TUESDAY: 5 April 2022. Afternoon paper. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question.

QUESTION ONE

1. Discuss seven objectives of Kenya Bankers Association (KBA) in reinforcing a reputable and professional banking sector. (7 marks)

2. Outline five functions of Bank’s Assets and Liabilities Committee (ALCO). (5 marks)

3. State eight functions performed by Financial Institutions Regulatory Agencies. (8 marks)

(Total: 20 marks)

QUESTION TWO

1. Propose four economic advantages of Islamic finance. (8 marks)

2. In relation to consumer protection Act and Regulations:

Describe six unfair practices that the Act considers as “false, misleading or deceptive representations”. (6 marks)

3. In respect of Non-Performing Assets (NPA), analyse four guidelines for treatment of a collateral. (6 marks)

(Total: 20 marks)

QUESTION THREE

1. Discuss four asset provisioning requirements that a Savings and Credit Cooperative (SACCO) is required to conform to. (8 marks)

2. Chief Risk and Policy Specialist at Diana Credit Analytics (PLC) was the Chief Guest of the 15th Credit Analysts Annual Conference. In her paper titled “Developments in Credit Underwriting and Bank Credit policy”, she was quoted saying “Credit policies may be the most important tool for the Board of Directors and Bank Management to define an institution’s underwriting standards and credit risk appetite. However, many credit policies at community banks have been in place for a long time, with only small or ad hoc updates put in place as needed, thus the reason for increase in Non-Performing Assets”.

Required:

Analyse eight steps a Bank’s Risk and Policy Analyst should follow to conduct an adequate and effective credit policy and manual review. (6 marks)

3. With reference to the Central Bank Prudential guidelines, identify three instances that could justify a bank loan to be written off. (6 marks)

(Total: 20 marks)

QUESTION FOUR

1. With reference to Microfinance Act, highlight five kinds of information contained in periodic reports submitted to Central Bank. (5 marks)

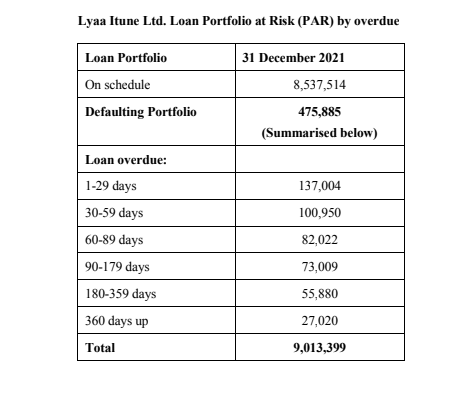

2. The following information was extracted from the books of Lyaa Itune Ltd. a Microfinance Institution (MFI).

Required:

Calculate PAR 30. (3 marks)

Calculate PAR 60. (3 marks)

Calculate PAR 90. (3 marks)

3. Identify three techniques that financial institutions could use to promote sound corporate culture. (6 marks)

(Total: 20 marks)

QUESTION FIVE

1. Enumerate four Disclosure Requirements under Basel III for banks. (4 marks)

2. Explain the following areas of financial institutions regulatory matrix:

Prudential regulation. (2 marks)

Systemic regulation. (2 marks)

Consumer protection. (2 marks)

Competition. (2 marks)

3.The Chief Executive Officer shall ensure that the Board of Directors is frequently and adequately appraised of the operations of the Sacco Society through presentation of relevant Board papers. With reference to the above statement, highlight eight contents of such Board paper. (8 marks)

(Total: 20 marks)