME: 2 HOURS

INSTRUCTIONS: Answer Question One and Any Two Questions.

QUESTION ONE

i) The following transactions are extracted from the books of Wali enterprises for the month

ended 31 January 2018.

January 1: Started business with Kshs.600,000 in the bank and 500,000 in cash

January 2: Bought goods on credit from Ndung’u Kshs.270,000

January 3: Bought goods on credit form S. Muigai Kshs.75,000

January 5: Bought goods for cash Kshs.54,000

January 8: Bought goods on credit from S. Muigai Kshs.57,000

January 10: Sold goods on credit to K. Mwaniki Kshs.117,000 January 12:

Sold goods for cash Kshs.63,000

January 18: Took Kshs.9,000 of the cash and paid it to the bank January 21:

Bought machinery by cheque Kshs.165,000

January 22: Sold goods on credit to M. Otieno Kshs.66,000

January 29: We paid Ndung’u by cheque Kshs.258,000

January 31: Bought machinery on credit from Kinuthia Kshs.81,000

Required

A) Enter the transactions in the relevant ledger accounts (12 Marks)

B) Balance of the ledger accounts and extract a trial balance (8 Marks)

ii) Explain FIVE users of accounting information and how the information influences their

decision making in the organization. (10 Marks)

QUESTION TWO

IT is integral in modern day organizations, elaborate 10 ways in which information technology

can aid in ensuring transparency and accountability in the entity.”. Discuss using relevant

examples. (20 Marks)

QUESTION THREE

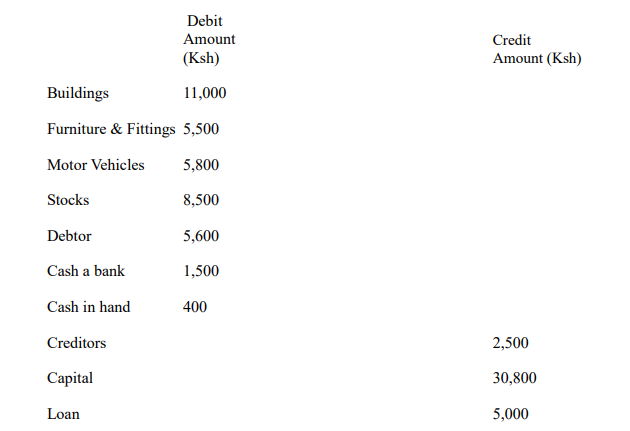

a) Kendi has a business that has been trading for some time. You are given the

following information as at 31.12.2017

You are required to prepare a Balance Sheet as at 31 December 2017 (10 Marks)

b) Explain FIVE limitations of financial accounting (10 Marks)

QUESTION FOUR

a)

Discuss the FIVE accounting elements that forms the foundation

of financial accounting.(Give examples)

(10 Marks)

b)

Explain using a diagram FOUR qualitative characteristics of

financial information. (10 Marks)

QUESTION FIVE

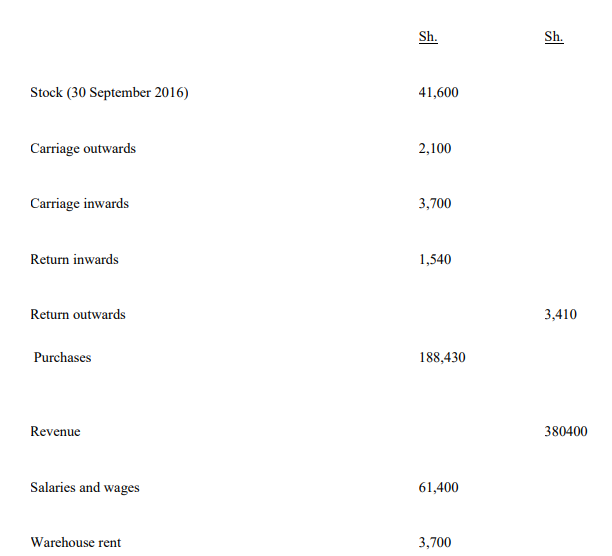

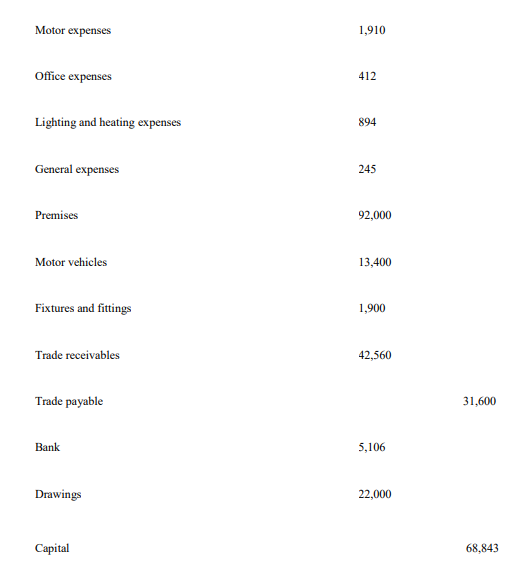

The following balances were extracted from the books of Kaizen Traders, a sole trader, as at

30th

Additional Information:

i. Stock at 30 September 2017 was Sh.50,000

ii. Depreciation is charged as follows:

Motor vehicles 10% p.a on cost

Premises 5% p.a on cost

Fixtures 3% p.a on reducing balance basis

iii. Lighting and heating amounting to Sh. 300 was not paid during the year and Salaries and

wages paid in advance amount to Sh. 400

iv. The bad debts written off in the year amount to Sh. 1,200. A provision for doubtful debts of

3% of remaining debtors should be made

v. General expenses outstanding amount to Sh. 700.

Sales on cash amounting to Sh. 2,600 were not recorded in the account

Required:

a)

A statement of comprehensive income for the year ended 30th September

2017. (12 Marks)

b) Balance sheet as at at 30th September, 2017. (8 Marks)