UNIVERSITY EXAMINATIONS 2017/2018

EXAMINATION FOR THE DEGREE OF BACHELOR OF BUSINESS IN

INFORMATION TECHNOLOGY

BUSS 305 STATISTICAL DECISION MAKING

FULL TIME/PART TIME/DISTANCE LEARNING

DATE: DECEMBER, 2017 TIME: 2 HOURS

INSTRUCTIONS: Answer Question One & ANY OTHER TWO questions.

QUESTION ONE

(a) Define the following terms as used in statistics

(i)Null hypothesis

(ii) Interval estimation

(ii) Decision tree (6Marks)

(b) Suppose that a random sample of 100students is selected to estimate the average amount of fees

arrears. The sample mean is Kshs 54000 with a standard deviation of Kshs 25,000. Calculate

(i) A 95 % confidence interval for the mean. (4Marks)

(ii) The sample size that would be required to estimate the mean to be within

200 with a 95%

confidence interval. (4Marks)

(c) Supposing a marketing expert is asked to test the hypothesis that at least an average of one

million units of a new product will be sold. Explain under what conditions this marketing

expert will be committing a type I error and under what conditions he would be committing a

type II error. (2Marks)

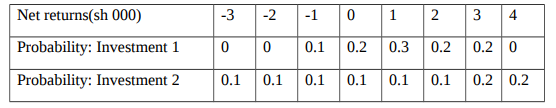

(d) The table below shows the possible net returns (discounted to present) and associated

probabilities of two investments to be undertaken by a particular company.

Determine the best investment option for the company using EMV criterion. (4Marks)

(f) List and explain THREE advantages of sampling over census. (6 Marks)

(g)Write short notes on the following methods of sampling

(i) Multistage sampling (2 Marks)

(ii) Stratified sampling (2

Marks)

QUESTION TWO

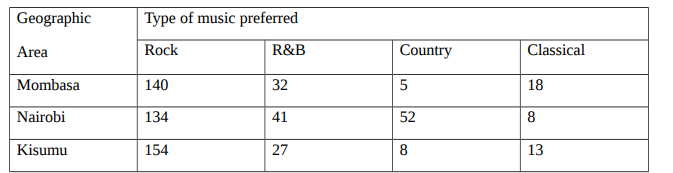

(a) A group of 30-year olds is interviewed to determine whether the type of music most listened

to by people in their age category is independent of the geographic location of their residence.

Use Chi-square test of independence, 0.01,and the following contingency table to

determine whether music preference is independent of geographical location.

(10Marks)

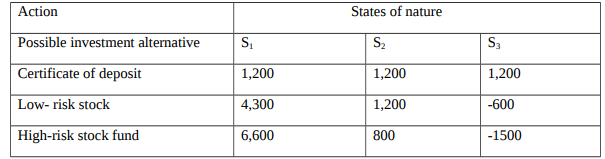

(b) An investor is considering three alternatives-a certificate of deposit, a low risk stock fund, and a high

risk stock fund- for a $20,000 investment. The investor considers three possible states of nature

S1: Strong stock market, S2: Moderate stock market, S3: Weak stock market

The pay off table (in dollars) is as follows:

(i) Which action is selected by the investor if he is a risk seeker? (2Marks)

(ii) Which action is selected by the investor if he is a risk averter? (2Marks)

(iii) Which criteria is selected by the minim ax regret criterion? (4Marks)

(iv) Draw the decision tree for the investor’s problem. (2Marks)

QUESTION THREE

a) Define the terms

(i) Alternative Hypothesis

(ii) Significance level (4Marks)

b) Explain the two types of errors made in hypothesis testing. (4Marks)

c) (i) Briefly explain the procedure generally followed in testing hypothesis. (5Marks)

(ii)An inventor has developed a new, energy efficient lawn mower engine. He claims that the

engine will run continuously for 5 hours (300 minutes) on a single gallon of regular gasoline.

Suppose a simple random sample of 50 engines is tested. The engines run for an average of 295

minutes, with a standard deviation of 20 minutes. Test the hypothesis that the mean run time is

300minutes against the alternative hypothesis that the mean run time is not 300minutes using a

0.05 level of significance. (7 Marks)

QUESTION FOUR

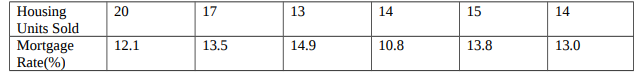

(a)As the chairman of the Federal Reserve System, Gil has the responsibility of controlling the nation’s

money supply. His actions impact directly on mortgage rates people must pay to buy houses. At the

beginning of this year his staff was instructed to examine the effect of mortgage rates on the number of

houses sold. A regional center in Nairobi, gathering data for the study provided the information below for

the last six years.

(i)Assuming a linear relationship exists between these variables, construct the regression model.

(8Marks)

(ii)What would be the level of units sold if the mortgage rate was 11.5%. (2Marks)

(b) A university random sample of 120 male students and 80 female students has been taken.

Among the male students 37% say that computing facilities are not a adequate, whereas 32%

female students say computing facilities are not adequate.

(i) Construct a 95% confidence interval for the difference between male and female

student’s opinion about facilities.

(6Marks)

(ii) At the 95% level of confidence, is there significant difference between male and

female student’s opinion about computing facilities at the University. (2Marks)

QUESTION FIVE

(a) (i) Explain the importance of statistics in Management Decision Making. (8Marks)

(ii) A micro finance bank is interested in setting up a branch in a new location. The

management undertakes to find out the average amount of transaction (in Kshs) per

individual per day in already existing branches so as to assess the viability of the project.

A random sample of eight existing branches is selected and the average amount per

individual per day recorded were

3600, 2700, 1900, 4800, 5200, 4600, 3500, 5300

If the average amounts are assumed to be normally distributed with mean µ and

standard deviation δ; construct a 95% confidence interval for µ, the population average

amount per individual per day for a transaction for the members of the bank.

(7Marks)

(b) The estimate of the population proportion is to be within -+

0.10, with a 99% level of

confidence. The best estimate of the population proportion is 0.45. How large a sample is

required?

(5Marks)